Bitcoin divergence, time for a bounce?

Hi everyone, welcome to issue #9 of the VirtualBacon Newsletter.

In this week's letter:

MARKET ANALYSIS 📈

- When will Bitcoin find its Bottom?

- Bitcoin divergence, time for a bounce?

- Ethereum: One Level for Glory and Death

NEWS 📣

- WBTC Depeg - FUD or Real Risk?

- Chainlink Staking Launch

- What happened on Curve/AAVE liquidation?

- Curve Stablecoin Launch

- Uniswap and MetaMask collecting User Data, How to protect your privacy

ALTCOIN INSIGHTS 💎

- Top Performing Cryptos of the Week

- Important Upcoming Events

MARKET ANALYSIS 📈

When will Bitcoin find its bottom?

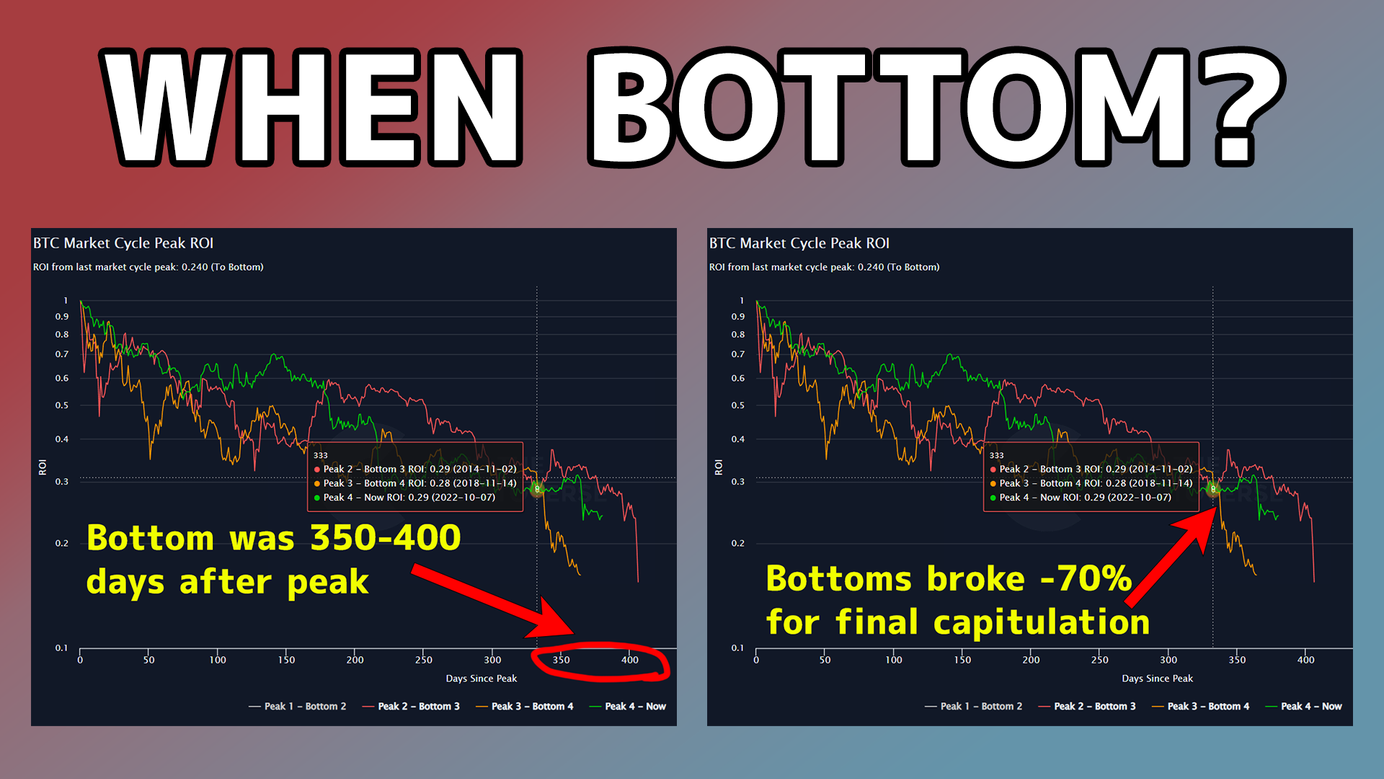

If we look at the bear markets of 2014 and 2018, both took around 1 year to find the cycle bottom, while having a 75 to 85 percent drawdown.

What's more interesting is at around the one year mark, both bear markets saw a sharp capitulation and dropped from minus 70% to minus 80%.

This matches exactly with the recent crash

However, you DON’T need to catch this knife .

Previous cycle bottoms did not recover in a sharp bounce, rather the prices went sideways for 3 months and even retested the panic lows before the bull run started.

So don't become bullish too quickly and get burnt.

The bottom is close, whether it's December or Q1 of 2023 doesn't really matter.

Bitcoin bottom is likely to be a boring sideways period, and it's the most dangerous as most people lose hope here.

You just need to hang in there to make sure you survive this last period.

Bitcoin divergence, time for a bounce?

After a brutal few weeks where Bitcoin has broken below the 18k key support, it is now showing signs of an imminent short term bounce.

