The Future of Cross-chain Interoperability - LayerZero Deep Dive | Weekly Digest

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon.

Omnichain: A Leap Towards Unified Liquidity and Enhanced Security

In an ever-evolving blockchain landscape, it's clear that the future of Crypto will not only exist on individual chains as siloes, rather we're starting to see liquidity flow between multiple chains.

However, the path to seamless blockchain interoperability is riddled with challenges such as fragmented liquidity, multi step user experiences, and security vulnerabilities with centralized bridges.

Crosschain bridges while significant in their contributions, offer piecemeal solutions that fall short of holistic interoperability. This gap in the crypto world is where Omnichain solutions emerge, which promise a reinvented approach to cross-chain applications.

What is Omnichain?

Omnichain is not just a new buzzword in the crypto space; it's a transformative development aiming to redefine the concept of interoperability. With Omnichain, we're looking at a future where a single transaction can effortlessly traverse through multiple blockchains without user intervention.

Today's blockchain ecosystem relies on umbrella blockchains, oracles, and bridges for cross-chain transactions. Umbrella ecosystems like Polkadot and Cosmos have their own consensus mechanisms and tokens, and although child blockchains built under these ecosystems can interoperate with each other, they still lack the ability to talk to players outside of their ecosystem.

Meanwhile, bridge providers such as Synapse, Multichain, and Celer allow token swapping across networks. However, these solutions merely act as transport layers, facilitating movement of assets but not truly enabling transactions across multiple chains. You still have to manually interact with applications on both the origin and destination blockchains.

Omnichain solutions such as LayerZero stands apart by permitting a single transaction to traverse through multiple blockchains. With Omnichain, a message can be transmitted from Ethereum to Solana to Cosmos, with the end user needing to sign just one transaction. It moves beyond the concept of a project merely existing on multiple blockchains, and instead enables dApps on different networks to communicate with each other directly.

