Crypto Weekly Digest | January 18, 2023

Hi everyone, welcome to issue #15 of the VirtualBacon Newsletter.

Before we start, I want to tell you guys about my upcoming course,

Primal Crypto Academy

If you're interested, click the button below to sign up for the early bird waitlist!

or go to primalcrypto.io

In this week's issue:

NEWS 📣

- Bitcoin Cash plans for Hard Fork in May

- Ethereum's Shanghai Hard Fork has both bulls and bears speculating

- Polygon Completed Hard Fork on January 17th

- FTX tracked down $5 Billion worth of customer assets that are "sellable"

- Metamask Launches Staking for all wallet users, Plugging into Lido and Rocket Pool Liquid Staking

- Beware of New Address Poisoning Attack for Ethereum wallets

- Shiba Inu's layer-2 Shibarium Finally about to launch

MARKET WATCH 📈

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS ▶️

- The BEST Crypto Portfolio For 2023 (Prepping for a Bull Market)

News

Bitcoin Cash plans for Hard Fork in May

Bitcoin Cash is getting a major upgrade.

The May hard fork is gonna bring more security and privacy to the network. Plus, CashTokens will allow people to use decentralized apps directly on the Bitcoin Cash network.

There are also gonna be smaller transaction sizes, which should make things faster. And the best part is, it'll enable some really cool possibilities like recurring payments, derivatives trading, and crowdfunding.

This is a token that many people have written off, but there is a good chance BCH could pump under the right conditions, and will likely be a good option if the "echo pump" continues.

Ethereum's Shanghai Hard Fork has both bulls and bears speculating

Last year saw a huge moment in the crypto market when Ethereum switched to a proof-of-stake network, known as 'the Merge'. This March, the 'Shanghai Hard Fork' is set to happen and it will allow people to get access to their Ethereum tokens which have been locked up for months - staking.

Some analysts believe that these unlocks will bring more sell pressure to Ethereum, however some believe the update will give users more reason to stake.

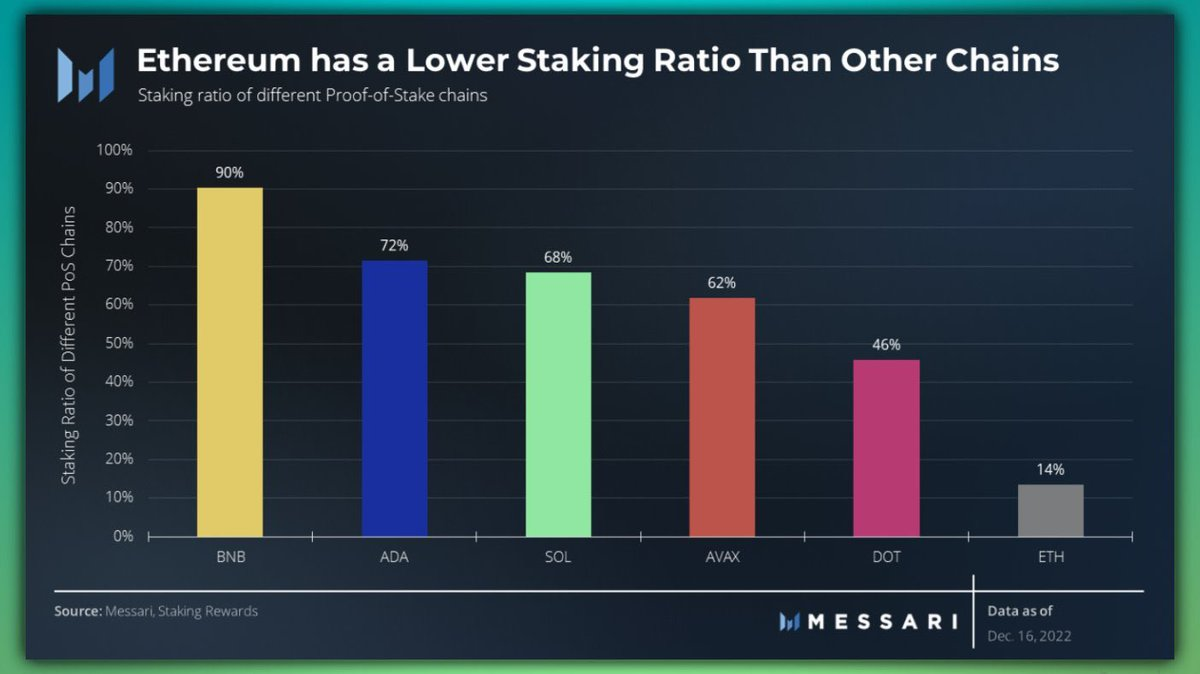

Most networks that offer easy staking methods have high staking rates, often with the majority staked. Currently, Ethereum staking only represents 14% of Ethereum's supply.

Polygon Completed Hard Fork on January 17th

Polygon's POS blockchain has successfully completed a hard fork in the network early this week. According to their blog post, this change will help reduce gas fee spikes and chain reorganizations.

