How to get the MetaMask Airdrop and Why you should do it now | Weekly Digest

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon

How to get the MetaMask Airdrop

And why you should do it now

Is a Metamask token airdrop coming soon? It certainly looks possible as MetaMask has been rolling out a suite of DeFi solutions on top of its wallet.

MetaMask Token has been confirmed by Consensys

Back in March 2022, Joe Lubin, ConsenSys co-founder, told Decrypt that MetaMask will pursue “progressive decentralization” and intends to issue a token moving forward. Lubin comments came the day after ConsenSys closed a $450M Series D, bringing its overall valuation to a whopping $7B.

Under the plan,MetaMask will launch a DAO, although Lubin said that it “won’t govern MetaMask, but will enable the creation of novel pieces of MetaMask to be funded.” The comments suggest that MetaMask users who expect to receive an airdrop may be disappointed, although an airdrop was not explicitly ruled out.

Lubin’s comments follow similar remarks from Jacobc.eth, MetaMask’s lead of operations, during the ETHDenver conference in early March.

“We believe really deeply in progressive decentralization and doing it over time in ways that are meaningful — and doing it in ways that are not a cash grab,” he said. Jacobc added that MetaMask will be cautious not to place the project “in jeopardy of… regulators or give governance to ‘airdrop farms’.”

He continued to emphasize that the token will become “an important aspect” of MetaMasks plans for community ownership.

So it's crystal clear that MetaMask WILL HAVE A TOKEN

MetaMask DeFi functionalities

Way back in 2020, MetaMask has already added token swaps to the wallet which not only acts as a DEX aggregator, but also charges transaction fees to MetaMask as a DeFi service provider.

