FTX is Dead, the sinister truth revealed

Hi everyone, welcome to issue #6 of the VirtualBacon Newsletter.

In this week's issue:

- Bitcoin isn't feeling too good...

- Ethereum holding onto last hope

- FTX is dead, the sinister truth revealed

- Web3 Social picking up steam

- Meta/Instagram integrate Polygon, Solana, Arweave

- Elrond Rebrands to MultiversX

Bitcoin isn't feeling too good...

Bitcoin isn't feeling too good...

We have lost the support level at $18,500, which was the summer lows this year and the 2017 bull market peak.

The next significant long term support is at $12,000. Although this doesn't mean price will for sure hit $12,000. But if it does, that would be a good level to buy at.

Zooming in to the daily chart, we see a clear breakdown + retest pattern. After getting oversold yesterday, Bitcoin is seeing a relief bounce.

But do not mistake it, unless we close above $18,500 today, this is nothing but a deadcat bounce.

I am still comfortable holding Bitcoin around these levels, as I have always prepared for the Bitcoin bottom to be somewhere between 12k and 18.5k.

However, I will not be touching any short term trades with Altcoins, as Bitcoin will at least be volatile for a few weeks and most likely will make a new low below $16,000.

Ethereum holding onto last hope

Ethereum is holding onto its last hope.

From the bounce from October, Ethereum has printed a higher low at $1250 which could have started a new uptrend.

However with the recent FTX collapse, ETH has retraced back to this level and even wicked below it.

Now the fate of Ethereum is on the line. If ETH can bounce from $1250 this week, we are still good for a reversal to the upside.

However, if $1250 breaks, the uptrend scenario will be invalidated. In this case, Ethereum is likely to retest the $1000 support and follow Bitcoin down into a longer bleed.

If you want to buy or trade Bitcoin and Ethereum, consider using my Binance Affiliate Links

You get a $600 Signup bonus and it helps support the VirtualBacon channel :)

FTX is Dead, Industry is shook

The whole saga started a few weeks back, when FTX's sister company Alameda Research was suspected to be insolvent. Their balance sheet was leaked which showed majority of their net assets comprised of their own exchange token $FTT, and Solana $SOL.

Alameda was apparently borrowing from every lender in the space, and using their inflated token $FTT as collateral.

This wasn't necessarily a problem, as long as FTX/Alameda have much larger cash balance to pay back those loans. But the situation changed when CZ ignited the run.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

CZ's exit from $FTT showed that:

- Alameda and FTX were one and the same

- The two firms do not have enough cash to prop up $FTT price and sustain all their credit lines

- CZ is declaring war on SBF

Word quickly spread in the space. Some people shorted $FTT with CZ, while others speculated on the integrity of FTX exchange itself.

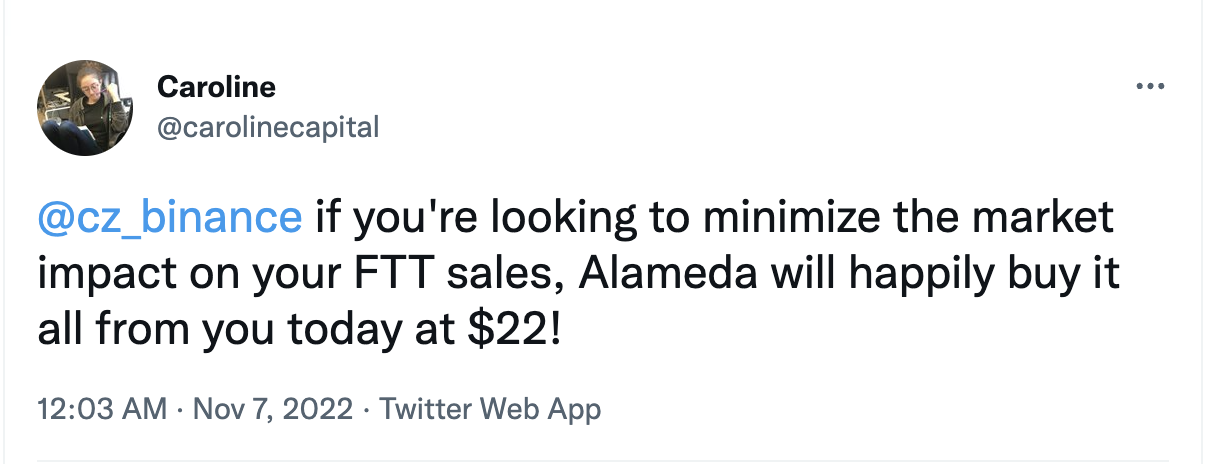

Of course the usual flex of "we'll buy all your coins, sell them all". We have all seen this story before.

People started withdrawing funds from FTX en masse, while $FTT price kept falling. The more withdrawals, the more dump, and the more Alameda gets pressure on their credit lines to fund the withdrawals.

A classic bank run.

