The 6 Sins of Crypto Investing

Hi everyone, welcome to issue #11 of the VirtualBacon Newsletter.

In this week's issue:

NEW VIDEOS ▶️

- 3 Ways to Earn Passive Income With Crypto ($1,000 / month)

- My Bitcoin Bottom Prediction (Next Bull market in 2023?)

EDUCATION 🤔

- The 6 Sins of Crypto Investing

NEWS 📣

- Important TradFi Market Events This Week

- Vitalik Highlights Ethereum's Future

- WAVES/USDN Depeg - the next (smaller) LUNA?

- CZ Exposes Kevin O'Leary Over FTX Promo Deals

- FTX/SBF Secretly Funded Crypto News Site "TheBlock"

- FTX/Alameda Full VC Portfolio Revealed

- Crypto.com Releases Proof-of-Reserves showing User Funds Fully Backed

- Binance FUD: Executives Charged for Money Laundering?

MARKET WATCH 📈

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS

3 Ways to Earn Passive Income With Crypto ($1,000 / month)

My Bitcoin Bottom Prediction (Next Bull market in 2023?)

EDUCATION

The 7 Sins of Crypto Investing

Avoid Leverage Trading

The most paramount rule I have is to avoid leverage, margin, or borrowing.

Doing so creates a liquidation threshold that price cannot go below, or you will be forced to sell your position at a loss. Getting liquidated means you lose all your coins that you have as collateral.

On top of liquidation risk, leverage trading is also designed to take advantage of the average investor. Your PnL (Profit/Loss) level will fluctuate much more dramatically than a regular investment postion, as your exposure is amplified by the extra leverage. Thus even if you are experienced in handling emotions when investing, you can still lose your shit. Leverage positions will play with your emotions and induce huge euphoria and depression, that most people simply cannot deal with.

I used to believe that only great traders and investors could handle using leverage, but as 2022 unfolded, we had many "great" traders blow up due to leverage, most notably Three Arrows Capital and FTX/Alameda.

It's best to admit you likely won't succeed long term with leverage.

Don't Fall in Love with Your Coins

In crypto, it's easy to fall into the hype of an investment narrative, we've all seen the popularity of DeFi, GameFi, Metaverse, Layer-1, etc.

Narratives is what ultimately drives the crypto market, and is crucial to being a good crypto investor.

However, the problem with narrative investing is that old narratives fall by the wayside as time moves on. Metaverse was a hot narrative a year ago, and now it couldn't be further from the case.

Those that were early to the metaverse narrative, should've done massively well. But those that were late, or bought into the story too deep and ended up holding long term, became the bagholders.

The takeaway is to recognize whether you are investing in a particular crypto based on narrative, or fundamental value.

It's paramount to not fall in love with coins in your narrative. You should only make investment decisions based on how early you are to the narrative, and how much longer it can last. Always take profit early.

In contrast, fundamental investing is about finding undervalued assets that you believe others will eventually have demand for. This type of investing is not all smokes and mirrors, but follow numbers driven methods such as valuation comparisons, token revenue share etc. If and only if you have an exact calculation of the crypto you're investing in, should you choose to hold long term.

Recognize whether you are investing based on a narrative, or real fundamental value, and do not fall in love with your coins.

Don't Try to catch the Bottom/Top

Everyone wants to buy the bottom and sell the top, but in practice this goes completely against the nature of trading. The definition of a capitulation is when ALL investors lose hope and think the asset is dead, therefore mass selling at a loss. How are YOU the only one left to go against the herd?

By design, buying the bottom and selling the top are the two most difficult thing to do in trading and investing. So stop trying to speculate and look everywhere for "when is the Bitcoin bottom".

The best traders don't try to time the bottom, but rather have different methods of dollar cost averaging (DCA). Most people think DCA is only a boring passive strategy that lets you invest periodically, but there is another usage of DCA in active investing.

For example, the current price of Bitcoin around 16k, and the next bull market is expected to begin sometime in 2023. You can start to actively DCA by taking the total amount of money you wish to invest in Bitcoin for the next year, and spreading it out to weekly purchases over a 6 months period. This way you will get an average entry price that should be quite close to the Bitcoin bottom, without having to time it exactly on the week of the bottom.

