FTX Caused Collapse of LUNA and Three Arrows?

Hi everyone, welcome to issue #7 of the VirtualBacon Newsletter.

In this week's issue:

- Bitcoin Breakdown Confirmed

- Ethereum Uptrend Invalidated

- FTX caused collapse of LUNA and 3AC?

- Projects effected by FTX contagion

- Crypto.com is next?

- Top Performing Cryptos of the Week

Bitcoin Breakdown Confirmed

Bitcoin has confirmed its breakdown below the key support at 18.5k.

This was the 2017 all-time-high and the previous lows made in summer 2022. Since we've now made a new low, the downtrend continues, and we enter into a strictly risk-off stage.

It has been one week since the FTX collapse, and since the weekly candle closed below 18.5k and did not see a sharp correction, we can now confirm that the bears are in control for the medium term.

The next significant support level is at $12,000, which was the peak of the 2019 rally.

Despite all the dramatic events in the past week, I still feel comfortable holding Bitcoin around these levels. I have always prepared for the Bitcoin bottom to be somewhere between 12k and 18k. And since everyone have been calling for a 12k bottom, it will also be a crowded trade and unlikely to happen.

Thus I'm not trying to time the exact bottom, and will continue to accumulate Bitcoin around current levels.

Ethereum Uptrend Invalidated

Ethereum uptrend has been invalidated.

The higher low at $1250 made in September is broken, as the recent crash has printed another lower low. The downtrend continues.

The support level at $1250 from last week now acts as resistance. and after the short correction this week, we should see Ethereum trend down towards $1000 to test the July lows.

$1000 is the key long term support and a major psychological level. If $1000 gets broken, we're in for a lot more pain.

Ethereum has held up relatively well against the market crash, and has even outperformed Bitcoin in the past few weeks.

We can see this on the ETH/BTC chart, where the ratio of ETH versus BTC has remained in the same range since Mid 2021. Ethereum has also been in a consistent uptrend against Bitcoin since the start of 2020.

Despite all the drama in the past week, I'm still holding and accumulating Ethereum around current levels.

If you want to buy or trade Bitcoin and Ethereum, consider using my Binance Affiliate Link

You get a $600 Signup bonus and it helps support the VirtualBacon channel :)

FTX caused the collapse of LUNA and 3AC?

Read the first part of the FTX story here.

Last week ended with Alameda taking a massive multibillion dollar hit from the collapse of Luna, and then FTX bailing them out with user funds.

New theories have emerged involving the once solvent Three Arrows Capital (3ac) and Luna.

There was likely some bad blood between FTX/Alameda and 3ac, which developed when they were a smaller exchange with sketchy investment language.

Early pictures of Alameda 2019 Telegram chatter "Deleted account" confirmed to be Su Zhu. Reposted for exposure as original tweet was deleted. pic.twitter.com/Q5kCrgUopl

— sumfattytuna (@sumfattytuna) November 12, 2022

These same guys are now trying to launch a "bitmex competitor" and do an ICO for it.

— Zhu Su 🔺 (@zhusu) April 13, 2019

🤔 https://t.co/HBp2XJ1TaB

3AC made a partnership with Luna earlier this year, buying $1b in UST.

This purchase was an attempt to back UST with a reserve, so there would be a backstop in event of a bank run.

FTX/Alameda later used this position against 3AC, eventually causing the collapse of Luna and UST.

In an effort to save face, 3AC had to help defend the peg of UST, likely burning hundreds of millions more dollars.

FTX had a liquidation engine that lets them front run other traders positions during liquidation cascades.

If I had to guess, it was widely known alameda had been internalizing (take other side) ftx client liquidations for years

— Zhu Su 🔺 (@zhusu) November 10, 2022

3 days of 99% sell-only liq flow from Luna1 (and many other coins) likely wouldve opened up a large loss from giving themselves non-liq on their own platform

This liquidation engine was likely highly profitable most of the time, however, with the bank run of Luna, their liquidation engine worked against them.