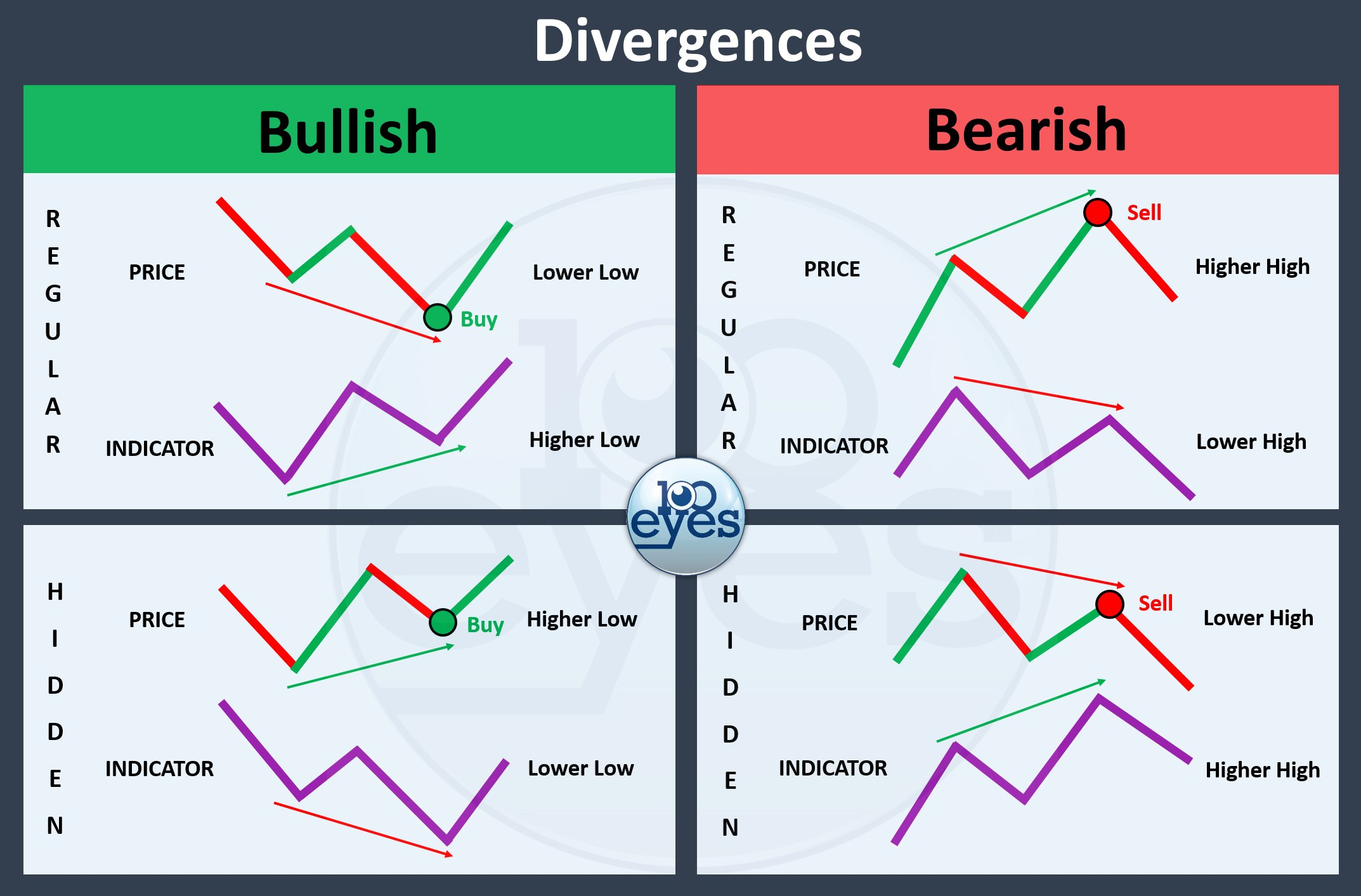

Both weekly and daily price action of Bitcoin are showing bullish divergence signals on the RSI indicator.

RSI measures the speed of an asset's recent price changes, and RSI can usually act as a early signal for trend reversals as it shows the speed of peaks/crashes slowing down at extreme price levels.

As Bitcoin price has made lower lows on both Weekly and Daily timeframes, while the RSI made higher lows, this forms a Bullish divergence signaling a reversal.

Combined with the fact that I expect the Bitcoin bottom to be between 12k and 18k, I think the current level is a great entry target for both short term long trades and long term holds.

For the short term case, the key resistance at 18k can be used as a take profit target.

For the long term case, 16k per Bitcoin is a no brainer level to accumulate for me personally.

Ethereum: One Level for Glory and Death

As the recent Ethereum uptrend attempt has failed, we now need to watch the final support level at $1000 for Ethereum.

The analysis is quite simple. $1000 is the recent low made in summer 2022, and Ethereum MUST hold above this level.

A break below $1000 and we are looking at some far away support levels at $784 then $420.

Before you panic, the fact that Ethereum is still above $1000, is thanks to its incredible strength against the rest of the market during the FTX crash.

Ethereum has held up relatively well against the market crash, and has even outperformed Bitcoin in the past few weeks.

We can see this on the ETH/BTC chart, where the ratio of ETH versus BTC has remained in the same range since Mid 2021. Ethereum has also been in a consistent uptrend against Bitcoin since the start of 2020.

Therefore, despite all the drama, I still believe Ethereum will hold above the $1000 support and I will continue to accumulate ETH around the current price of $1150

Sponsor Pill 💊

If you want to buy or trade Bitcoin and Ethereum, I recommend ByBit as they're the ONLY exchange which supports every part of world

(Yes US and Canada included)

Sign up to ByBit - For Global Users

Sign up to APEX: ByBit's DEX - For US Users

You get Cash Rewards just for depositing, and it helps support the VirtualBacon channel :)

