Bitcoin Bottomed when Accounting for Money Supply? Aptos Autumn is here!

Hi everyone, welcome to another issue of the VirtualBacon Newsletter.

In today's issue, we present a new perspective to look at the Bitcoin price when compared to the M1 money supply, to visualize Bitcoin's long term support and resistance levels when accounting for inflation. We also analyze Ethereum and Bitcoin dominance as usual. For alpha insights, we continue to discuss the few pending narratives like ApeCoin, World Cup as these opportunities are still valid for the next month. Lastly, we present an overview of the ZK-EVM ecosystem and Aptos/Sui/Move ecosystem which are both launching this month and likely to continue their hype for the rest of 2022.

Bitcoin Analysis

Bitcoin is still holding above its key support level of 18.5k. Same price action as last two weeks, nothing has changed.

18.5k needs to hold in order for Bitcoin to avoid a larger crash. If 18.5k does break, the next support level down is around 12k which is the bear market peak in 2019 and the consolidation in the summer of 2020.

24.5k is still the key resistance level to watch. If Bitcoin can retest 24.5k, it would complete a double bottom pattern which signals a long term reversal and price likely will continue rallying for at least 3-6 months into the 30k ranges.

Before either of these scenarios happen, Bitcoin is technically in a sideways chop period between 18.5k and 24.5k. So exercise caution and don't jump to random predictions too quickly. Wait for the next move to be confirmed before acting.

Bitcoin Accounting for Money Supply

Bitcoin is showing a disturbing signal when accounting for the inflated money supply.