FTX's stablecoin reserve just reached a year-low.

— Ki Young Ju (@ki_young_ju) November 6, 2022

$51M as of now. -93% over the last two weeks.https://t.co/eG4SVOO6cV pic.twitter.com/GIj3nJGXf6

By Tuesday morning, FTX has "effectively paused" withdrawals. Things were bad.

Then came the most shocking announcement in recent memory.

Binance intends to acquire FTX, and help its liquidity crunch.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

For a brief moment, users were relieved.

"It's just a business play!"

"Binance will probably cover all withdrawals and make $FTT valuable again!"

But with this annoucement came more doubts.

- Why does FTX even need Binance's help, if it's only a short term crunch. Did they not have all the user funds?

- If FTX did misappropriate user funds, it would've definitely gone to Alameda

- Then how was Alameda in so much trouble and have no cash on balance?

- If Alameda is still doomed, their balance sheet full of $FTT still needs to be dumped. Their billions of credit lines will all need to be closed and $FTT collateral will be dumped too

The whole thing became way more sketch, and it seemed Binance had nothing to gain from saving a sinking ship.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

The next day November 9th, Binance pulled out from the deal. FTX indeed could not be saved.

If the (supposed) richest person in the world could not save FTX, who would?

FTX faces SEC and CFTC investigation: Bloomberghttps://t.co/zv8dW5G7ia

— The Block (@TheBlock__) November 11, 2022

Regulators pounced on FTX, and the trail of information started to make sense.

1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇 pic.twitter.com/DtCyPspME0

One Twitter detective found on-chain evidence of Alameda blowing up alongside Three Arrows Capital, but was saved by a massive loan from FTX.

This involved $4 billion worth of FTT being sold to FTX, and Alameda siphoning user funds from FTX.

It now makes sense why SBF were quick to bail out lending platforms like BlockFi and Voyager, as they were their main customers and would go down with them.

Borrowing against their own token is fine as long as FTX is generating revenue and able to create value for the $FTT token. It was still within the game rules.

However, when CZ revealed that FTX and Alameda were not simply leveraging their own money, but rather stealing money from their users, it was clear the ship was sinking.

Lessons learned from FTX, which feels like repeat of LUNA

- Don't borrow money against your own token

- Focus on generating revenue and building reserve

But the most sinister of it all, don't steal from your users.

Many lives are ruined. I personally lost some money on FTX as well.

If you still have any Crypto deposited on FTX.US or any centralized lending platform like BlockFi, Nexo, Ledn, whatever. Please withdraw them NOW!

Web3 Social Picking up Steam

One of the strongest narratives this week has been web3 social media.

With Elon acquiring Twitter, there has been mind blowing speculation around Doge being integrated with Twitter.

Since CZ (Binance CEO) was one of the people that helped funded that acquisition of Twitter, with a $500m investment.

With the investment, there has been hopeful speculation that CZ might join the Twitter board. CZ even said he would join the board "if Elon asks".

BNB has been performing well, in light of CZ's potential involvement with Twitter, setting new BNB/BTC ATHs.

Mask Network is infrastructure to connect Web3 features to social media like Twitter. Their browser extension directly integrates MetaMask with Twitter to allow Ethereum transactions and messaging in Twitter.

Mask had a very impressive week, and there's a chance that this success will continue, if Twitter decides to continue their crypto plans.

Binance released an index comprised of BNB, Mask, and Doge. The Bluebird Index is currently live trading.

Meta/Instagram NFTs + Polygon, Solana, Arweave, who else?

Last week, Meta announced Instagram will release NFTs for their creators called "digital collectables".

With this announcement, Polygon, Arweave, and Solana all saw positive price action, as they all have involvement with Meta and their Instagram NFTs.

Instagram will launch creator "digital collectables", where creators can create and sell NFTs to their followers.

Instagram will initially only allow select creators to create NFTs, but intend to open the doors to all users.

Arweave will be used for decentralized storage, as mentioned here.

Polygon will be the first blockchain feature an end-to-end toolkit for creating NFTs, and be the first blockchain to host Instagram NFTs, but will soon be followed by Solana, according to Meta's announcement.

Meta has had a large involvement within the crypto space, and these integrations and partnerships will likely not stop here.

With large announcement like this, it's imprtant to look at a projects Business development teams.

Polygon, AR, and Solana have strong business development teams, and it wouldn’t surprise me if we see more web2 giants start using these protocols.