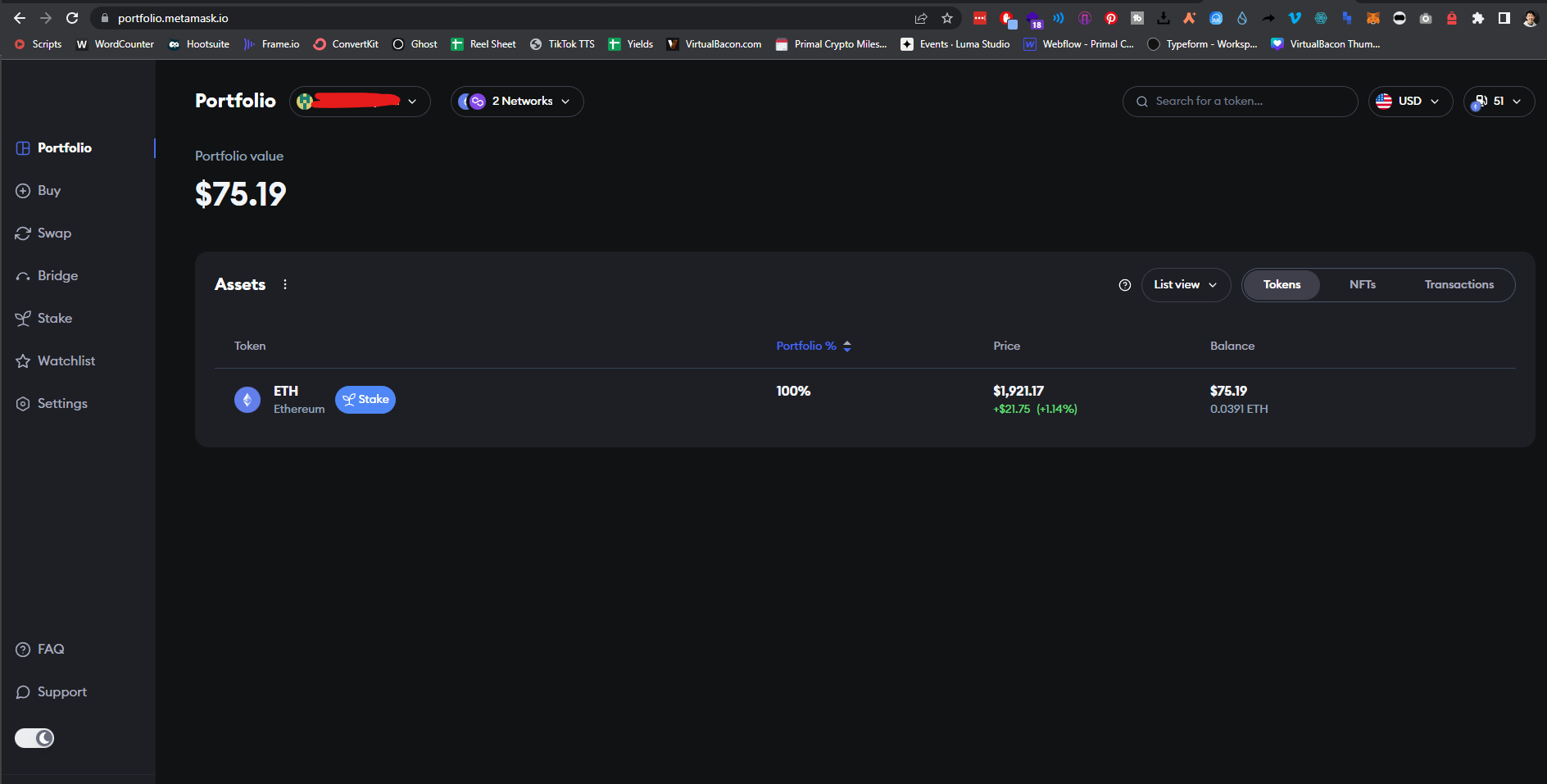

Then throughout the past year, MetaMask has launched its own portfolio dapp and has been slowly integrating new features to it. Currently, you can track coins, buy Crypto with fiat, swap between coins with an aggregator, staking Ethereum, and even move tokens between chains using their bridge aggregator.

How to get the MetaMask Airdrop: Step-by-Step Guide

This tutorial will be super easy and short, but the costs to complete all tasks in this guide will be about $100 in gas fees.

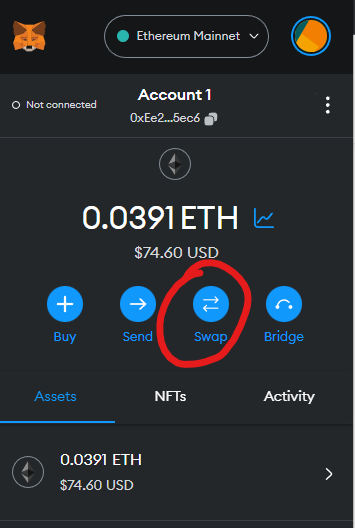

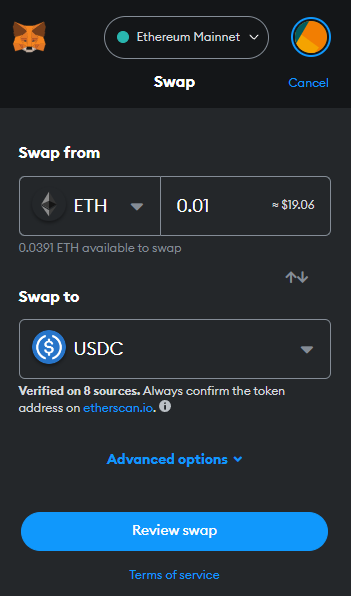

Step 1: use the swap function on MetaMask to trade some coins.

To maximize the chances, I'm swapping coins on Ethereum mainnet instead of other layer-2s.

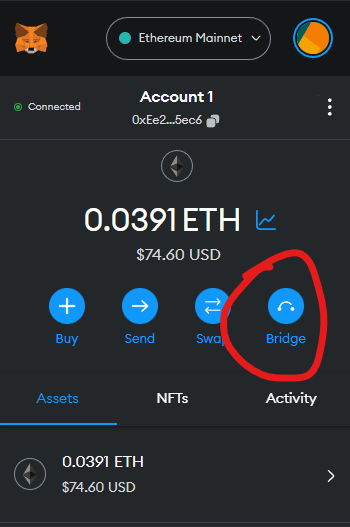

Step 2: click the bridge button on metamask to go to the new Metamask portfolio website