NEWS 📣

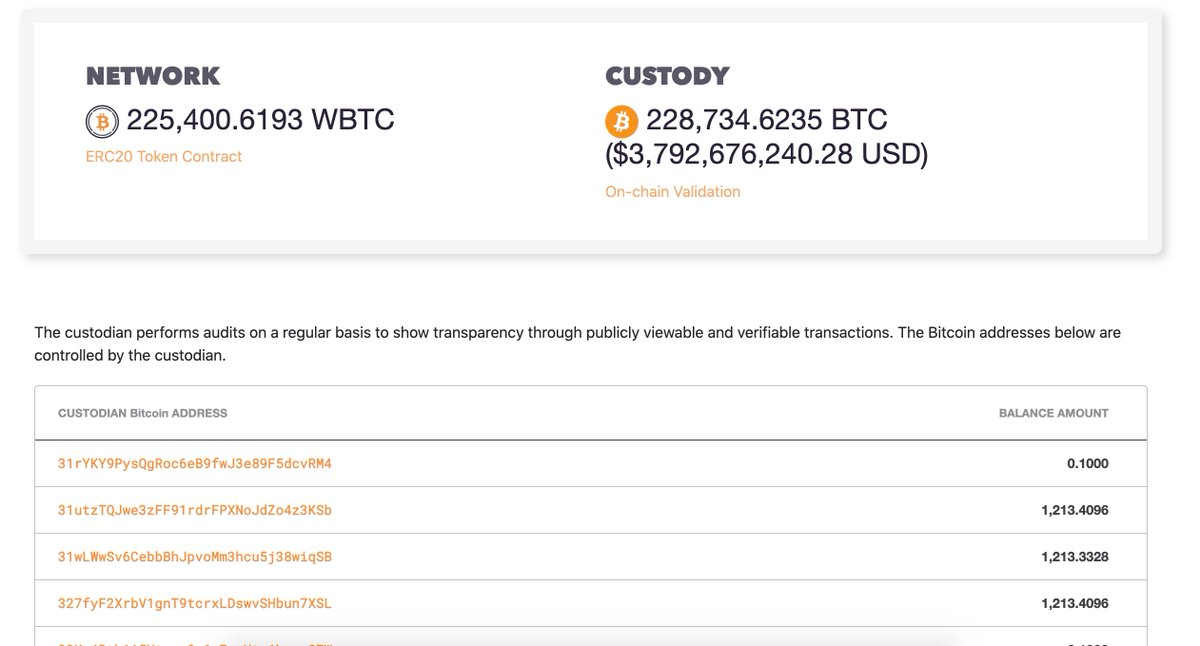

WBTC Depeg - FUD or Real Risk?

As the market slowly stabilizes from the collapse of FTX and Alameda, there are still lingering uncertainties in the market.

As a result, FUD is often formed. Sometimes it's informed FUD, sometimes its's FUD created for profit, sometimes it's the naive selling their bags for a loss.

Get out of #WBTC NOW!!!

— Duo Nine | discord.gg/ycc (@DU09BTC) November 25, 2022

Turns out half of all #WBTC was minted by none other than… wait for it:

🔸 Alameda Research

🚨 They minted over 100k WBTC 🚨

This explains why the depeg of #WBTC vs #BTC began when #FTX imploded!

Major red flag below (pictured)! pic.twitter.com/K0GqFc1cY0

In wBTC's case, influencers can paint a picture that makes wBTC look insolvent through their connection to Alameda. The tweet above highlights that Alameda was the top wBTC minting/burning merchant.

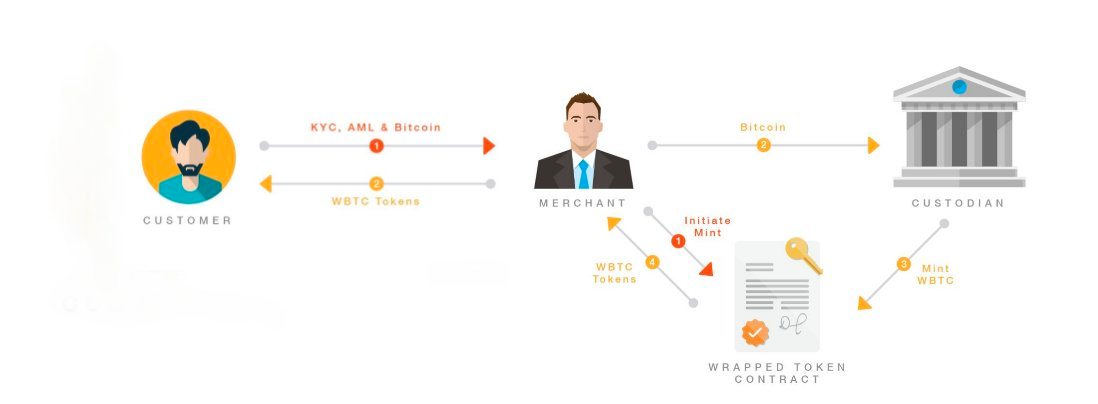

Initially, it seems FTX/Alameda minting and issuing the majority of wBTC, but in reality they were only acting as a merchant.

Alameda needs high amounts of WBTC for their DeFi farming in the bull market and liquidity provision as the largest market maker in Crypto. This has led to them acquiring high amounts of WBTC.

However keep in mind that Alameda has NO custody of the BTC backing wBTC and no access to the wBTC minting smart contracts.

Rather, BitGo is the centralized entity behind wBTC, and they manage the custodial, minting, issuance, and redemption services for wBTC.

FTX/Alameda were the #1 customers of BitGo, and that's the only connection between the two companies.

Everytime Alameda wants to mint one wBTC, they have to send BitGo 1 BTC and receive 1 wBTC back.

As all BTC backing the wBTC minted, can be verified on-chain 1:1, there is no risk for wBTC to depeg.

Furthermore, Alameda's exposed balance sheets show no holdings of wBTC, so there is also no risk of wBTC being sold or locked up in legal settlements in any way.

