What are Bitcoin Ordinals and BRC-20 Tokens? | Weekly Digest

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon. This week we will take a deep dive into the latest craze around the Bitcoin Ordinals and BRC-20 Token technologies.

What are Ordinals?

In December 2022, the Ordinals software was launched. This innovative tool leverages the Segwit (2017) and Taproot (2021) Bitcoin upgrades, marking a transformative moment in Bitcoin's history. Ordinals allow for the storage of arbitrary data, such as text, images, and videos, within transaction witness data, which brings much more utility over storing only Bitcoin transactions.

From NFTs to Fungible Tokens: The Emergence of BRC-20

At a first glance, the world viewed Ordinals as a Bitcoin take on Ethereum's ERC-721 tokens, or NFTs, as image-based inscriptions were the order of the day. But March 8, 2023, marked a turn of the tide. A pioneering Ordinals Face holder, known as Domo, saw potential beyond just NFTs, leading to the birth of the BRC-20 token standard for Bitcoin.

This trailblazer proposed using Bitcoin's base layer to produce inscription-fueled tokens - enter the BRC-20. What started as an experiment quickly ignited a boom in BRC-20 tokens, sparking a resurgence of text-format inscriptions.

Drawing inspiration from Ethereum's ERC-20, the BRC-20 standard uses inscriptions to breathe life into tokens. Today, the BRC-20 standard is defined in JSON, stored as text content on Bitcoin's Blockchain using the same Ordinals protocol. This is truly a revolutionary stride in Bitcoin's journey as there are now tokens on the blockchain.

Bitcoin's BRC-20 vs Ethereum's ERC-20

As we've delved deep into how BRC-20 tokens function, it's time to compare them with their well-known counterpart, ERC-20 tokens, and highlight their fundamental differences:

- Blockchain Ecosystem: BRC-20 tokens operate within the Bitcoin network, distinguishing themselves from the ERC-20 tokens that are part and parcel of the Ethereum ecosystem.

- Smart Contract Capabilities: The functionality of BRC-20 tokens is currently limited due to the absence of smart contract capabilities. On the other side of the coin, ERC-20 tokens enjoy extensive engagement with other chains and protocols, thanks to their inbuilt smart contract specifications.

- Market Capitalization: At the time of writing (mid-May 2023), the BRC-20 market is approaching a respectable $450 million. Yet, it's worth noting that the market cap of ERC-20 tokens still eclipses this, exceeding a colossal $150 billion.

- Consensus Mechanism: BRC-20 tokens adhere to the traditional proof-of-work consensus mechanism, which ultimately benefits miners during periods of network congestion. In contrast, ERC-20 tokens employ the proof-of-stake consensus, centering the spotlight on validators and staking.

- Tracking: Etherscan remains the tool of choice for tracking ERC-20 token movements. Ordiscan, however, offers comprehensive tracking for BRC-20 ordinals and inscriptions, serving as the Dextools equivalent for BRC-20 and providing a broad perspective on NFTs, BRC-20 tokens, and related Bitcoin operations.

- Wallets: BRC-20 wallets are in the midst of adjusting to the new concept of inscriptions, with a few dedicated ones emerging in popularity. ERC-20 token wallets, conversely, are ahead of the curve, currently exploring account abstraction to cater to web enthusiasts.

While they share certain aspects of their name, it's clear that the BRC-20 and ERC-20 tokens diverge significantly in function and use. As the utility of BRC-20 tokens evolve, these shortcomings will start to become more and more limiting.

BRC-20 Wallets, The First Thing you Need to Get Started

As of now, while the options for wallets supporting BRC-20 tokens are relatively few, there are a handful of solid contenders you can turn to:

