Will China's New Pro-Crypto Stance Trigger a Bull Market? | Weekly Digest

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon.

Historically, China's stance on cryptocurrencies has been quite restrictive, with outright bans on crypto transactions and mining activities since 2017. Hong Kong, while more lenient than mainland China, has also proposed stricter regulations for crypto exchanges and warned banks about crypto trading for years.

In an unexpected turn, China and Hong Kong's stance on cryptocurrencies is quickly turning to a favorable position. This shift could fundamentally change the crypto landscape, not just locally, but globally. This week, we'll navigate through these new policies, and decode what they mean for the crypto industry.

Hong Kong's Crypto Licensing Guidelines

The first significant step towards the clarification of crypto regulations in Hong Kong was taken by the Securities and Futures Commission (SFC). In a game-changing move, the SFC released comprehensive guidelines for digital asset licenses in late May 2023. These new guidelines primarily focus on crypto trading platforms, addressing key areas such as Anti-Money Laundering (AML) procedures and fund security measures.

This step was pivotal, marking Hong Kong's first foray into creating a well-defined regulatory framework for cryptocurrencies. Crypto trading platforms within the region have become subject to detailed regulations, which in turn instilled increased confidence amongst investors and traders.

The new guidelines brought a considerable degree of stability to the local crypto industry, by introducing a new level of transparency and security. Together with the regulatory shift in mainland China, Hong Kong's licensing guidelines could be the beginning of a significant reshaping of the regional crypto landscape.

The issuance of these licensing guidelines represented an important step in acknowledging and integrating digital assets within the established financial ecosystem. As we delve further into these regulatory changes, we'll closely monitor the impact of this significant policy shift.

Arrival of Licensed Crypto Exchanges

With regulatory clarity comes newfound opportunities, leading crypto exchange Huobi, among others, secured a license to operate in Hong Kong. Given the green light, these platforms are now offering users the opportunity to trade in mainstream digital currencies, including Bitcoin (BTC) and Ethereum (ETH).

Huobi's entry into the Hong Kong market signifies a pivotal moment in the realization of the region's crypto regulatory vision. It underscores the maturing of a regulatory environment that not only embraces crypto trading but also ensures a robust framework for user protection. The domino effect of these developments may very well pave the way for more crypto exchanges to set foot in Hong Kong, further enriching the local crypto ecosystem.

Beijing's Blueprint for Web3 Development

A progressive step taken by Beijing has marked a substantial move towards the embrace of decentralized technologies. The city recently unveiled an ambitious Web3 whitepaper, outlining a strategic roadmap for digital innovation and development, setting the stage for the advancement of the digital economy with a decentralized Web3 framework as its centerpiece.

Binance's CEO CZ, lauded this initiative, interpreting Beijing's move as a clear sign of its future-focused outlook. He highlighted that the emphasis on a decentralized, privacy-centric Web3 framework represents a marked shift in China's previously guarded approach to blockchain and cryptocurrencies.

This sentiment stands in stark contrast to the recent trends in the United States, which has seen heightened regulatory scrutiny over cryptocurrencies. Interestingly, this move by Beijing signifies a divergence from China's 2021 blanket ban on cryptocurrencies, implying a potential thawing of its stance and a possible welcoming gesture towards the industry.

The issuance of the Web3 whitepaper not only illustrates Beijing's own future trajectory but also serves as a benchmark for other economies aiming to harness the potential of cutting-edge technology. With this development, the narrative around cryptocurrencies in the region takes a positive turn, reflecting a determined commitment to creating a conducive ecosystem for the growth and inclusivity of the blockchain and crypto sector.

Introducing a USD Stablecoin in Hong Kong

First Digital Trust (FDT), a Hong Kong-based digital assets company, has taken a major step forward by launching a new USD-pegged stablecoin called FDUSD. This development is significant as it marks the arrival of a locally controlled stablecoin in a market that has been traditionally dominated by international entities.

As a licensed trust company, FDT offers a competitive edge by providing added assurance to investors about the security and legality of their investments. Furthermore, the introduction of FDUSD could also support a more diversified and competitive stablecoin market. As it is backed 1:1 with US dollars, investors can trade with confidence, knowing they have a solid reference point.

