Grayscale: the Crux of Institutional Bitcoin Collapse

Hi everyone, welcome to issue #8 of the VirtualBacon Newsletter.

In this week's letter:

- SBF tries to explain himself

- FTX "exploiter" dumping $300M+ in major coins

- Mainstream media cover up FTX - Wider Conspiracy?

- Gemini Earn shutting down

- Genesis/DCG seeking $1b bailout

- Grayscale - the crux to Intitutional Bitcoin

- Can Solana survive FTX aftermath?

- How I'm storing cryptos now to stay safe

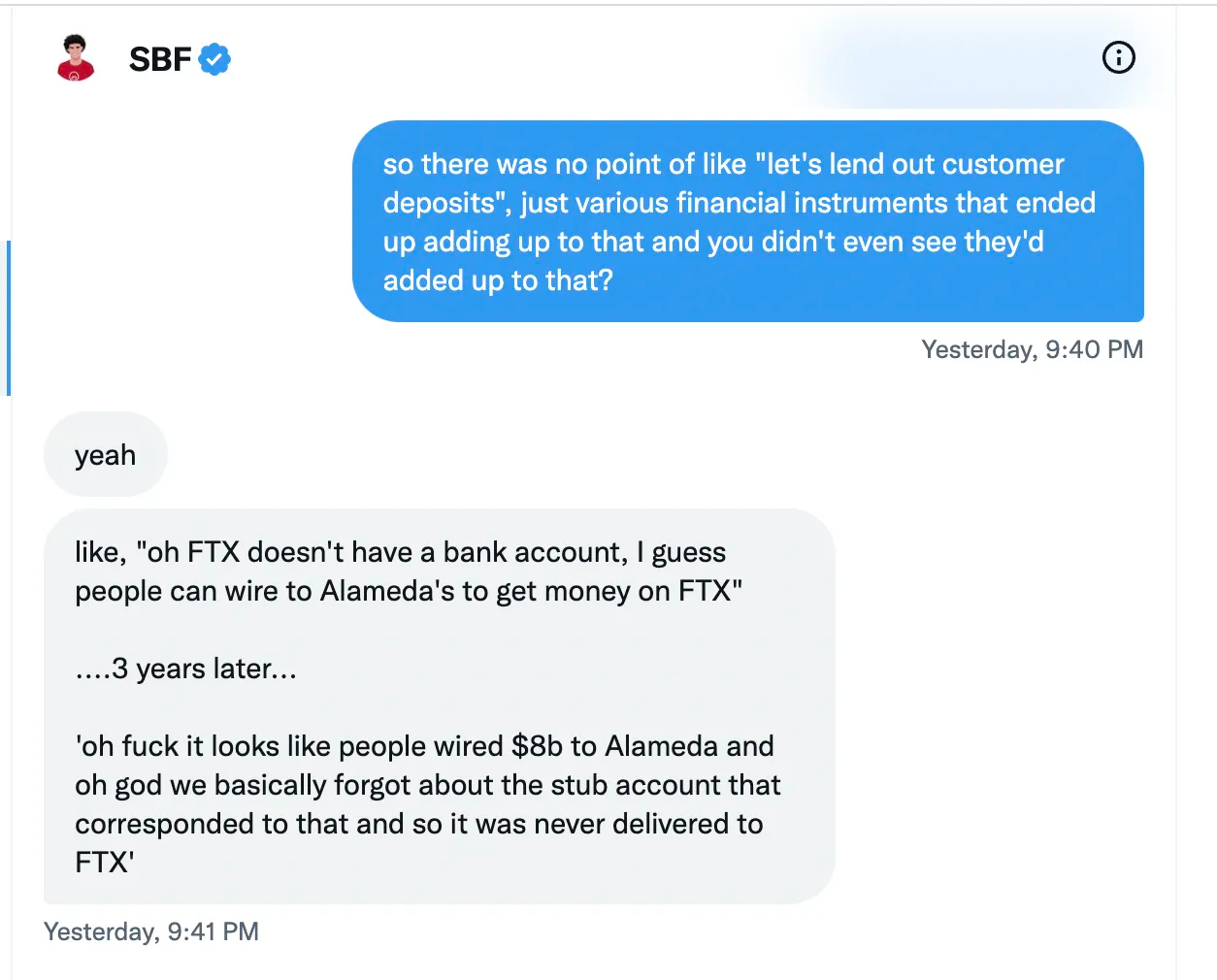

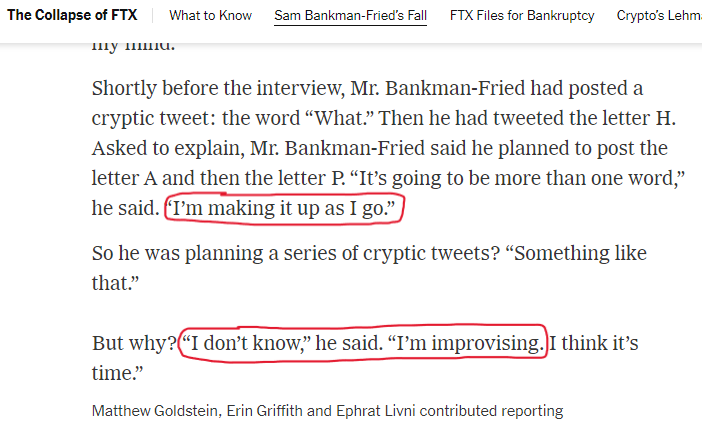

SBF tries to explain himself

Sam Bankman-Fried reached out to a Vox journalist, wanting to comment on the FTX situation.