How Omnichain Tech Improves Security

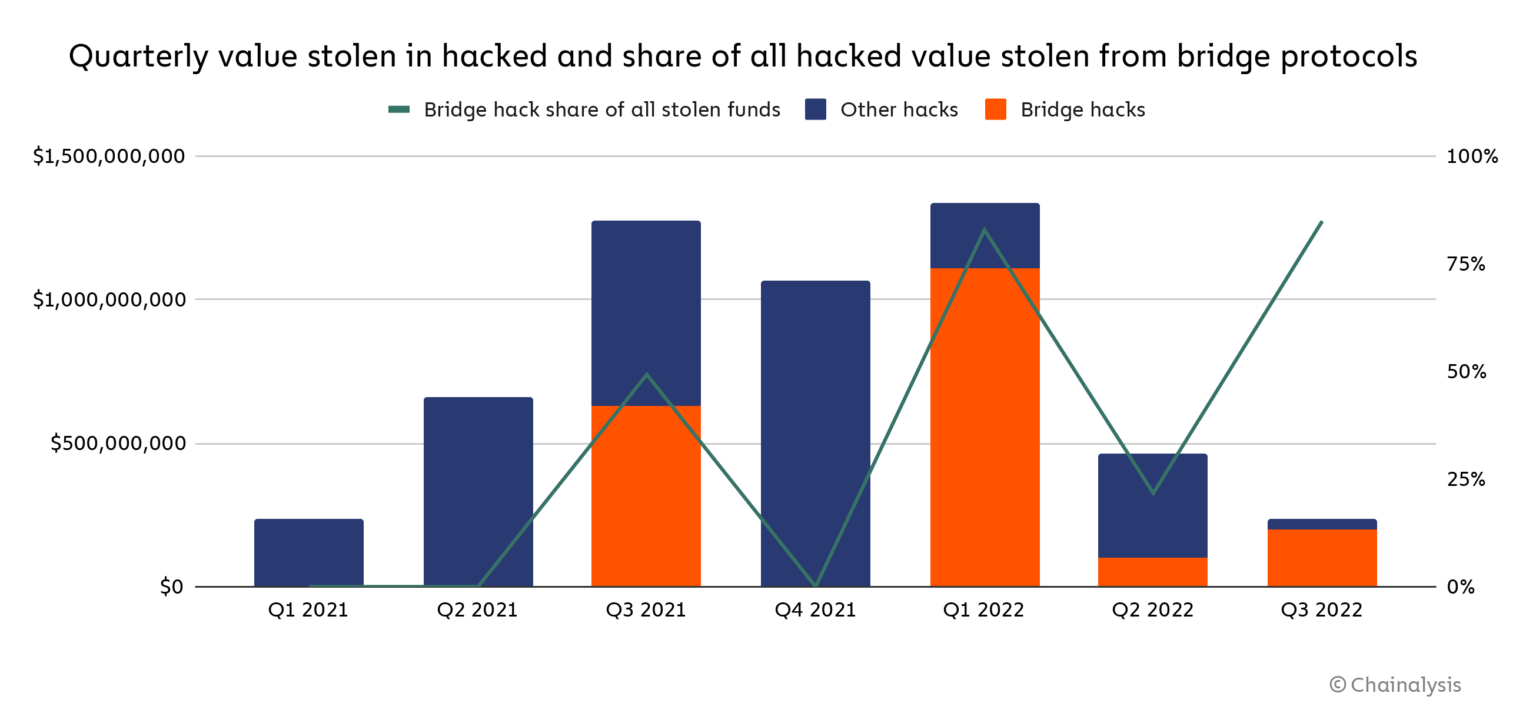

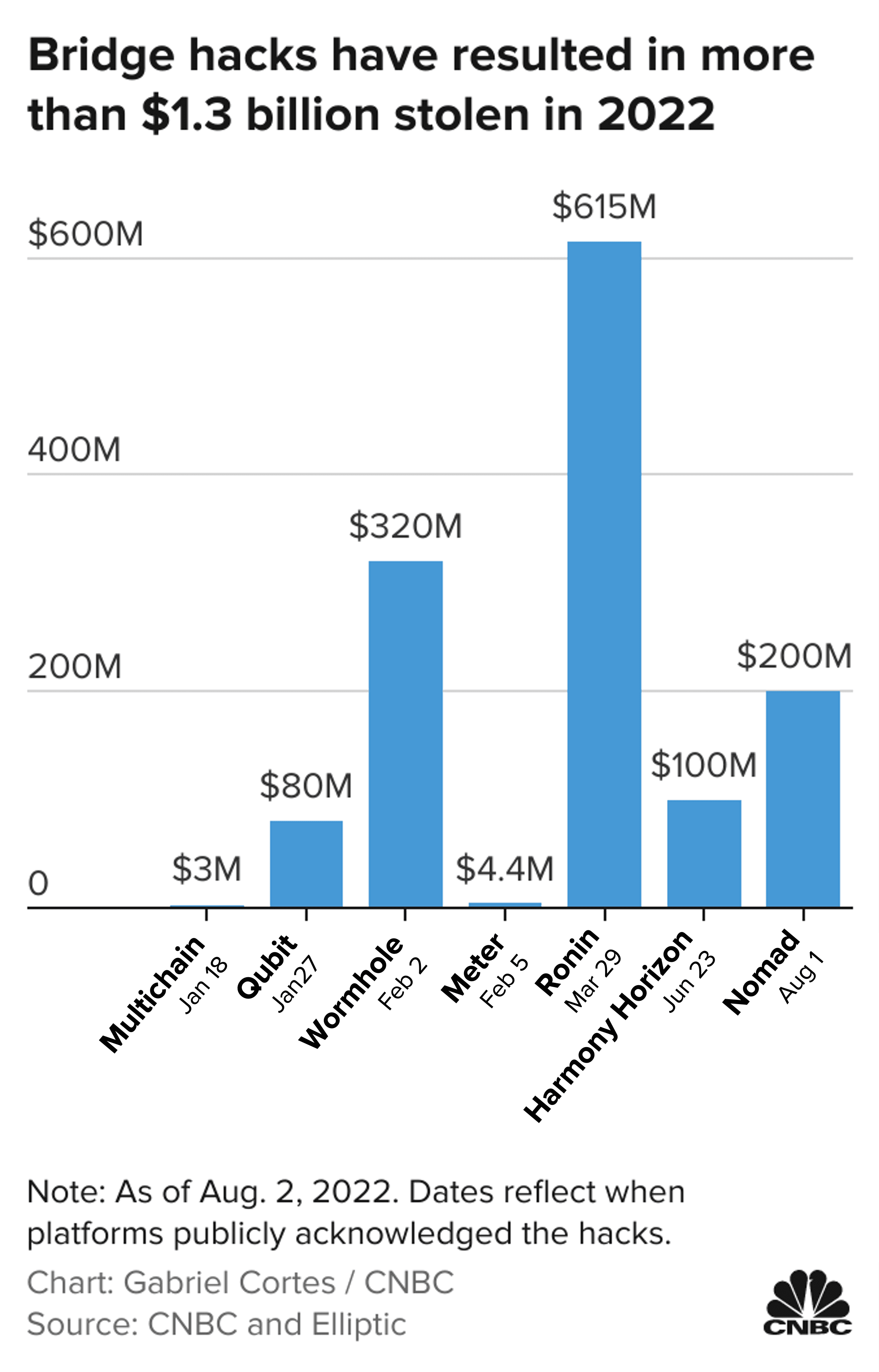

Another pressing concern in the crypto space is security, this has been especially apparent in the last bull run with most large exploits happening around bridges.

