My Ultimate 2023 Crypto Portfolio

Hi everyone, welcome to issue #12 of the VirtualBacon Newsletter.

In this week's letter, I want to provide a deep dive of what I think is the ultimate Crypto Portfolio going into 2023 and leading up to the next cycle in 2024.

Why now is a good time to make a portfolio?

- Inflation slowing down as shown by CPI number

- FOMC meeting dovish, US Fed might start to pivot 2023

- April 2024 Bitcoin halving, and usually 1 year before halving starts the bull run, which points to Q1 2023

- Most leverage in crypto has been washed out, both from retail traders and greedy institutions have already collapsed.

Some checklist criteria to consider

- Will the token survive a prolonged bear market?

- How big is the fully diluted valuation compared to its competitors?

- Is the project team motivated to continue working on the project? Or have they already accomplished the hype and seems to have given up?

- Is the project in a narrative that's likely to see hype in the next cycle? Something we haven't seen before, or haven't reached its full potential?

- Is the project the leader in the sector and continuing to grow?

- How does the token's potential ROI compare to that of Bitcoin and Ethereum as a benchmark?

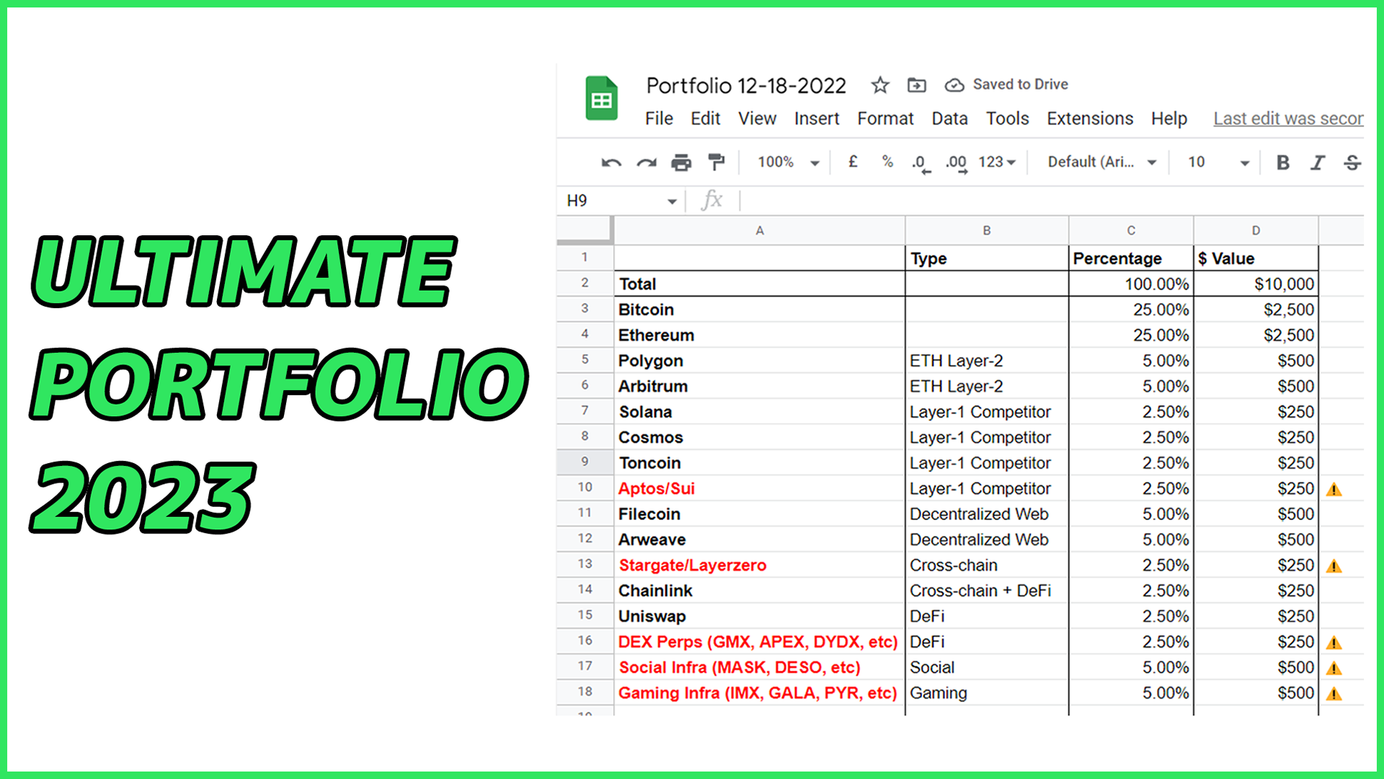

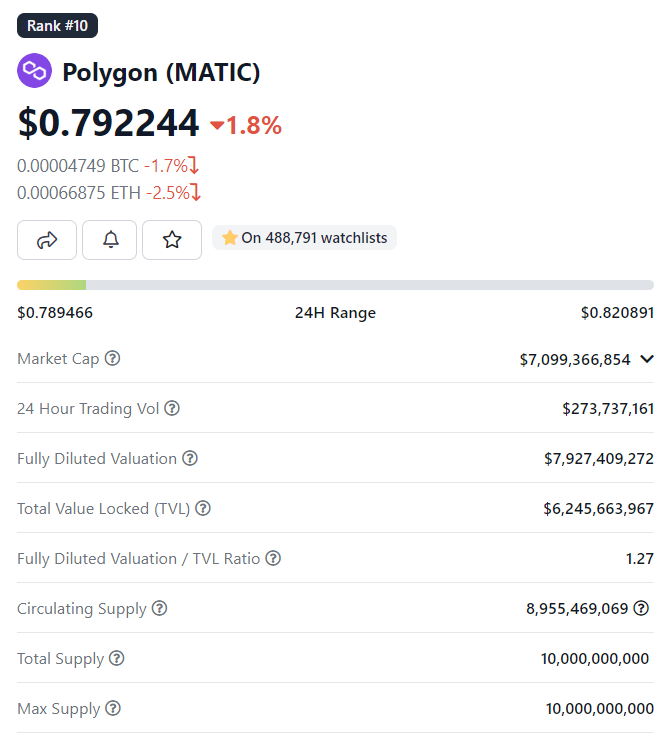

Here's the portfolio breakdown. Sit tight and lets get into each allocation in the next sections.

Bitcoin $BTC: 25%, Ethereum $ETH: 25%

I keep 50% of this portfolio in BTC and ETH, as they are the safest assets in Crypto AND actually have super good ROI potential from current prices.

Assuming BTC and ETH can both make a new all-time-high by the next bull run peak, with a conservative estimate of reaching 2X of the 2021 all-time-high, that gives us a target of $136k per Bitcoin, and $9.6k per Ethereum. That's a 8X return for both Bitcoin and Ethereum.

These are super high potential returns and by definitition they have the highest chance of achieving these targets among all other Cryptos, as they are the largest and most recognized coins.

Keep the 8X return number in mind, as we will be using these as a minimum benchmark for other coins in our portfolio as we go down the list.

Polygon $MATIC: 5%

Polygon is the leading Ethereum scaling solution, and as Ethereum continues to dominate the decentralized application space, it's clear that Polygon will continue to ride the same adoption wave.