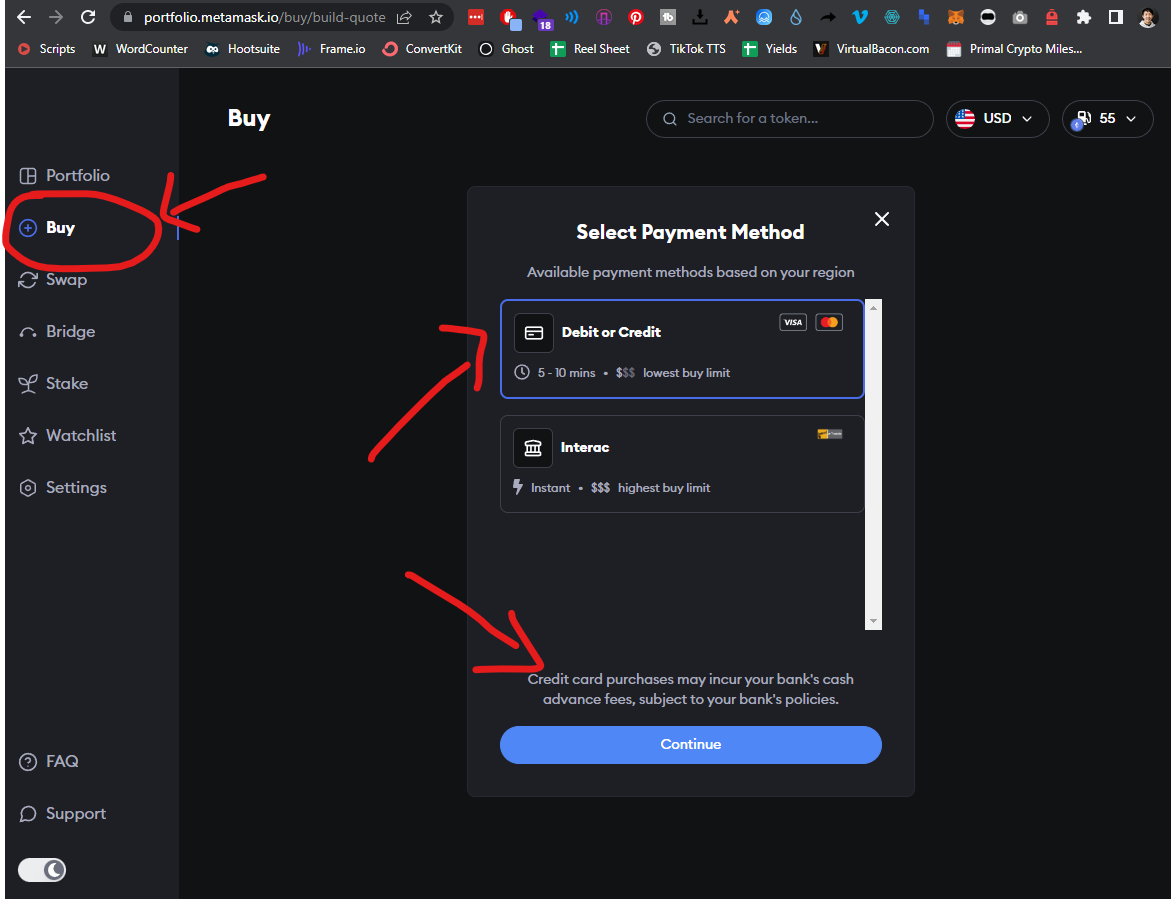

Step 3: Buy some crypto through MetaMask Portfolio

It supports most countries and payment providers. The amount you buy does not matter. And I chose to buy Ethereum as this is the most likely coin to be included as task requirements.