Don't know anything non-public on this, but I am guessing the FTX liquidation engine has something to do with Alameda's massive realized losses

— Sisyphus (@0xSisyphus) November 12, 2022

Very difficult to get to the size of the balance sheet hole they have with any other explanation https://t.co/qxGb8iiXdO

The collapse of Luna, created a massive hole in Alameda’s books, as their liquidation engine kept bidding the worthless Luna all the way down to zero.

1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇 pic.twitter.com/DtCyPspME0

It's rumored that CZ then engaged with SBF, saying these actions are reckless for the entire crypto space, however, Sam didn’t heed his warning.

2) Apparently CZ warned Sam re his reckless actions on multiple occasions, but SBF ignored him. As things got worse, CZ saw no choice but to make the issue public.

— Mario Nawfal (@MarioNawfal) November 11, 2022

This led to the infamous tweet by CZ 3 days ago that took down FTX.

CZ had no choice 👇

The final straw for Sam was lobbying against the DeFi space, making it easier for him to obfuscate his illegal activities.

Sam was almost able to create an even bigger hole, with the nearly launched FTX stablecoin.

This would have let FTX mint new unbacked stablecoin, while stealing the USD that was supposed to back the stables.

In the beginning, CZ likely didn't know FTX were using user funds, but questions arose around why FTX was having a hard time sourcing user liquidity.

If this saga has not been exposed, it's crazy to think how much bigger the hole could've gotten.

FTX conveniently "hacked" for $600M, Apps infected with Malware

Shortly after FTX filed for bankruptcy, the exchange was mysteriously "hacked" for $600M. User balances are officially "zeroed" and logins are showing error.

What's left of FTX support also warns users to delete all FTX related apps, as there has been software updates likely infected with malware.

Completely crazy end to the story. One week ago FTX was still the second largest exchange. Today the entire balance and userbase is gone, in the most dramatic showdown.

SBF is now tweeting one letter at a time on his profile, mocking us with

"What H A P P E N"

Stay safe from these FTX Contagion targets

FTX and Alameda were huge in crypto, and their impact on crypto is yet to be felt in full.

FTX was one of the most influential exchange and venture funds in the crypto space.

Their exposure to certain coins, protocols, and platforms should make all crypto investors skeptical, as it will likely equate to liquidations or bad debt.

Solana

Solana is FTX’s largest and most successful investment.

They hav around 29m in SOL unstaked Wednesday, and a minimum of 32m Sol to be sold. Their Sol might be sold OTC, but the fear alone could cause Solana to drop further.

Solana fans are remaining optimistic, but they have a rougher road ahead.

Solana Ecosystem

Solana’s ecosystem was largely funded by Alameda and FTX Ventures, as this was how they propped up the value of Solana.

Now, lots of ecosystem tokens are going to be devastated by sell pressure from FTX, the lack of new funding, and the liquidity exiting from Solana DeFi platforms.

It's fair to expect many existing ecosystem coins to die, especially the tokens with direct involvement with FTX and Alameda.

Voyager

Voyager, one of the largest centralized lending platforms, went bankrupt in July.

FTX won a bid to buy Voyager for $1.4b, in September.

FTX was also providing up to 72% of users' funds with the bail out.

Now, Voyager’s destiny is in limbo, as FTX doesn’t have any money for the purchase.

Voyager’s token, VGX, has became a source of speculation around this acquisition, and now its fate is sealed as a meme coin.

BlockFi

BlockFi paused withdrawals this week, again.

In May, BlockFi, a centralized crypto lending platform, announced its insolvency.

In July, FTX.US was there to pick up the pieces, acquiring the company, and making users whole again.

BlockFi was acquired for $240m, with FTX.US giving them $400m in credit.

With the recent FTX insolvency, the future of BlockFi is put in jeopardy.

Aptos

Aptos is a recently launched layer-1 with a similar developer stack as Solana.

Due to their influence in the crypto space, prior to their bankruptcy, the Aptos Labs team was happy to have Alameda as one of their lead investors.

Alameda had exposure to the Series A funding round.

These coins will have to be sold OTC, due to not being vested. So these coins will likely not see the open market for some time.

Aptos will also likely have less funding going forward, as the Solana community has been hurt massively.

Sui

Sui is in the same position as Aptos. It is also a Layer-1 from the Facebook libra team, and adopts the Solana developer stack.