In the Twitter DM with Vox journalist - SBF admits his altruistic facade was a lie.

At the time, Sam was still trying to source funding for the 11 figure hole he created.

Prior to FTX's collapse, Sam was lobbying against DeFi and other crypto innovations.

Sam was careful to not talk ill of the wrong political figures, but now finds himself with a changed tune, saying "f*ck regulators"

While agreeing some customer protections would be good regulation, SBF basically says every other kind of regulation is worthless, expressing his views on the big tech crackdown and other regulatory short fallings.

He then goes on to say that all of his prior philosophical threads on ethics were all BS and it was all for PR.

SBF calls out CZ for trying to act virtuous, but he still fails to see how using customer funds was wrong, as he alludes that CZ only won cause of the size of his balance sheet.

Sam then says that they had enough collateral to cover customer deposits, however, fails to mention that the collateral was getting propped up by them to represent a valuation far greater than it would trade on the open market.

If it was never his intention to lose customer funds, then he would have never used the funds for his hedge fund and venture investments.

Sam blames messy accounting and even confirms the Luna hit theories, I wrote about last week, for FTX's downfall.

Sam also confirms the theories that customer funds on FTX and Alameda's balance sheet were the same bank account, and when it came time to pay they had no idea how much liquidity was their customer's.

Sam's biggest regret wasn't losing nearly 11 figures in customer funds, it was filing for bankrupcy.

He suggests that he would have found the funding to cover the $8-$10b hole, and "withdrawals would be open in a month".

Sam also has no idea about the hack that occurred with customer deposits, but thinks it could be either an ex-employee or some sort of malware.

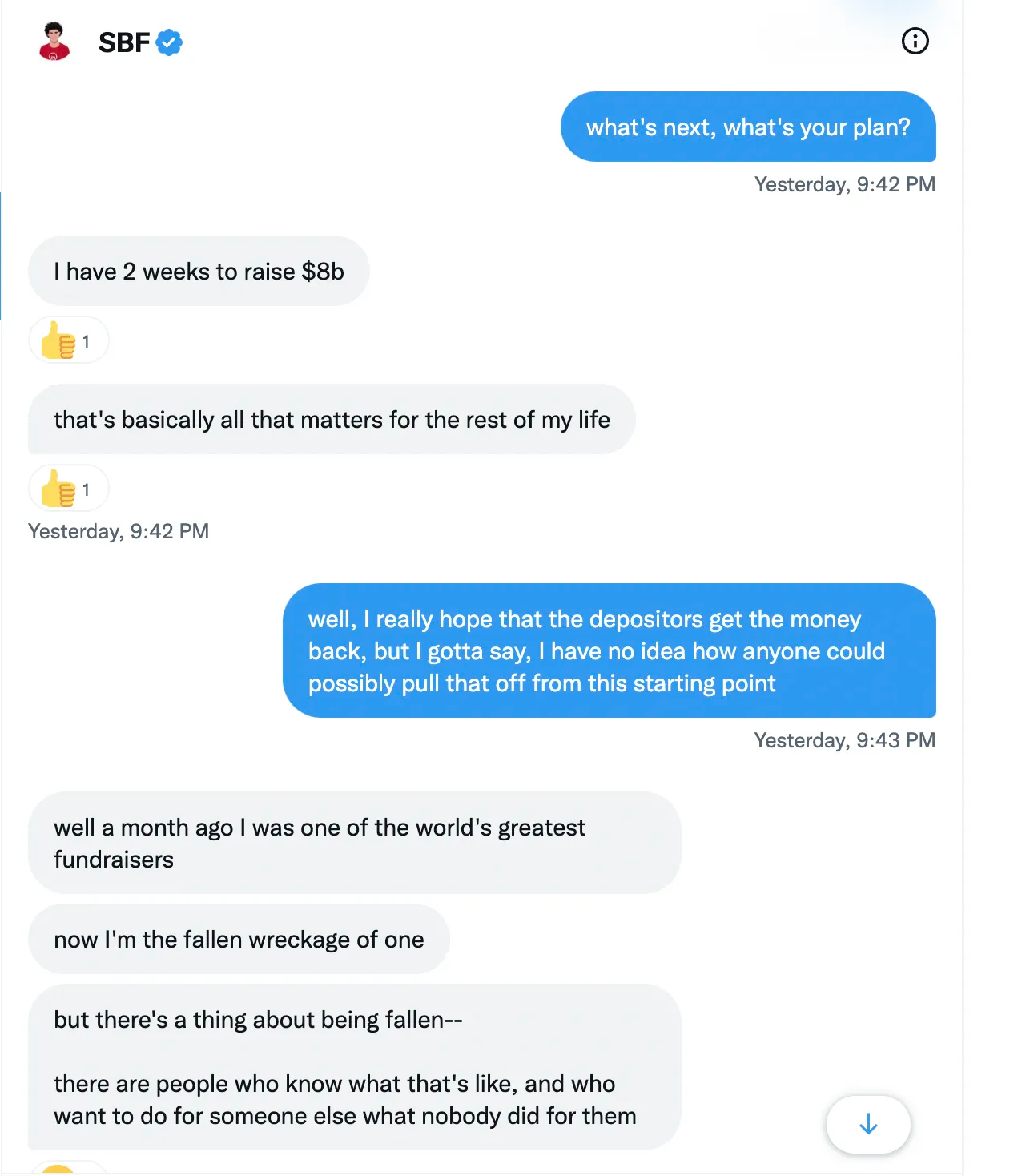

Sam was quick to move away from this, and said that he has 2 weeks to find $8b in funding.