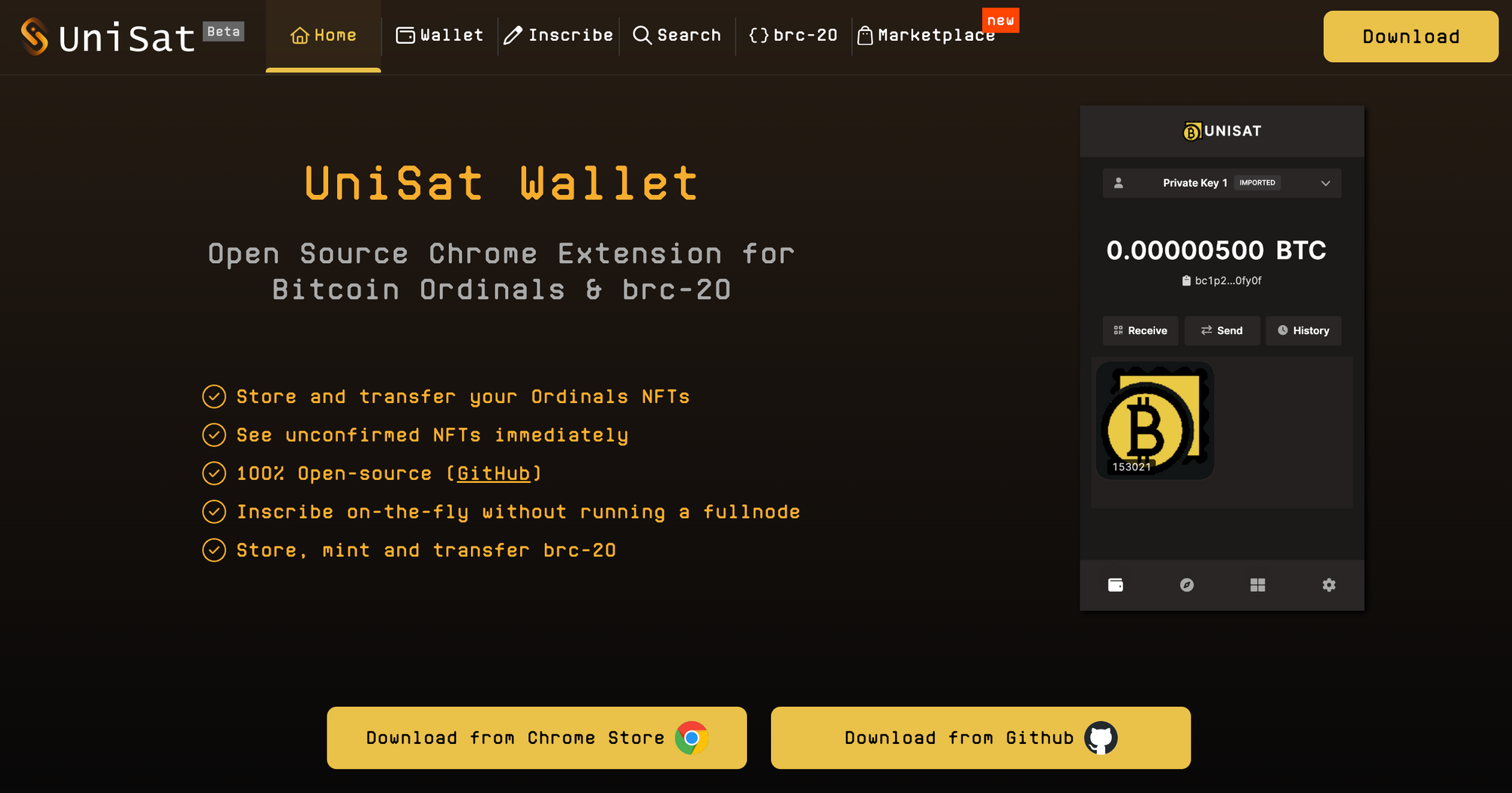

UniSat is garnering significant attention within the crypto community due toits open-source nature and impressive speed. This wallet has quickly established itself as one of the go-to options for users interested in exploring the BRC-20 space. Its easy-to-use interface and reliable functionality make it an attractive choice for both beginners and seasoned crypto enthusiasts.

Ordinals Wallet is another popular option that offers a wallet, trading, and inscription features all in one. Although the platform is still in its early stages.