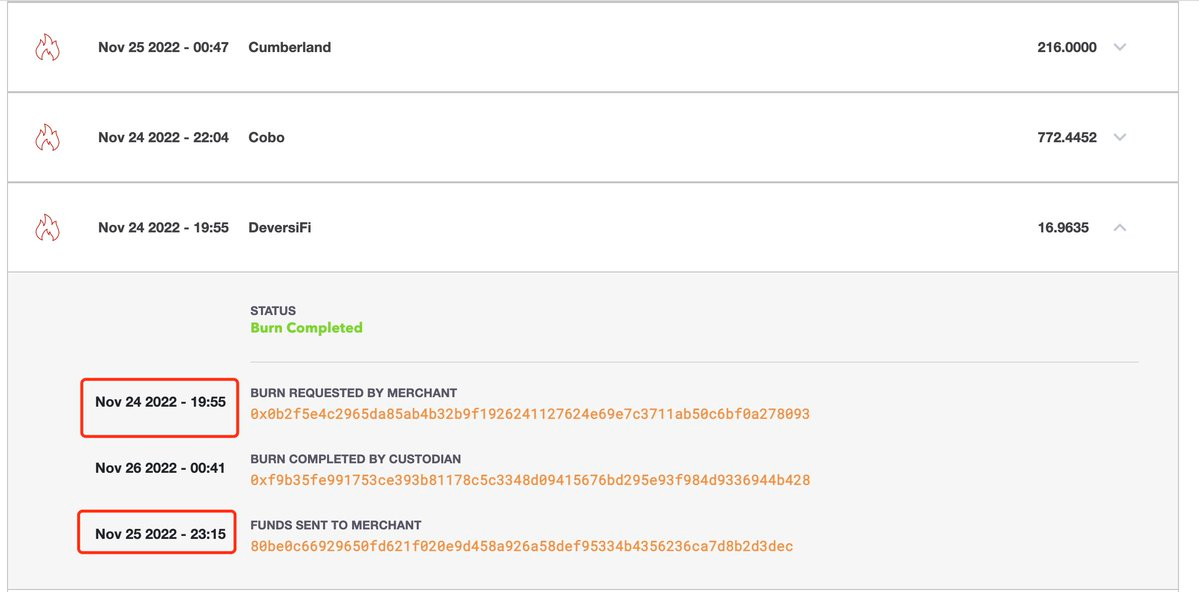

Why is wBTC Depegging?

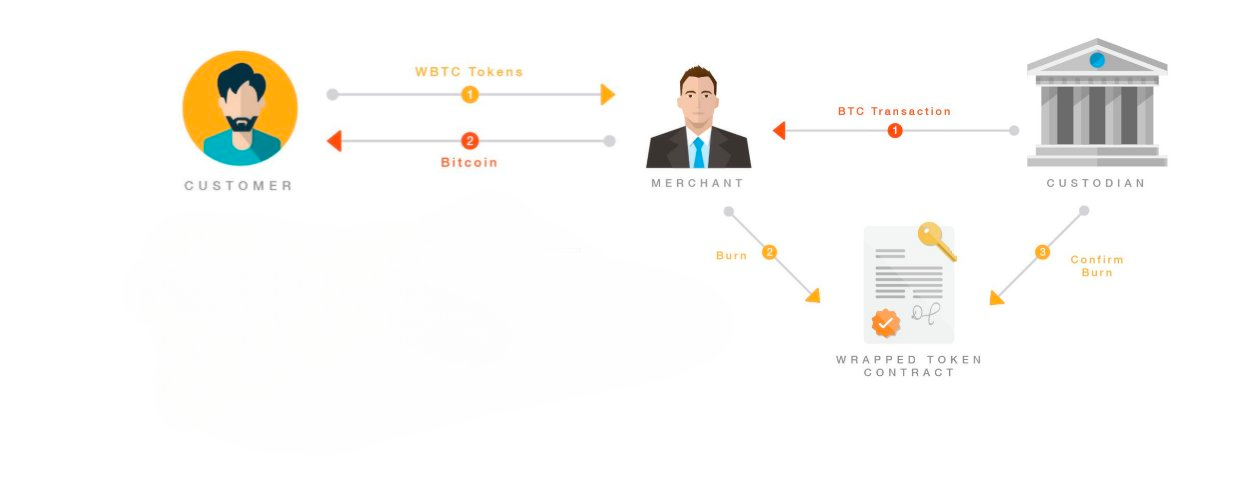

Alameda did have a large role as they were the largest user of wBTC by Volume.

This created FUD and people wanting to close their wBTC positions, which lead to mass redemptions of wBTC for real Bitcoin.

On November 24th, the wBTC redemption was delayed for 24 hours.

This delay spurred even more fear about possible insolvency.

However, BitGo was able to meet all redemptions.

All #WBTC burn requests have been fulfilled — the website takes a bit to update (only updates after many BTC on-chain confirmations)

— 🍟 Chen Fang (@chenbfang) November 25, 2022

The next redemption window was delayed by 2 hours, but now everything is running efficiently.

Beware of unnecessary FUD in the current Crypto market. Tons of misinformation are being spread around assets which are 100% verifiable. Make sure to do your own research on rumours before taking drastic actions.

Chainlink Staking Launch

Chainlink Staking is finallying launching on December 6.

How to participate and how does this change the chainlink network?