As a retail trader, its best to DCA in times of panic.

Timing the bottom with your whole portfolio is a dream, and you have to be asleep to believe it. However getting an average entry price close to the bottom is much more achievable, if you think longer term and have a gradual entry plan.

Understand Good vs Bad Yield

Yield is an incentive to let others use your liquidity, for better or worse.

There's good yield on Uniswap that is generated from trading fees, similarly with many DEXs.

However, there's yield that depends on new users to continually add more liquidity – pretty much an elaborate Ponzi scheme

Examples of this would be Luna or the yield on FTX.

Luna needed to maintain a high price for UST, the native stable coin, to be properly backed, while FTX offered high yield to users in an effort to help plug the hole in their balance sheet.

If you don't know where the yield comes from, you are likely the exit liquidity for the people before you.

Locking Tokens is Usually a Mistake

Token locking is a mechanism that's usually offered in tandem with high yields. The longer you lock your tokens, the higher yield you can get.

Although many DeFi fans have praised this design for its long-term focus, it still lacks merit if the protocol does not generate any revenue and the yield only comes from other peoples' speculation.

Locking tokens is often a sin because many protocols that participate in this practice use it as a means to inflate price while those that lock cannot sell.

There are many sound protocols that have token locking, like Curve or Yearn. However these protocols are worthy platforms not because they lock tokens alone, but rather they generate real revenue in order to fulfill its yield. Their token locks are simply ways to gradually distribute the protocol's revenue, in order to achieve long-term growth.

The real deciding factor is always the product and its revenue, not the clever locking mechanisms of the yield farm.

When in doubt, it's always a good idea to stay liquid and completely avoid locking tokens.

Only Invest in What You Understand

There are countless types of Crypto assets and different ways to make money in Crypto.

Holding large caps, Swing trading based on events, lowcap gem hunting, NFT minting, LP on DEXs, DeFi yield farming, Airdrops, new token sales, the list goes on.

The downside of this, there's many different protocol/token models that are greatly different than stocks, bonds, or commodities.

It is easy to get carried away and trying to participate in every type of opportunity in Crypto, however this will only lead to time and money wasted.

In reality, you just need to be good at ONE type of opportunity in Crypto, and spend all your time in that area.

- You can trade large-cap and mid-cap coins based on their significant events all year.

- You can track new NFT mints daily

- Find the highest yields on DEXs and optimize

- Farm the latest tokens on all the different chains

- Hunt the latest airdrops like arbitrum, there's one every week

- Evaluate new token sales, at least a few a week

Nobody has the time nor energy to engage in all activities in Crypto, pick one area that you understand well, and stick to it.

NEWS

Important Macro Events this week

Dec 11th: US 10-Year Bond Auction

Dec 13th: US CPI + 30-Year Bond Auction

Dec 14th: FOMC Meeting Keynote

Dec 15th: ECB Hike + US Retail Sales

Vitalik Highlights Ethereum's Future

Vitalik published a new article on what excites him the most in the ETH ecosystem right now

— Blockworks (@Blockworks_) December 5, 2022

Here’s what he said:

In a blog post earlier last week, Vitalik Buterin, the co-founder of Ethereum, highlighted what he is most excited for for Ethereum – DeFi, DAOs, Money, Blockchain identities, and hybrid applications.

Vitalik said that DeFi started honorably, but that soon fell to the way side, as overcapitaliztion took over, and users began chasing unsustainable yields.

Moving to blockchain IDs, Vitalik adds, that sign in methods like Sign In With Ethereum (SIWE) could not only improve the seamlessness of logins, but would also improve security for the end user, as they wouldn't have to forfeit their google/email information.

To DAOs, Vitalik mentioned that the term "captures many of the hopes and dreams that people have put into the crypto space to build more democratic, resilient and efficient forms of governance", but concedes that work needs to be done to improve censorship resistance and susceptibility to internal organization.

Lastly, Vitalik was exited for Ethereum to potentially be used in hybrid application like voting.

Ideally, this voting would be done on an encrypted, preserving privacy, and a ZK-SNARK-based solution.