Sam remains optimistic about this near impossible fund raise, and thinks someone "knows whats its like (to fall), and want to do for someone else what nobody did for them".

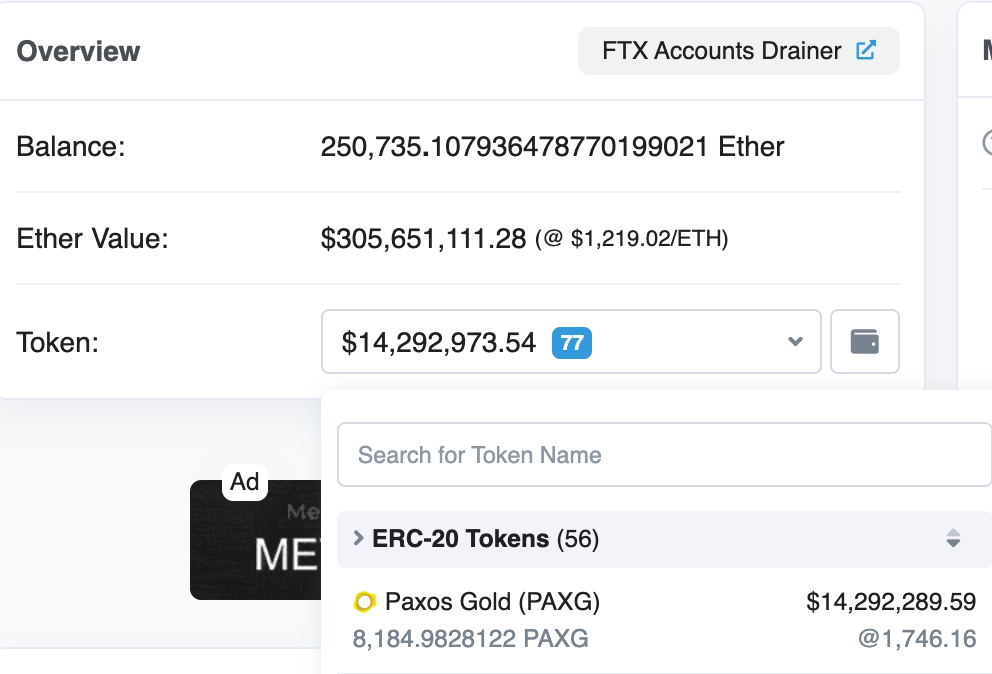

FTX "exploiter" dumping $300M+ in major coins

A day after FTX filed for bankruptcy, an exploit happened the the remain funds in its custody.

According to blockchain security firm Beosin, The FTX hacker holds nearly $338m in crypto assets, as of November 15th.

The exploits happened on both FTX and FTX.US, so it gives the impression that this is an inside job, orchestrated by an rogue internal team or individual.

After the exploit, they bought huge amounts of ETH and other tokens on BNB.

Recently the hackers swapped more than 10,000 BNB for 2,000 ETH as it's one of the only asset that cannot be frozen.

$300 Million of it is currently in ETH, making the FTX hacker is now 35th largest holder of ETH, and people worry they may need to dump.

Most of the wallets in the top 20 are bridges, exchanges, and L2s; so this may pose a real risk to Eth DeFi.

Currently, the hacker is selling their ETH holding for renBTC, the redeeming the renBTC for BTC to try to to wash the illegal funds.

Ren announced they will close renBTC mints, but this may just speed up the hackers selling.

It’s hard to know how sophisticated the FTX Hacker is, but Ren protocol announced earlier (completely by coincidence with no connection to the ongoing ETH dump) that they will be disabling renBTC mints soon

— kamikaz ΞTH 🦇🔊 (@kamikaz_ETH) November 20, 2022

That gives the hacker an incentive to dump the ETH asap https://t.co/YKBSD1KWyY

The hacker has over 200,000 Eth and is selling. You can track the two FTX hacker wallets:

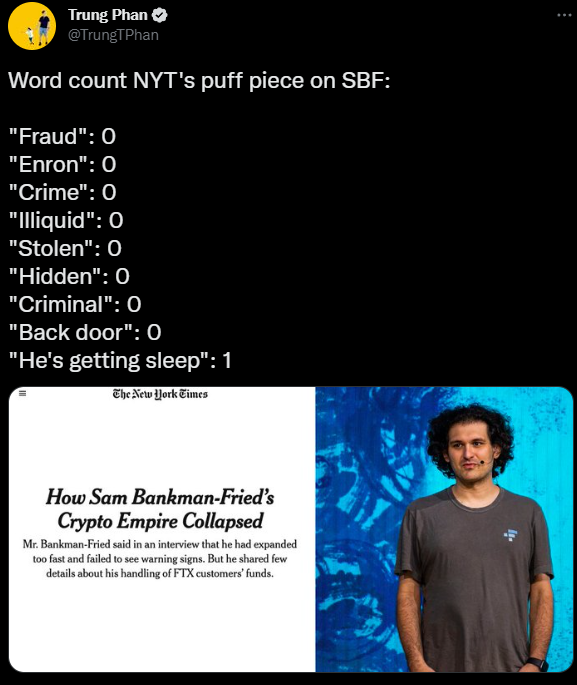

Mainstream media cover up FTX - Wider Conspiracy?