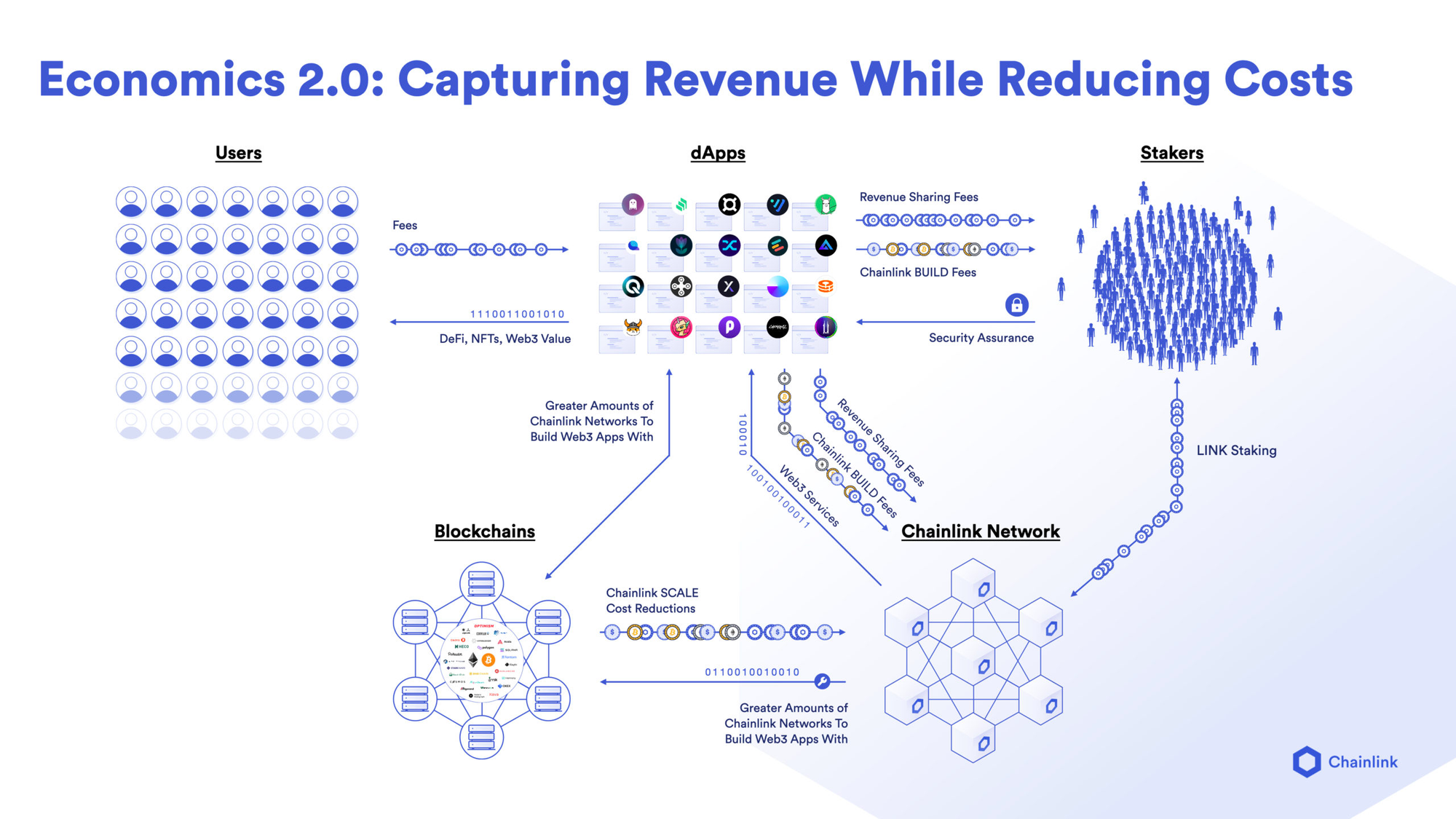

Earlier this year, Chainlink announced its economics 2.0 plan.

In this whitepaper, Chainlink highlighted 4 key initiatives to pursue:

- Chainlink staking

- BUILD program

- SCALE program

- CCIP upgrade.

On November 21st, Chainlink accounced its V0.1 staking initiative starts on December 6th for early access members and two days later for public access

#Chainlink Staking v0.1 Early Access launches on Ethereum mainnet December 6th at 12PM ET.

— Chainlink (@chainlink) November 21, 2022

This blog update covers:

• Pool design

• Alerting mechanism

• Auto-Delegation

• Staking rewards

• Reputation system

And more. Explore the latest below ⬇️https://t.co/M0wQVcUsSk

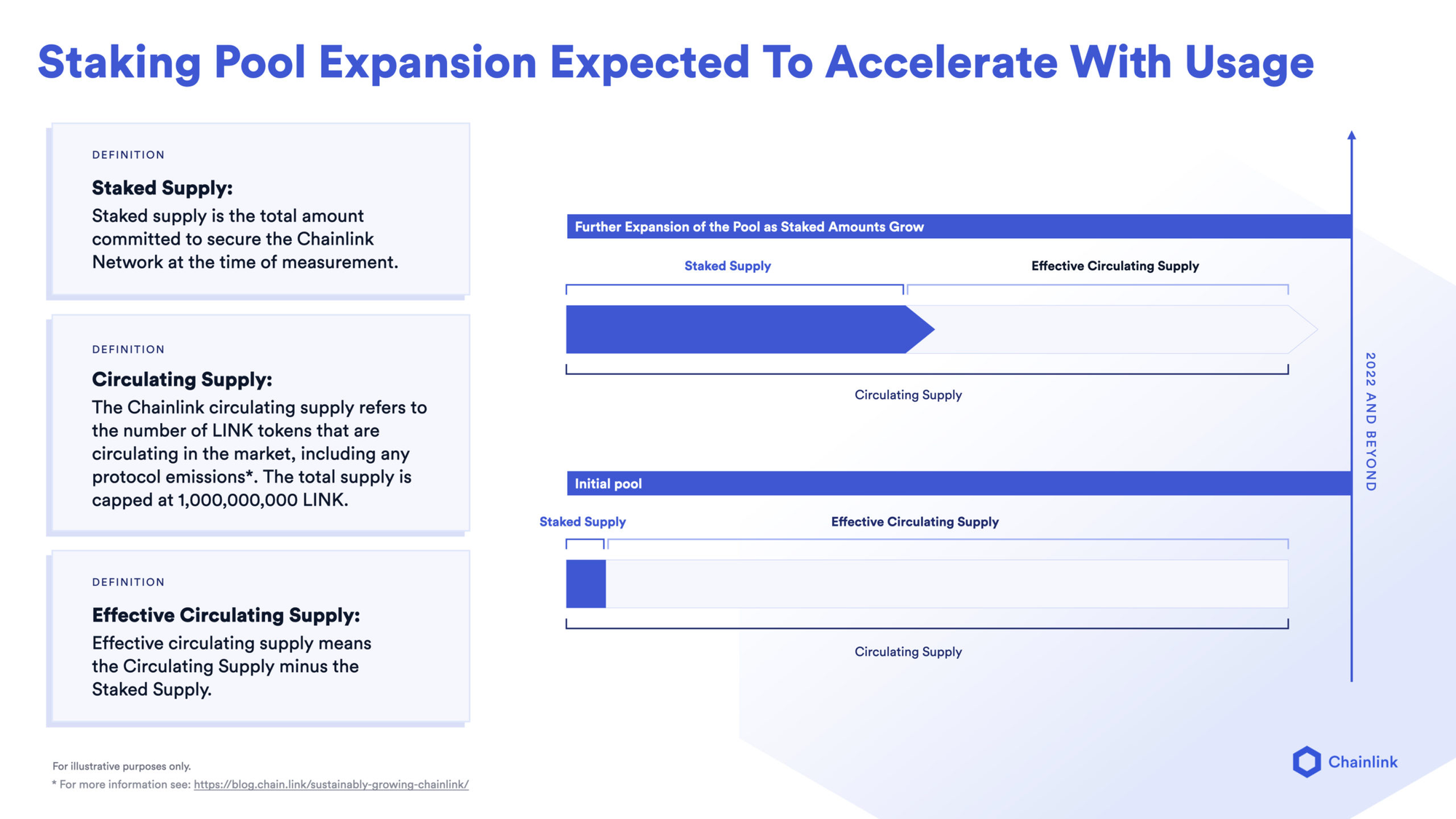

Users will be able to lock up $LINK tokens in a smart contract for rewards, while improving the Chainlink network.

Chainlink Staking helps improve the crypto-economic security of oracle networks, initially through alerts around predefined performance standards.

Stakers gain access to staking rewards for securing the network through timely and valid alerts, and in the future, for slashing and loss protection.

V0.1 stakers will also be eligible to earn additional benefits from the Partner Growth Program (PGP), benefits to accelerate their growth and align their economic incentives

Individuals can stake a maximum of 7,000 LINK and node operators can stake 1,000 - 50,000 LINK

Chainlink has a goal of having 75m LINK (~15% Circ. supply) staked, within the coming months.

LINK Staking will take place on Ethereum Mainnet.

All LINK staked in Vo.1 will be LOCKED till v1, and v1 will introduce various locked staking durations.

This catalyst could drive demand when general access drops, as there could be lucrative rewards to stake link at first.

There was differing language whether staking rewards commence in V0.1 or V1, so there may not be a surge in demand till V1 is announced.

What happened on Curve/AAVE liquidation?

There was some interesting price action with CRV and AAVE this week.

Someone tried to execute a "highly unprofitable trade" on CRV, while using AAVE to borrow and dump CRV.

ponzishorter.eth was likely aiming to liquidate CRV's Founder, who had a sizable position with liquidation threshold at $0.26.

idly wondering if any other teams made a token and then borrowed against a 9 figure position

— Avraham Eisenberg (@avi_eisen) November 20, 2022

The CRV shorter was trying to cause a liquidation cascade, liquidating the CRV founder, and was likely shorting and going to long the bottom of his short coverings on a CEX.

The CRV shorter even knew a potential Curve update was around the corner.

Only a few hours of short seeling later, Curve released the news – a new stablecoin.

The catalyst created new demand for an inflationary governance token, and the CRV shorter had to cover his position.

This caused CRV to skyrocket, as shorters had to buy back CRV faster than those longing CRV, or their shorts faced possible liquidation.

The CRV shorter was squeezed from his position and liquidated.

Taking the day off to spend time with family, hope y'all behave yourselves

— Avraham Eisenberg (@avi_eisen) November 22, 2022

Because of this liquidation, Aave accrued bad debt to the tune of $1.6M.

There was also speculation around the CRV shorter trying to exploit or manipulate Aave's locked funds, as he has speculated about doing this before.

This speculation caused a surge of AAVE shorters, only for the CRV news to wipe out the copy trader shorters.

The Curve founder has since added more collateral, Curve Governance DAO is working with AAVE to recover the bad debt, and AAve will adjust lending parameters to prevent something like this from happening again.

Curve Stablecoin Launch

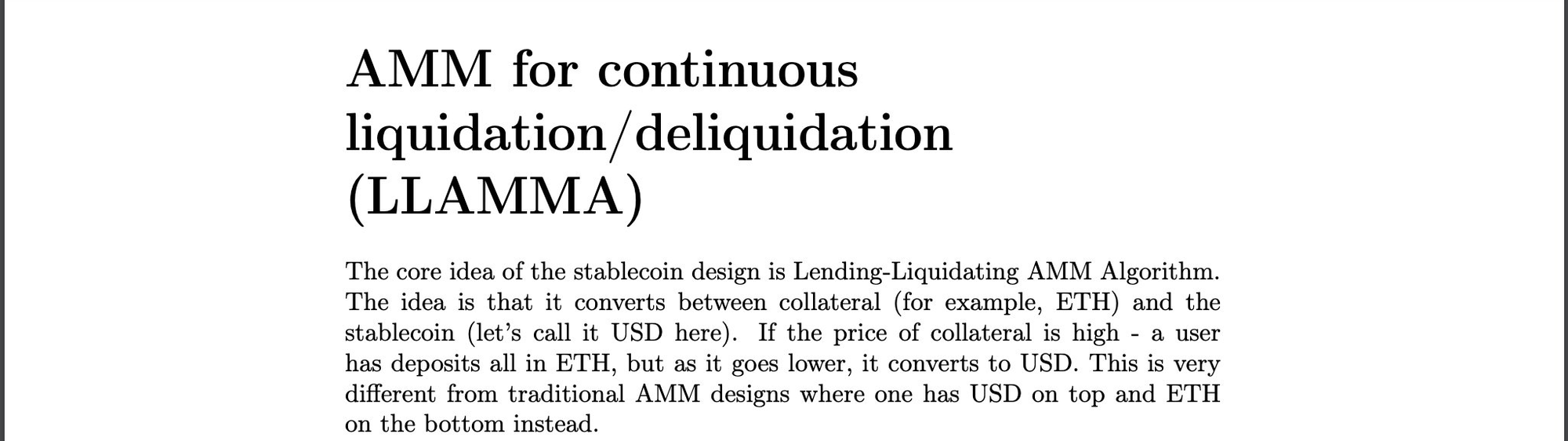

Curve, the largest stablecoin AMM, has announced the launch of its new stablecoin and liquidation engine.