BRC-20 Marketplaces: Where to Buy and Sell BRC-20 Tokens

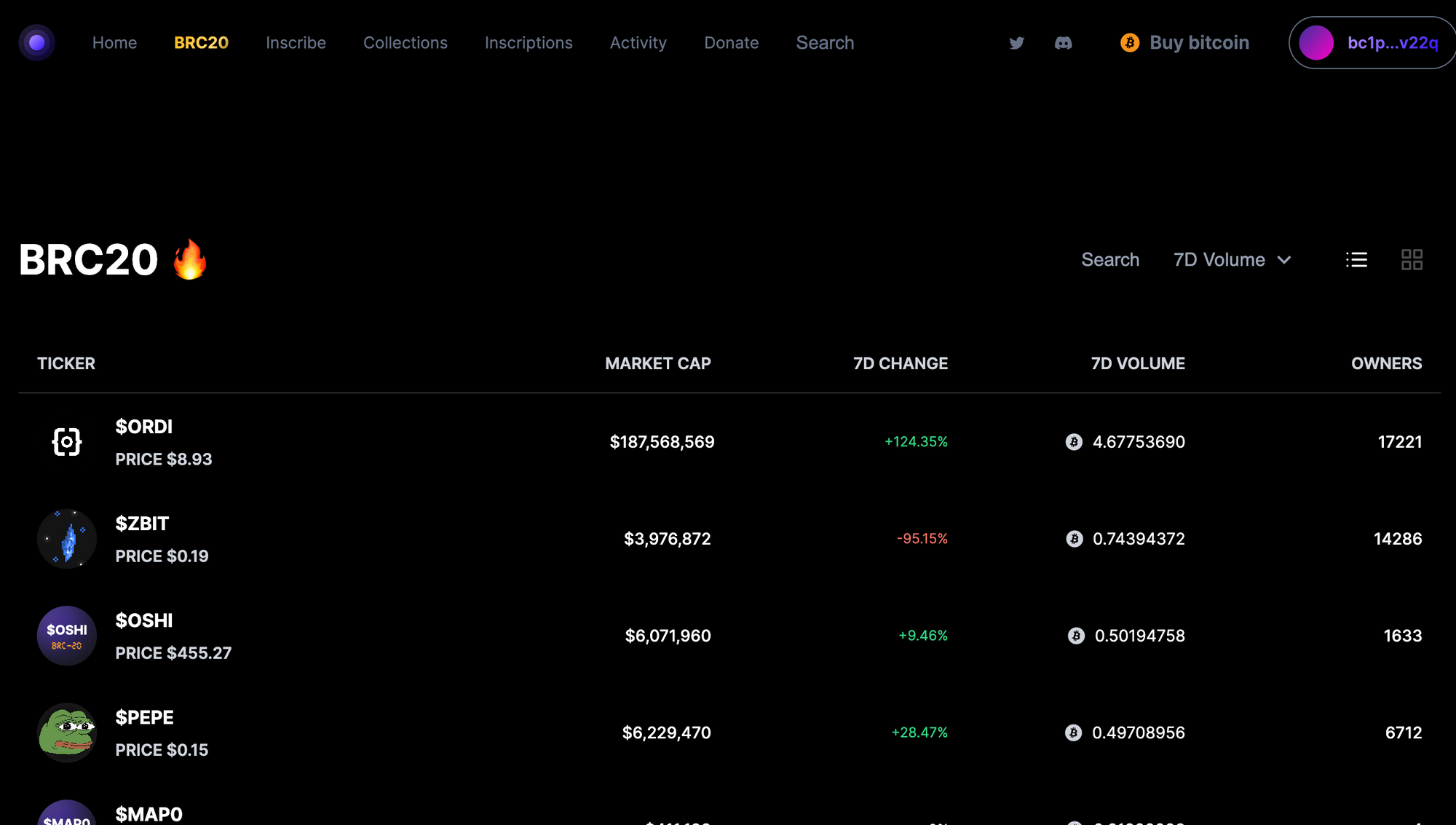

For those interested in trading BRC-20 tokens, a few platforms stand out as dedicated marketplaces:

- UniSat: This platform offers a range of services, including trading in BRC-20 tokens.

- Gamma: Known for its user-friendly interface, Gamma offers a smooth trading experience.

- Magic Eden: Offering a wide range of tokens, Magic Eden is an excellent platform for BRC-20 enthusiasts.

- Ordinals Market: As the name suggests, this platform specializes in BRC-20 tokens and Ordinals.

- Ordswap: Providing a seamless experience, Ordswap makes trading BRC-20 tokens easy.

Exploring the Leading BRC-20 Tokens: Are They Worth Your Consideration?

