Three ways to make passive income in Crypto

Hi everyone, welcome to issue #10 of the VirtualBacon Newsletter.

In this week's issue:

NEW VIDEOS ▶️

- My Bitcoin Bottom Prediction (Next Bull market in 2023?)

- MetaMask Tutorial 2023 (How to use MetaMask Safely)

EDUCATION 🤔

- Three ways to make passive income in Crypto

NEWS 📣

- Stripe launches fiat-to-crypto onramp widget

- BlockFi files for Bankruptcy

- Brazil legalizes Crypto and a payment method

- Fantom inside financials leaked by Andre Cronje

- Uniswap Soon to start sharing fees?

ALTCOIN INSIGHTS 💎

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS

My Bitcoin Bottom Prediction (Next Bull market in 2023?)

MetaMask Tutorial 2023 (How to use MetaMask Safely)

EDUCATION

Three ways to make passive income in Crypto

Airdrops

Airdrops are a simple way to earn cryptocurrency without buying any coins. If you're not familiar with airdrops, they're basically free money—usually in the form of tokens or coins—that's given away to members of the crypto community at random.

Crypto Startups share a portion of their project tokens to users. The benefits for them are twofold.

1. Users turn into investors and customers

2. Users act as free advertisement.

Airdrop hunting is one of the best ways for small investors to make passive income in Crypto.

Many popular tokens launched as airdrops like Uniswap, 1Inch, ENS, Optimism. And the early participants received thousands and sometimes tens of thousands of dollars in these tokens as reward

All of these airdrops are worth over a thousand dollars AND you don't need to actually spend money.

Just put in a small amount like a hundred dollars, do some actions, and then take it back out.

That's why it's the best for small investors.

Here's how you do it:

- Go to airdrop tracking sites like airdrops.io or DeFi airdrops twitter account.

- Read the instructions on how to qualify - typically it involves setting up a wallet, bridging in some coins, and doing some actions like trading.

- Lastly, make sure to target the legit projects first, I have done Arbitrum, Zksync, Starknet, Aztec, and Hop protocol.

DeFi Farming

DeFi yield farming has long been known as both a lucrative and dangerous way to earn income in Crypto. This is because although yields can be high, the main token you are farming with matters a lot.

If you hold a volatile token in a farm, the token price can go down a lot and your initial investment will go down in value. So it isn't passive income but more like investing.

In general, you should only farm with stablecoins or largecap coins that you believe can go up in price.

I tend to stick to farming only BTC, ETH and USD, and I'm ok with any combination of the three.

Best farms that I recommend

Convex Finance (which uses Curve Exchange)

Curve Exchange is the #1 DEX for stablecoin exchanges. When you exchange one stablecoin to another like USDT <-> USDC, you are most likely using Curve Finance under the hood.

Convex Finance is the leading platform that lets you provide liquidity to Curve Exchange. This earns you $CRV tokens completely passively, and you can withdraw your assets at any time.