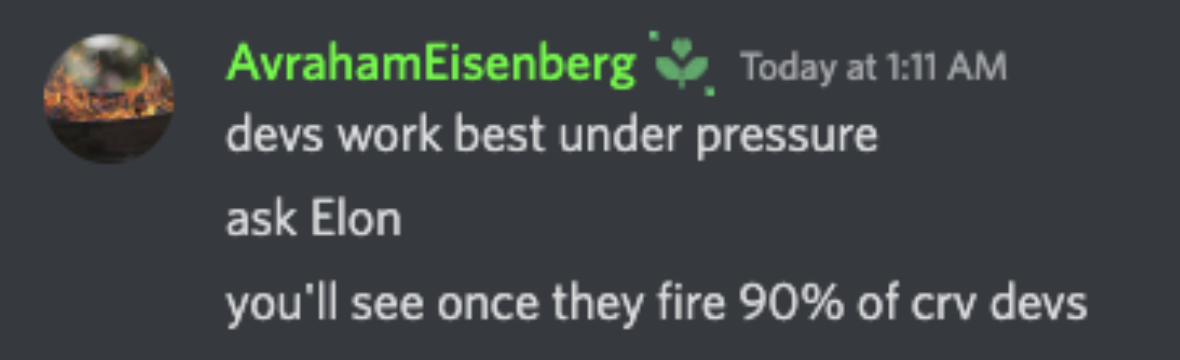

Stables suffer from a trilemma where the stable coin is either centralized, unstable in price, or capital inefficient.

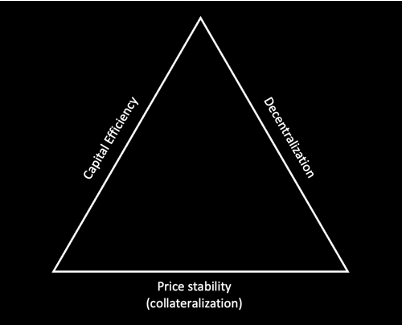

Curve is the first stable to break the trilemma with its new monetary policy (mpolicy), peg keeper (stabilizer), and lending liquidation AMM (LLAMMA).

The new lending liquidation AMM, LLAMMA, optimizes the CDP (collateralized debt position) stablecoin model, which MakerDAO and DAI uses.

LLAMMA does this by gradually selling collateral as the collateral decreases, and by gradually rebuying the collateral as the value of the collateral increases.

This lets users deposit a volatile collateral and mint stable coins, while Curve is essentially acting as a market marker for your collateral in the background, making your position unliquidatable.

The peg keeper mints new stables when price is >$1 and deposits in a single sided swap pool at no less than $1. Conversely, when price is <$1 the peg keeper withdraws the stablecoin and burns it.

This means price will quickly depreciate when >$1 and quickly appreciate when <$1.

Bullish Cash: UST was another prominent decentralized stablecoin that grew massively in popularity in 2021. One of the ways it grew to be so dominant was because off all the CEXs that listed it for pair trading (btc/ust, eth/ust, luna/ust). If Curve's stable can emulate this move, then its use case will surge

Risks: the buy high/sell low model will lose sometimes, and the collateral backing the positions could slightly diminish, however, there should always be sufficient collateral in the system at all times.

You can learn more about the Curve Stablecoin on this Detailed thread

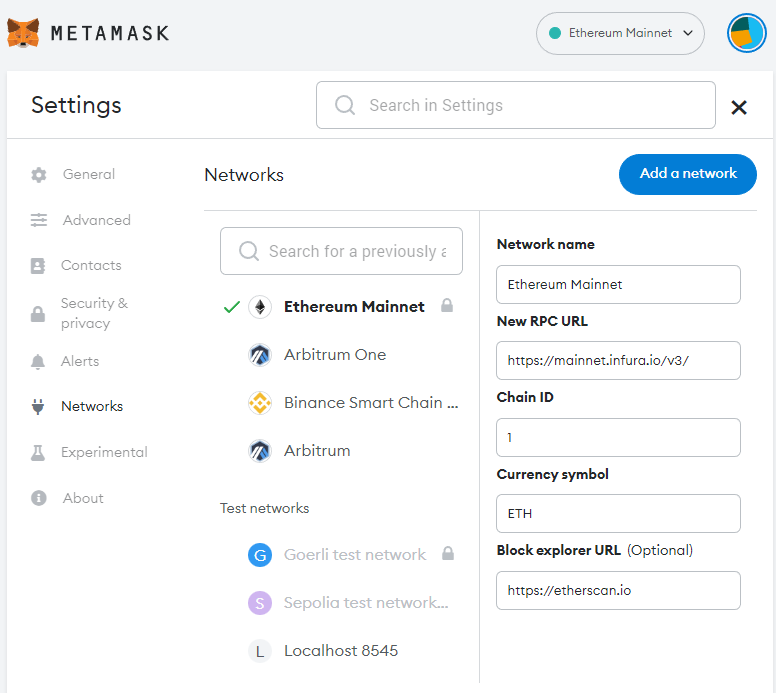

Uniswap and MetaMask collecting User Data, How to protect your privacy

Uniswap, the largest decentralized exchange, announced that it collects users data to better optimize their products.

Uniswap also said they do not collect personal data, such as first name, last name, street address, date of birth, email address or internet-protocol address, and that they will not sell this data to third party for marketing purposes.

Consensys, one of the main companies building Ethereum infrastructure products, recently changed some privacy policies and announced this week that it collects users IP address, Wallet address, and other user data.

This is done through their wallet service, Metamask, and its default Blockchain RPC provider , Infura.