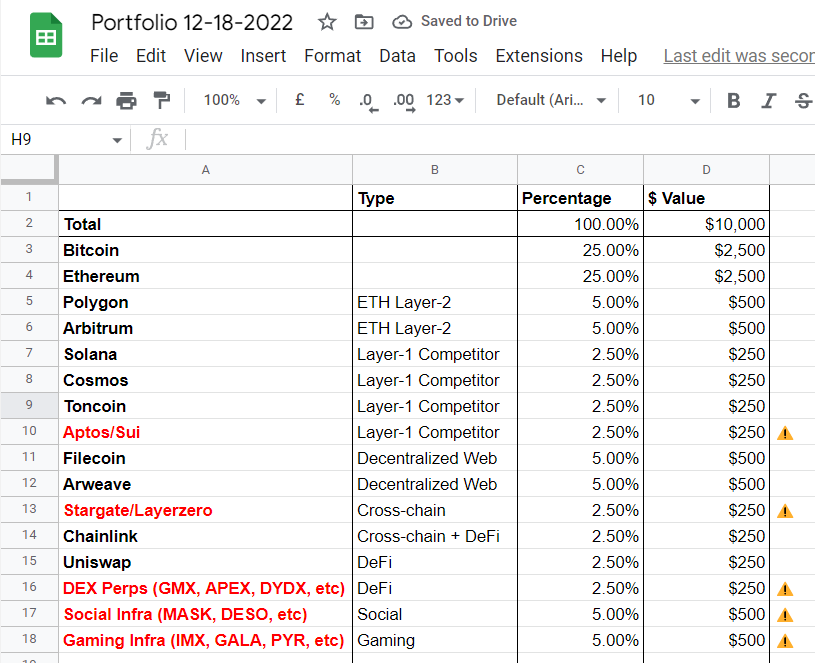

Another plus for Polygon is that unlike other layer-2 scaling solutions, Polygon supports all types of Layer-2 technology. Whether it's a POS sidechain, optimistic rollups, zk-rollup, appchains, privacy chain, or whatever new technology that emerges in the future.

It's clear that Polygon's approach is to latch onto the Ethereum layer-2 narrative, and adapt to whichever technology that ends up being the winning solution. This makes them extremely flexible and highly likely to survive in the long run.

Polygon also has a killer business development team with major partnerships in Web2 tech companies, every big company that wants to integrate Ethereum, is considering Polygon as first option for cheap/fast/green solution

For these reasons, I see Polygon as a no brainer pick assuming Ethereum continues to do well in the next cycle.

One concern for Polygon is that they still has not released most of their scaling solutions to support Ethereum mainnet, and the only live network for Polygon right now is the POS sidechain.

This is a clear distinction that people get wrong: the Polygon network you are using today is a separate layer-1 Blockchain rather than a layer-2 for Ethereum. The layer-2 technologies of Polygon still have not been released to the public. This is understandable as Polygon wants to focus on all the layer-2 technologies in order to not miss the boat, but they sacrifice in the time to reach the market.

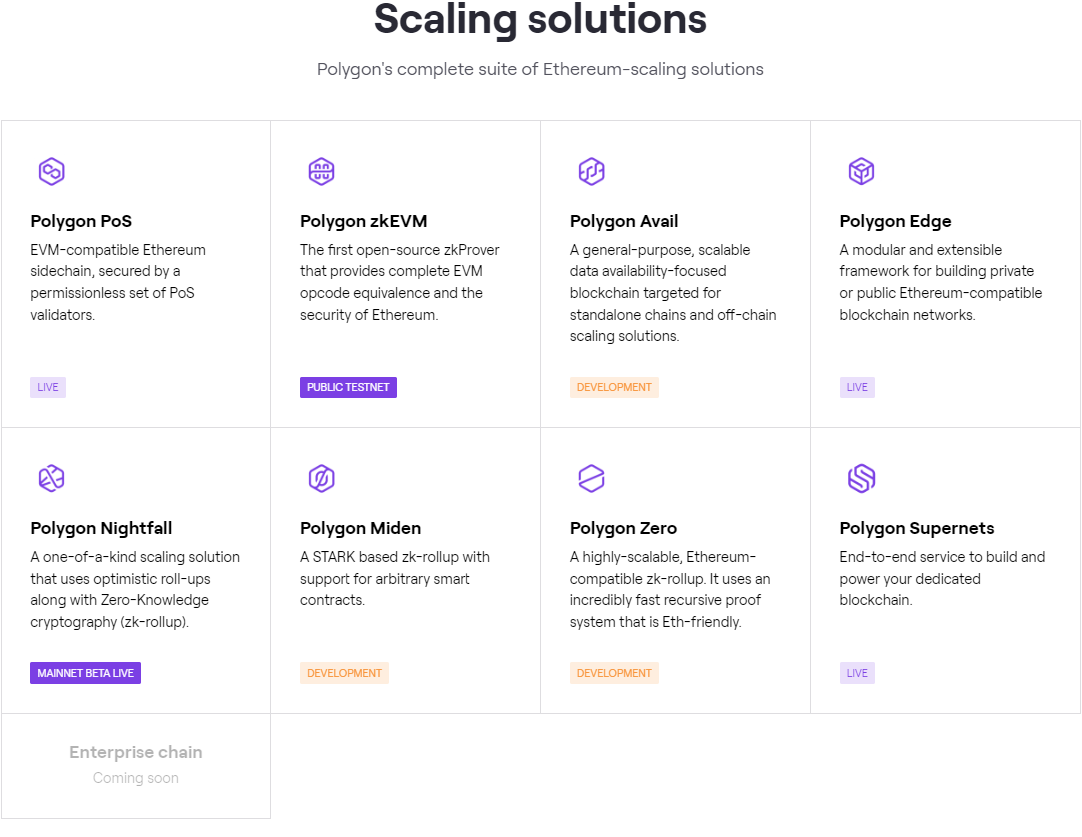

Another downside of Polygon is its high valuation. Currently already a top-10 Crypto, it sits at a $7B valuation. Assume Polygon price pumps and dumps at the same time as ETH, being in the same narrative, it needs to outperform the 8X estimate of ETH

Using a 10X multiple for MATIC, it needs to reach a price of $8 with a market cap of $70B. This is quite a big ask, as $70B will no doubt put Polygon in the top 5 crypto ranks.

So while I’m bullish on Polygon as the best scaling solution for Ethereum, I still think Ethereum price is more undervalued than Polygon at current price.

Arbitrum (unreleased): 5%

Arbitrum is another leader in the Ethereum layer-2 space. Arbitrum's main advantage over Polygon is their exceptional technology which is already live on Mainnet. The Arbitrum One roll-up has been widely adopted by the Ethereum community for 1.5 years, and is currently the #1 choice for Ethereum developers. This is due to Arbitrum heavily focusing on the optimistic roll-up as their layer-2 technology, instead of adopting every type of solution like Polygon.

That's not to say Arbitrum is behind in technology, as they are also actively working on their own appchains called Arbitrum Trust, and already have adoption from web2 giants like Reddit.

The reason I picked Arbitrum over their other competitor Optimism is for their larger ecosystem and user adoption. Arbitrum has been able to sustain its high TVL and fees for majority of 2022, all without any incentive to attract people. This means developers are willingly choosing Arbitrum as their network to deploy on, and users are enjoying the experience. I can personally attest to the user experience of Arbitrum, transactions go through under 2 seconds and truly feel like interacting with a traditional website rather than a decentralized app.

This is in stellar contrast to Optimism, which was unable to sustain its TVL and users even with their $OP token acting as incentive to attract users.

Keep in mind that the Arbitrum token is not live yet, and right now the best opportunity is in trying out applications on Arbitrum to potentially get the Arbitrum token airdrop in the next few months.

When Arbitrum eventually releases, I plan to allocate 5% of this portfolio to it.

Solana $SOL: 2.5%

Moving on to the alternative layer-1 bets, first is a controversial pick Solana.

As many people are now scared of Solana after the FTX/Alameda collapse, Solana price is completely in the dumpster. Having a peak marketcap of $75B, it now sits at only $4.5B.

We've kind of seen the Solana DeFi ecosystem getting destroyed as well, but keep in mind that this is really because majority of DeFi projects were being custodied by Alameda, namely Sollet wallet, sollet assets, Serum, Raydium, and Solend. DeFi users fleed as they feared for their assets' safety given Alameda's involvement with Solana.