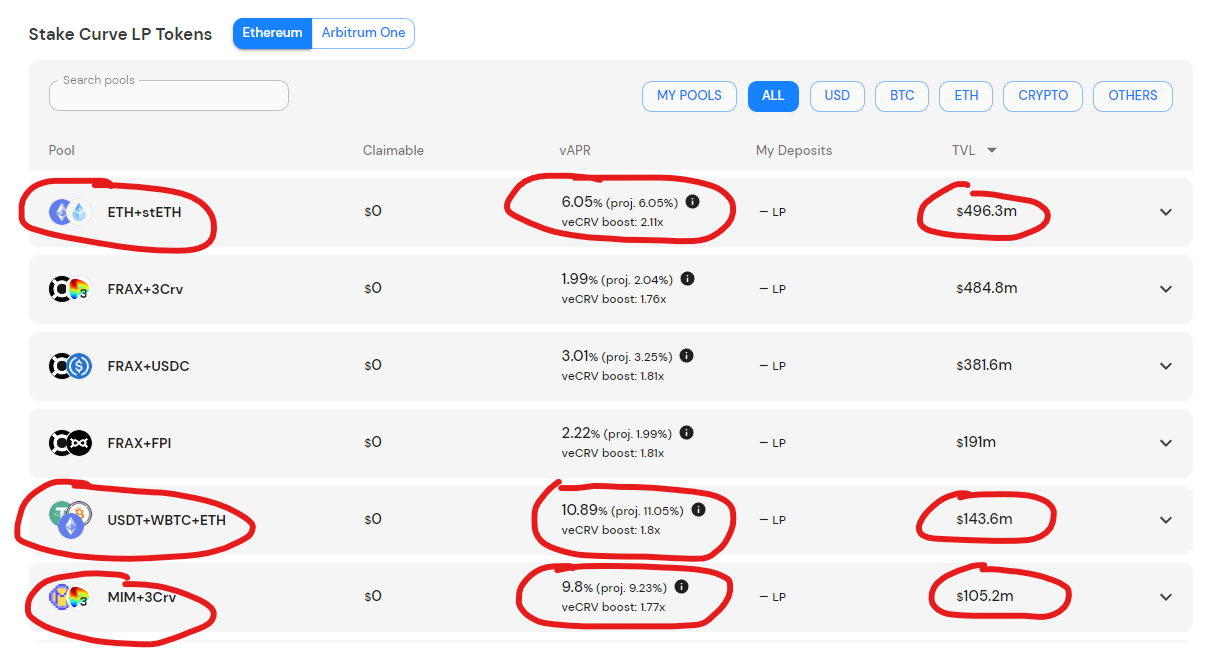

There are many pools on Convex, but the ones I recommend are the following three types:

ETH-stETH

This pool lets you trade between ETH and staked ETH from Lido Finance. Since both assets are ETH, their prices stay the same, so you are only exposed to the price fluctuations of ETH.

This pool earns 6% APR per year, and it's a nobrainer if you hold ETH long term.

USDT-WBTC-ETH

This pool contains 33% of USDT, WBTC, and ETH. Which means when you put money in, you are holding 1/3 each in USDT, WBTC, and ETH. This is commonly known as the TriCrypto pool.

This pools earns 10% APR per year, and is another good option with a balanced portfolio. By depositing in this pool, your position will constantly rebalance itself so its value is always 1/3 each in USDT, WBTC, and ETH.

MIM-3Crv

This last pool is a stablecoin pool which consists of Magic Internet Money $MIM, USDC, USDT, and DAI. As all 4 assets in this pool are USD stablecoins, its value never fluctuates.

By depositing in this pool, you effectly hold all four stablecoins, and earn 10% yield per ear.

Very simple and straight forward.