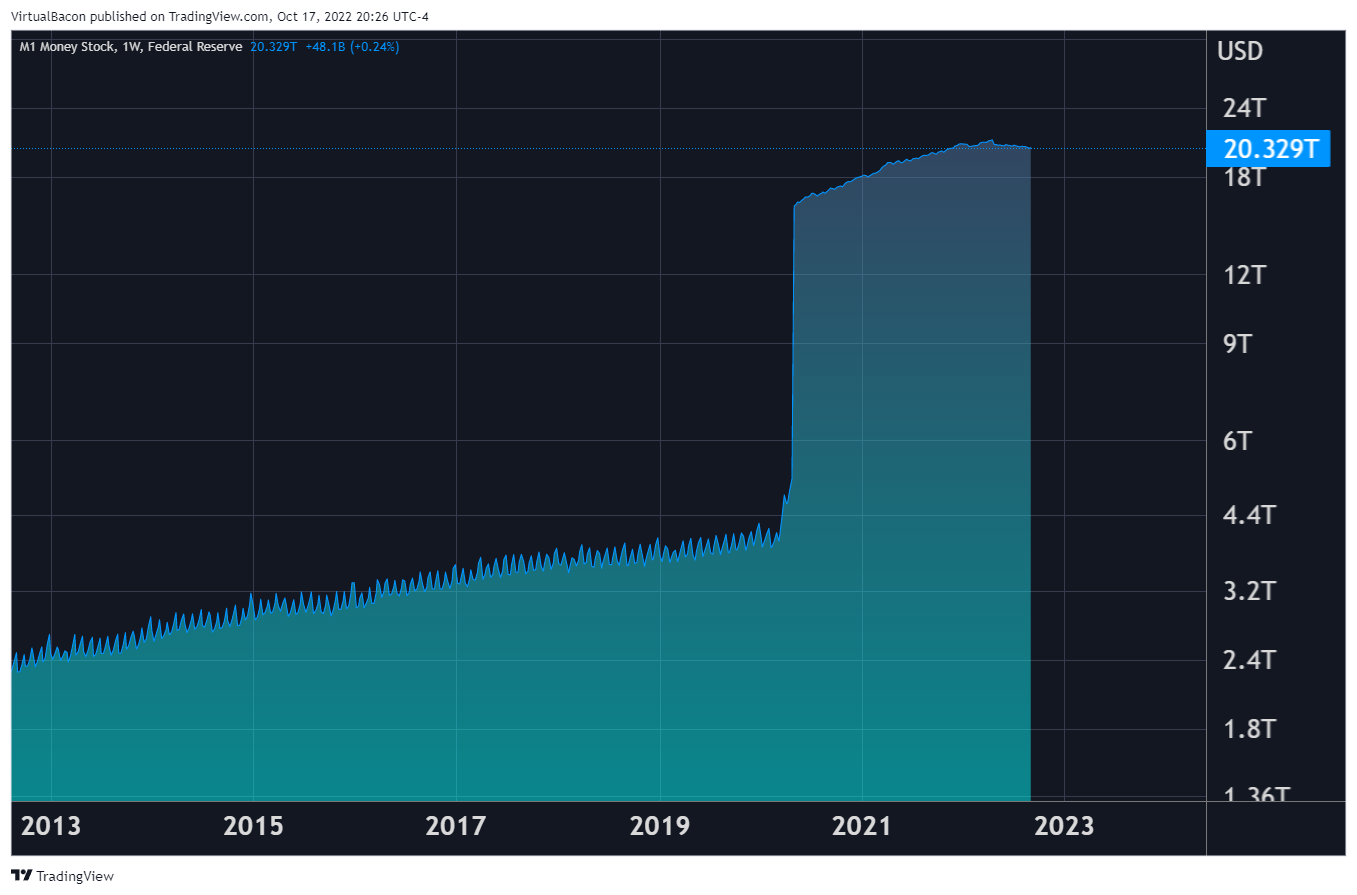

The M1 Money Supply measures how much money is circulating in the US. And you can see the sharp increase in 2020 when we had massive printing.

If we take the Bitcoin price divided by the M1, we get its real price performance adjusted for the money supply.

This chart is mind-blowing as the tops and bottoms of the last cycle match up exactly with this cycle.

It shows that Bitcoin hasn't really made a new all-time-high this cycle, rather, it's priced higher because the money supply has inflated.

On the bright side, 18k Bitcoin right now is like the 6k Bitcoin bottom in 2019, when you account for inflation.

And if Bitcoin drops another 30% to the covid crash levels on this chart, it will coincide exactly with the 13k target that most people are expecting.

Either way, I think the bottom is quite close, and it should be between 13k and 18k.

Ethereum Analysis

Another boring week for Ethereum, as it's at the exact same price as last week.

Key levels are still the same.

Support at 1k needs to hold in order to avoid a larger crash, this is similar to the 18.5k support for Bitcoin.

Resistance is at 2k which dates back to summer of 2021. If ETH can test and break above the 2k resistance, we're likely to see 3-6 months of uptrend as it finally reverses the downtrend we've had since November of last year.

Bitcoin Dominance Analysis

Bitcoin dominance has the exact same analysis as last week. The uptrend continues, thus we remain cautious in Altcoin positions. When BTC.D trends up, money is likely to continue flowing from Altcoins back into Bitcoin.

I continue to hold BTC and ETH in this risk-off period, as it gives me a good balance of safety and risk. The bleed in Altcoin market doesn't affect BTC and ETH as much, and if there's a surprise rally, I'm also able to capture some upside and not be left on the sidelines.

Remember this is the bear market. It's better to be patient and wait for the Altseason to come, instead of trying to bet against the wind.

If you want to buy or trade Bitcoin and Ethereum, consider using my Binance Affiliate Link

You get a $600 Signup bonus and it helps support the VirtualBacon channel :)

Insights

Aptos/Sui/Move Ecosystem

Aptos and SUI are new layer 1s that are based on a new smart contract language called MOVE.

This language is based off of Rust, so Solana Devs can easily deploy in the ecosystem.

Both of these have recently raised $150m+, with huge backers like a16z crypto, Jump Crypto, Apollo, Binance Labs, and many more.

The dev team behind both of these projects are Meta’s Libra and Diem teams.

With such strong backers, immense funding, and unrivalled retail attention, its hard to believe that these L1s won’t have success.

Aptos

Aptos Mainnet has just gone live TODAY.

$APT will start trading on every exchange including Binance and Coinbase on October 19th.

Coinbase will add support for Aptos (APT) on the Aptos network. Do not send this asset over other networks or your funds may be lost. Inbound transfers for this asset are available on @Coinbase & @CoinbaseExch in the regions where trading is supported.

— Coinbase Assets (@CoinbaseAssets) October 18, 2022

Pay attention to the launch valuation. The last round of fundraise already put Aptos at a $2 Billion dollar valuation. So if we can get any prices similar to that, it should be a no brainer.

Regardless of what you think about a big project like this, you should still pay attention in case it becomes a significant ecosystem. Getting set up with the wallets and early projects now should give you a huge advantage if there is a real Aptos Autumn hype wave.