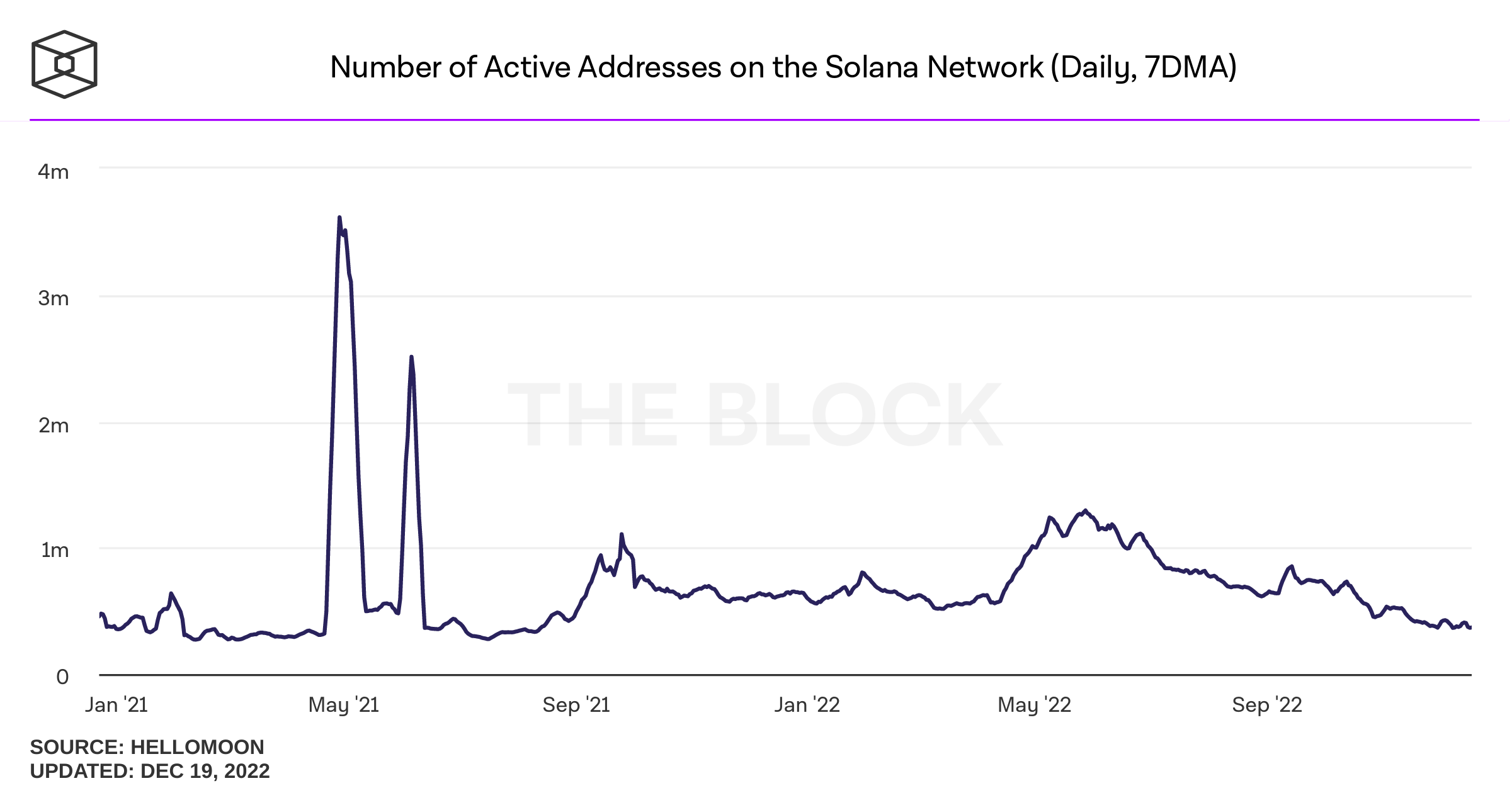

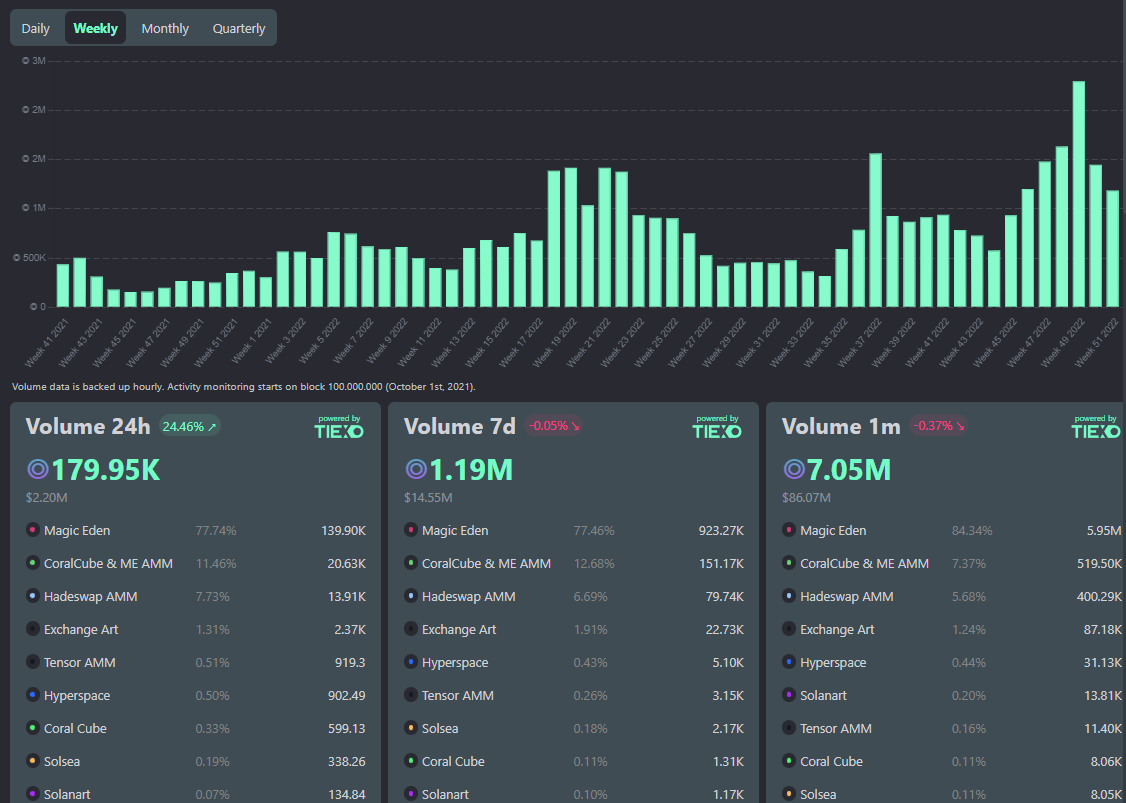

However when you look at real user stats like daily active users and NFT volume, Solana's ecosystem is still thriving. Yes it's not the same as the bull market peaks, but it still has roughly the same number of active users as the quiet months of fall 2021 and winter 2022, AND its NFT volume is even reaching a new all-time-high.

The current price of Solana at $12 truly feels oversold, as it's the same as the lows in March 2021 before Solana ever got popular.

I understand why people are so afraid of Solana due to its massive rally and fall manipulated by FTX, but we should not carry the old burden with us into the next cycle. Solana is an independent project and should continue to survive after FTX and Alameda. And even if $SOL only revisit its All-time-high but does not make a new high, that would still give us a handsome 18X return in the next cycle.

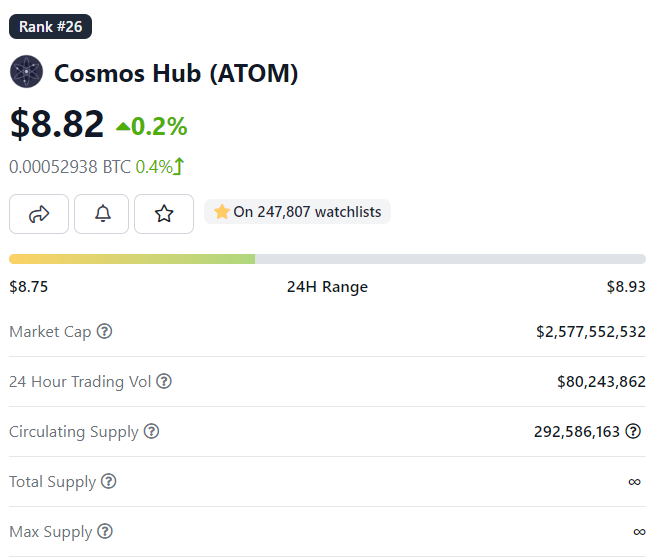

Cosmos $ATOM: 2.5%

The next Layer-1 that I'm allocating to is Cosmos. I've long been a proponent of Cosmos as its IBC technology is likely the second most widely adopted across all blockchains, second only to the EVM.