Interestingly, the FDUSD is also issued on the BNB Smart Chain. This could be the next stage of Binance's Stablecoin efforts after the BUSD stablecoin is forced to pause minting by US regulators.

First Digital, a Hong Kong licensed trust company, launches a new USD pegged stablecoin (FDUSD), on #BNB Smart Chain.

— CZ 🔶 Binance (@cz_binance) June 1, 2023

Crypto Takes Centre Stage on China Central Television

For the first time in recent history, the cryptoverse has been thrust into the limelight on China's prime television channel, China Central Television (CCTV). The station is well-known for its close ties to the Chinese Government and broadcasts to the entire country, with staggering viewership in the hundreds of millions. This was surely an unexpected move by featuring a segment entirely dedicated to digital assets and cryptocurrencies.

Binance CEO Changpeng Zhao was quick to appreciate this development, highlighting the importance of crypto education and acknowledging the potential impact of such widespread exposure. According to him, this could lead to a broader understanding and acceptance of cryptocurrencies among the general public.

In summary, the airing of a dedicated crypto segment on a prominent channel like CCTV signals a changing attitude towards digital currencies in China. The ripples from this broadcast may well be felt across the globe, potentially accelerating the march towards mainstream crypto adoption.

Is It Time to Refocus on the China Coin Narrative?

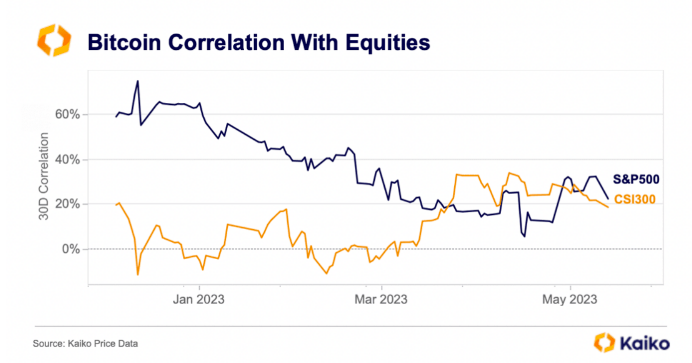

In the current year, we've witnessed a marked strengthening in the correlation between Bitcoin (BTC) and Chinese equities (notably the CSI 300 Index), even though it remains modest, settling near 20%. With this intriguing development, it could be the opportune moment to keep a closer eye on crypto projects based in China.