Wallets: Pontem, Martian, Fewcha

First Legit DEX: Pontem

Early projects list here

Sui

Sui, by Mysten Labs, is currently still in Dev testnet. The technology stack is highly similar to that of Aptos, and uses the same Move smart contract language. Thus, with Aptos just launched, Sui should follow suit very soon.

Get yourself familiar with this ecosystem early as well.

Wallets: Fewcha, Morphis, Ethos

Early projects list here

ZK-EVM Ecosystem

ZK-Rollup is the next generation of scaling solutions for Ethereum. The zk-rollups supporting native EVM environment and solidity smart contract language will have the first mover advantage as all existing dApps on top of Ethereum can be deployed on these networks directly.

The two main ZK-EVMs to launch this year are zkSync and Polygon's ZK-EVM.

The first ZK-EVM ecosystems will be worth paying attention to. They are the first new type of smart contract ecosystem since Arbitrum and Optimism.

zkSync’s native token will likely launch first, and this has a strong likelihood of becoming a top coin in the crypto space.

It’s best to compare zkSync’s valuation to other scaling solutions like Optimism, to better judge the potential for their token to pump in price. If its fully diluted valuation is much lower than that of Optimism's, it could be a good opportunity.

zkSync

zkSync zkEVM mainnet launching on October 28th. This is likely the most developed ecosystem, among other zkEVMs.

zkSync’s zkEVM FAQ link.

The ecosystem has been growing rapidly over the last few weeks. Here’s a few threads mentioning the projects deploying. Thread 1, Thread 2, Thread 3

Polygon

Polygon’s zkEVM testnet is currently live. To access the testnet, you need Goerli testnet ETH. You can sign-up for some here. To bridge, follow the tweet below.

Just created my first token $NAS using Polygon's #zkEVM testnet on @DexPad ^^

— Naz (@CryptoNasss) October 11, 2022

Steps:

1) Obtain Goerli $ETH

2) Bridge over to zkEVM testnet here: https://t.co/upUTMMXbAp & make sure to finalize the txn

3) After bridging is completed head over to @DexPad token factory and boom! pic.twitter.com/D1ImlQATXe

Although there won't be another token for Polygon's zkEVM, there should still be many big projects to launch on the ecosystem when it goes live. Pay attention to this launch which is slated by the end of this year.

ApeCoin Staking

The Bored ape yacht club NFTs and Apecoin will have staking coming soon.