Way back in 2018, Cosmos was already a big infrastructure provider for new blockchains, and most major chains you see today implement the IBC (inter-blockchain communication) for their crosschain messaging standard.

One of the biggest problems with Cosmos is the inability for the $ATOM token to capture the value from IBC adoption due to poor tokenomics. BUT with the ATOM 2.0 upgrade in October this year, this has been addressed and the next few years in Cosmos development will be mainly focused on accruing Cosmos adoption value to $ATOM token price. This should align nicely with the next crypto bull cycle in 2023-2024.

You can refer to this previous newsletter issue to learn more about the ATOM 2.0 upgrade.

Another strong narrative going for Cosmos is the rising interest in Modular Blockchains and AppChains. Projects like Celestia and Fuel Labs are gaining traction by separating the execution and settlement layers to implement a modular blockchain stack. Other Layer-1 networks are spinning up their own AppChain tools to facilitate big applications to run their own blockchain. These trends should continue to increase in popularity in the next bull cycle.

Notably, most of the modular blockchain/AppChain narratives were started by Cosmos back in 2018, and most of the projects have come emerged from Cosmos or run as a Cosmos based chain today.

As Cosmos works as the underlying technology for this narrative, it should be able to latch onto the hype wave when it comes.

My super optimistic target for Cosmos $ATOM is to be a top 10 coin. At the peak of the 2021 bull market, top 10 coins had a valuation of $50B+. This translates to a price of $160 per coin.

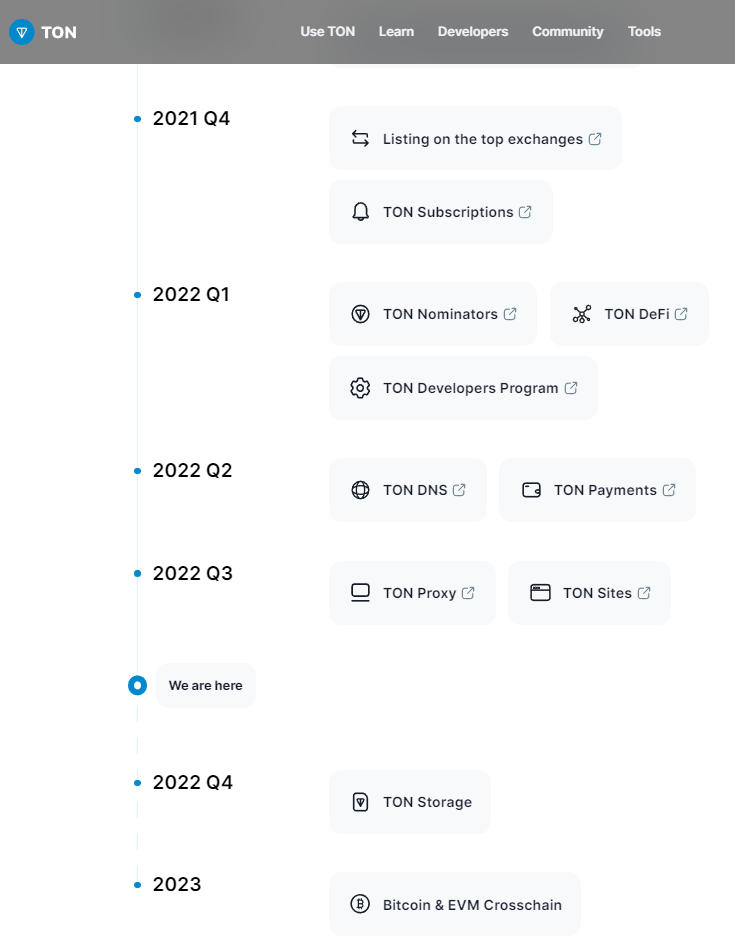

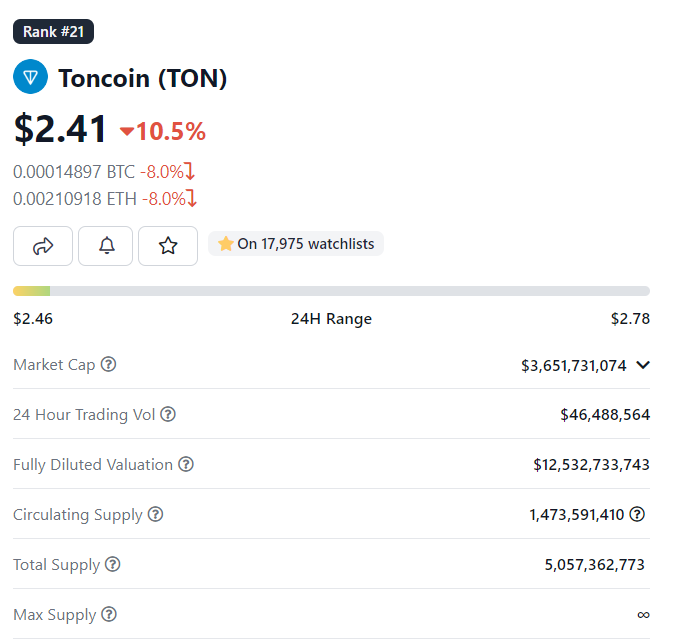

The Open Network $TON: 2.5%

The Open Network is a blockchain made by Telegram. If you haven't been in Crypto that long, you might not know that Telegram actually held one of the biggest ICOs back in 2018, raising over 2 Billion dollars for $TON.

Unfortunately they were struck by the SEC and had to return most of the money.

Fast forward to August 2021, $TON quietly released to the market, and slowly climbed to top 21 on the coin rankings list.

I think this network will be one of the biggest no-brainer plays by the next bull run.

"Of course TON got big, they have 50 million users from Telegram!"

The current use of TON is for Telegram users to trade user IDs as NFTs. As well as other decentralized messaging usage like TON Proxy, TON Sites, and TON Payments.

Eventually, Telegram plans to turn the chat app into a wallet for every user. This can create massive network effects comparable to major social media giants

The Open Network’s position is similar to that popular layer-1s in the 2021 market such as Solana.

With Solana’s peak valuation of $70B, this seems highly optimistic. One negative to keep in mind is that $TON has a large amount of tokens to be unlocked, with only 1.4B of the 5B total tokens currently circulating.

If we use an estimate of 3B tokens to be unlocked by the next bull market, this gives a price target of $23 per $TON coin.

As you can see this is about a 9X increase from current price, which is not as attractive as Ethereum already has a 8X target.

Therefore I plan to wait for $TON price to finish the recent pump and become cheap again before adding it to my portfolio. My target entry is below $1.

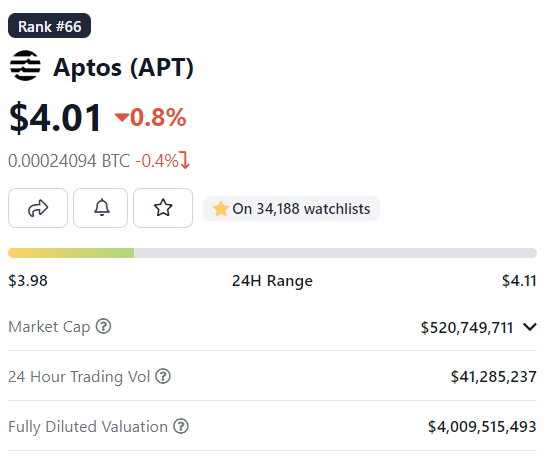

$APTOS + $SUI: 2.5%

The last layer-1 picks I have for this portfolio is the recently launched Aptos and soon-to-launch Sui Network. I grouped them together as they uses highly similar technologies and have come from the same team of Facebook's Diem project.