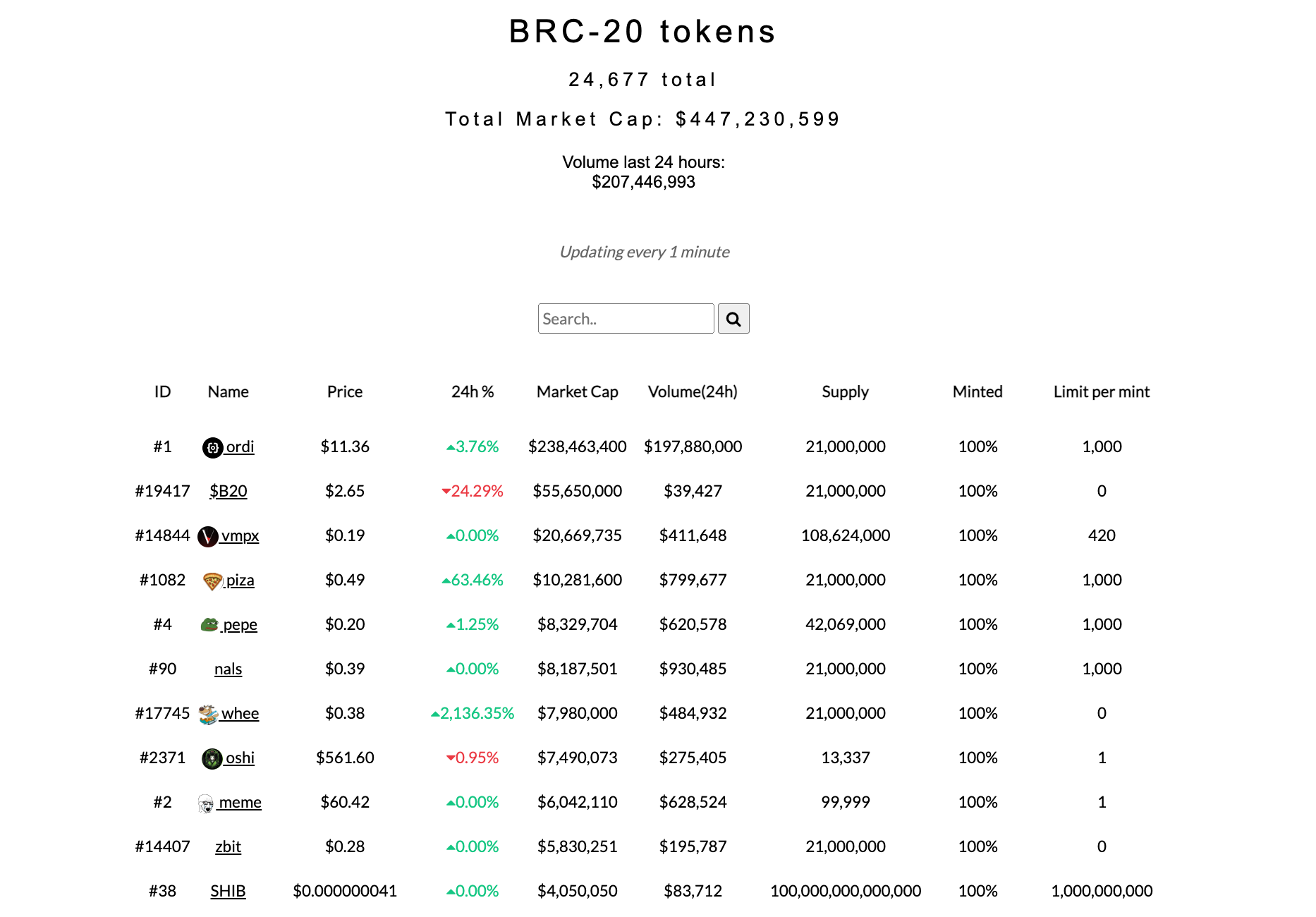

You can find all the popular BRC-20 tokens on the tracker site https://brc-20.io/

Diving into late-May 2023, the BRC-20 tokens have astoundingly accumulated a market capitalization exceeding $447 million. However, the captivating narrative doesn't end there. Above are some of the highly recognized BRC-20 tokens that have been creating a buzz.

Interestingly, the token ORDI, bearing ID #1, holds the title of being the inaugural BRC-20 token minted.

Assessing the Merits of BRC-20 Tokens

BRC-20 tokens have sparked lively debates across the crypto sphere, with discussions revolving around their necessity, significance, and potential benefits. Here's what we've distilled from these dialogues:

- BRC-20 tokens introduce an intriguing new utility to Bitcoin, expanding its functionalities beyond just being a peer-to-peer digital currency.

- The creation and minting process of BRC-20 tokens is relatively straightforward, avoiding the complexities associated with smart contracts found in systems like ERC-20.