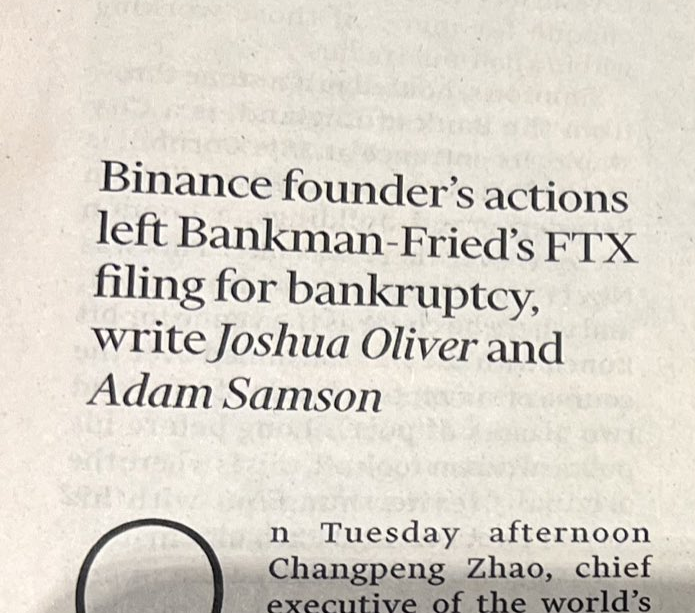

After the collapse of FTX and Alameda, the media coverage of the matter casted Sam Bankman-Fried as a benevolent leader who was brought under due to regulation, investors, and CZ publicly selling FTT.

This week, we saw a New York Times puff piece that had no mention of the words fraud, crime, nor criminal when describing his "empire".

However, are happy to mention his lax work ethics, how he sleeps at the office, and his fun twitter trolling ("What H-A-P-P-E-N-E-D").

Conveniently, the New York Times story sheds no light on Sam Bankman-Fried's political donations, crypto policies he backed that would better hide his fraud, and the connection between the head of the SEC and the CEO of Alameda.

They didn't even mention how Sam stole FTX user funds for their spray and pray Venture Arm, Alameda.

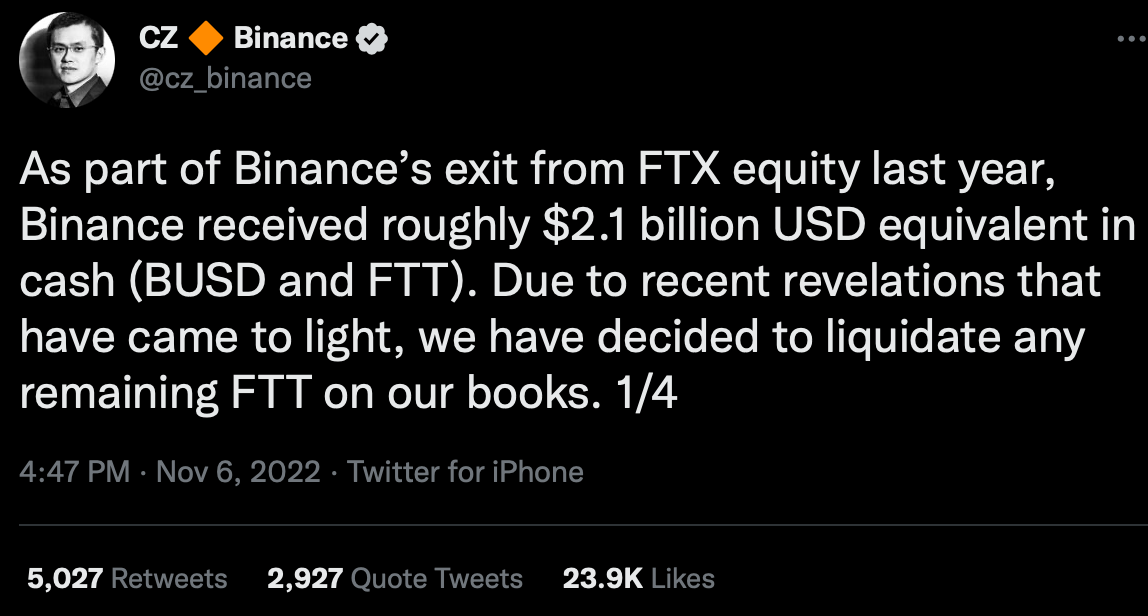

NYT didn't blame Sam, but are willing to treat Binance's CEO, CZ, as the scapegoat.

While CZ's tweets and activities, before the FTX downfall, were toxic, causing fear around the solvency of FTX.

However, it wasn't CZ's decision to illegally use customer funds to gamble on vaporware.

All CZ did was publicly suggest that he would sell his investment to avoid a Luna-esque situation.

CZ might have cut us, but it was to cut out the cancer in our community.