These projects are highlighted as red in my portfolio as I think they have a long way to go before being in fundamentally strong positions. Purely being cheap and fast is no longer a worthy investment in 2022.

However, we must not discount the ability of these teams with their experiences from Facebook's blockchain project since 2018. On top of that, having $300M+ of money raised in their treasury in a bear market also puts them in the best position possible to survive until the next cycle.

The main selling points for Aptos and Sui right now are their native MOVE programing language for developing smart contracts, which is based on the Rust language used in Solana. Based on what I've heard from Solana developers, MOVE is actually a much more usable stack to develop on, and this combined with the mass exodus of Solana projects, have led to Aptos and Sui scoping up large developer communities.

At the current stage, Aptos and Sui are still simply copy-pasting projects from Ethereum, and sustaining themselves with their own treasury and ecosystem incentives. However, I do think these two networks have a better chance to reinvent themselves in the next bull market and find their own niche, more than the existing EVM competitors like AVAX, Fantom, Harmony etc.

I say so because the market tends to value newer projects higher than older ones, as they are likely to catch on to new narratives. On top of that, as Aptos/Sui founders still have much to prove in the Crypto space, they are likely to keep trying and innovating in the next cycle.

For these reasons, I'm keen on allocating a small percentage of my portfolio to both of these networks for the next bull run.

One major caveat is that Aptos still sits at a $4B fully diluted valuation which is overvalued compared to the rest of the layer-1 picks on this list. Therefore I'll continue to wait for its price to come down, and potentially for $SUI token to release first before allocating my portfolio to them.

Filecoin $FIL: 5%

The next category of coins in this portfolio are infrastructure projects for Decentralized Web applications. These applications are different from DeFi/crypto applications as they do not focus on financial usecases and instead target things like decentralizing social media, web hosting and browsing, online messaging etc.

Filecoin is the the leading infrastructure provider for such non-financial usecases of Blockchain. It focuses on Storing files for the decentralized Web applications, instead of just decentralized Finance.

Every major Decentralized Web project today is integrating Filecoin through the inter-planatary file system (IPFS). The IPFS standard is like the HTTP standard but for Web3. IPFS is already the default solution to power NFT metadata, every picture, video, asset is stored on IPFS.

Decentralized Web/Social narrative is one of my biggest conviction bets for the next cycle. And if they become big, Filecoin will be the number 1 solution that gets integrated in every application.

One major concern for Filecoin is its tokenomics.

Peaking at over $180, its fully diluted valuation was as high as $260 Billion dollars. This meant that early investors had insane profits dumping the price during the 2021 bull market.

Today, the price sits at below $3, which is still a $5B fully diluted valuation, as only 20% of the tokens have been released.

While I’m bullish on Filecoin’s narrative, it’s hard to imagine $FIL breaking this all-time-high, and its current valuations are still quite high.

Using a optimistic estimate of a top-20 coin rank with 20-30B in valuation, $FIL currently has around 5-6X growth in its fully diluted valuation. This makes it not so attractive at current prices compared to the 8X we are expecting for Bitcoin and Ethereum. Therefore, I'll continue to wait for Filecoin's valuation to drop before allocating to it. I plan to target below $2B in fully diluted valuation for FIL.

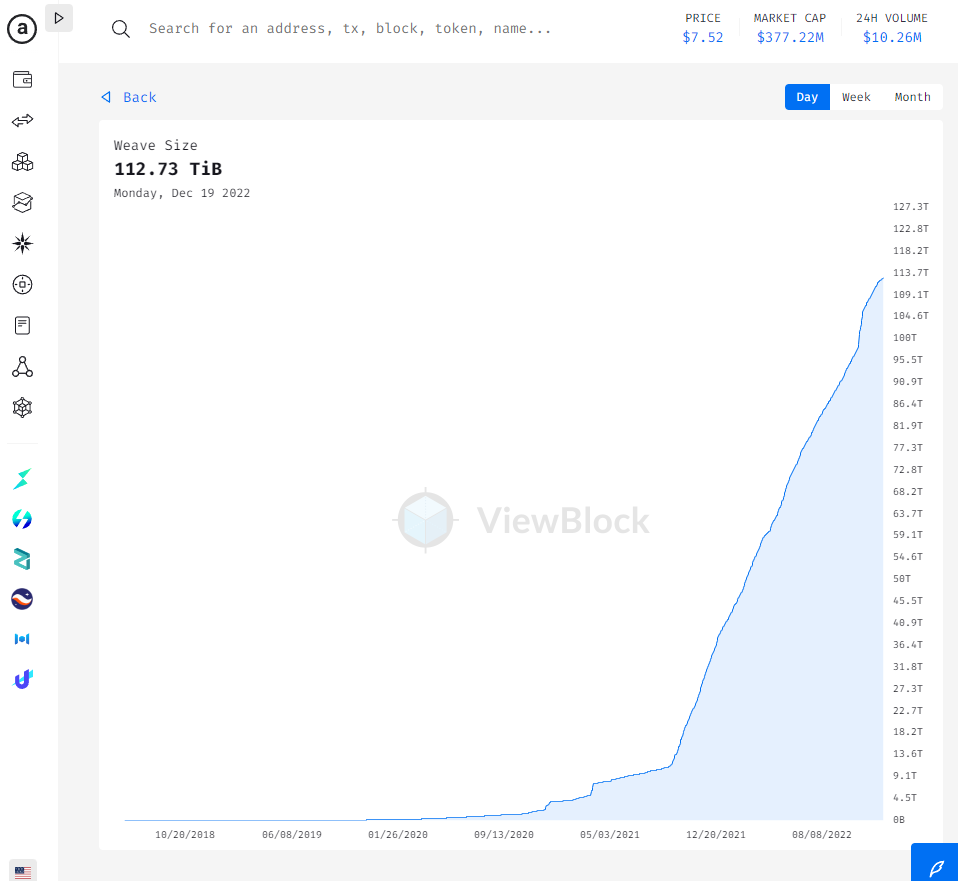

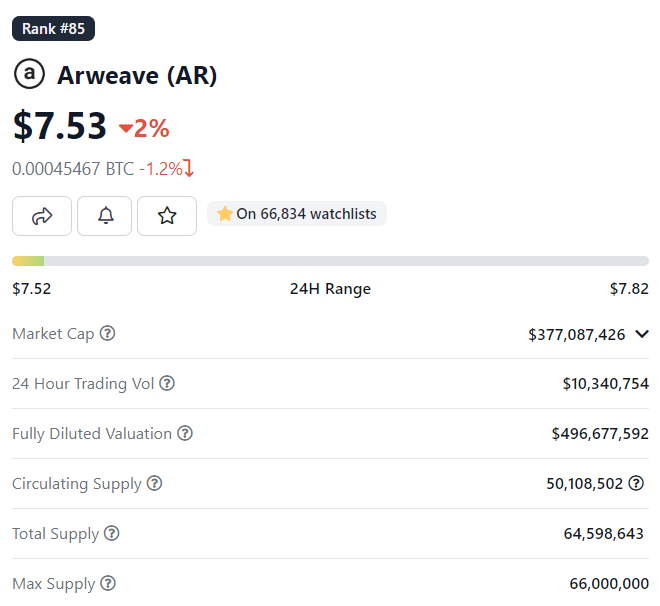

Arweave $AR: 5%

Arweave is another leading solution for non-financial usecases of Blockchains. But unlike the temporary access layer of IPFS and Filecoin, Arweave focuses more on permanent file storage.

If Filecoin is the HTTP standard for Web3, Arweave acts more like the Google Drive file system for Web3.