The update consists of doubling the value of the "BaseFeeChangeDenominator" which should smooth out the base fee when gas surpasses or drops below a certain limit. Plus, it should make the network less susceptible to attack through reorgs. All node operators must update to the latest software in order for the hard fork to take effect.

Polygon has had a problem with reorgs in the past, and this update should bring drastic improvements to the network.

FTX tracked down $5 Billion worth of customer assets that are "sellable"

Crypto exchange FTX has managed to track down $5 billion worth of customer assets. That's not including the $425 million in crypto held by the Securities Commission of the Bahamas. However, it appears there's still a mysterious sum missing from what's owed to customers, and no one knows how big the shortfall is yet.

A spokesperson on FTX's behalf explained how Alameda had spent the money, including on planes, houses, parties, political donations and personal loans to its founders. They also sponsored the FTX Arena in Miami, a Formula One team, League of Legends, Coachella and many other businesses, events and people.

This brings the estimated customer return to ~55 cents on the dollar, when the bankruptcy case closes.

Metamask Launches Staking for all wallet users, Plugging into Lido and Rocket Pool Liquid Staking

The firm behind MetaMask, ConsenSys, recently added a new liquid staking feature to their interface.

Users can now use Lido and Rocket Pool to stake their Eth through the platform. This means locking up their ether in a smart contract on the blockchain and collecting rewards. Before the update, users had to visit the Lido and Rocket Pool websites to stake.

Ether can't be withdrawn until the Ethereum Shanghai upgrade in March, but Lido and Rocket Pool get around that by giving depositors tokens representing their staked ETH. These tokens are called stETH and rETH and can be traded on the open market. Now, MetaMask customers can swap their tokens back to ETH via MetaMask Swaps, but these assets prices are often susceptible to depegging from Ethereum's price.

Beware of New Address Poisoning Attack for Ethereum wallets

A new scam called 'Address Poisoning' is on the rise. Here's how it works: after you send a normal transaction, the scammer sends a $0 token txn, 'poisoning' the txn history. (1/3)

— MetaMask Support (@MetaMaskSupport) January 11, 2023

Address poisoning is a new scam that takes advantage of the copy-and-paste habit of most crypto wallet users.

Since wallet account addresses are long strings of numbers and letters, people tend to only remember the first and last few characters of their address, and most people copy and paste their address without verifying the entire address.

Essentially, attackers use software to monitor token transfers, and if they spot your address, they generate a similar-looking address using vanity address generators. Then they send you worthless tokens to “poison” your transaction history. If you’re not careful, you could end up copying and pasting the attacker’s address and sending your funds away.

An article by crypto analysts X-explore and Wu Blockchain reported that over 340,000 addresses have been poisoned and $1.64 million stolen from victims. Cases started spiking in late November and are occurring daily. The article suggested MetaMask should improve UI features to help prevent these attacks, such as adding color markers or other prompts to help users identify trusted wallet addresses in the transaction history.

Shiba Inu's layer-2 Shibarium Finally about to launch

The developers of Shiba Inu, a cryptocurrency, have announced the launch of a beta Testnet for their upcoming layer 2 network, Shibarium. The network will focus on providing an affordable way to settle transactions for dApps on the network, with a focus on metaverse and gaming applications. The developers anticipate that the market for non-fungible tokens (NFTs) will grow in the coming years.

It's worth noting that the main gas token for the Shibarium Layer-2 is NOT $SHIB, but rather the $BONE token from ShibaSwap. Expect this network to have built in users at launch, as existing SHIB holders will want to take advantage of extra functionality for their tokens while promoting their beloved memecoin.

Market Watch

Top Performing Coins of the Week

GALA

Gala games has been teasing the launch of their newly acquired gaming studio, Ember Entertainment. This has led to massive speculation around price.

APT + SOL

Tokens that are held up in the FTX/Alameda bankruptcy may take time to sell. This led to tokens like Solana and Aptos to catch a bid. Due to the similarities in the networks, when Solana does well Aptos usually does well too – high through put narrative.

MANA

Decentraland is one of the top performers this week, as it leads the metaverse narrative. The meta verse was one of the most explosive narratives during the bull run, so with the echo bubble around the corner, the metaverse could be a top narrative

Important Upcoming Events

- January: Redacted Cartel $BTRFLY launching $DINERO stablecoin, collateralized by LSDs

- January: Curve Finance Stablecoin launch

- January: AAVE $GHO stablecoin public testnet

- January: Optimism Bedrock upgrade testnet

- Feb 2: DYDX massive token unlock with 105% of circulating supply distributed to investors

- Feb 4: $FLUX halving

- Feb 28: Filecoin FEVM release

- Feb: Shiba Inu's Shibarium Layer-2 launch

- March: EOS Trust EVM mainnet launch

- March: Ethereum Shanghai Hard Fork

- Q1: DCG to liquidate main investment holdings including $API3, $HBAR, $ZEC, $FLOW, $MANA

NEW VIDEOS

The BEST Crypto Portfolio For 2023 (Prepping for a Bull Market)

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code APEX-BACON for Bonus)