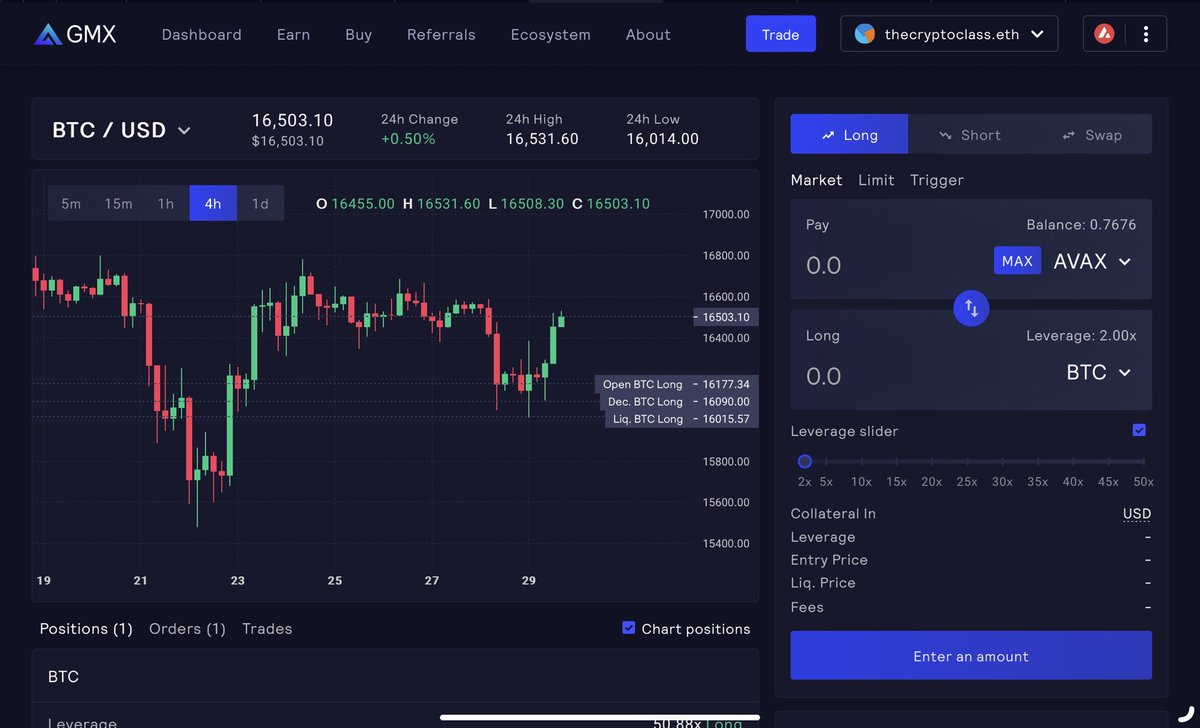

GMX GLP

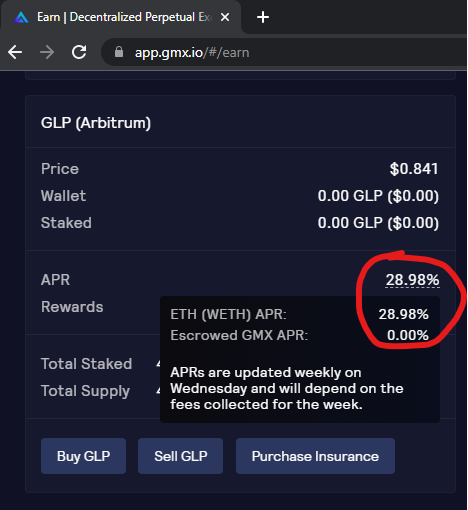

GMX is another decentralized exchange that provides good yield. The pool we are interested in here is calld GLP, or the GMX Liquidity Pool.

Unlike the designs of Curve and Uniswap which has many pools for each asset pair, GMX only has one pool for its entire exchange.

This simple design allows GMX to easily share high fees with its liquidity providers.

The GLP pool current earns 29% APR per year, and keep in mind that you get this amount in ETH, instead of a inflationary token. This is the beauty of "REAL YIELD", as people trade on GMX, part of their transaction fees are distributed to GLP liquidity providers.

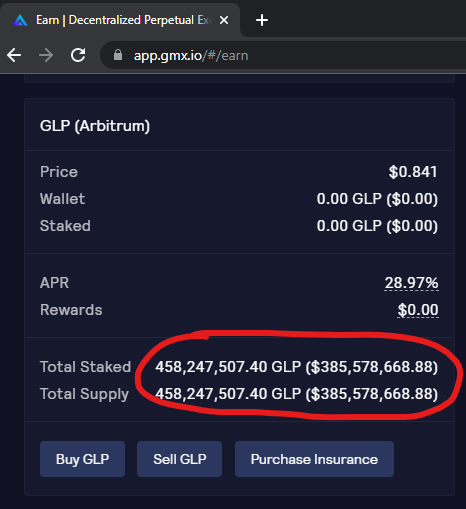

The GLP pool currently has $385M in deposits, and has been running smoothly for around a year. So it has been decently battletested.

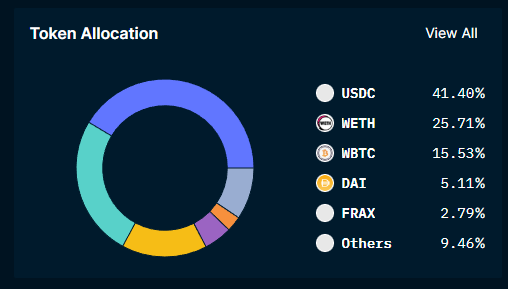

Keep in mind that unlike Uniswap and Curve, the GLP pool contains many different assets such as USDC, ETH, BTC, DAI, FRAX, UNI, LINK.

You can see the full breakdown on its dashboard

This means when you deposit money into this pool, you are effectively holding this exact breakdown of a portfolio in the pool. So when the price of ETH, BTC, UNI, and LINK fluctuates, so does your deposit amount.

Luckily, metrics have shown that the GLP asset pool has outperformed simply holding BTC or ETH, and even outperformed most DeFi farms competitors.

So if you are comfortable holding your portfolio in roughly

50% in USD, 25% ETH, 15% BTC, 5% UNI, 5% LINK

this pool does exactly that for you.

AND remember you earn 29% APR on it.

UniswapV3 Liquidity Provider

Uniswap V3 is the most advanced but also most lucrative passive income farm that I know.