WAVES & USDN Depeg - the next (smaller) LUNA?

The problem is that Sasha, founder of Waves, has rugged the protocol, stealing $500 million in the process. You can't run a liquidation on their protocol and expect to get paid because they literally changed the views to prevent the account from being liquidated.

— Avraham Eisenberg (@avi_eisen) December 3, 2022

Waves was a layer 1 protocol that followed Luna's model of having a governance token and a stable coin collateralized by that governance token.

Prior to Luna's downfall, everyone's favorite "highly profitable" trader, Avraham Eisenberg, highlighted that the waves team borrowed $400m in stables against USDN, a stablecoin that they created.

Essentially they created a highly risky stablecoin similar to UST, and completely exited from it by borrowing other safe stablecoins against it.

This means USDN has nowhere to go but down. There is no new capital coming in from anywhere else to recapitalize it.

WAVES/USDN comes back into the limelight this week, as not only CT discovers their unliquidatable position. The Digital Asset eXchange Association (DAXA), also issued a warning on WAVES/USDN.

DAXA is a crypto exchange group representing South Korea’s largest firms like Upbit, Bithumb, Coinone, Korbit and Gopax.

As of now, $300 million of their Bitcoin holdings were used to collateralize the USDN stablecoins, and Market price of their BTC is below their borrow price.

CZ Exposes Kevin O'Leary Over FTX Promo Deals

CZ posted a video along with his tweet calling out Shark Tank's Kevin O'Leary.

This video includes a segment of an interview where Kevin discloses he was paid $15m for his role as a spokesperson for FTX.

It seems $15m not only changed @kevinolearytv’s mind about crypto, it also made him align with a fraudster. Is he seriously defending SBF?https://t.co/JoKapOcMXr (baseless attacks start around 4:20).

— CZ 🔶 Binance (@cz_binance) December 9, 2022

A thread. 1/11

This is after Kevin previously called crypto a scam.

In the interview, Kevin takes on a spindoctor role, as he goes on damage control on Sam Bankman-Fried's (SBF) behalf, saying that buying back their equity from Binance cost a couple billion dollars.

Kevin never mentions misappropriation of customer funds.

CZ then delves into the books, saying that they exited their FTX equity position in July 2021, however, FTX invested a total of $5.5b in various companies.

They not only took on these massive investments, but also naming a stadium, multiple superbowl ads, baseball referees, F1, luxury real estate, and political donations – likely with customer funds.

4/ Worse than losing $15M, you’d think that being used as the poster child for one of the greatest financial crimes in history would make @kevinolearytv think twice before taking Sam at his word AGAIN. But clearly not, based on his appearance on https://t.co/hoyHqjdUk3

— CZ 🔶 Binance (@cz_binance) December 9, 2022

Why does this matter?

Kevin will be appearing in front of the Senate next week for their hearing of the FTX implosion.

Kevin will likely continue this positive rhetoric in favor of SBF, opting for the naive misappropriation of funds narrative.

FTX/SBF Secretly Funded Crypto News Site "TheBlock"

TheBlock is one of the leading Crypto News sites. It has been revealed that its CEO Mike McCaffrey had received two loans from Alameda Research worth $27 Million in 2021, to fund its company restructuring.

A confirmed FTX insider provides more color on the relationship between FTX and The Block: pic.twitter.com/IS5aiXIqzx

— Autism Capital 🧩 (@AutismCapital) December 9, 2022

Larry Cermak, The Block’s vice president of research, posted a list of Alameda Research’s investments to his Twitter account on Dec. 6 — which included two of the loans to the platform

McCaffrey has since resigned from TheBlock, and published an article on the matter.

"He did not disclose that this money came from Alameda nor did he disclose the fact that he had received an additional 16 million dollars from Alameda this year to buy property in the Bahamas"

For what it's worth, I always found The Block to be a highly unbiased crypto news source, one which purely focuses on covering the most timely and breaking news but nothing more.

I strongly suggest looking up who has been backing your favorite crypto media platform and consider whether their coverage remains unbiased based on their financial interests.