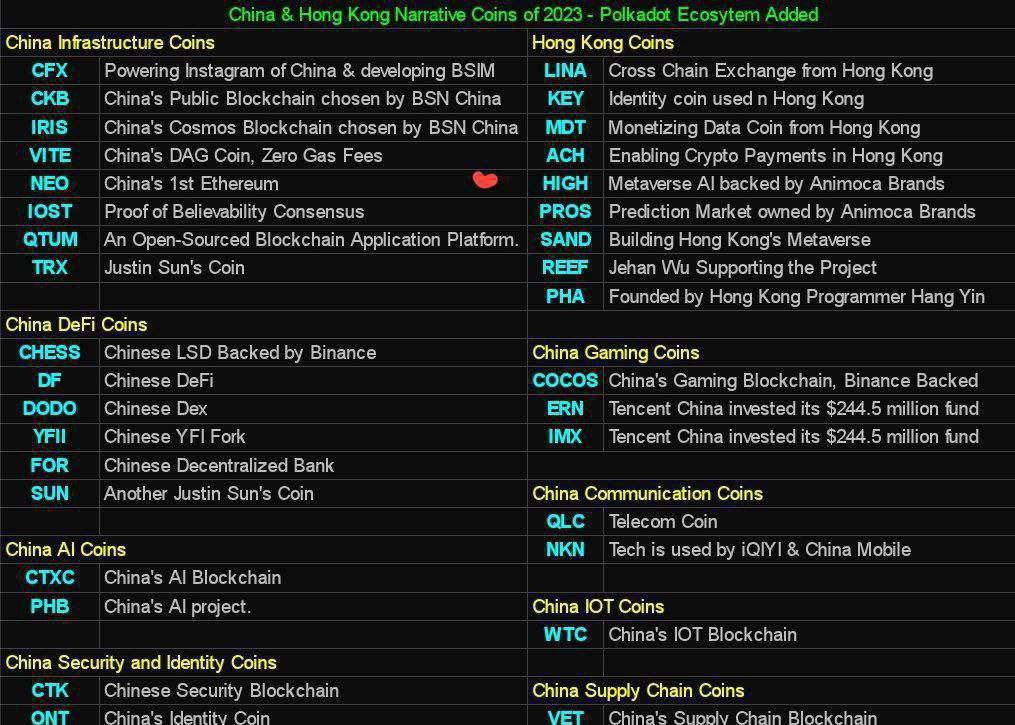

As we delve into the resurgence of interest in Chinese cryptocurrency narratives, let's shift our focus towards a few distinct Chinese coins. Their impressive fundamentals are not just promising, but worth our close attention. Here are a few that might be worth keeping our eye on:

1. Conflux Network ($CFX): Currently, Conflux is the only regulatory-compliant public blockchain in China, headquartered in Beijing. Recently, Conflux announced its integration with Little Red Book, China's Instagram equivalent.

2. Nervos Network ($CKB): China's public blockchain chosen by the Blockchain Service Network. One of the oldest proof-of-work blockchains still running.

3. Linear Finance ($LINA): Cross Chain Exchange platform based in Hong Kong. Linear has partnered with HK's key asset custody player HexTrust to provide DeFi services.

4. Sandbox ($SAND): Chosen to build Hong Kong's metaverse solutions. Also a partner of HexTrust to offer exlusive metaverse land related services.

5. Alchemy Pay ($ACH): Chosen crypto payments provider in Hong Kong.

6. Mesurable Data Token ($MDT): Data sharing app based in Hong Kong, focusing on the AI crypto narrative.

Conclusion

Hong Kong's move towards crypto-friendly regulations is a massive step forward, opening doors to a whole new demographic of investors. This progress, coupled with China's economic prowess and the increasing interest in digital assets, presents a bright outlook for Chinese tokens.

China's vast economic influence, coupled with its escalating digital asset curiosity, paints a bright future for Chinese tokens. While we must navigate cautiously given the strict regulatory environment, these steps show positive indications towards becoming a pivotal hub for crypto innovation.

However, we must remain aware of the potential roadblocks. The looming digital currency from China's central bank might pose challenges, and geopolitical tensions could cast a shadow over the widespread acceptance of Chinese tokens.

Yet, as China strategically infuses capital to invigorate its economy, we might witness an influx of investors drawn towards the Chinese cryptocurrency token market. This could lead to increased popularity and further integration of these tokens into the global cryptocurrency ecosystem.

Despite these potential challenges, the overall trajectory for Chinese tokens looks promising. As always in the crypto world, vigilance and adaptability remain key. So, let's keep an eye on this space - there could be seismic shifts on the horizon!

Weekly Bullets

🟠Hong Kong legalizes retail Crypto trading, opens official exchange license applications

🟠ByBit's BitDAO soon to rebrand to Mantle Network $MNT to fully focus on its layer-2 blockchain project

🟠Brics Bank and Saudi Arabia Explore Funding Options for Alliance.

🟠Japan Kicks off Digital Yen Pilot Project Following Successful Second Proof-of-Concept.

🟠Russia Allegedly Set to Introduce Regulatory Framework for Crypto Exchange Operations.

🟠China focused Gaming blockchain $COCOS completes rebrand to $COMBO network and token swap

🟠Crypto Exchange Bybit Exits Canada Amid Recent Regulatory Developments.

🟠Binance Removes Privacy Tokens from Its Platform in France, Italy, Spain, and Poland.

🟠Gate.io Refutes Liquidity Issues Amid Multichain CEO's Disappearance.

🟠Dogecoin Investors Lodge Lawsuit Against Elon Musk, Accusing Him of Insider Trading.

🟠Japan's largest bank is launching a stablecoin on public Ethereum, Polygon, Avalanche, and Cosmos.

New Videos

Sui vs Aptos: Which new Layer 1 Crypto has the most Potential?

Is Ledger Wallet Safe? | The TRUTH about the Ledger Hardware Wallet Backdoor

End

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out APEX Exchange - The official DEX of ByBit.

They have all the advanced trading tools like limit orders, stop loss, and even leverage for long and short positions.

The best part is you control your own funds as you can directly trade from your MetaMask Wallet. There is no KYC and you can trade from anywhere in the world

Start Trading on APEX and earn extra $APEX tokens