Ethereum Bottomed? How to play a new ecosystem like Aptos, zkSync, and Arbitrum?

Hi everyone, welcome to another issue of the VirtualBacon Newsletter.

In this week's issue:

- Bitcoin's recent bounce is interesting but not out of the woods yet.

- Ethereum's rally is much more convincing as a reversal.

- Bitcoin dominance continues its uptrend and we must stay patient.

- How to play a new Ecosystem like Aptos, Arbitrum, and zkSync?

- Aptos Projects to Watch

- zkSync Projects to Watch

- Arbitrum Projects to Watch

Bitcoin Analysis

Bitcoin is still holding above its key support level of 18.5k. Same price action as last two weeks, nothing has changed.

18.5k needs to hold in order for Bitcoin to avoid a larger crash. If 18.5k does break, the next support level down is around 12k which is the bear market peak in 2019 and the consolidation in the summer of 2020.

Many people are getting super bullish this week saying "Bitcoin is back". But zooming out shows the clearer picture around this move.

Bitcoin is still clearly in a sideways chop between 18.5k and 24.5k. Yes this is a good bounce, but Bitcoin needs to at least reach 24.5k before we can consider this a significant move.

If Bitcoin can retest 24.5k, it would complete a double bottom pattern which signals a long term reversal and price likely will continue rallying for at least 3-6 months into the 30k ranges.

Before either of these scenarios happen, Bitcoin is technically in a sideways chop period between 18.5k and 24.5k. So exercise caution and don't jump to random predictions too quickly. Wait for the next move to be confirmed before acting.

Ethereum Analysis

Ethereum is looking strong! Although we are still within the sideways range between 1000 and 1950, the price action this week is giving early signs of a longer uptrend.

Looking at the Ethereum price action since last November, we see a clear downtrend as indicated by a series of Lower Highs (LH) and Lower Lows (LL).

This is why the recent bounce on Ethereum is so important, as we have formed the first Higher Low (HL) in the past year. A higher low is the first signal before a major reversal.

The next area to watch for Ethereum is at the 1950 resistance. If Ethereum can break above 1950 and form a new Higher High (HH), this would produce a classic trend reversal signal. Following this signal we are likely to see 3-6 months of uptrend for Ethereum to rally into the 3k ranges.

Support level for Ethereum is now at 1200, which is the recent Higher Low formed last week. This level must hold in order for the reversal to play out. If Ethereum breaks below 1200, this idea would be invalidated as the Higher Low no longer holds.

Bitcoin Dominance Analysis

Bitcoin dominance has the exact same analysis, and I will keep being patient. When BTC.D trends up, money is likely to continue flowing from Altcoins back into Bitcoin.

I continue to focus on accumulating BTC and ETH in this risk-off period, as it gives me a good balance of safety and risk. There are some short term opportunities that highlighted in this newsletter, but these are only short term focus and won't become a medium to long term hold in my portfolio.

I will only start to accumulate other Altcoins, when Bitcoin Dominance reaches close to the 47% level.

Remember this is the bear market. It's better to be patient and wait for the opportunities to come, instead of trying to bet against the wind.

If you want to buy or trade Bitcoin and Ethereum, consider using my Binance Affiliate Link

You get a $600 Signup bonus and it helps support the VirtualBacon channel :)

INSIGHTS

How to play a new Ecosystem

How do you profit from a new ecosystem when the Coin is already super expensive?

When a highly anticipated ecosystem first launches like Aptos, Arbitrum, or zkSync, their native coins can become very expensive right away.

When this happens, it’s sometimes better to bet on other core projects within the ecosystem.

I personally target the leading decentralized exchange, lending protocol, and stablecoin issuer on these new ecosystems.

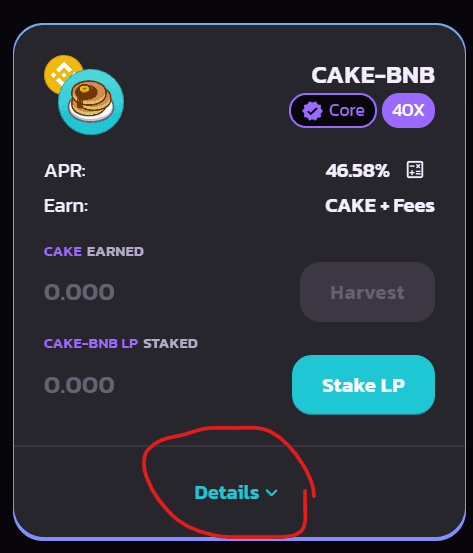

For example when Binance Smart Chain first launched, the leading DEX PancakeSwap and the lending protocol Venus both rallied at the same time as BNB.