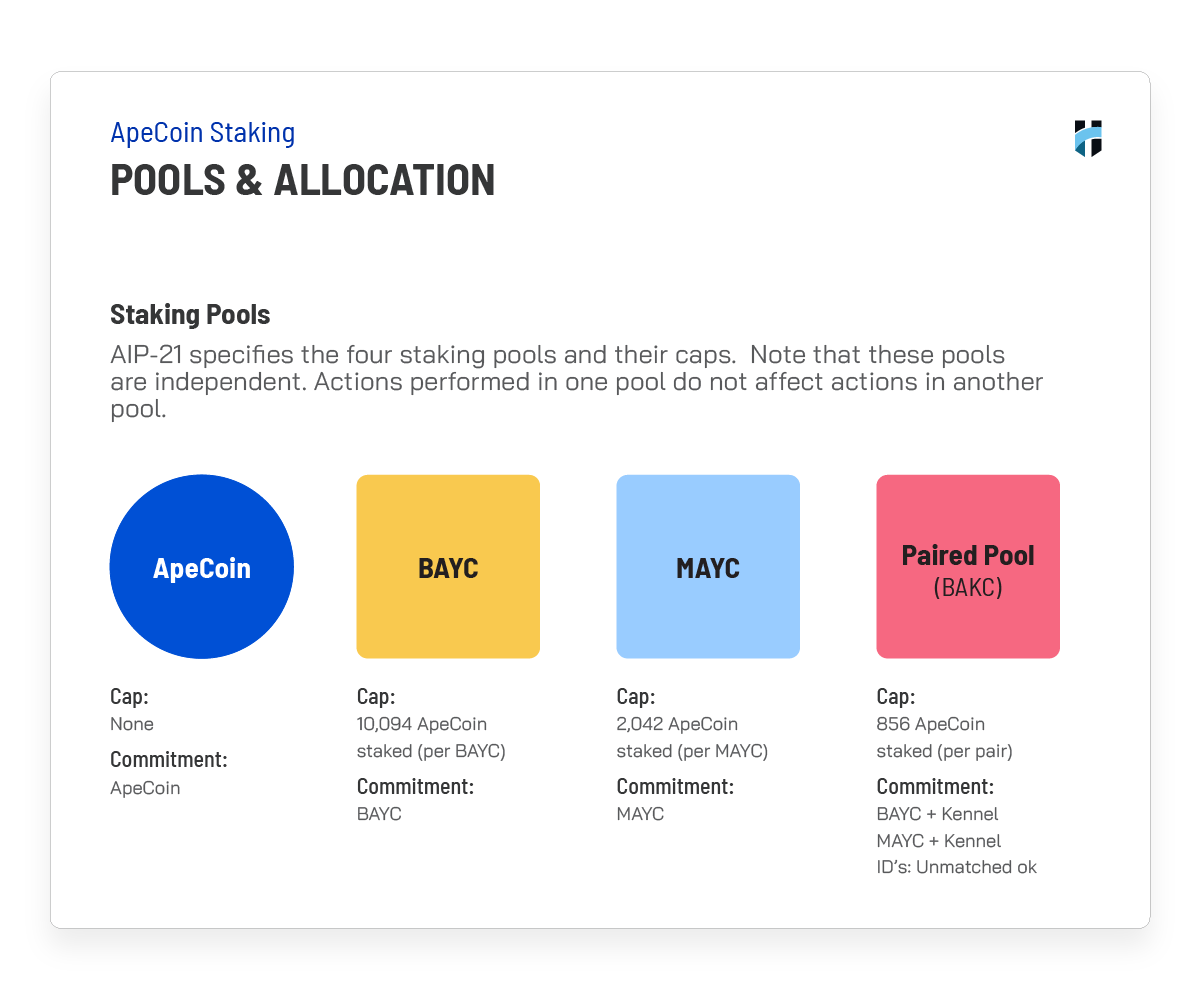

Staking rates vary for each of the BAYC NFT variants. The more NFTs you own, the more $APE can be staked. The pools with highest staking weight are BAYC and MAYC NFTs respectively.

The staking rates will start off very high because most BAYC and MAYC holders do not meet the maximum staking amounts.

Rates will start off at 300-400% APR, which is super attractive. BAYC and MAYC holders will want to buy APE and stake, until the rates decrease to equilibrium.

There’s a handy dune analytics dashboard with all the numbers

If all BAYC and MAYC holders bought and staked the maximum amounts to bring down the staking rates, this would bring 110 Million $APE coins of buy pressure.

The initial launch date was October 31st. But a new AIP proposal could delay this launch to mid November. This is perfect as it gives us more time to wait for Bitcoin dominance to finish its uptrend and reduce

I will continue to accumulate ApeCoin in the $4-$5 range, and simply wait for the staking launch hype to come and sell into the frenzy.

More threads for research 👇

5/N: 175mn $APE has been earmarked for the staking feature which will be distributed as such. In other words, 100mn $APE to be distributed to stakers in the first year. 30% (30mn) for Apecoin stakes, 47% (47mn) for BAYC and 19% (19mn) for MAYC. pic.twitter.com/0mBBOlR8hF

— Ouroboros Capital (@0xroborosCap) September 11, 2022

1/

— ponz (@ponzidope) September 12, 2022

recall in April $APE was sent 3x from $9->$27 w/ just 17m apecoin buy pressure from @OthersideMeta drop

wat if i told you the upcoming staking launch can generate up to 6x those buy flows (110m $APE / $600m)

warning: number heavy pic.twitter.com/SVW7YYNK2D

World Cup Coins

FIFA World cup begins on November 20th, and there are 3 main ecosystem coins to benefit from this hype.

- Algorand which is FIFA's official partner and have launched the FIFA collect NFT platform

- Chiliz which is the leading platform for issuing Football Fan Tokens

- FOOTBALLUSDT Index launched by Binance is a great way to speculate on the overall football fan token category instead of picking individual teams.

- National Team Tokens for top contenders to the world cup, which you can find on the CoinGecko Category

Revisit last week's newsletter coverage if you want the full breakdown of this narrative.

Overall, the world cup hype is yet to come on November 20th, so these plays are still active. I will be actively accumulating for the next month and sell into the hype when world cup starts.

End

That’s it for this week's newsletter.

If you liked this content, please subscribe to the newsletter and share it with your friends.

Consider using our affiliate links as it'll support our channel

Binance.com - $600 Signup bonus, 10% off fees

Thanks for reading!