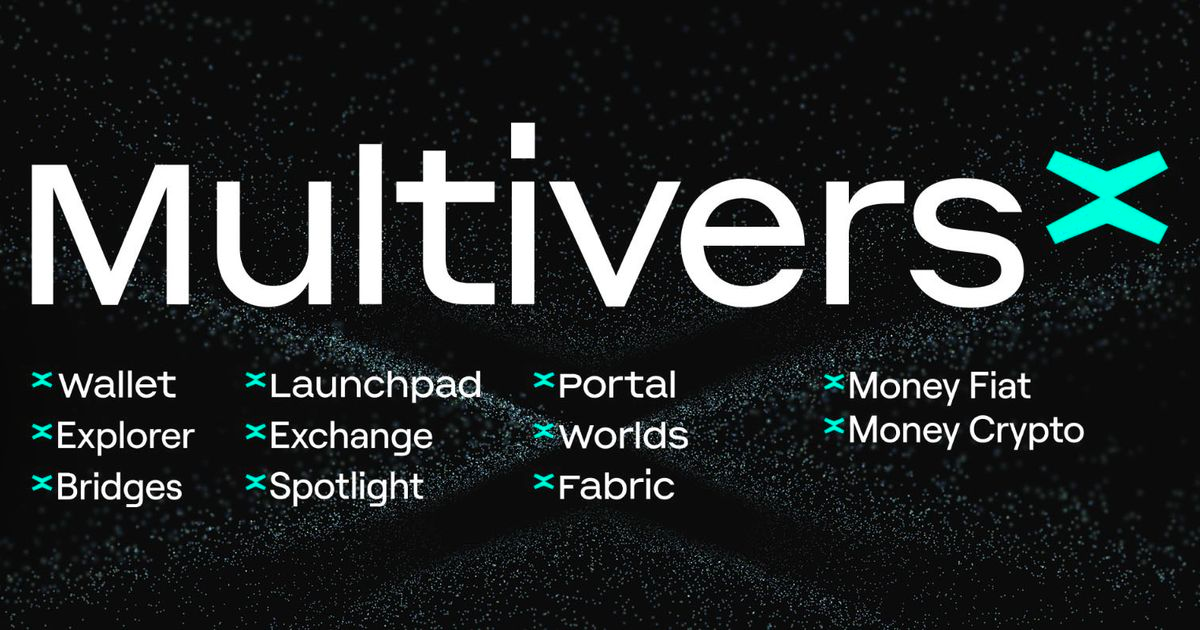

Elrond Rebrands to MultiversX

This weekend was the 3 day Elrond conference in Paris, France.

During the event, it was announced that Elrond would rebrand into MultiversX, in a push to further adoption.

The new name will not only give Elrond a new look, but better describes the future they see their blockchain moving towards – the metaverse.

MultiversX will be a metaverse focused blockchain, and will feature asuite of toolkits for Devs that will help with creating new worlds within MultiversX.

The new range of products includes: xWorlds, a creation engine thats connected to interoperable metaverses; xPortal, a finance-based metaverse app; and xFabric, sovereign blockchain module, with core blockchain apps.

The metaverse has been a hot narrative, since Facebook's rebrand to Meta, last year.

The metaverse will likely continue to be a hot narrative for sometime, likely a top narrative contender for next cycle, so this rebrand might steal limelight away from other metaverse projects.

The Conference is still on going, so there should be more developments, as the event continues.

Top Performing Cryptos of the Week

While a desperate week in the Crypto markets, it's still worth paying attention to the top performers out of this crash.

$BAND

- Band was the top performer of the week, after the launch of their V2.4 upgrade, their most significant upgrade yet. This upgrade increased speed, drastically reduced gas fees, and more flexible gas consumption. More.

$MASK

- Mask Network is an infrastructure to connect Web3 features to social media like Twitter. Their browser extension directly integrates MetaMask with Twitter to allow Ethereum transactions and messaging in Twitter.

- Binance launched a Bluebird Index, a new Twitter-themed cryptocurrency index that tracks the performance of BNB, DOGE and MASK.

- Seems that Binance is investing heavily in the future of decentralized social media and Twitter, and MASK network is at the forefront of this narrative.

$CHZ

- Chiliz remains strong as the football fan token narrative leader as the World Cup nears.

$MATIC

- Polygon is the only top project to quickly bounce from the FTX crash. They are one of the only few projects not under FUD recently, and still remains in a positive light alongside Ethereum.

- Betting on Polygon is like betting on Ethereum scaling. And if Polygon can survive this FTX fallout, it would make them one of the few bluechip coins that's easy to bet out for the next run.

Upcoming Events to Watch

- November 21: FIFA World Cup (Algorand, Chiliz, Football Fan Tokens)

- December 1: Theta Network Metachain launch

- December 31: EOS Trust EVM Launch

- December 31: Chiliz Mainnet 2.0 Launch

- 2022: Arbitrum $ARBI Token Launch

- 2022: StarkNet $STARK Token Launch

- 2022: zkSync Token Launch

- 2022: Sui Network Mainnet Launch

- 2022: Curve Finance Stablecoin Launch

- 2022: DogeCoin Twitter Integration?

- 2022: BitMex $BMEX Token Launch

End

That’s it for this week's newsletter.

If you liked this content, please subscribe to the newsletter and share it with your friends.

Consider using our affiliate links as it'll support our channel

Binance.com - $600 Signup bonus, 10% off fees

Thanks for reading!