The cumulative weave size, or amount of data stored on Arweave is also continuing to grow during this bear market, as more and more blockchains, NFTs, and other rich media platforms are backing up their data to Arweave.

Instagram also announced that they'll be storing NFTs on Arweave, proving its usage for decentralized social media narrative

Again this is one of the only core infrastructures behind the Decentralized Web narrative that has proven itself. If this narrative becomes big, investors will likely flock to Arweave.

Another plus for Arweave is its tokenomics and valuation which are much stronger than Filecoin.

With 50M of the 60M already unlocked, and the current valuation at only 400M. If we assume AR can move into the top 30-40 ranks among all coins, that puts it at a 15-20B valuation based on the numbers from 2021 bull market. That gives us a target of $300-$400, a 45-55X target.

Stargate $STG + LayerZero: 2.5%

Moving on to the next category which is Cross-chain interoperability solutions. This area was heavily tested in the 2021 bull market and we saw a massive demand but also massive risks with many bridges being hacked.

Going into the next cycle, expect the demand to remain from cross-chain DeFi users, but hopefully the technology can actually become stable to use. On top of that, we are seeing the advent of interoperability to not only focus on bridging assets, but rather letting applications interact with multiple blockchains at the same time. This is the core technology which LayerZero does best.

Imagine you have a DeFi app which uses the full security of Ethereum for high value transactions, while executing small transactions on Solana for its instant speeds for user experience, this is what LayerZero already provides to some applications today.

I fully expect interoperability to continue being a popular narrative going into the next cycle, but we must distinguish between the last generation of projects which are still developing a closed ecosystem like Polkadot, to the next generation of solutions that aims to connect every blockchain out there.

Although LayerZero is the market leader in cross-chain solutions today, you need to know that the Stargate $STG token might not be the main token of the LayerZero network. $STG only serves the Stargate Finance bridge, which is one application that the LayerZero team built to facilitate bridging tokens between chains.

This is why I have not allocated any money to Stargate/LayerZero yet, as we don't know if LayerZero will have another token sometime in the future. There has been hints on Twitter around a potential LayerZero airdrop in 2023, so keep an eye out for that. But for now, I'll continue to watch LayerZero for when they announce the plans for the main token around their cross-chain infrastructure solution.

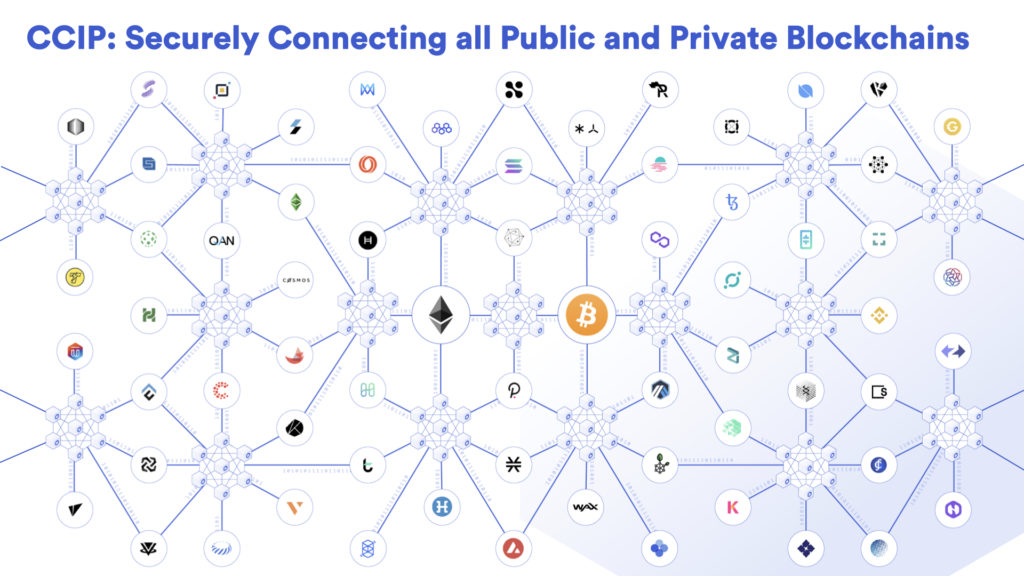

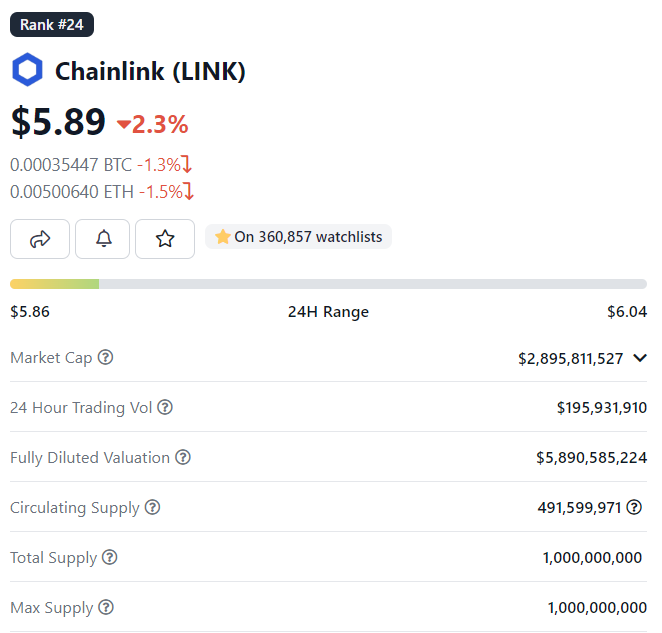

Chainlink $LINK: 2.5%

The other interoperability project in this portfolio is Chainlink. Most people still think Chainlink is only an oracle provider solution, but in 2022 LINK has been heavily moving in the interoperability space with their CCIP protocol.

We've seen how Chainlink was quick to deploy their oracle to every chain and become the #1 oracle provider for the entire DeFi space. This clearly shows their team is capable of penetrating the market.

My hope is for them to also integrate all chains and become the default interoperability solution for all blockchains to connect with each other, similar to how they became the default oracle solution.

Chainlink CCIP also differs from the Cosmos/Polkadot model, as it only connects existing blockchains, but doesnt require them to be tied down in a closed ecosystem. This puts it in the same category of next-gen interoperability solutions with LayerZero.

Another plus for $LINK is its deep recognition in the DeFi space. Every major DeFi protocol uses Chainlink oracles, and integrates the $LINK token in its products. Therefore if we get another DeFi hype wave, $LINK is also likely to follow that closely just like DeFi summer of 2020.

In terms of price performance, $LINK has been under the radar in 2021 bull market due to its hype wave arriving early in 2020 DeFi summer. So it also helps that most people have written off $LINK as a real contender in the market.

Chainlink’s previous all time high is $50. Which puts it at a $25B valuation. If we assume $LINK can make a shot for the top 10 to 20 coins in the next bull cycle, that puts $LINK at a peak valuation of $30-$40B, which translates to $60-$80 in price.

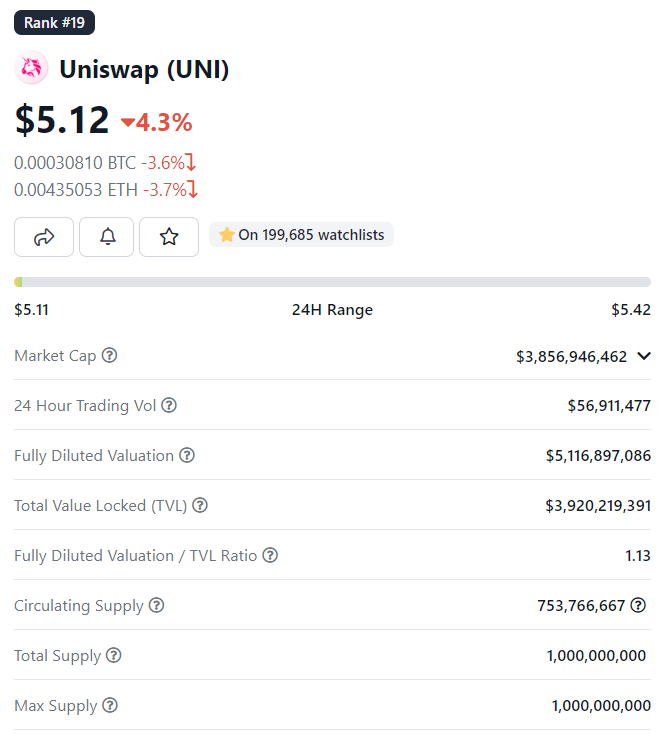

Uniswap $UNI: 2.5%

Moving on to pure DeFi picks, I chose Uniswap as they are still the undisputed king of DeFi. Uniswap invented the AMM exchange model, which powers every decentralized exchange today. WIthout Uniswap, the DeFi hype wave and all the applications would have never existed. It truly was a groundbreaking technology that paved the way for the entire 2021 bull run.