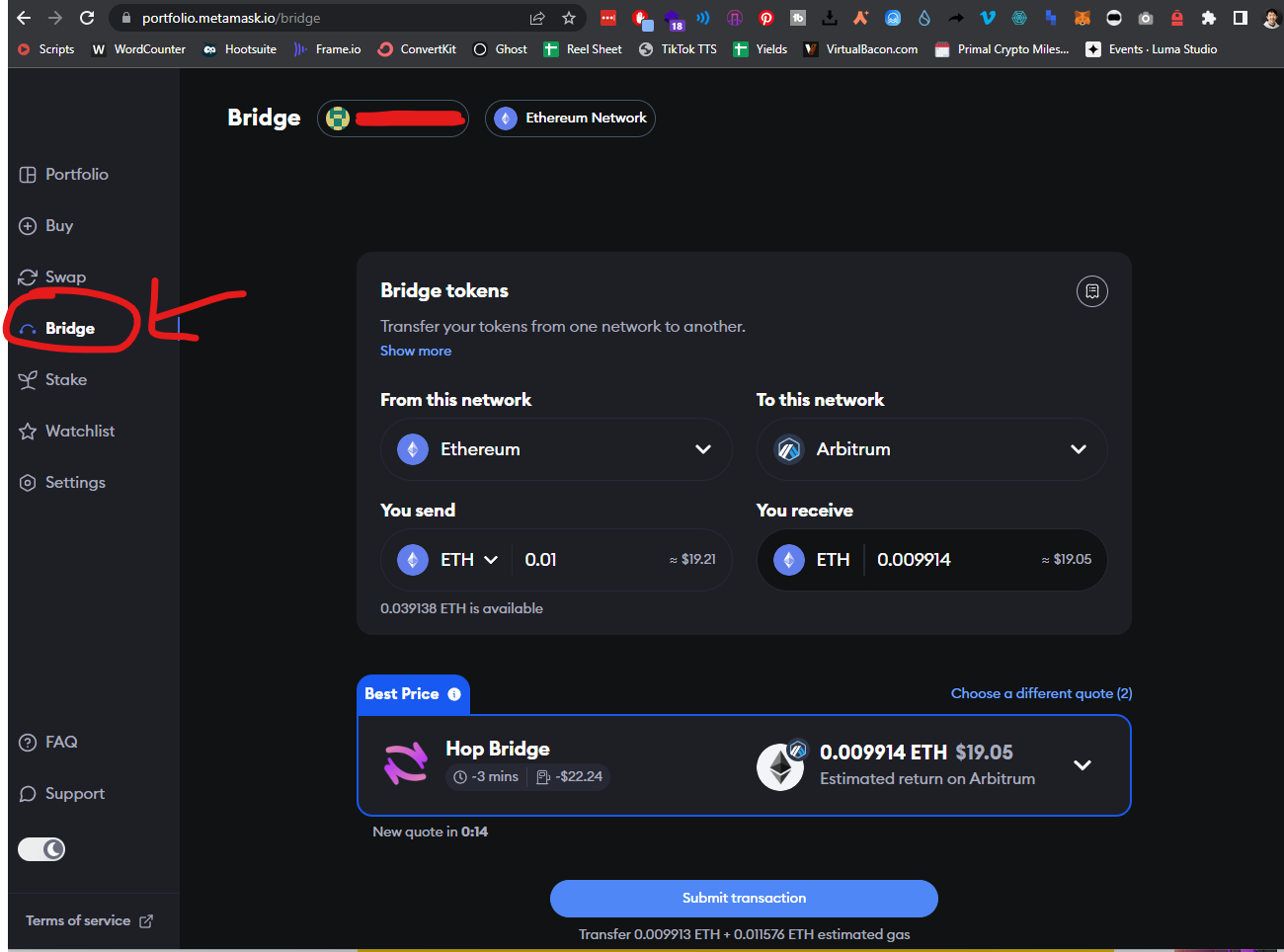

Step 4: Use the MetaMask bridge aggregator to transfer some coins between chains.

You can bridge tokens from Ethereum to any other chain. They all should work.

The amount you bridge also does not matter, you can use any small amount.

The bridge provider you select also does not matter. Every bridge is routed through MetaMask's aggregator, so just let MetaMask choose the default one for you.

I sent ETH from Ethereum to Arbitrum as it's the network most closely related to the Ethereum ecosystem.