You can get 30-60% APR on BTC, ETH, and USDC pools on native UniswapV3. This all comes from fees and there is no token that you are farming. So this is also a "REAL YIELD" farm where all income is from transaction fees instead of a inflationary token. The security risk is also super low as you are only exposing yourself to the native Uniswap platform.

You can find the current highest APR pools for Uniswap on DeFi Llama. Use the Yields tab and use a filter to find the pools you need.

I use these three filters:

- Token: ETH/BTC

- Platform: UniswapV3 only

- TVL: at least $1M

The downside is Uniswap V3 uses what's called "Concentrated liquidity", which means you need to actively monitor your position to make sure the price of the assets in your pool has not moved outside of your pre-defined range. If this happens then your farm will stop earning rewards.

In general, I check my Uniswap V3 LP position once per day, and this keeps me in the loop and I pretty much never lose profits this way.

I also only farm on the ETH-USDC and BTC-USDC pools as they tend to fluctuate not that much. If you farm on any smaller coins with larger fluctuations, you will need to monitor your positions more frequently, or use a wider range and receive a lower reward.

Watch this video for an in-depth guide on UniswapV3

Launchpools and Launchpads

The last way to earn passive income is through LaunchPools and Launchpads

These platforms are a way for projects to launch their token similar to an ICO.

The main difference is that Launchpools and Launchpads are not huge public ICOs where you buy at a crazy high price, instead they are meant to reward early community participants.

Launchpool

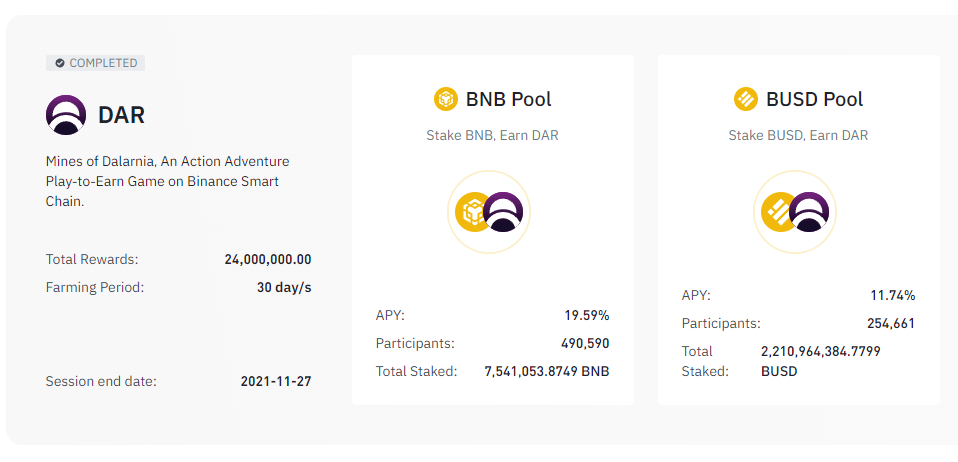

Most exchanges have a Launchpool product that you can participate. The pool usually lasts around one month for each new project.

You deposit some of the exchange's tokens, for example on Binance it's BNB and BUSD, and over one month you accrue the new project's token as rewards.

After one month you can claim all your rewards, and the token gets listed on the exchange.

You can learn more about how to participate in Launchpools here

Obviously the performance of launchpools will depend on the price performance of the specific project token that you are farming. But we have seen rewards as high as 19% on BNB and 11% on BUSD.

And because you are only holding stablecoins and large coins on these platforms in order to farm, you don't have the risk of exposure from the project tokens you are farming.

Launchpads

Launchpads are another popular way to earn some passive income in Crypto. The process is simple, most exchanges and launchpads have raffles for their users to participate in the latest token sales at a steep discount.

To qualify, users usually have to buy the Launchpad's token and stake it for a certain period.

The downside to this is you will have to hold the exchange or launchpad's token for a certain period, and depending on what the platform is, their token can be volatile.

Therefore I personally only participate in the largest exchanges and launchpads that have proven track records.

Some launchpads that I have participated in and feel comfortable recommending:

- Binance Launchpad

- ByBit Launchpad

- DaoMaker

- Polkastarter

Please do extensive research on other launchpads you see on the market, there are hundreds of them and most only launch shitty projects. If a launchpad is bad, you end up holding the bags of the launchpad token PLUS the shitty new project token that they dumped on you.