The startling reality of bridge protocols is captured in the two figures above. These graphics depict a staggering accumulation of losses, which, by the end of 2022, amounted to an estimated $2 billion due to hacks.

Omnichain protocols are poised to alleviate this concern by removing the need for trust-based bridging on central custodians or third parties. For instance, LayerZero uses an "ultra-light node" that combines the security of a light node on the native blockchain you're trying to connect to, with the cost benefits of a middle chain.

In this approach, LayerZero only acts as a message relayer between blockchains, but never takes assets into its custody. This innovative approach reduces security risks associated with bridging, and provides a safer environment for transactions.

Looking ahead, Omnichain technology is set to revolutionize the blockchain ecosystem. Projects like Stargate Finance, TraderJoe, SushiSwap, and many other leading DEXs are already leveraging LayerZero to enable cross-chain swapping.

As more projects adopt this style of next-gen interoperability solutions, we can anticipate a future where blockchain networks are no longer segregated and developers do not need to worry about where they are building on. Instead they can pick and choose the blockchains that they want to use, and have omnichain solutions handle their transactions and process them on multiple blockchains all within the same platform.

The Omnichain era promises a more inclusive and secure future for the blockchain world, and we're just at the beginning of this exciting journey.

Deep Dive of LayerZero Technology

LayerZero is a name that has emerged as a market leader in blockchain interoperability.

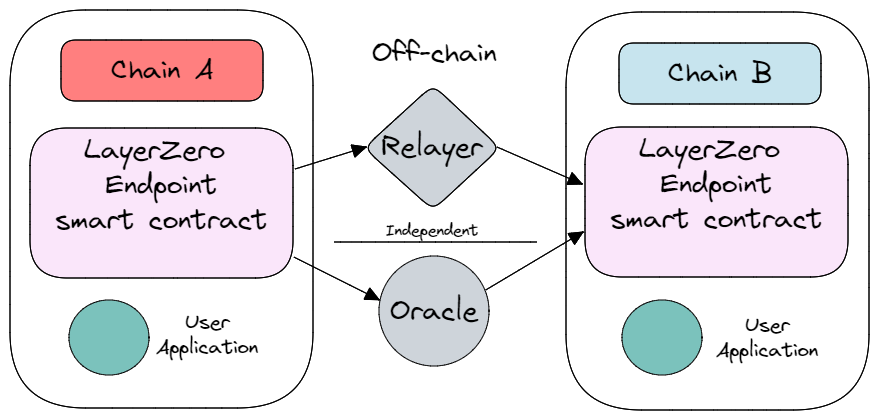

LayerZero operates by employing two pivotal components, an Oracle and a Relayer. The Oracle plays a key role in sending data across chains, while the Relayer verifies the proof of specific transactions.

Now, let's unpack the features that make LayerZero stand out:

- Transaction Guarantees: The independence of the Oracle and Relayer is LayerZero's cornerstone. The confluence of a block header and transaction proof provided by these two independent entities guarantees the validity of a transaction. This is in direct contrast with other "Middle chain" designs of other bridges, which need to rely on their own consensus to secure the assets being transferred.

- Open and Decentralized Network: Any project or team can choose to run their own Relayer or Oracle for the LayerZero network. For instance Chainlink is an official Oracle provider for LayerZero. This means the cost to attack the protocol is much higher as multiple providers in separate categories need to collude together.

- Risk Sharding & Risk Shielding: LayerZero empowers users to spread the risk by choosing different Oracle/Relayer combinations. Users can even run their own relayers to ensure independence and minimize the possibility of collusion.

- Simple and Effective Design: LayerZero refrains from adding extra mechanisms to its bridging protocol. This means the security of LayerZero is anchored in the native chains of its Endpoints.