Alameda also secured a spot in Sui’s Series A funding round, due to their influence.

Aave’s Lens

Lens is a decentralized social media platform, with a service similar to Twitter.

Lens was supposed to let users collect their own data in the form of a NFT which then can either be sold or kept secret, depending on user desire.

FTX Ventures made a large bet on Lens, and now their largest supporter is gone

TrueFi

TrueFi is an undercollateralized loan protocol.

One of the main risks associated with undercollateralized loan protocols is that there is a chance than those taking out loan never repay them.

Alameda had a $12m loan, issued by Truefi.

This loan will likely never be repaid, and now Trfuefi has bad debt it must fill.

Ren Protocol

Ren protocol is project that wraps assets on one chain and deploys them on another, with their top product being RenBTC, a wrapped BTC issued on Ethereum and other chains.

Alameda has been funding Ren, and then acquired it in early 2021.

Ren has lost its entire treasury on FTX, and is looking for other options.

There has also been rumors stating Alameda controls the admin keys of Ren which lets them issue tokens and withdraw assets.

BitDAO

BitDAO is a venture DAO that tries to grow their treasury through various means.

One of the ways they grow their treasury is to form partnerships with other projects in the crypto space, and using that treasury for venture.

FTX and BitDAO performed a token swap, swapping 100m BIT for 3,362,315 FTT.

BitDAO’s token was dumped by another large holder, and now FTX’s Bit will need to be sold.

BitDAO’s FTT has also lost most of its value.

FTX Investment List

Here are all the known FTX Investments

If you have significant exposure to the small projects on this list, research whether they were using Alameda as Market Maker, and whether if Alameda/FTX were their largest investors

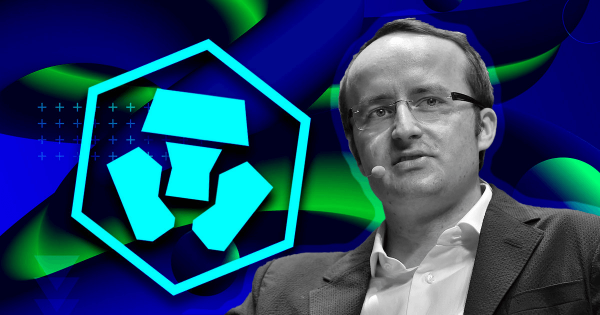

Crypto.com is next?

In the wake of FTX’s downfall, users are taking preemptive measures to save their crypto, and this has led to users withdrawing their crypto en mass.

On-chain sleuths are looking for questionable actions from exchanges.

Of these, one of the most notable, Crypto.com, has been executing a variety of suspicious transactions.

This initially started when users found Crypto.com has sent a total of $1b of USDC to FTX over the past year, and there were no return records of these funds.

🧵: 🚨 @cryptocom SENT 1B+ to @SBF_FTX 🚨

— WIZΞ (@TraderWize) November 13, 2022

1 / After some TXID digging FTX has received around 1B+ $USDC from @cryptocom. They likely fell victim to @SBF_FTX incredibly great APR deception. And they figured, "Why not make some decent money from the deposits from the users?" pic.twitter.com/CN6NPL3iJD

The fear of insolvency arose around this transaction, causing the token to dump more than 50%, over the past couple days.

This resulted in Crypto.com’s CEO, Kris Marszalek, taking to twitter for damage control.

Kris dispelled the FUD, saying these transactions were to hedge trades by using FTX as a trading venue, but never deployed capital for yield on FTX.

Crypto.com did lose $10m in the FTX fiasco, but for an exchange of its size, $10m is a small loss.

This is false. We have minimal exposure to FTX (under US10m) and only used it as a trading venue to hedge customers’ trades. We never deployed capital for yield with FTX or any 3rd party.

— Kris | Crypto.com (@kris) November 13, 2022

Crypto.com’s reserves came into question, as they hold a large amount of Shiba Inu

Again, fear arose around the possibility of Crypto.com taking unrecoverably huge losses from meme coins.