NEWS

Stripe launches fiat-to-crypto onramp widget

Stripe debuted a new fiat-to-crypto widget allows users to easily acquire cryptocurrencies without signing up for an exchange.

It is ideal for enabling payments of cryptocurrency across a variety of web3 products like DEXs, NFT platforms, wallets and dApps.

Introducing a customizable and embeddable fiat-to-crypto onramp: https://t.co/YNUdv6R9PE. pic.twitter.com/raZ50juvxi

— Stripe (@stripe) December 1, 2022

This product will make it easier for individuals to avoid centralized exchanges when dealing with crypto assets. By leveraging Stripe as their crypto gateway, users can easily fund cryptocurrencies to retail friendly apps like Argent or Magic Eden without having to grapple with the difficulty of exchanges

This integration is also incredibly important for merchants that are exploring crypto payments but are looking to remain compliant with regulations around digital currencies. Stripe takes on the responsibility of KYC, payments, fraud and compliance so that developers can focus more on their crypto product.

1/ @Stripe debuted its fiat-to-crypto payments onramp — and 11 of the 16 projects in the program are built on Solana 💪@AudiusProject@xNFT_Backpack@FastAF@fractalwagmi@glowwallet@MagicEden@magic_labs@orca_so@ottrfinance@spotwallet@UltimateMoneyhttps://t.co/F8uNupoucQ

— Solana (@solana) December 1, 2022

The platform charges a fee ranging from 2.9-4.5% depending on payment methods in addition to any fees connected with cryptocurrency price fluctuations at the time of purchase which can be paid via card payments, bank transfers, Apple Pay or Google Pay etc..

Overall, Stripe’s new fiat-to-crypto widget provides the convenience and security features needed to Fastrack merchant adoption interests while increasing access to a variety of payment mechanisms.

BlockFi Files for bankruptcy, revealing large hole in liabilities

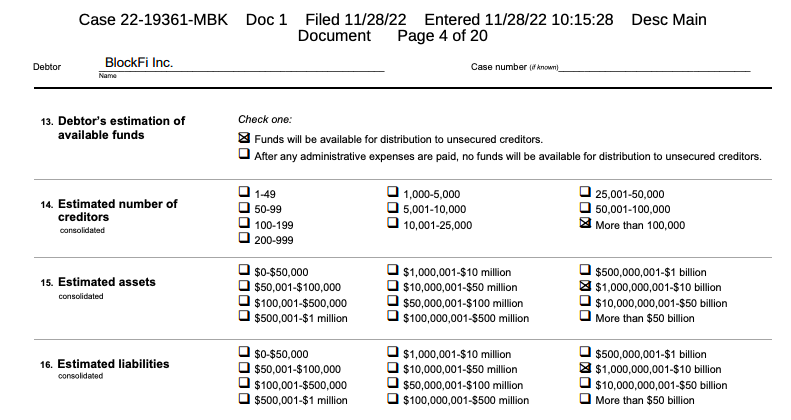

Cryptocurrency lender BlockFi has officially filed for bankruptcy.

In a statement made by the company on Monday, BlockFi mentioned that they will make use of Chapter 11 proceedings in order to recover obligations owed from its counterparts including FTX and other corporate entities associated with it.

Reports from their bankruptcy declaration indicates that there are over 100,000 creditors registered for BlockFi Inc., ranging between $1 billion to $10 billion worth of assets and liabilities. These figures further revealed that 3 largest creditors account for more than one-billion dollars while 50 accounts hold around 1.3 Billion dollars respectively.

Regulators face growing concern due to lack of international regulations governing crypto loan platforms at present period which could possibly lead additional regulatory standards being enforced within the industry in various areas continuing this major incident as a reference model going forward.

Shortly after the bankruptcy filings, BlockFi filed a lawsuit against FTX founder Sam Bankman-Fried's investment firm.

Reports show that back in June, SBF had promised BlockFi $250 million to 'bail it out.' Afterwards, it was estimated that the crypto lender had exposure of up to $4-5 billion with relationship to SBF.

Documents viewed by Financial Times reveal that just days before FTX bankrupted there were collveralized loans planned with Robinhood stock as the security attachment; however, SBF's investment company did not transfer them over without orders from a court.