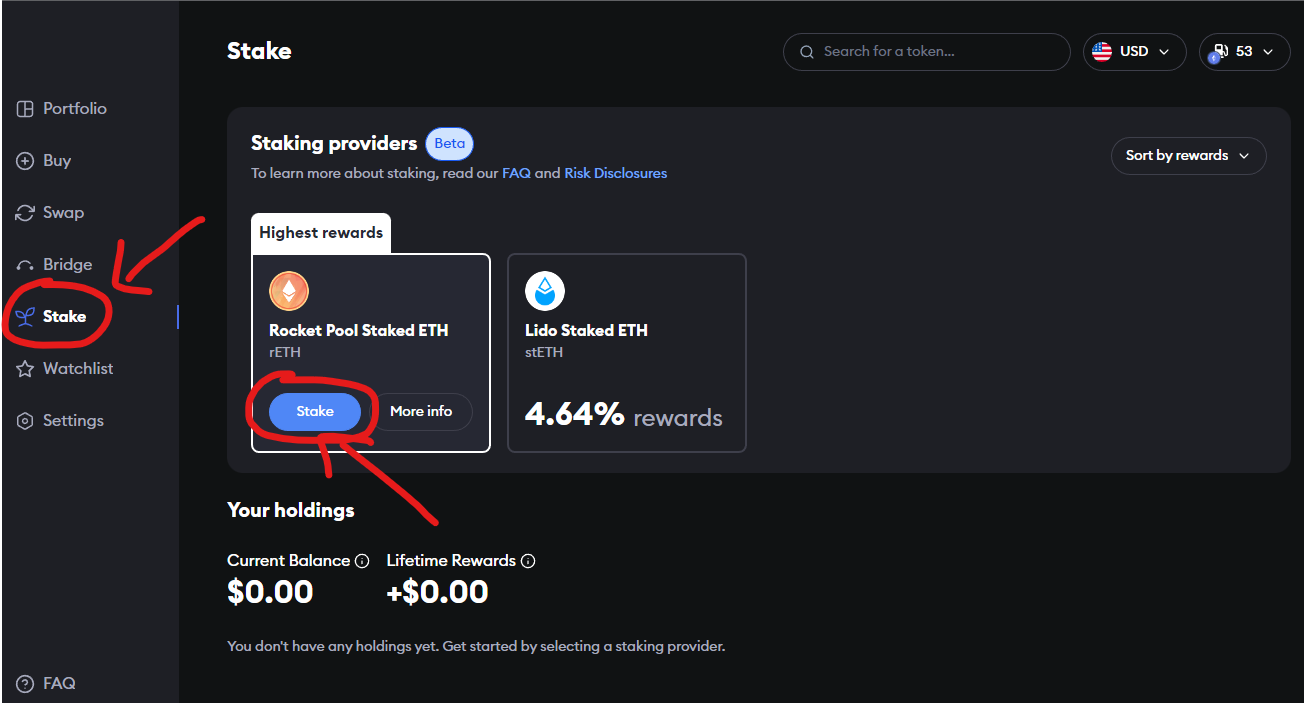

Step 5: Stake some Ethereum through Metamask portfolio

At the time of writing, there are two staking providers Rocket Pool and Lido. Both providers should work so pick either one.

The amount you stake also does not matter. So stake any small amount of ETH.

That's it, simple right?

These transactions together might cost you 100 bucks in gas fees, but I think

Keep in mind that although the token has been confirmed, the airdrop is not. So all the tasks we will talk about today are only based on community speculation. Regardless, I still think it’s totally worth it considering the sheer adoption size of MetaMask as basically the default wallet for Ethereum.

When the MASK token launches, it will likely be a top 30 token guaranteed. And IF there is an Airdrop, it will likely be one of the biggest airdrops to date.

Hong Kong's Emergence as a Crypto Hub

The Hong Kong Monetary Authority (HKMA) has recently relaxed its rules to make it easier for crypto companies to open bank accounts in the city.

This move signals Hong Kong's growing interest in becoming a crypto hub, despite China's recent crackdown on cryptocurrencies. Previously, crypto companies had to go through a rigorous vetting process to open bank accounts, which often resulted in rejections or delays. The new guidelines require banks to apply a risk-based approach to their AML measures, which should make the process of opening bank accounts more streamlined.