FTX lost $10b of their customer's money, and they would have kept taking unimaginably large losses without the bankrun exposing them.

The downfall of FTX caused a fire, and now new growth will begin and continue through the soot.

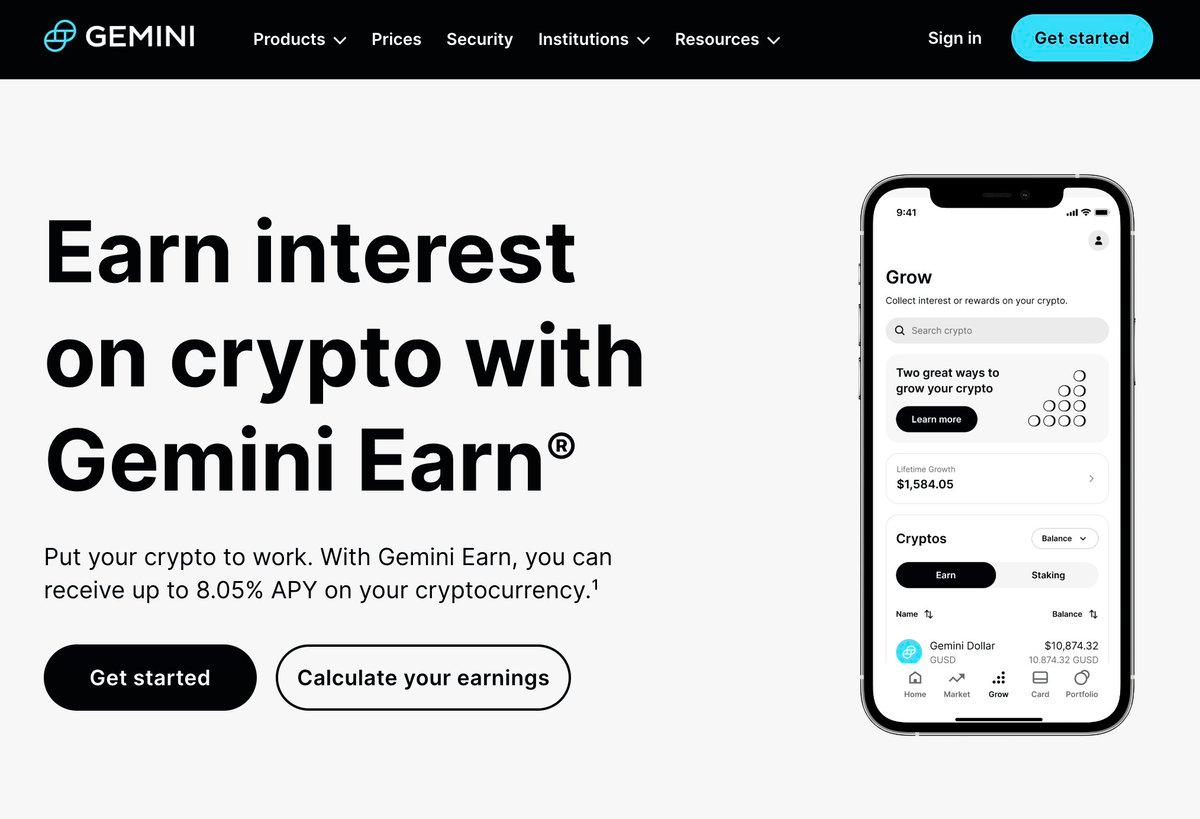

Gemini Earn shutting down

Gemini Earn unable to meet customer redemptions due to Genesis unit pausing withdrawals

Gemini was forced to close its Gemini Earn program, as it ultimately had exposure to the domino effects of Crypto collapse through Genesis Global Capital.

Genesis Global Capital (short for Genesis) were the main borrowers from the program, so when they paused withdrawals, there was little Gemini could do to recover the assets.

Now, Gemini are working with Genesis and its parent company Digital Currency Group (DCG), to fulfill their customer deposits.

This only effects Gemini Earn, and all other Gemini Exchanges features remain active, including staking, trading, and withdrawals.

The parent exchange Gemini saw a $485M rush of outflows amid contagion fears however operations returned to normal.

After the fallout of FTX, the general consensus was that the contagion could stretch to other exchanges, and that FTX was the fuse that would spur on more bank runs.

This was not the case, as Gemini, OKX, and Crypto.com all saw massive outflows.

Gemini withstood the largest outflow, nearly $500m in just EVM withdrawals, as highlighted by Nansen.

Gemini's liquidity went from $2.2b to $1.7b, as Gemini's "Earn" program pausing withdrawals only created on more fear.

Genesis, DCG, and Grayscale next to fall?

Genesis/DCG Seeking $1b bailout

The largest crypto lending desk Genesis is seeking $1b in credit.

Genesis is part of DCG, the largest holding company in Crypto that owns CoinDesk, Genesis, Grayscale, and many other large platforms.

DCG recently announced their exposure to the FTX collapse through Genesis, and now have a $1b hole they need to recover.