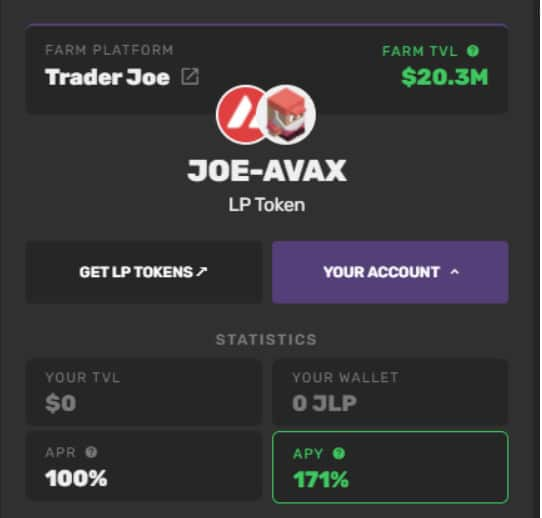

A similar trade happened on Avalanche. Last year, while AVAX experienced few dips to buy, TraderJoe and Benqi Finance pumped.

The list goes on.

So, when a new chain first launches, it’s important to research which projects have a close relationship with the parent chain itself, and will be the first DeFi infrastructure providers in the ecosystem.

The tokens for many of the ecosystem projects will usually receive the same hype as the parent ecosystem and can even outperform the native coin.

Last but not least, you can often pair the DeFi platform coins with the native coin and put them in a farm for extra rewards.

Farming CAKE-BNB, JOE-AVAX, and VVS-CRO pools were super profitable when their respective chains were hyped.

In summary, when a big ecosystem launches and the native token is very highly valued, you can focus on the core DeFi coins in the ecosystem. These coins usually pump along with the ecosystem, and usually outperforms. You can sweeten the deal by putting these DeFi coins in a farm with the native coin of the ecosystem, and get some extra farming rewards. Just remember to exit when the ecosystem hype is over!

Aptos Projects to Watch

Aptos mainnet launched last week, and the ecosystem has a ton of opportunities to profit right now.

The core infrastructure projects, like DEX, lending protocol, Stablecoin issuer, and yield aggregator are integral parts of the ecosystem.

The core infrastructure’s tokens will receive a similar hype as Aptos, but have lower valuations, so there’s opportunities to strike true gems.

The best projects have been building on Aptos for a few months, and have an official partnership/backing from Aptos Labs.

Projects I’m Watching

Top Aptos DEX: Pontem’s LiquidSwap.

Pontem is building a suite of defi and infrastructure in the Aptos ecosystem.

Currently, Potem’s DEX, Liquidswap, is the top DEX on Aptos in both TVL and volume.

The Team behind Pontem has been working with Aptos’ ecosystem since the beginning of testnet 6 months ago. Pontem also received investment from Aptos Labs directly, cementing their position.

The Team also secured a partnership with Aptos to build key infrastructure to the ecosystem, like wallet, DEX, etc. Even building an EVM that is yet to launch, with 10,000 TPS.

The token details are yet to be announced, so this gives a chance to potentially enter at a good price and farm the token early.

Check their Twitter for further details.

Twitter: https://twitter.com/PontemNetwork?s=20&t=s0WBOnzO6lGIalLbaU_ehg

Website: https://pontem.network/

Top stablecoin: ArgoUSD

ArgoUSD is a collateralized debt position (CDP) that creates a stable coin, USDA. The CDP style stablecoin is highly battletested, with the leader being MakerDAO and DAI.

This Argo’s stable coin has little chance to depeg, as the debt can be liquidated before entering a risky debt threshold.

Each $1 in $USDA will be over collateralized by a basket of coins like APT, wBTC, wETH, and other stables.

Argo currently doesn't have a governance token, so it might be worth using the app to get a possible airdrop

Twitter: https://twitter.com/ArgoUSD?s=20&t=uDEg1G9b--OVnNCdBoXVSQ

Website: https://argo.fi/

Docs: https://medium.com/@argo_fi/argo-mainnet-launch-50fb859d8719

Yet to launch Stablecoin: Thala Labs

Thala is another algo stable coin backed by a collateralized debt position (CDP).