- Inheriting Bitcoin's robust security architecture, BRC-20 tokens are bolstered by the most secure blockchain in existence.

- The advent of BRC-20 tokens unlocks an expansive range of possibilities for layer-2 and scaling solutions in the Bitcoin network, including the promising Lightning Network.

- BRC-20 tokens do have good support from centralized exchanges (CEXs). For instance, ORDI token have already been listed on popular exchanges OKX, Bitget, Huobi, Crypto.com, and Gate.io. Although the self custody solutions for BRC-20 storage is still primitive and hard to set up. I'd imagine most traders tend to keep all their BRC-20 tokens on exchanges.

- BRC-20 tokens champion the cause of fungibility, introducing Bitcoin to fresh avenues and opportunities.

- The surge in demand for network space due to BRC-20 tokens could potentially be a boon for Bitcoin miners. According to the Proof-of-Work (PoW) protocol, miners still need to authenticate and verify BRC-20 transactions.

Scrutinizing the Drawbacks of BRC-20 Tokens

While the benefits of BRC-20 tokens are appealing, it's important not to overlook some of the key concerns surrounding this new token standard:

- BRC-20 tokens don't have a deep-rooted connection to the Bitcoin network. They essentially represent an embedded metadata to a satoshi, allowing interaction based on the inscribed script.

- BRC-20 tokens are traded in a secondary market, entirely detached from the foundational Bitcoin ecosystem.

- These tokens are not user-friendly. Interacting with them requires a repertoire of tools, wallets, and additional steps, potentially confusing for beginners.

- BRC-20 tokens can be mass-produced with relative ease as no smart contracts are needed to enforce complex rules, potentially leading to oversupply.

- As BRC-20 tokens using the Ordinals protocol inscribe on satoshis individually, the seemingly insignificant transactions can accumulate and contribute to network congestion.

- An unchecked proliferation of BRC-20 tokens could inadvertently create a thriving, unregulated securities market within the Bitcoin network.

Experts in the field argue that the pitfalls of the BRC-20 space seem to overshadow the benefits.

Do Ordinals and BRC-20 Have Long Term Potential?

At the moment, the BRC-20 token standard offers limited utilities, aside from a possible surge in miner revenue and royalties for token deployers. The crypto community remains split over its merit, with some developers viewing these entities as spam and advocating for their removal. Nevertheless, the concept has sparked interest among tech-savvy crypto enthusiasts due to the potential applications it could bring to the Bitcoin ecosystem.

Discussions around the integration of the lightning network and BRC-21 give us a glimpse of the new horizons the BRC-20 token standard might unveil in the realm of web3.

As we navigate the emerging world of BRC-20 tokens, it's essential to approach with curiosity and caution. The potential they hold is promising, yet the challenges they face are substantial. As always, informed and mindful engagement will guide us through this novel frontier.

Weekly Bullets

🟠Tether Will Start Investing 15% of Future Profits into Bitcoin

🟠Hong Kong Opens the Door for Retail Investors to Access Licensed Crypto Exchanges.

🟠Beijing Takes Bold Steps Towards Web 3.0 with New Comprehensive White Paper.

🟠Huobi Gears Up for Hong Kong Trading Platform Launch.

🟠Chinese City Launches Government-backed Metaverse Platform.

🟠CCTV (China Central Television) broadcasted crypto

🟠Visa and Microsoft Join Forces for Brazilian CBDC Pilot Project.

🟠 Multichain Bridge hit by regulators and paused withdrawals

🟠Dubai Developer Sets Out to Construct the World's First Bitcoin Tower.

🟠Ledger to Address Concerns About its Recovery Service, plans to go Open Source

🟠Leaked Plans Show EU Banks Could Access Stablecoins More Easily.

🟠VISA Explores the Potential of Smart Contracts for Payments With Ethereum.

New Videos

Sui vs Aptos: Which new Layer 1 Crypto has the most Potential?

Is Ledger Wallet Safe? | The TRUTH about the Ledger Hardware Wallet Backdoor

End

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out APEX Exchange - The official DEX of ByBit.

They have all the advanced trading tools like limit orders, stop loss, and even leverage for long and short positions.

The best part is you control your own funds as you can directly trade from your MetaMask Wallet. There is no KYC and you can trade from anywhere in the world

Start Trading on APEX and earn extra $APEX tokens