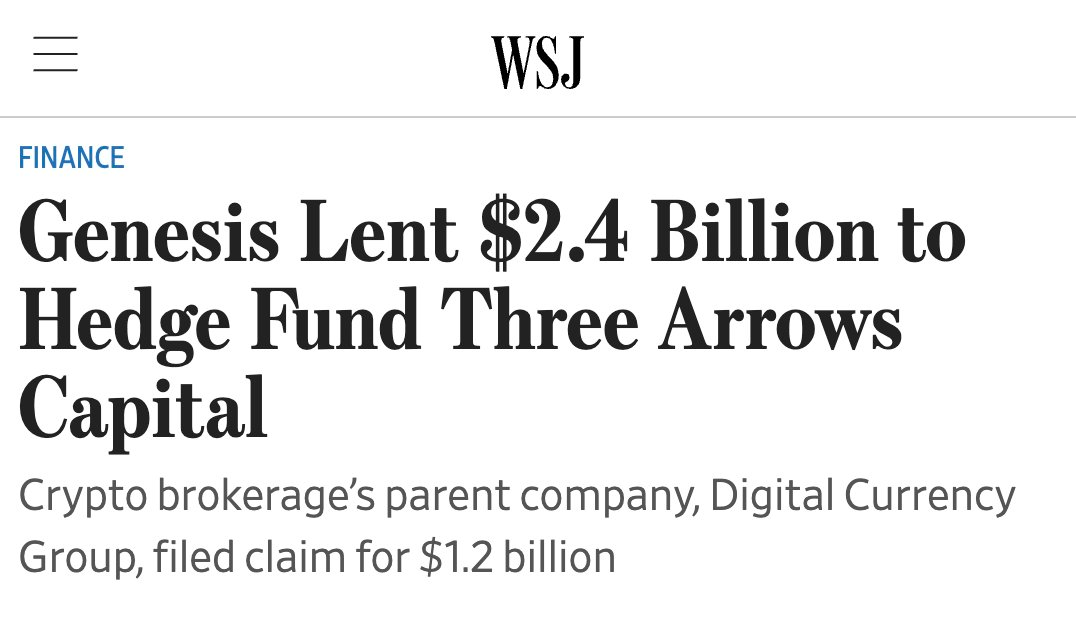

Earlier this year, Genesis also announced their exposure to Three Arrow Capital (3ac), a failed highly leveraged hedge fund. Genesis had over $2 in exposure to 3ac.

Genesis paused withdrawals on Wednesday, citing the liquidity crunch after FTX.

This holding firms hold other crypto for other people, and then lends these funds to earn revenue for the firm and on the depositors behalf.

Why is the downfall of Genesis so bad? Dozens of companies like Gemini use Genesis to help their consumers earn yield. If you're a CeFi platform that offers yield, you probably use Genesis. Using some rough numbers and simplifying the process a bit, here's how it works..

Genesis also sufferd a $1 billion loss to LUNA, as they took in 1 billion UST for $1 billion worth of BTC, during a swap with Luna Foundation Guard. These UST are now worthless.

The @LFG_org closed a $1.5 billion OTC swap of UST <> BTC, with Genesis leading the way.

— Genesis (@GenesisTrading) May 5, 2022

The Genesis aspect of the deal represents the first of its magnitude, with Genesis Asia Pacific Pte. Ltd. taking on 1 billion UST in exchange for $1 billion worth of BTC. https://t.co/07z2oFSCWL

Genesis moved size, during the bull market.

Now, they find themselves with massively decreased volumes.

DCG are likely trying to raise $1b to recover these losses, however, we don't know all the details of the raise.

If there is a debt and they cannot raise the funds in time, then DCG will have to either sell equity, sell their venture, sell all their liquid GBTC, or sell some of their subsidiaries like Coindesk/Luno/Foundry.

Given their size, the sell pressure from their liquid assets would devastate the thin liquidity in the open market currently.

Grayscale - the crux to Intitutional Bitcoin

At the center of Genesis/DCG crisis is Grayscale, the most important subsidiary of DCG. Grayscale issues and manages the GBTC fund which they are desperately trying to turn into an ETF.

As DCG is under question, people are pressuring Grayscale to provide Proof of Reserves for all the BTCs held by their trust. Grayscale have cited security concerns and is witholding on-chain proof.

To be fair, GBTC is a US-registered security, and it is the most popular way for institutions to invest in Bitcoin. The integrity of the assets should be secure. Coinbase Custody has also vouched for its Bitcoin holdings.