Thala will let you borrow against APT, tAPT (Tortuga Staked APT), and other coins to mint $MOD, the Thala stablecoin.

The team behind Thala has focused on build partnerships and integrations with various protocols on Aptos.

The main competitor to Thala will be the already launched ArgoUSD

Thala will soon announce plans for their dapp and token launch on their social media.

Twitter: https://twitter.com/ThalaLabs?s=20&t=s0WBOnzO6lGIalLbaU_ehg

Website: https://www.thala.fi/

Liquid staking: Tortuga

Tortuga is a liquid staking platform which allows users to earn yield on their APT and unlock further defi potential in dapps like Thala.

Tortuga is backed by top funds, FTX ventures and Jump Capital.

Currently yielding 7% APY and with over $300k in TVL, tAPT and Tortuga have room to grow.

There isn’t a Governance token for Tortuga yet, but this should be announced in the coming days, as the ecosystem's active users continue to grow.

You can easily swap your APT for tAPT and possibly earn an airdrop or reward for using the platform.

Be sure to follow Tortuga’s twitter for further announcements about a token

Website: https://tortuga.finance/

Twitter: https://twitter.com/TortugaFinance?s=20&t=uDEg1G9b--OVnNCdBoXVSQ

Liquid staking: Ditto

Ditto is a liquid staking platform with just less than 500k TVL, currently.

Ditto let’s users convert APT into stAPT, and earn up to 7% APY on their APT, while still having the liquidity.

Ditto’s governance token, $DTO, isn’t live yet, but there is a rewards campaign to farm some $DTO tokens early

By staking APT with Ditto platform, Liquidity providers are currently earning DTO rewards.

Website: https://www.dittofinance.io/

Twitter: https://twitter.com/Ditto_Finance?s=20&t=PRRaW_4mqgyeaUjK6HZ7eQ

Top Money Market: Superposition

Lending protocols are key for the growth of the ecosystem, as this allows whales to take leveraged bets within the ecosystem, and tap into otherwise locked liquidity.

BNB grew in usage with Venus protocol, Polygon saw explosive growth with Aave, Avax expanded quickly with Qi. This will likely be similar.

The leading lending protocol will not only draw immense TVL, but also be key infrastructure for the ecosystem as a whole.

Superposition has also received investment from Aptos Labs directly, so definitely a ecosystem leader to watch.

The dapp and token are yet to launch, so Follow their social media for more information.

Website: https://www.superposition.finance/

Twitter: https://twitter.com/SuperpositionFi?s=20&t=PRRaW_4mqgyeaUjK6HZ7eQ

Top perpetual DEX: Tsunami Finance

Derivative markets overlap spot markets in traditional finance, as it allows for investors to protect and leverage financial assets.

Futures are the largest derivative in the crypto space, as it allows speculators to tap into crazy leverage

Futures on robust L1 chains, like Arbitrum’s GMX and Solana’s Mango Markets, are growing in popularity and volume.

If Aptos continues to have a longevity like Solana, then it’s Futures markets will continue to grow in volume.

Tsunami is a yet to launch perp exchange with no price impact, low fees, and high leverage (30x).

Tsunami’s governance token hasn’t launched yet, but I’m sure it will be a highly anticipated launch within the ecosystem.

Website: https://tsunami.finance/

Twitter: https://twitter.com/TsunamiFinance_

Docs: https://docs.tsunami.finance/guides/nami-governance-token

Top Leverage Trading DEX: Aries Markets

Aries Markets is a Margin trading protocol that lets users borrow against their assets for undercollateralized trades.

Aries Markets isn’t live yet, but the protocol is currently live on the Dev testnet.

Aries markets secured an Audit from OtterSec, and is now working to open margin trading with whitelisted DEX pools.

This project is still early, so expect more information about launch in the coming days or weeks.

Pay attention to their social media and discord for updates about the dapp and token launch

Website: https://ariesmarkets.xyz/

Twitter: https://twitter.com/AriesMarkets

Closing Thoughts on Aptos

Now that Aptos mainnet is live and $APT token is trading, these top infrastructure projects should be launching soon.

Remember the strategy: find the leading DeFi projects with close relationship with Aptos Labs itself, and buy or farm their tokens together with the $APT coin.

Remember to compare its Valuation, Volume, fees, and other metrics to make sure it's around the same value as other leading projects in the Aptos ecosystem.