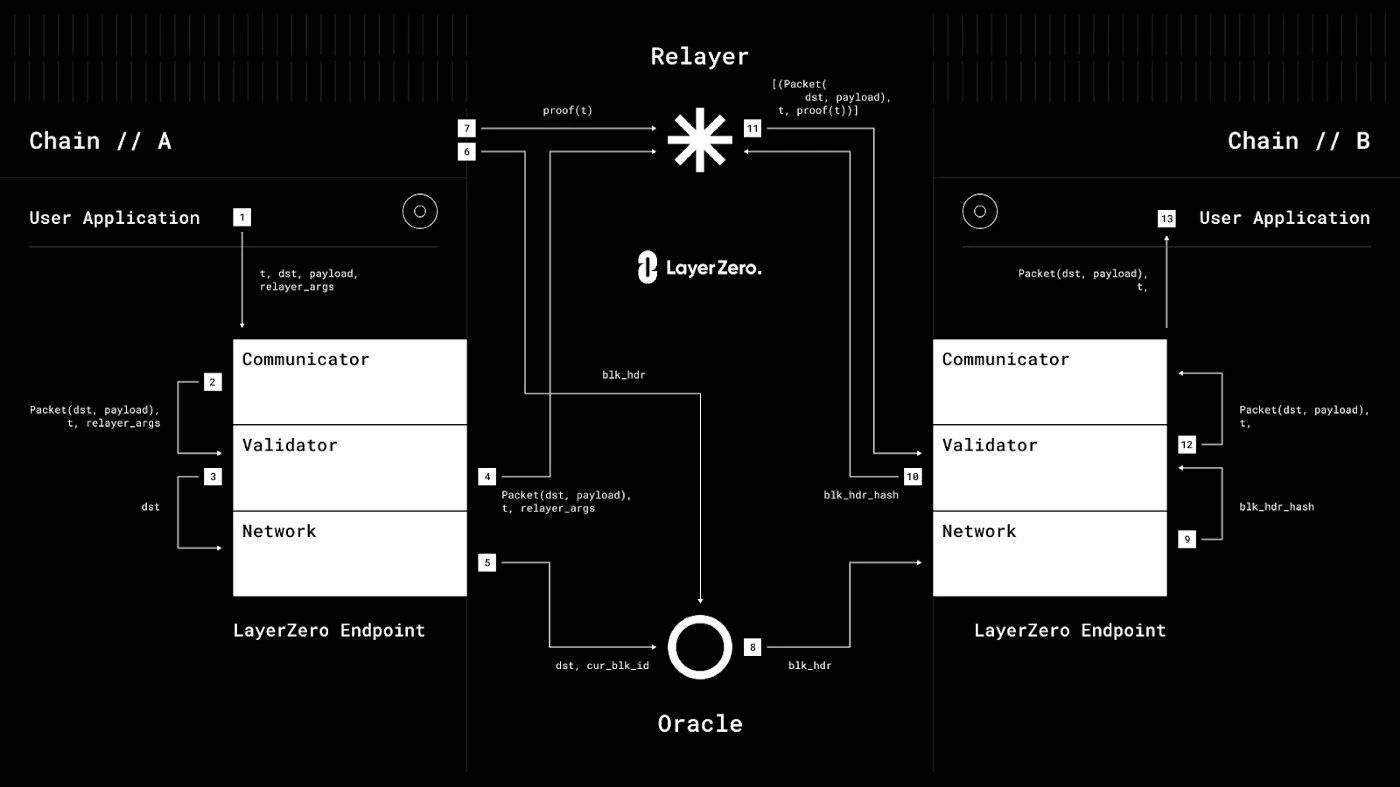

Following our exploration of LayerZero's security features, let's visualize how a typical transaction works within this system. The image below illustrates the process of a transaction on LayerZero. From initial request to final verification, observe how the Oracle and the Relayer interact to ensure cross-chain functionality

Let's break down a typical transaction on this network into simpler terms, without delving too deep into the technical nitty-gritty:

- Initiation: A User Application initiates a transaction, sending request details to LayerZero's Communicator, which packages and forwards the information to the Validator. This essentially notifies the Network of the upcoming cross-chain transaction.

- Notification: The Validator and the Network cooperate to alert the Relayer and the Oracle of their respective tasks - The Relayer needs to fetch the transaction proof, and the Oracle needs to fetch the block header.

- Fetching: The Relayer and the Oracle independently obtain the transaction proof and block header from Chain A, and store this information off-chain.

- Confirmation and Validation: After waiting for block confirmations, the Oracle sends the block header to Chain B's Network. The Network and the Validator work together to confirm the transaction's validity by comparing the block header and transaction proof.

- Finalization: Once the transaction is validated, the Communicator on Chain B receives the information and forwards it to the User Application on Chain B, completing the cross-chain transaction.

This brief rundown offers a peek under the hood of LayerZero. It shows how all the parts work together to let a User Application move transaction info from one blockchain to another. It's proof of LayerZero's solid design, which is all about making different blockchains talk to each other easily.