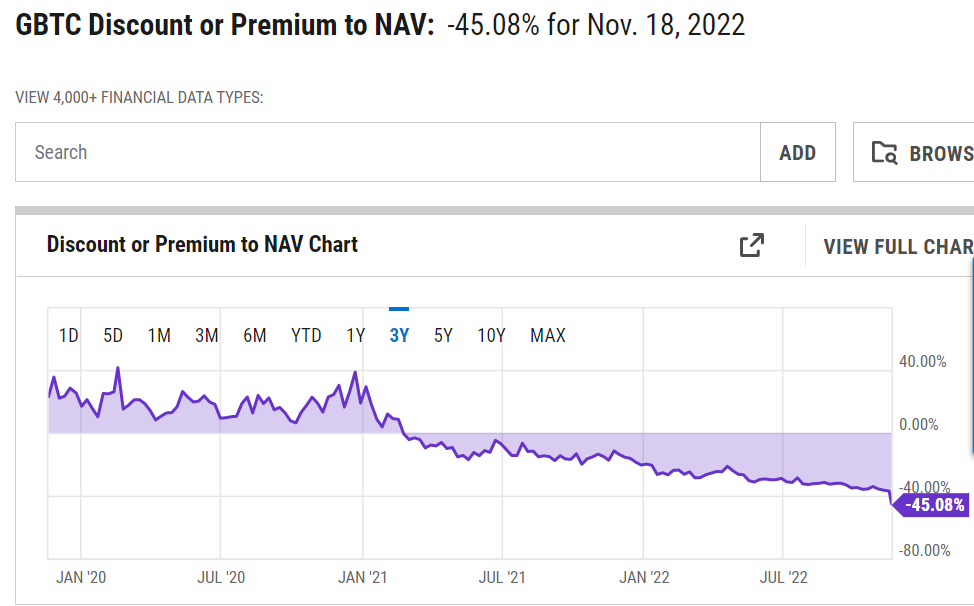

The real concern is with the price decline of GBTC. GBTC used to trade above regular Bitcoin price in the bull market, but since beginning of 2021 its price has fallen below the backing. It now trades at -45% discount to the price of real Bitcoin

As GBTC has been dumped by institutions all year long - parent company Digital Currency Group (DCG) has chosen to pick up the bag.

3AC dumped 100% of its bags. BlockFi dumped 100% of its bags. DCG is now the largest holder of GBTC.

The problem now is, does DCG dump their GBTC shares to cover the hole in Genesis?

If GBTC gets dumped, this is obviously bad for Bitcoin price directly, and impacts institutional adoption of Bitcoin.

However, Grayscale is a cash-cow business that has maturity, while the assets and other businesses of DCG are now essentially worthless.

Therefore I think the more likely scenario to happen is:

DCG spin off Grayscale or sell it to a large TradFi player like Fidelity, and let the rest of their business die including Genesis, Coindesk, their VC firm, etc.

This would be both good and bad, as instituional Bitcoin interest gets protected, but Crypto native firms will be massively hurt as the biggest lender Genesis goes under.

Regardless of what happens, this is one of the biggest events/risk to watch in the Crypto collapse saga.

Can Solana survive FTX aftermath?

Solana is one of the biggest collateral damage from FTX. Can it survive this fallout? Let's break down its damage points.

Solana foundation didn't hold too much money on FTX

As of 11/14/22, Solana Foundation has assets on FTX: 3.24m shares of FTX Trading LTD common stock; 3.43m FTT tokens; 134.54m SRM tokens and only had ~$1M in cash or equivalents on FTX. https://t.co/beabWrxE0C

— Wu Blockchain (@WuBlockchain) November 14, 2022

The total exposure to Sollet-based assets on Solana in circulation is valued at approximately $40 million as of Nov 10, 2022.

This is better than expected, and luckily Solana Foundation mostly lost speculative assets like FTX stock, FTT, and SRM tokens, which would be worthless regardless. Their cash exposure of $1M on FTX is not big.

How much SOL does FTX and Alameda hold?

Checking out those Solana foundation sales to FTX/Alameda is CRAZY. Absolutely nuts that they sold ~9-10% of the supply off to Sam. 🤯🤯 Had no idea it was that big. When I was out hunting OTC SAFTs in 2020, Sam was wheeling and dealing with the team direct. Well played Sam. pic.twitter.com/FnPmlkfE0m

— S◎L Big Brain (33.3%) (@SOLBigBrain) November 14, 2022

It is common knowledge that FTX and Alameda are the biggest supporters of Solana, and it's public knowledge that they bought up huge amounts of SOL tokens.

FTX and Alameda bought over 50M SOL tokens over the years, which accounts for around 9% of the total supply.

These tokens are set to unlock slowly from September 2021 to January 2028. However since FTX and Alameda have filed for bankruptcy, these contracts will need to be sold OTC to the highest bidders.

1) FTX x Alameda Research x Solana

— NWN (@NFT_World_News) November 9, 2022

Why is Solana $SOL dropping?

On Nov 7. Alameda holds $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.”#FTXToken #AlamedaResearch #Solana #Binance #Bitcoin #FTT #cryptocurrency

Although these tokens will remain locked and won't be dumped on the market, OTC buyers could potentially short equal amounts to take advantage of these locked SOL tokens that are forcibly sold.

For example, if I can buy a large batch of SOL for $1 per coin from FTX bankruptcy, I can short the same amount of SOL in the open markets. This lets me lock in the profits early, and I just have to wait until all tokens eventually unlock.

Overall, the huge chunks of SOL held by FTX are terrible for Solana, and we need to keep following their movements from bankruptcy proceedings.

Solana TVL down 70% since November 6th

Since the collapse of FTX, the total value locked (TVL) across Solana ecosystem has dropped from $2 Billion to only $570 Million, a 71% drop.

It's not looking good as most Solana projects rely on Alameda to provide liquidity or back the underlying assets.

You can track the realtime Solana TVL data on DeFi Llama

Largest DEX on Solana Serum compromised

Serum is the largest liquidity hub on Solana, all trading goes through it

It is now compromised as FTX holds the admin keys for Serum. Solana foundation and developers are now forking Serum.

Until this happens, much of the trading on Solana DEXs will be impacted as the biggest liquidity hub is down.

USDC & USDT suspended on Solana Network

Many leading exchanges have suspended USDC and USDT deposits through the Solana network. This includes Binance, OKX, Kucoin, and Bybit.