JUST IN: #CryptoCom CEO and founder @kris just released their "Proof of Reserve". The scary party... they hold more $SHIB than $ETH. pic.twitter.com/XmMOxFzkYR

— Mr. Whale 🐳 whalechart.org (@WhaleChart) November 11, 2022

Kris had to save Crypto.com’s face again, shedding light on these funds by saying this is their reserve where they keep all customer assets 1:1.

These are customer deposits @NeerajKA - we securely store 1:1 everything our users buy & hold on the platform.

— Kris | Crypto.com (@kris) November 11, 2022

And indeed, users bought a lot of Shiba & Doge in 2021. You could figure it out by looking at their global marketcap rankings (Doge #9, Shiba #14).

The following day, on-chain sleuths found suspicious transactions leaving Crypto.com for Gate.io, one in particular for 320,000 Eth (>$400m).

Anyone know why https://t.co/2vZHyCaKNe would send 320k ETH (82% of their ETH today) to https://t.co/bVgf3bCqwp on October 21? pic.twitter.com/2E1NxX1pJz

— Conor (@jconorgrogan) November 12, 2022

Kris explained that the transfer to Gate.io was a mistake, and the Eth was later returned to their cold wallets.

In this particular case the whitelisted address belonged to one of our corporate accounts in a 3rd party exchange instead of our cold wallet. We have since strengthened our process and systems to better manage these internal transfers.

— Kris | Crypto.com (@kris) November 13, 2022

Gate.io also issued an announcement verifying Kris’ s statement about the matter

Clarifications on @cryptocom's transfer for the sake of transparency & education:

— Gate.io (@gate_io) November 13, 2022

1) Snapshot for PoR audit taken on Oct 19. https://t.co/a4NJTN8Brj's deposit was not included https://t.co/5U5tZWFfBF

2) All 320K ETH were returned https://t.co/7G5l3YLLIhhttps://t.co/IvyiBu9aBY

All this FUD in a short time frame is certainly battle-testing Crypto.com, as users fear losing money in a FTX-like situation.

Crypto.com lost >$500m, since the 11th, in their verified on chain addresses.

Crypto.com also became the top gas spender, so much so that they ran out of gas in their withdrawal wallet – creating even more FUD.

A user sent CDC gas and transactions restarted. So they aren't halted, just running a bit slow now that they are out of gas

— Conor (@jconorgrogan) November 14, 2022

Thanks friendly user! https://t.co/SMvNQoCwkV pic.twitter.com/XyQfuPCBFk

This wallet has since been funded with more Ethereum, and you can view it here.

One of the symptoms of FTX’s downfall is that users are now testing centralized exchange reserves, and this could manifest as another bank run.

While Crypto.com has done a sufficient job dispelling the FUD surrounding their reserves, however, they have yet to disclose their liabilities.

We don't know of any outstanding loans Crypto.com has, margin call threshold, or the timeframe they have to repay these loans.

The retail driving the FUD of insolvency fear a FTX repeat and are so far incorrect, as CRO’s >50% dump hasn’t caused a liquidation cascade similar to FTT – yet.

Maybe Crypto.com has sufficient user funds, however, they haven't done a very convincing job at proving this publicly.

Top Performing Cryptos of the Week

Trust Wallet

Trust Wallet surged this week, as more user take self custody measures. Being owned by Binance, Trust Wallet is the largest mobile wallet for retail users. CZ also tweeted about it.

With people waking up to the importance of self custody, we can expect coins related to wallets to have more interest.

.@TrustWallet allows you to store your crypto yourself, if you want. Your keys, your coins.

— CZ 🔶 Binance (@cz_binance) November 13, 2022

DYDX

DYDX is a decentralized futures exchange where users can tap into high leverage on chain. DYDX is getting a lot of attention and users as the collapse of FTX highlights the need for onchain futures exchanges.

GMX

GMX is another leading decentralized exchange offering leverage trading with good liquidity. It is built on the Arbitrum Layer-2 and has long been seen as a decentralized competitor to FTX.

With the fall of FTX, the industry is waking up to the importance of DeFi.

End

That’s it for this week's newsletter.

If you liked this content, please subscribe to the newsletter and share it with your friends.

Consider using our affiliate links as it'll support our channel

Binance.com - $600 Signup bonus, 10% off fees

Thanks for reading!