Brazil legalizes Crypto as payment method

This week, Brazil's Congress passed a bill that would regulate the use of digital assets such as cryptocurrencies and frequent flyer rewards from airlines as payment methods throughout the country.

This means that banks may start allowing people to buy goods with crypto, just like we do with credit cards. Brazilian banking institutions have already taken steps towards crypto adoption; Santander is experimenting with crypto services, while Itaú is planning on launching its own asset tokenization platform.

Under this law, certain government entities will be in charge of regulating cryptocurrency exchanges and service providers must separate their funds from those belonging to clients for protection against scenarios similar to FTX’s recent liquidity crisis.

If signed into law by the executive branch of the government, this new regulation stands premier among countries in Latin America regarding cryptocurrency adoption and would mark a significant advancement in cryptofinance industry on an international basis.

Fantom: an inside financial peek at being a “crypto company”

Andre Cronje, one of the key developers behind Fantom Blockchain, has revealed the inside financials of the company since its ICO in 2018. It is an eye-opening saga of rollercoster where the Fantom treasury has not only survived but 1000Xed since the last bear market.

Here's the full timeline:

- Fantom raised $40,000,000 in June 2018 but ended up with significantly less due to its major expenses of exchange listing fees and "influencers" fees. Once listed, Fantom become incredibly frugal, freezing all marketing, and salary cuts for staff.

- By May 2019, they had less than $2,000,000 left and 100,000,000 FTM worth ~$900,000 and would periodically sell FTM to help fund unplanned expenses.

- In February 2020, Fantom has around $3,000,000 in assets and 45,000,000 FTM ($400,000).

- For the rest of 2020 where DeFi was skyrocketing, they began to use their assets to to farm DeFi protocols, and used the farming profits to rebuy FTM. Initially, they had a gaol of growing the treasury to $8,000,000 by the end of 2020.

- By July 2020, Fantom repurchased 57,933,544 FTM (207,378,636 FTM total treasury holdings) and their nonFTM treasury was just over $8,000,000, mainly from farming SNX and COMP.

- By January 2021, Fantom had ~$50,000,000 in assets (including FTM), surpassing their initial $40,000,000 raise.

- In Q1 2021, Fantom foundation had ~$150,000,000 ( $20,000,000 in stables, $50,ooo,ooo in CRV, $50,000,000 in FTM, with $30,000,000 in other cryptos.

- Late February 2021, Fantom Foundation sold 81,500,000 FTM to Alameda for $34,949,726.5 and 10,384,165 FTM to Blocktower for $5,000,000

- In May 2021, they had $300,000,000 in liquid assets, but had nearly $1.5b in liquid and nonliquid assets.

- By late September 2021, Fantom Foundation had roughly $263,000,000, not including FTM.

- In May 2022, they took some big losses in BOO, CRV, YFI, CVX, and ETH, but still maintained >100,000,000 in stables.