This is seen as a positive development for the crypto industry in Hong Kong, as it provides a more favorable environment for companies to operate in. With this new development, it is expected that more crypto companies will be attracted to Hong Kong as a hub for their operations.

Licensing Guidelines for Exchanges to be Issued

Hong Kong's Securities and Futures Commission (SFC) has announced that it plans to issue licensing guidelines for cryptocurrency exchanges in May, marking a significant development for the city's cryptocurrency industry.

The SFC has previously granted licenses to only a handful of crypto trading platforms, including OSL and Coinbase, due to strict regulatory requirements. However, the new guidelines may pave the way for more exchanges to receive licenses in the future.

This move is part of Hong Kong's broader effort to position itself as a leading fintech hub and attract more cryptocurrency-related businesses to the city.

The latest news coming out of Hong Kong is a big step forward for their acceptance of crypto and comes after their plans to allow the retail sector to trade larger crypto tokens were revealed in February.

In conclusion, Hong Kong's growing acceptance of cryptocurrencies is a positive development for the industry, as it could pave the way for more mainstream adoption. With more regulatory clarity and support from governments, cryptocurrencies have the potential to become an important part of the global financial system.

Declining Power of the US Dollar in the Global Economy

Argentina Joins List of Countries Dropping US Dollars

Argentina is the latest country to join the list of nations moving away from the US dollar. The country's central bank has announced that it will stop using the dollar as a benchmark for its foreign exchange operations, instead adopting a basket of currencies that includes the euro, yen, yuan, and Swiss franc.

This move is part of a wider trend of nations diversifying their reserve currencies as the dominance of the US dollar continues to decline. Other countries, such as Russia and China, have also been shifting away from the dollar, with China promoting the use of its own currency in international trade.

With China already making the decision to move away from the dollar, a recent analysis by Bloomberg Intelligence showed that the Chinese Yuan overtook the US Dollar as the most-used currency in China's cross-border transactions for the first time in history.

JUST IN: 🇨🇳 Chinese Yuan overtakes US dollar as most-used currency in China's cross-border transactions for the first time in history.

— Watcher.Guru (@WatcherGuru) April 26, 2023

Over 70% of Trade Deals Between China and Russia is Settled in their Local Currencies

With the Yuan overtaking the Dollar as the most-used currency in China's cross border transactions and Russia already making the decision to move away from the dollar, recent reports from the People's Bank of China reported that more than 70% of trade deals between China and Russia are now settled in their local currencies.

The report highlights the increasing use of local currencies in international trade, which is reducing the reliance on the US dollar. This trend is part of a wider move by countries to diversify their reserves and reduce their exposure to the US dollar. The use of local currencies in trade deals is also becoming more prevalent in other countries, such as Brazil and India, which are part of the BRICS alliance.