Consensys has denied that they are collecting user data, but this this has been the call to action for many privacy concerned users.

We have literally no desire to store more data than we need to. We just happen to have the most assertively transparent privacy policy in web3, and we're more self critical about how our current web infrastructure works than others are admitting. https://t.co/X0VIOmaX6Z

— Dan Finlay 🦊💙 (@danfinlay) November 25, 2022

This means if you use the default MetaMask settings to connect to Ethereum, your usage data such as wallet info, IP address etc will be collected by MetaMask.

Keep in mind that MetaMask is still an open tool to access the Blockchain, so you can opt out of this data collection.

Simply change your Metamask RPC URL from Infura to an indepedent provider.

1RPC is a good service to access privacy-protected RPC endpoints by default, it supports Ethereum, Binance Smart Chain, and all other main EVMs.

You can also check if the RPC you're using is privacy protected by going to ChainlistOrg

For the tech savvy, you can also create your own private RPC to access all blockchains through Alchemy. This will incur some cost however you can be sure that you aren't reliant on any centralized provider.

look its simple and free

— Brent 🟪 (@Brentsketit) November 24, 2022

just make your own private eth rpchttps://t.co/SOXBv3mm40

It's also wise to use a VPN when transacting with crypto and DeFi, so your IP address doesn't get collected.

Privacy is is key for financial security, don't fall victim to complacency.

Altcoin Insights 💎

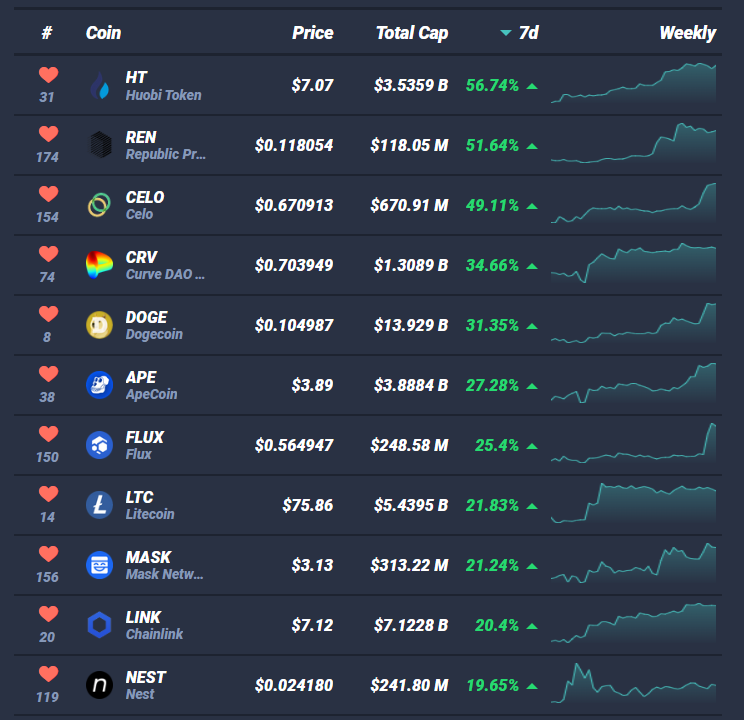

Top Performing Coins of the Week

Two weeks ago, the market experienced a fearful week, as insolvency fears around CEXs, custodial firms, Stable coins, and Wrapped assets surged.

This week, the markets stabilized, and some of the most devastated coins are the top performers this week. Here are the top performing coins of the week

Huobi Token $HT

had a hot week. This is due to the CEX insolvency fears, however, Huobi and Justin Sun have done a lot of good in the wake of FTX's collapse, and now their token is rallying.

Republic $REN

REN was a double whammy. REN was an asset under FTX, but the assets under management were secure in the protocol. The FTX hacker also used Ren to transfer their public illegal ETH to BTC, and doing so better hides where the funds went – washing them. Now its speculated to be in Binance's recovery fund

$CELO

Celo is fresh off the heels of a hackathon, and recently experienced a huge short squeeze. Now retesting resistance. There's also rumours that $CELO and its native stablecoin is the next shortsqueeze target by Curve/Mango exploiter Avraham Eisenberg to produce another "highly profitable trade"

Curve Finance $CRV

Stablecoin News + Heavily shorted

$DOGE

Doge is rallying as the market slowly stablizes. Doge shrugged off a lot of downside relative to the rest of the market and where it was at Prior to November. It shows retail is likely anticipating more Doge + Elon news.

ApeCoin $APE

Highly anticipated APE staking will launch December 5th. Check this newsletter issue for a detailed breakdown of the bullish case

Litecoin $LTC

Litecoin has <260 Days till next halving. LTC also tends to rally before the rest of the market enter a bull market.

$MASK

Mask Network continues its hot streak as Elon/Twitter/CZ/Binance continues to push the Crypto + Twitter integration and Decentralized Social Media narrative

Chainlink $LINK

Staking starts December 6th

Important Upcoming Events

- December 6th: ApeCoin staking launch

- December 1st: Theta MetaChain Mainnet launch

- 2022: AAVE stablecoin $GHO launch

- 2022: YFI veYFI (Locked YFI) proposal and Tokenomics revemap

- 2022: Sushi new tokenomics proposal

- 2022: GMX potentially expanding to Polygon and BSC

- 2022: DYDX V4 upgrade

- 2022: Chiliz (CHZ) chain launch

- 2022: Secret (SCRT) 2.0 mainnet launch

- 2022: LRC protocol upgrade with fee sharing for stakers

- 2022: XRP lawsuit settlement

New Videos to watch

Can Grayscale be Saved? DCG & Genesis Meltdown, Explained

Ranking top 100 Cryptos from my head

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out ByBit as they're the ONLY exchange which supports every part of world. (Yes US and Canada included)

I highly recommend it to buy or trade BTC, ETH and tons of Altcoins

Sign up to ByBit - For Global Users

Sign up to APEX: ByBit's DEX - For US Users