Although LayerZero offers a more secure and powerful solution than traditional bridges, it does have 2 main concerns around trust assumptions:

- Dependence on Relayer and Oracle: LayerZero's security depends on an increasing number of relayers and oracles on the network. Users are reliant on the security of the Relayer and Oracle to pass messages across chains.

- Reliance on Chains' Security: LayerZero is fundamentally reliant on the native chain of an Endpoint to function correctly. This brings up the question of how LayerZero would handle a major security breach on a native chain, like a 51% attack.

As a testament to its potential, LayerZero has attracted an impressive lineup of backers, including Circle, Sequoia, Andreessen Horowitz, Samsung Next, and Christies Inc. The latest funding round saw LayerZero raise $120 million at a staggering $3 billion valuation, three times its valuation in March 2022.

This speaks volumes about the confidence of the market in LayerZero's vision and its potential to revolutionize the blockchain landscape. For those keeping a close watch on the forefront of blockchain innovation, LayerZero is undeniably something to keep on your radar.

The Potential of the $ZRO Token: A Future Opportunity?

Peering into the future of LayerZero, we can see hints that suggest the possibility of a new token, potentially dubbed $ZRO. This isn't just a wild guess - breadcrumbs in their code suggest that they might be planning to issue a token soon.

Why would LayerZero want to launch a token? Well, several compelling reasons make this a smart move:

- Investor Returns: Token issuance could be a strategic way to offer returns to their investors. It’s a common practice in the blockchain world, and it allows the backers to realize value from their investment.

- Community Building & Hype: A token can be a rallying point for a community. It's a way to reward early adopters, generate excitement, and get people more involved.

- Decentralization: Tokens can help LayerZero become more decentralized. This is appealing to both users and developers, as it aligns with the ethos of blockchain technology.

The notion of a $ZRO token isn't just exciting for the company - it could also mean an opportunity for potential token holders. If LayerZero does launch a token, it's likely they could distribute it through an airdrop. Airdrops are a popular way to reward early supporters and generate buzz, so it makes perfect sense.

Remember, I've already covered how to participate in such an airdrop in a recent video. If you haven't had a chance to watch it yet, make sure to check it out - you don't want to miss out on this potential opportunity. As we keep our eyes on LayerZero and the possibility of $ZRO, it's clear that exciting times are ahead!

Weekly Bullets

🟠 PulseChain Mainnet Launched, $PLS and $PLSX Tokens Now Trading

🟠 UAE Embraces CryptoEconomy: Recognizes its Transformative Potential. Coinbase Views UAE as Potential Global Crypto Powerhouse.

🟠 Ripple Sets Sights on Dubai Expansion, Says CEO.

🟠 LimeWire's Blockchain Revival: Secures Over $16M in Funding.

🟠 MetaMask and PayPal Join Forces: US Users Can Now Buy Crypto with PayPal in MetaMask

🟠 Bitcoin Fee Spike Prompts Shift to Lightning Network: Binance and Coinbase Follow Suit.

🟠 Industry Titans Goldman, Microsoft, CBOE, and Others Unite to Launch Blockchain Network.

🟠 Binance NFT Marketplace Expands: Now Supporting Bitcoin NFTs, BRC-20 Support Soon?

🟠 Grayscale Gears Up for Crypto ETFs: A New Era of Investment. File for a semi-spot bitcoin ETF, as well as Ethereum Futures ETF and a Privacy ETF.

🟠 BRICS Nations Unite: New Common Currency for International Trade on the Horizon.

🟠 Elon's Influence: Milady NFT Value Soars After Musk's Tweet.

🟠 New York's Innovative Step: Bill Proposed to Accept Stablecoins for Bail Payments.

🟠 Binance Calls it Quits in Canada.

🟠 Florida Governor Bans Central Bank Digital Currencies in the State.

🟠 Ethereum Mainnet Experiences Hiccup, Dodges Full Outage.

🟠 Ethereum Developers Gearing Up for 'Dencun': The Next Planned Hard Fork.

🟠 Texas Lawmakers Aim to Include Crypto in Proposed 'Bill of Rights'.

New Videos

How to qualify for the MetaMask Airdrop $MASK Step-by-Step Guide

This TRILLION dollar Crypto Narrative is just getting started

End

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out APEX Exchange - The official DEX of ByBit.

They have all the advanced trading tools like limit orders, stop loss, and even leverage for long and short positions.

The best part is you control your own funds as you can directly trade from your MetaMask Wallet. There is no KYC and you can trade from anywhere in the world

Start Trading on APEX and earn extra $APEX tokens