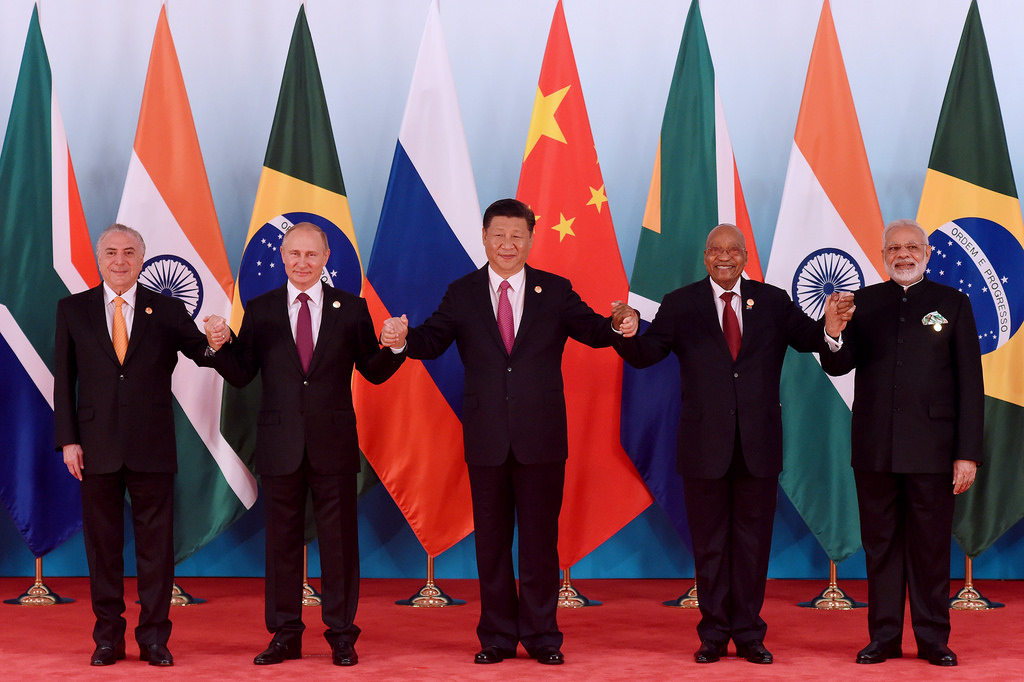

How Many Countries are currently in BRICS?

BRICS is an alliance of five emerging economies: Brazil, Russia, India, China, and South Africa. The alliance was formed in 2006 and has since become an important player in the global economy. The countries in the alliance are working together to promote trade and investment, as well as to create a more balanced global economic order. One of the goals of the alliance is to reduce the dominance of Western countries, such as the United States, in the global economy. The alliance is also promoting the use of local currencies in international trade, which is reducing the reliance on the US dollar.

Will there be more?

The BRICS nations have been considering expanding their alliance and introducing a common currency. The United Arab Emirates (UAE) has expressed interest in joining BRICS, leading to speculation that the country may also be interested in adapting the BRICS currency.

However, there is no official confirmation yet of UAE's membership in the BRICS alliance or its adoption of the proposed currency. The idea of a BRICS currency is still in its early stages and would require significant cooperation and coordination among the member countries. Nevertheless, the potential addition of UAE to the BRICS alliance could bring significant benefits and enhance the economic and political influence of the group in the Middle East region.

It remains to be seen how this shift away from the US dollar will impact the global economy and the future of international trade. However, it is clear that the US dollar's position as the world's reserve currency is being challenged. As the world continues to move towards a more multipolar global economy, it will be interesting to see how these developments play out and what role crypto will have in shaping the future of finance.

Quick Takes

China plans to expand the use of its CBDC for Belt and Road Initiative projects.

Ethereum’s Shanghai and Capella updates drive $17M inflows.

KuCoin to Reimburse Victims of the Short-Lived Twitter Account Hack.

Paradigm Files Amicus Brief in US SEC Lawsuit Against Terra and Do Kwon.

Cathie Wood's Ark Invest buys $87 million Coinbase stock and files third Bitcoin ETF application amid SEC lawsuit.

FTX confirms plans to restart its Japanese exchange.

Visa announces plans for new crypto payment product.

Binance lifts restrictions on Russian users and returns to the market.

Bybit to introduce mandatory KYC requirements starting May 8.

Coinbase Sues SEC Over Digital Asset Rule Answer Delay.

Mastercard collaborates with Polygon, Solana, and others to launch a crypto credential system.

Binance US Terminates Deal to Acquire Voyager Digital's Assets.

PayPal's Venmo App to Offer Crypto Transfers for Users.

Binance CEO Denies His Net Worth is $28 Billion.

Consequenses of The First Republic Bank Crisis.

Google Cloud Partners with Polygon Labs to Provide Developer Tools and Enterprise Infrastructure.

Lens Protocol Unveils Bonsai: Latest Scaling Solution - Then Rebrands to Momoka Just a Day After Launch.

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out APEX Exchange - The official DEX of ByBit.

They have all the advanced trading tools like limit orders, stop loss, and even leverage for long and short positions.

The best part is you control your own funds as you can directly trade from your MetaMask Wallet. There is no KYC and you can trade from anywhere in the world

Start Trading on APEX and earn extra $APEX tokens