Although there are many other DeFi plays out there, I chose Uniswap primarly as they are both the inventor of the AMM and the market leader. When a new technology emerges, you want to bet on the inventors instead of the imitators, this is because inventors are much more likely to continue working on the project as they are emotionally attached to their creation, versus copycats that are in it for the money.

For the case of Uniswap, we can see their continued innovation with the incredbly power Uniswap V3 model which dramatically helps DEX liquidity. All exchanges have since copied this model just as Uniswap V2. Uniswap has also recently released their own NFT trading protocol, and will potentially start distributing Real Yield to its token holders.

Price action is also on our side, as $UNI token has only seen one all-time-high way back in May of 2021, and has been slowly declining ever since. The current price around $5 seems to have formed a sideways bottom since the LUNA/3AC crash in 2022, which shows another good period to start accumulating.

Although Uniswap valuation still remains high at $4B, it still presents decent returns if we use the same $30B-$40B estimates of a bull market peak for a top 10-20 coin. What's different here is that a bet on Uniswap is a direct bet on the DeFi narrative. This gives our portfolio a bit of diversified risk, as other coins might not be so clearly categorized as a DeFi coin. If there is a DeFi boom sometime in the next cycle, Uniswap will undoubtably be a top 3 coin in that narrative.

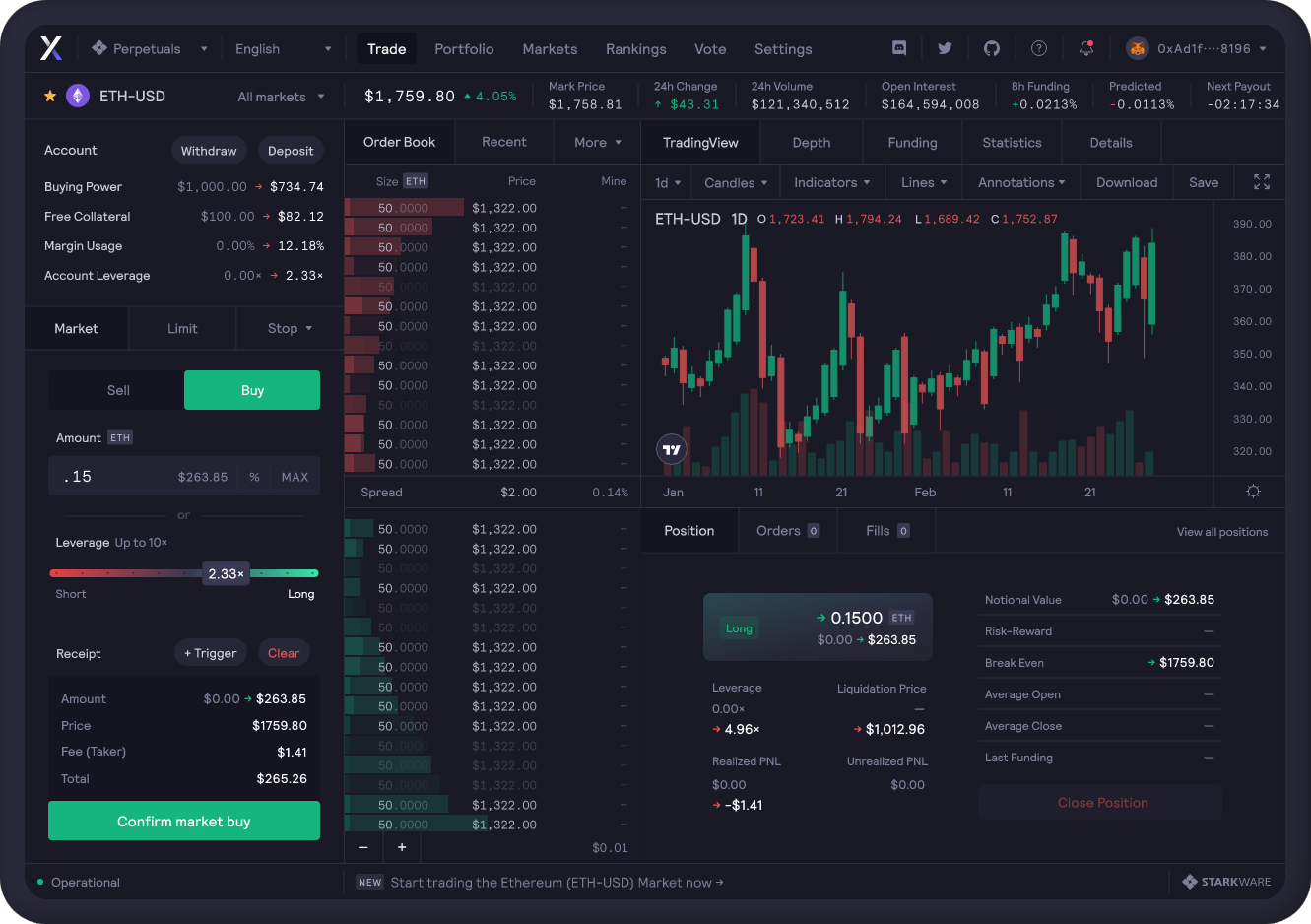

Decentralized Perpetual Exchanges ($GMX, $APEX, $DYDX): 2.5%

Another bet I'm making in DeFi is around Decentralized Perpetual Exchanges. These DEXs are different from Uniswap in the sense that they allow leverage trading with long/short positions instead of only swaping tokens between one another.

You are probably familar with this type of trading interface, but did you know that these platforms are completely decentralized and lets you long/short with leverage from your MetaMask wallet?

You might want to ask, why do you need these platforms?

My answer is: KYC and regulation.

If you are a trader in the US, Canada, China, or other restricted countries, you are completely running out of options to trade with leverage on centralized exchanges. None of the popular exchanges accept users from these countries. And as regulation becomes ever tighter, using a VPN no longer helps. Exchanges now all require you to KYC with an ID from an unrestricted country, so you are truly out of luck.

My prediction is that both users and exchange operators will start to migrate their leverage trading platforms to decentralized exchanges. We've seen the popularity of GMX in 2022, and recently ByBit also launched their own Perpetual DEX called APEX.

Small plug, if you are forced out of centralized exchanges and need an alternative, I wholeheartedly recommend APEX as they are the only platform that's launched by a leading exchange which is ByBit. All other competitors like GMX, DYDX, GNS, etc are all DeFi startups first and trading second.

Sign up with the link here, and use code APEX-BACON for a welcome bonus.

It's free and helps support the channel!

APEX: ByBit's DEX - TRADE WITHOUT KYC

Alternatively, if you're looking to gain exposure to all the decentralized perpetual exchanges out there as an investment narrative, the top ones in my opinion are $GMX, $APEX, and $DYDX. There isn't a clear winner in terms of token valuations yet as they are all in their early stages with similar valuations.

I have highlighted this segment with red in the portfolio, as there really isn't a market leader yet. So it's more important to gain overall exposure to the sector and keep watching closely.