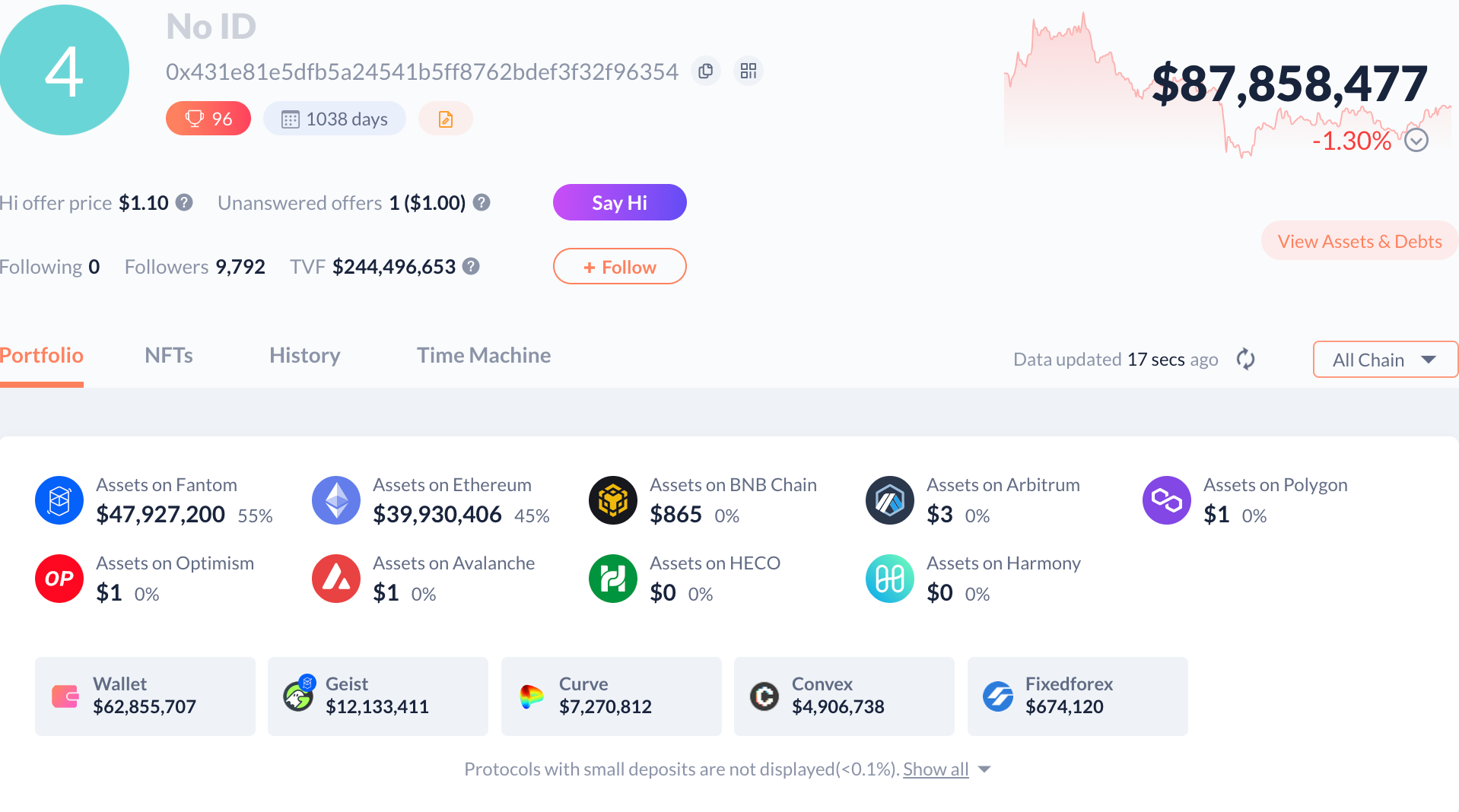

- Today, Fantom foundation makes 10% of all transaction fees, 60m FTM from validator delegation, ~$6,000,000 on yield farming, totaling ~$10,000,000 a year.

Fantom Foundation's onchain Wallet

Lessons for founders and investors from Andre:

Don't let yourself be weighed down by the constant competition for "integrations," "listings," and "partnerships" that other blockchain companies constantly face.

Fantom, unlike similar Layer 1s, only owns 14% of its token supply at maximum which pales in comparison to the 50-80% ownership of most competing projects.

They tend to prefer buying our tokens instead of exchanging them for these partnerships and alliances.

These strategies are not viable sources of income for us as a business since decentralized finance (DeFi) and Treasury Management aren’t our primary sources of revenue.

The fees they collect from staking act more like supplemental funds than anything else. If you want to stay afloat by selling your token exclusively then you risk falling short indefinitely when all is said and done..

When assessing any new opportunities or partnerships we focus squarely on how much long term impact said association can bring us after 10 years - if there's even an opportunity then for another chain swooping in either way things would go downhill quickly so always keeping efficiency and scalability at top priority is key here too!

Also consider whether such alliances can realistically sustain us over those next 10 years without burning out everyone's resources

In conclusion, don’t focus on simply “winning the race” in crypto. There is no one size fits all approach to success in this industry, and you should never base your decisions solely off short term commercial benefits or partnerships.

Focus instead on what models best support a sustainable long-term future for your blockchain, because that's the only thing that truly matters when it comes to building real companies and influencing long-term adoption.

Crypto shouldn't be about the "hype" but rather the ideas behind it: decentralization, permissionlessness, censorship resistance — these will always remain at their core values of cryptocurrency despite sometimes turbulent market cycles.