The Block CEO resigns after failure to disclose loans from Bankman-Fried’s Alamedahttps://t.co/rToxS1AipN

— The Block (@TheBlock__) December 9, 2022

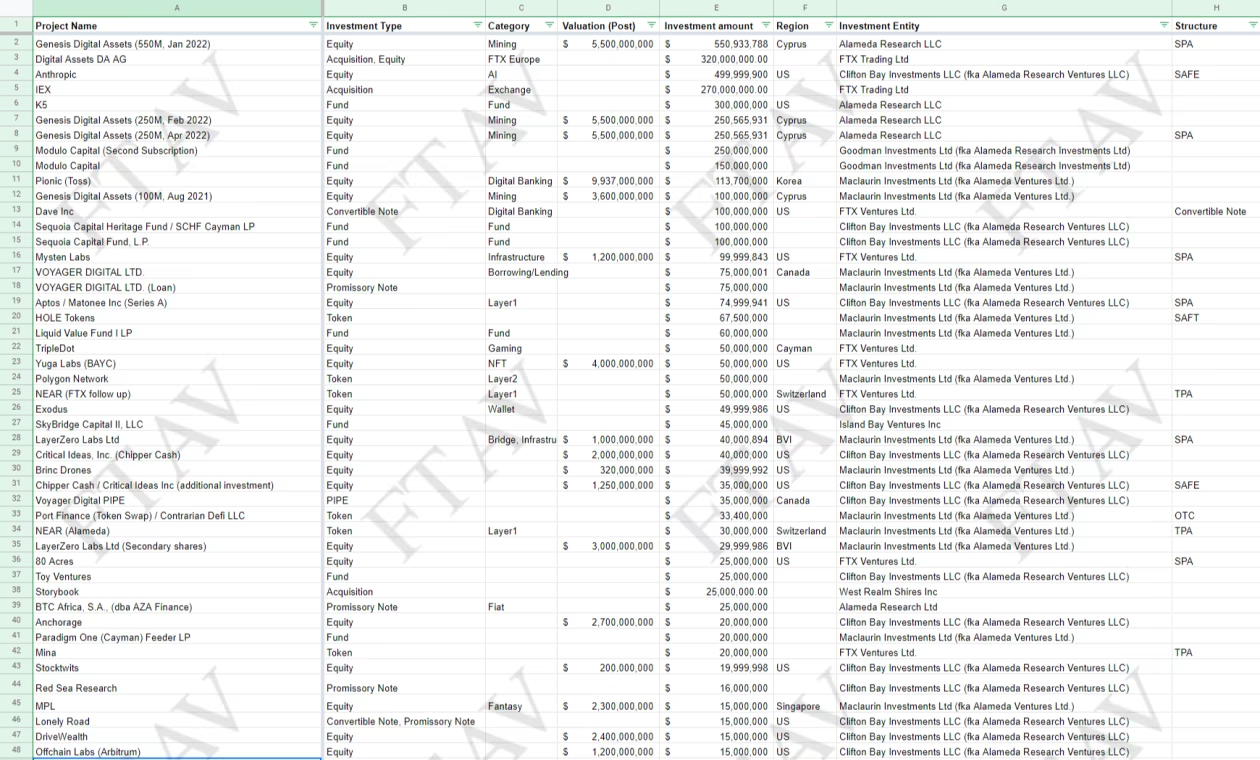

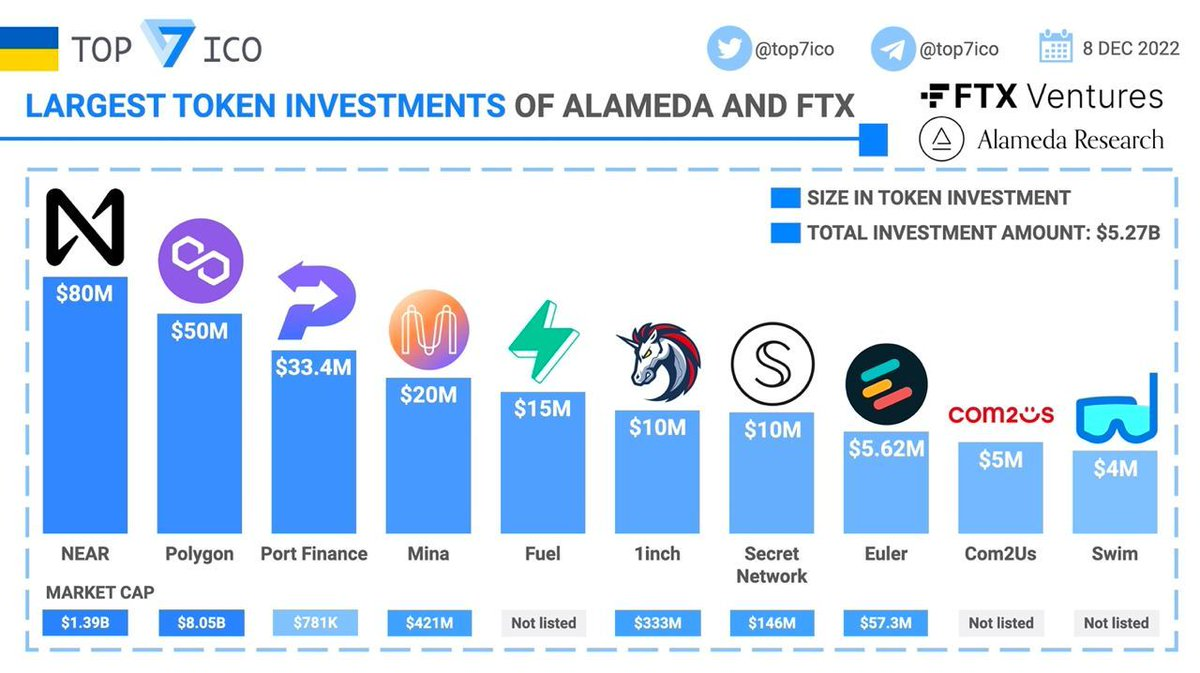

FTX/Alameda Full VC Portfolio Revealed

Latest document revealed the full Alameda Research private equity portfolio that was being offered as collateral in an attempt to secure a new credit line.

The screenshot is taken from an Excel spreadsheet from early November, when SBF was seeking rescue funding amid a bankrun on FTX.

Some of the notable assets being offered as collateral include: Near, Mysten Labs (SUI), Aptos, BAYC NFTs, Polygon, Mina.

As previously reported, the portfolio includes stakes in FTX backers Sequoia Capital and Anthony Scaramucci’s SkyBridge Capital, as well as in Elon Musk’s SpaceX and Boring Company projects through the investment in K5

As most know, FTX/Alameda didn't get funding in time, and are now insolvent with a ~$10b hole.

If you hold any of the assets mentioned, keep an eye on the FTX news coverage for the amounts of assets in question, and whether if the tokens will be sold off in public or private markets.

Crypto.com Releases Proof-of-Reserves, but critics keep FUDing

Crypto.com is the latest exchange to publish full Proof-of-Reserves.

This Proof-of-Reserve method is the standard of audit used by most Crypto exchanges including Binance, Crypto.com, ByBit, Kraken, and many others.

These report have been met with criticism from accounting experts, quoting that the report is not an official audit, but a "matching exercise based on information provided by the client about on-chain addresses of assets and a client database of customer balances".

Ultimately only time can tell whether exchanges are truly safe from mass withdrawal sprees when rumor spreads. Crypto.com was able to withstand the pressure in November amist its mass FUD, so I tend to think that the worst is over for Crypto.com

Binance FUD: Executives Charged for Laundering?

The latest FUD around Binance claims its executives are being charged for money laundering. However It seems that the investigation story is old and ongoing for the past two years.

14th May 2021https://t.co/asSvHGbK6x

— Dark Crypto Lady 🦊 (@DarkCryptoLord) December 12, 2022

21st Jan 2022https://t.co/pDG2UlhbB0

1st Sept 2022https://t.co/AFmu4FpiDw

Pretty sure there's more, but its the same old same old stuff being regurgitated instead of probing sbf's anal hole. pic.twitter.com/JkSah7TLAF

The timing also feels a little coordinated with the recent criticism about Binance Proof-of-Reserves, and the media circus tour to distract people from hunting down FTX.