Exchanges are worried about Solana DeFi apps stability and how people might be arbitraging stablecoins out of the ecosystem.

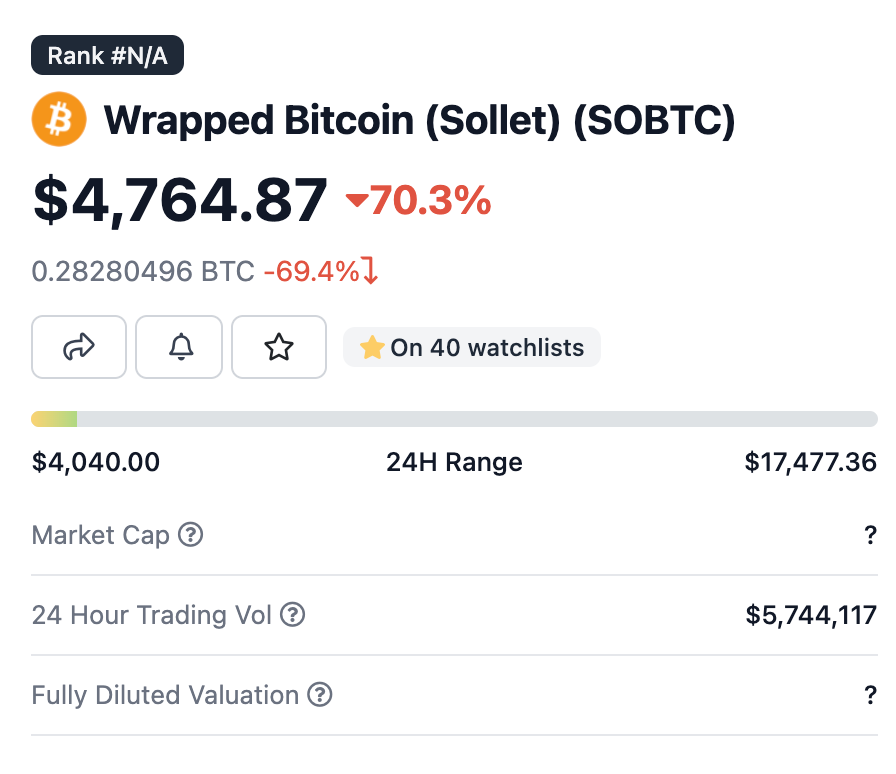

soBTC and soETH depeg on Solana

The wrapped versions of BTC and ETH on the Solana Blockchain have completely depegged.

soETH and soBTC were issued by bridging Bitcoin and Ethereum in escrow and issues an equivalent number of their derivative versions on Solana.

Unfortunately, these tokens were issued by FTX, so the status of the underlying assets are unknown. The prices of these two wrapped tokens have been depegged as people rush to exit.

soBTC is currently trading at $1,100, less than 10% of the price of Bitcoin.

soETH is trading at $175, making it less than 15% of the ETH price.

How I'm storing cryptos now to stay safe

Exchanges are still good options for beginners

For most people, letting professionals custody your crypto is still the best choice. However, this is only the case if it's on a secure exchange.

The main exchanges I use to trade on and hold some of my funds are Binance and Coinbase.

NEVER keep all of your crypto on one exchange, wallet, or protocol.

You could lose all your money, or only a portion of it – your choice.

Only using MetaMask is NOT SAFE!

It's much worse than using an exchange.

After the FTX fiasco, many people are taking self custodial measures for their Eth.

If you only use a Metamask, then you're NOT taking the best precautionary measures to secure your funds. You'd be better off keeping money on a reliable exchange, such as Binance or Coinbase.

Bored Ape instagram has been hacked ❗️

— Loopify 🧙♂️ (@Loopifyyy) April 25, 2022

It looks like this is the wallet and so far 4 Bored Apes and 6 Mutant Apes have been lost. pic.twitter.com/LWTOAScfNM

Everyday people lose money to scams that mock Metamask or another wallet/protocol and then steal your seed phrase, also known as a Phishing scam.

Would you hold your life savings in a Chrome web extension?

It's difficult for beginners to understand what’s safe and not safe when using a wallet. Most people myself included should not hold large amounts of money in a browser extension.

Its best to have a hardware wallet or leave it on a reliable exchange.

Is a hardware wallet actually worth it?

Not your keys, not your crypto.

Hardware wallets not only safely store your keys, but also makes transacting with crypto more clear.

With a hardware wallet, if your computer gets compromised and hacks your MetaMask, it still cannot steal from the wallet.

You are insusceptible to phishing scams, as your hardware wallet needs to send the final confirmation to execute a transaction – instead of one click in a web extension.

You can sleep easy at night knowing that your crypto needs YOU to physically press "Confirm" to execute a transaction.

Security Tips summarized:

- Beginners should continue to use a top exchange like Binance or Coinbase

- Pick the platforms with the longest history and the highest amount of money deposited

- If you want to use self custody wallets, hardware wallet is a MUST

- Open an extra wallet with little money for "playing" with new projects

- Split your money across multiple platforms and different types of platforms (eg: Exchanges, "playing" defi wallet, cold hardware wallet)

End

That’s it for this week's newsletter.

If you liked this content, please subscribe to the newsletter and share it with your friends.

Consider using our affiliate links as it'll support our channel

Binance.com - $600 Signup bonus, 10% off fees

Thanks for reading!