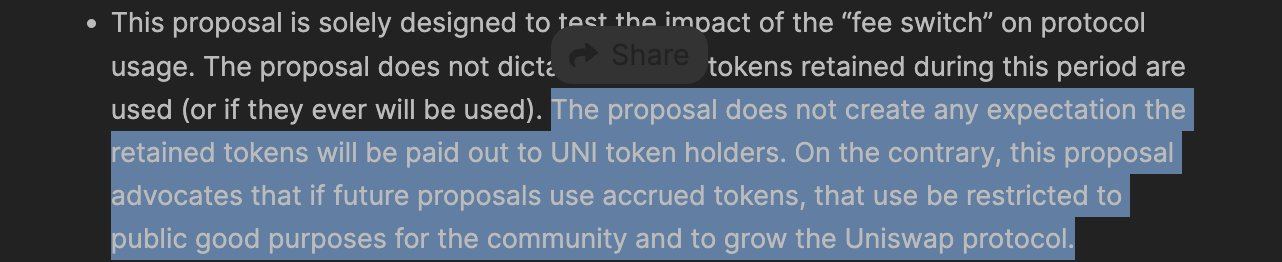

Uniswap Soon to start sharing fees?

Will Uniswap implement Real Yield and start to share fees?

The UNI token recently surged over 7% after a governance proposal calling for a vote to reserve a portion of trading fees was posted. If it passes, 10% of the trading fees from three pools on Uniswap V3 would flow to Uniswap’s treasury.

This has led DeFi enthusiasts to speculate that holders of the UNI token will one day be eligible for some portion of these fees.

This proposed change is an experiment that aims to assess the impact of setting aside part of the trading fees—the success or failure will depend on whether trade execution diminishes as a result or not.

The fee switch proposal sidesteps legal and regulatory concerns associated with sharing protocol revenue, but it's definitely in the right direction towards implementing Real Yield for UNI token holders.

UNI holders have 14 days to decide whether they want this experiment move forward through voting in favor or against it in Governance Proposal.

ALTCOIN INSIGHTS

Top Performing Coins of the Week

Bone

Bone is the gas token for Shiba's new chain, Shibarium.

Shibarium was supposed to launch in Q3 2022, but has since been pushed back.

The date of launch is still unkbown, but the founder of Shibarium has been hyping the chain up for months.

I have an answer for this... pic.twitter.com/wi3LWiannz

— Shytoshi Kusama™ (@ShytoshiKusama) October 7, 2022

Shib does garner a retail crowd, and the launch of Shibarium will likely cause Bone to rally.

Mask

Mask Network is an infrastructure to connect Web3 features to social media like Twitter. Their browser extension directly integrates MetaMask with Twitter to allow Ethereum transactions and messaging in Twitter.

While Elon said that Twitter was focusing on other things beyond integrating crypto, the narrative around the integration has became hyped again.

Elon Musk hints at Crypto Payments coming to Twitter, during a Twitter space recently. @elonmusk pic.twitter.com/s21gXFgI6P

— DogeDesigner (@cb_doge) December 4, 2022

RocketPool

Rocketpool is a decentralized Ethereum staking services, and the main decentralized competitor to Lido.

It's rallying this week because it's been added to Coinbase's Listing Roadmap

TrustWallet

Trustwallet's token, TWT, has been a top performer over the last few weeks.

Not only are wallets still a hot narrative after FTX's fallout, but Metamask's/Infra's new privacy policy update has been a catalyst for a new narrative – Privacy.

Wallets like TWT, C98, XDEFI all performed well this week, and this could be the beginning of a new wallet flipping Metamask

GMX

GMX Surpassed Uniswap in 24hr fees for the first time.

This marks a huge win for the "real yield" crowd, as many new traders take on decentralized derivatives.

GMX also recently released some new updates, allowing users to now tap into 50x leverage.

Important Upcoming Events

- December 6th: ApeCoin staking launch

- December 1st: Theta MetaChain Mainnet launch

- 2022: AAVE stablecoin $GHO launch

- 2022: YFI veYFI (Locked YFI) proposal and Tokenomics revemap

- 2022: Sushi new tokenomics proposal

- 2022: GMX potentially expanding to Polygon and BSC

- 2022: DYDX V4 upgrade

- 2022: Chiliz (CHZ) chain launch

- 2022: Secret (SCRT) 2.0 mainnet launch

- 2022: LRC protocol upgrade with fee sharing for stakers

- 2022: XRP lawsuit settlement

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out ByBit as they're the ONLY exchange which supports every part of world. (Yes US and Canada included)

I highly recommend it to buy or trade BTC, ETH and tons of Altcoins

Sign up to ByBit - For Global Users

Sign up to APEX: ByBit's DEX - For US Users