The timing of this makes me think this was brought up before the ftx hearing so ftx doesn't look like the only bad guy and everyone was doing questionable things in an unregulated industry.

If I had to guess, short term hit on markets and on $BNB price, Price action of bnb will probably be the best leading indicator for Bitcoin price.

Binance gets slapped with a fine and we move on since this has been an on-going probe and probably something binance was prepared for.

MARKET WATCH 📈

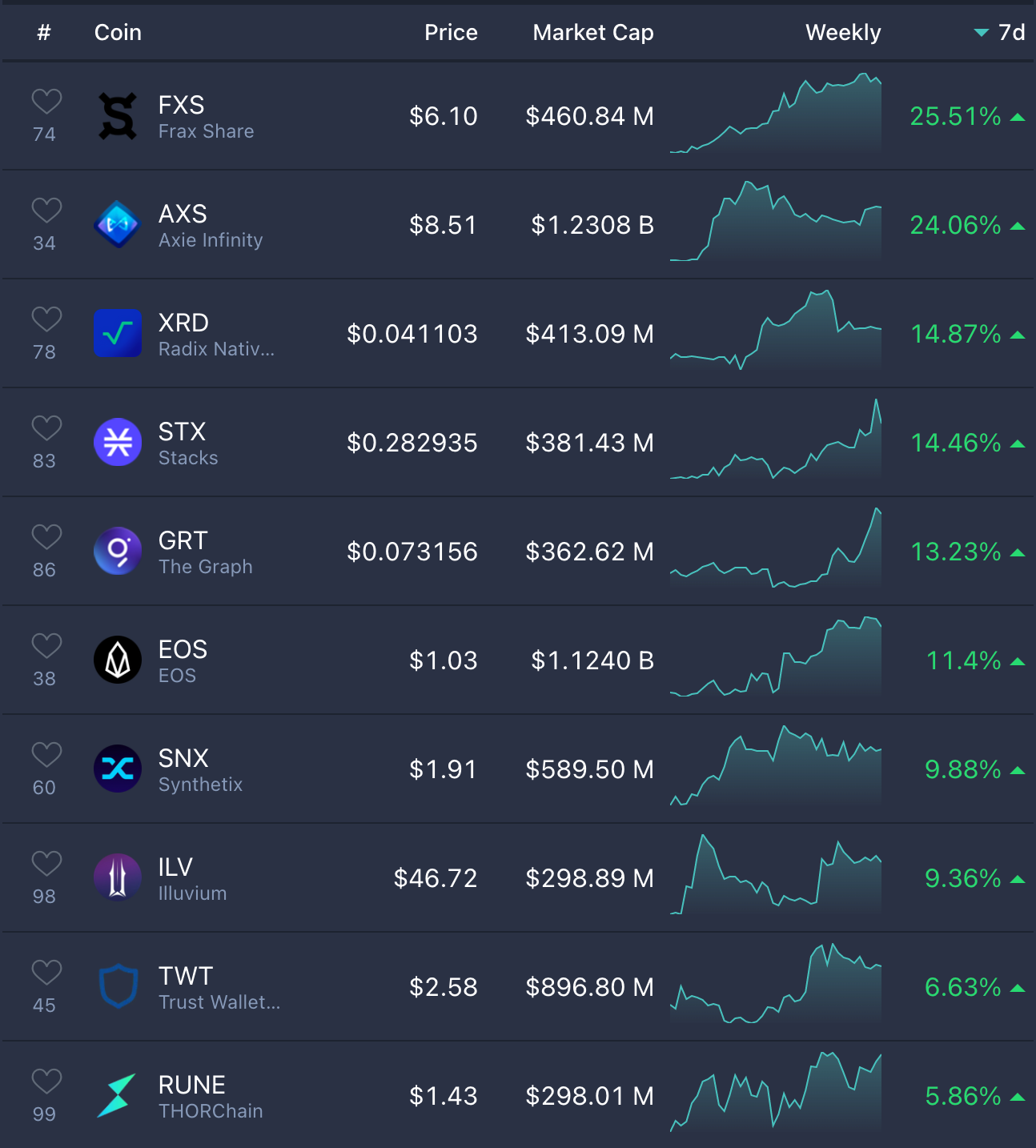

Top Performing Coins of the Week

FXS

FXS is the goverance token behind the stablecoin Frax.