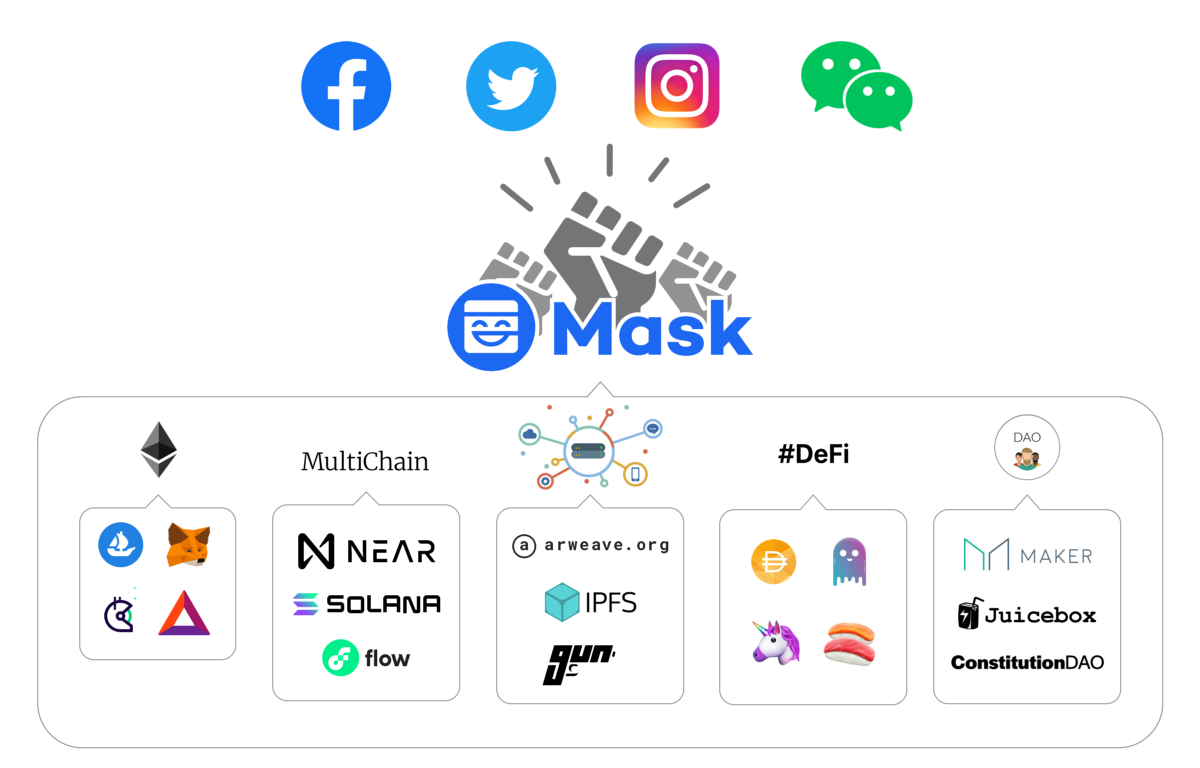

Decentralized Social Media Infra ($MASK, $DESO): 5%

The next category of coins in this portfolio are around the Decentralized Social Media narrative. This is a narrative that I have been particularly bullish on for quite a while, and has been highlighted more recently by the decentralized Twitter narratives around the Elon Musk rumors.

And no I'm not talking about simply putting Twitter on the Blockchain, that idea has been tested many times and failed. Rather, I'm referring to the general infrastructure of enabling existing Web3 users to have a non-financial layer around their wallets, and for Web2 social media apps to put some of their data on chain as a "Web2.5" solution.

This area is still ripe for disruption as not many projects exist currently for this usecase. Two of the leading projects that have caught my eye are Mask Network $MASK and Decentralized Social $DESO.

Mask is a platform that allows you to connect Web3 wallets like MetaMask to Web2 social media platforms like Twitter. This lets users directly encrypt and post content from their wallet to their favorite social platforms.

DeSo is a layer-1 blockchain specifically built for social media applications. Quite a controversial project as it first launched as BitClout, the hugely popular project that lets users purchase creator coins of famous Twitter profiles. Despite all the controversy, it seems that BitClout was really a marketing stunt to both prove the ability of the DeSo blockchain and raise money for its development.

I have labeled this part of the portfolio in Red because these coins are still relatively small and carries high risk. Also there should continue to be major projects launching in the next year around the Decentralized Social Media narrative, which we can allocate to later. Notably I'm also watching Lens, Farcaster, Ceramic, and Lit Protocol for when they launch.

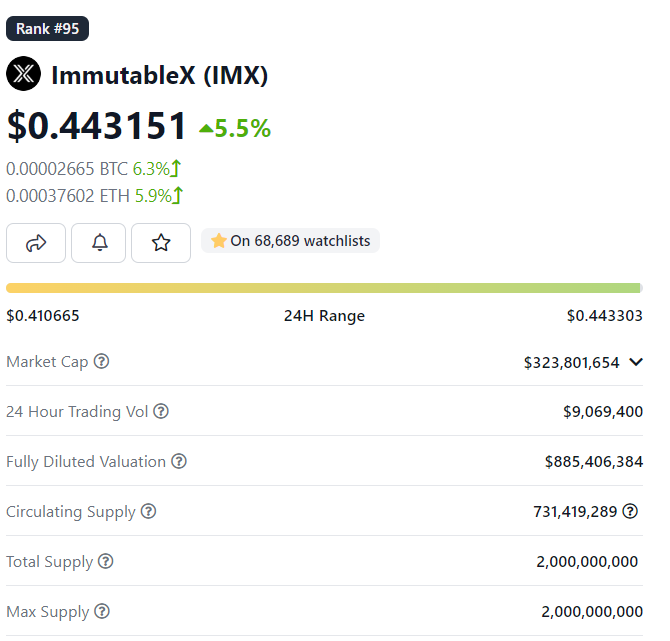

Gaming Infra ($IMX, $GALA, $PYR): 5%

The last category in this portfolio are around Blockchain Gaming Infrastructure projects. The synergy between gaming assets and blockchain are incredibly clear and should continue to see adoption in the far future. However the 2021 cycle was plagued by the rise and crash of Play-to-earn and GameFi, which ultimately led to many vapor projects and not much legitimate options.

When it comes to gaming, there are currently a few investable categories.

- Individual games like Axie, Illuvium, Star Atlas, etc

- Metaverse canvas like Sandbox, Decentraland

- Gaming blockchains like ImmutableX, Enjin

- Game publishers/stores/explorers like $GALA, $PYR

- Gaming guilds like YGG, Merit Circle, GuildFi

Out of these categories, the ones most likely to survive are #3 and #4 in my opinion, as they are the underlying infrastructures powering the blockchain gaming space.

However even out of the gaming blockchain and game stores list, there are many good options that are not overvalued.

ImmutableX seems like the most legit solution that provides a zk-rollup Layer-2 infra for gaming, however they don't yet have any major game partnership aside from games that they've made themselves. In contrast, gaming publishers are much more friendly towards Solana and Polygon as their blockchains of choice. As we already have positions in both Solana and Polygon, $IMX does not seem too appealing.

Enjin is another contender but has fallen off dramatically in the 2021 bull run. It really seems like they have stopped working on the project. There has been no major announcements for ages.

In terms of game stores and publishers, GALA games is everyone's favorite shill. Every major influencer seems to be partnered with them to soft shill their potential as the one gaming project to rule them all.

Yet despite all that marketing, there doesn't seem to be major integration from any traditional games, and the GALA token continues to get dumped.

All in all, while I truly believe Blockchain gaming will continue to see adoption far into the future, there simply isn't any good choices to get investment exposure to the narrative right now. Therefore I will save this 5% allocation and continue watching this space until some fundamentally strong infrastructure projects emerge with real gaming adoption.

NEW VIDEOS

6 Crypto Investing Mistakes to AVOID (If You Want to Get Rich)

3 Ways to Earn Passive Income With Crypto ($1,000 / month)

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code APEX-BACON for Bonus)