If you can identify the legit projects early, you should be able to get undervalued projects in the early days of the Aptos ecosystem.

zkSync Projects to watch

zkSync is another highly anticipated ecosystem set to launch in October.

zkSync2.0 is zkSync’s yet-to-launch EVM compatible chain that uses the vitalik-approved zero-knowledge proof technology.

When the native token launches, it is likely to become expensive right away, so it’s important to identify the top ecosystem projects early, as these tokens can ride the same hype wave.

You can find the list of all projects building on zkSync here: https://ecosystem.zksync.io/

When searching for projects, it’s important to find the projects that are building exclusively on zkSync, instead of an existing platform that begin to support zkSync.

Here are the main projects which fit these criteria.

DEX: SyncSwap

SyncSwap will likely be the top native AMM DEX within the zkSync ecosystem

SyncSwap will utilize zkSync2.0, when mainnet launches.

SyncSwap is currently live on testnet, so there’s a possible opportunity for early testers to get airdrops.

To try to earn an airdrop, engage with the faucet, and test the platform out here: https://syncswap.xyz/intro

Website: https://syncswap.xyz/intro

Twiiter: https://twitter.com/syncswap

DEX: Mute

Mute is another DEX to watch on zkSync.

Mute will feature limit orders, bonding, and other innovations beyond the average AMM DEX.

Mute is currently live on the testnet, so this gives an opportunity for early users to possibly earn an airdrop

The team behind the project has been building Mute for months, and are likely to release the project on day 1.

$Mute is currently trading as a ERC20 on Uniswap here

The price action of Mute has picked up, as mainnet nears.

Website: https://mute.io/

Twitter: https://twitter.com/mute_io

CoinGecko: https://www.coingecko.com/en/coins/mute

Perpetual DEX: Phezzan Protocol

The most analogous project to this would be Arbitrum’s GMX. These are on robust networks that share security from Eth mainnet, except zkSync will be miles ahead of Optimistic roll-ups like Arbitrum and Optimism.

Phezzan has been live on testnet since August, but has ended.

Phezzan will feature multi collateral support that can be simultaneously used for liquidity providing, so users can use multiple alts as collateral, while earning yield.

Since its built on zkSync, Phezzan will be fast and will have low fees, bringing true competition to other on-chain perps.

Website: https://www.phezzan.xyz/

Twitter: https://twitter.com/PhezzanProtocol

Perpetual DEX: Increment Finance

Increment will be another perpetual DEX featured on zkSync.

Increment will bring a seamless trading experience to zkSync investors and speculators.

Increment will allow users to long and short with leverage (undisclosed currently), and feature multi collateral support.

Expected to launch in 2023, the team is planning to have a trading competition on Beta V2 sometime soon.

You can earn a role in their discord for being a beta tester here, and this could be a good way to earn any potential airdrops or rewards.

Just like Phezzan, Increment has a lot of potential to be the top perp exchange on zkSync, and could become the go-to on-chain futures market.

Website: https://increment.finance/

Twitter: https://twitter.com/IncrementHQ

zkSync Closing Thoughts

As you can see these projects are all exclusive to zkSync and openly market themselves as a project in the zkSync ecosystem. Thus they are the most likely to follow zkSync hype when it launches.

Zero-knowledge chains are supposed to be the next big thing, Vitalik Buterin seems to think so. Validators verify transactions without exposing information about your transactions to the public.

Pay attention to zkSync, as the combination of zk-Rollup hype and EVM compatibility should bring lots of attention to its relatively small ecosystem.

Arbitrum Projects to watch

Arbitrum is the top 2 layer-2 solutions for Ethereum which has been running for over a year. However Arbitrum still has not launched its token yet.

Looking back at the explosion of the Optimism ecosystem, when the OP token first launched, it acted as an incentive for major DeFi projects within Optimism.

Abri will likely be used to boost yields within the Arbitrum ecosystem, just like OP did for Optimism.

This would bring more TVL and users to Arbitrum.

There have long been rumors that Arbitrum will launch its own ARBI token in 2022, and we can see the same effect when ARBI launches.

Now is the best time to identify the top projects within the Arbitrum ecosystem as they will receive a lot of attention when ARBI launches.

Since Arbitrum is a live ecosystem, we can find the ecosystem leaders by ranking project TVL or Total Value Locked on DeFi Llama.

Arbitrum TVL Stats: https://defillama.com/chain/Arbitrum

Here’s the best way to use this data.