Frax is a is a fractional-algorithmic stablecoin protocol that mints FRAX from USDC, with a collateral ratio of ~85%.

The reason behind the recent price action is the protocol will halve emissions on FXS.

This emission halving saw price rally over 200% last year.

Given the current market and how Link's price action around staking unfolded, this will likely be a sell the news event.

AXS

AXS is the governance behind the crypto game, Axie Infinity.

AXS is hard capped, but the game has been issuing it as an incentive, since their inflationary token (SLP) fell by the way side.

Sky Mavis, the company behind the game, has recently had some inquiries for over-the-counter (OTC) deals for AXS.

In a public tweet, the founder of Sky Mavis said, that AXS is cheap enough to just buy on the

open market.

Whether or not the large OTC buyers bought or not, AXS's price action short squeezed following the founder's tweet, as others rush to front run one another.

GRT

The Graph is an indexing protocol that organizes blockchain data to make it easily accessible.

AI has been a hot narrative in many crypto communities, and many crypto projects are now pivoting to capitalize on this innovation.

The Graph is one of these pivotors, as they issue a $60m dollar grant to a reinforced learning machine (RI) and cryptography company,

SNX

Last week Synthetics launched staking V2 for SNX.

Synthetics is an exchange for synthetic assets like stocks.

These synthetic assets are 1:1 with the asset they are supposed to mirror, so crypto traders can easily trade stocks without having to transact over a centralized exchange.

The exchange will also launch V3 Synths and V2 perps early in the new year.

SNX has been on top of many people's "real yield" shortlist, as the protocol seems to be undervalued compared to competitors across a few metics.

I looked at the #realyield potential of several protocols, $SNX, $GMX, $GNS, $MYC, $MCB and $UNIDX.

— Midgetwhale (@derpaderpederp) December 9, 2022

Perps only in this overview, call me when $PERP, $DYDX and $CAP finally pay out token holders and/or get their stats site in order. pic.twitter.com/N18npdEZRn

ILV

Earlier this week, Illuvium hyped up the beta gameplay trailer for the game.

Featuring crisp graphics and an open world, Illuvium is a crypto game like we haven't seen yet.

This game beta walkthrough was likely a huge selling point for many, as most crypto games have been primitive in gameplay.

The Illuvium team said they would open the beta to public soon, but haven't given a date yet – they're expecting to have it by next showcase.

Look in their discord for event schedule.

TWT

Trustwallet continues to outperform, as users take self-custody measures.

After the fallout from FTX, self-custody has been a key narratuve, with TWT getting most of the hype.

They have an affiliation with Binance, so many say it saw as a sound custody solution.

Metamask changed its privacy policy, implying that they now collect users data, and this sparked a new narrative for TWT.

Most recently, Binance blocked a user's account for being unreasonable.

Tweet deleted. But CT remembers.. pic.twitter.com/p5nkeDmhe1

— CoinMamba (@coinmamba) December 9, 2022

And this should serve as a reminder to not praise or whole heartedly trust egotistical leaders in the space, especially after Dani/sifu, Do Kwon, SBF and plenty more.

Important Upcoming Events

- Dec 13th: US CPI Data

- Dec 14th: US FOMC Keynote

- Dec 20th: FXS halving

- 2022: AAVE stablecoin $GHO launch

- 2022: CRV stable coin launch

- 2022: YFI veYFI (Locked YFI) proposal and Tokenomics revemap

- 2022: Sushi new tokenomics proposal

- 2022: GMX potentially expanding to Polygon and BSC

- 2022: DYDX V4 upgrade

- 2022: Chiliz (CHZ) chain launch

- 2022: Secret (SCRT) 2.0 mainnet launch

- 2022: LRC protocol upgrade with fee sharing for stakers

- 2022: XRP lawsuit settlement

- 2022/2023 Shibarium Launch (Shib + Bone) (unknown launch date)

- March 2023: Ethereum Shanghai Hardfork

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code APEX-BACON for Bonus)