- First, rank by TVL on the rightmost column.

- Then, look at the chains category to find the projects which exclusively run on Arbitrum.

- Lastly, take note of these projects and do research on them individually.

With this method, we find the top projects on Arbitrum:

GMX

GMX is the top perpetual DEX on Arbitrum.

GMX is loved by many because it allows users to tap into a decentralized, secure DEX that has high leverage, with no KYC.

GMX will likely be a top project to watch when Arbi launches, as it would accelerate GMX’s yield and TVL.

Website: https://gmx.io/

Twitter: https://twitter.com/GMX_IO

Radiant

Radiant is an Arbitrum based lending protocol built on top of layerzero

With nearly $90m TVL, Radiant is the top money market protocol in the Arbitrum ecosystem.

Website: https://app.radiant.capital/#/markets

Twitter: https://twitter.com/rdntcapital?s=11&t=stsZd2_n52wxecroCZNXug

TreasureDAO

TreasureDAO is a “decentralized video game console” that connects games with gamers.

TreasureDAO is building a network of games, AMM, NFT marketplace, and more all powered by the Magic token.

TreasueDAO’s DEX and NFT marketplace may earn Arbitrum rewards for users, as well as a possible retroactive $ARBI airdrop for users.

Website: https://treasure.lol/

Twitter: https://twitter.com/Treasure_DAO

Mycelium

Mycelium is the top perpetual futures market after GMX.

With around $20m TVL, Mycelium could greatly benefit from an incentives program, as this would bring more users and liquidity to the protocol.

Pangolin was overtaken by TraderJoe on Avax, when Avalanche’s incentives began.

With a little help, Mycelium could close the gap on GMX.

Website: https://mycelium.xyz/

Twitter: https://twitter.com/mycelium_xyz

Vesta Finance

Vesta is the first stablecoin protocol on Arbitrum. It lets users mint stable coins using select alts as collateral.

Vesta’s stablecoin, VST, is backed by a collateralized debt position of multiple crypto assets, same setup as MakerDAO and DAI

Again, any incentive program would boost the yields within Vesta, bringing more liquidity and users.

Website: https://vestafinance.xyz/

Twitter: https://twitter.com/vestafinance

PlutusDAO

PlutusDAO is an Arbitrum native yield aggregator.

Plutus has developed key relationships with other Arbitrum-based DAO’s to become a governance “blackhole”, seeking to own as many governance tokens as possible.

Plutus has mid two digit yields for many tokens in the Arbitrum ecosystem like Dopex, DAOJones, and more.

Website: https://plutusdao.io/

Twitter: https://twitter.com/PlutusDAO_io

Umami Finance

Umami is a DeFi suite tailored to on-boarding institutional and retail investors.

Umami lets anyone seamlessly use their yield generating pools to create yield for crypto assets like USDT, wBTC, and ETH.

Umami’s goal is to build fully decentralized yield for all.

Website: https://umami.finance/app

Twitter: https://twitter.com/UmamiFinance

JonesDAO

JonesDAO is a yield, strategy, and liquidity protocol for options.

JonesDAO run sophisticated option hedging strategies, so users can earn stable yields.

JonesDAO lets users earn a yield on assets like ETH, gOHM, and DPX.

JonesDAO also has some of the most influential backing on CT.

With less than $3m TVL, JonesDAO has the ability to soar from an ARBI token incentive

Website: https://www.jonesdao.io/

Twitter: https://twitter.com/DAOJonesOptions

Closing Thoughts on Arbitrum

Its best to go to the socials of each of these projects to verify they have any official partnership or marketing campaigns with Arbitrum itself.

The Arbitrum Odyssey campaign is a good place to start, which included 56 projects that were officially partnered with Arbitrum

These projects are probably going to be in Arbitrum’s ecosystem incentive program, post launch.

This brings new capital and attention to these projects.

In summary, find the projects that are exclusive to Arbitrum, have a large userbase/TVL, and have a close relationship with Arbitrum itself.

When ARBI token goes live, these are the projects that are most likely to receive ARBI tokens as incentive to boost their platform, thus their coins have the best chance to pump along with ARBI.

End

That’s it for this week's newsletter.

If you liked this content, please subscribe to the newsletter and share it with your friends.

Consider using our affiliate links as it'll support our channel

Binance.com - $600 Signup bonus, 10% off fees

Thanks for reading!