What is the new RWA Crypto Narrative? | Weekly Digest

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon

What is the RWA Crypto narrative?

Real World Assets (RWAs) are taking the crypto world by storm as they bridge the gap between DeFi and traditional finance (TradFi). By tokenizing assets such as gold, real estate, and intangible assets like bonds or carbon credits, RWAs enable all users to participate in the same open and fair market while enjoying sustainable yields backed by traditional assets.

Recently the Tokenized gold market cap has surpasses $1B.

S&P Global is also hiring a DeFi director to explore bridging their equities markets with DeFi

Binance also published a full report detailing their bullish stance on the future of RWA crypto platforms

The Defi Edge discusses the growing trend of RWA tokenization and its potential to revolutionize the financial landscape.

One crypto sector is estimated to reach $16 Trillion by 2030:

— Edgy - The DeFi Edge 🗡️ (@thedefiedge) March 30, 2023

Real World Assets.

This will be the CATALYST for mainstream Crypto adoption.

Here's your 2023 guide to RWAs (and the top protocols): pic.twitter.com/bGudNQX0zq

DeFi giants like MakerDAO, AAVE, and Synthetix have all ventured into the RWA space, with RWAs contributing over 55% of MakerDAO's revenue.

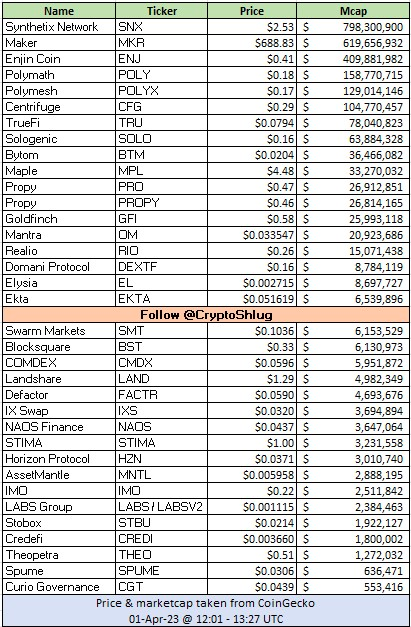

The leading RWA protocols I'm watching are

- Centrifuge $CFG

- Goldfinch $GFI

- Truefi $TRU

- Maple Finance $MPL

You can find more risky RWA altcoins from this list, although most of these are pre-product stage and should only be treated as a narrative based position.

zkSync: The Alpha Ecosystem You Can't Miss

zkSync is currently the most promising ecosystem to explore in the crypto world.

As the first zkEVM layer-2 to launch, it allows anyone to create and use applications directly from their MetaMask wallet. Now is the perfect time to get involved, as numerous new projects and tokens will be launching on zkSync in the coming months.

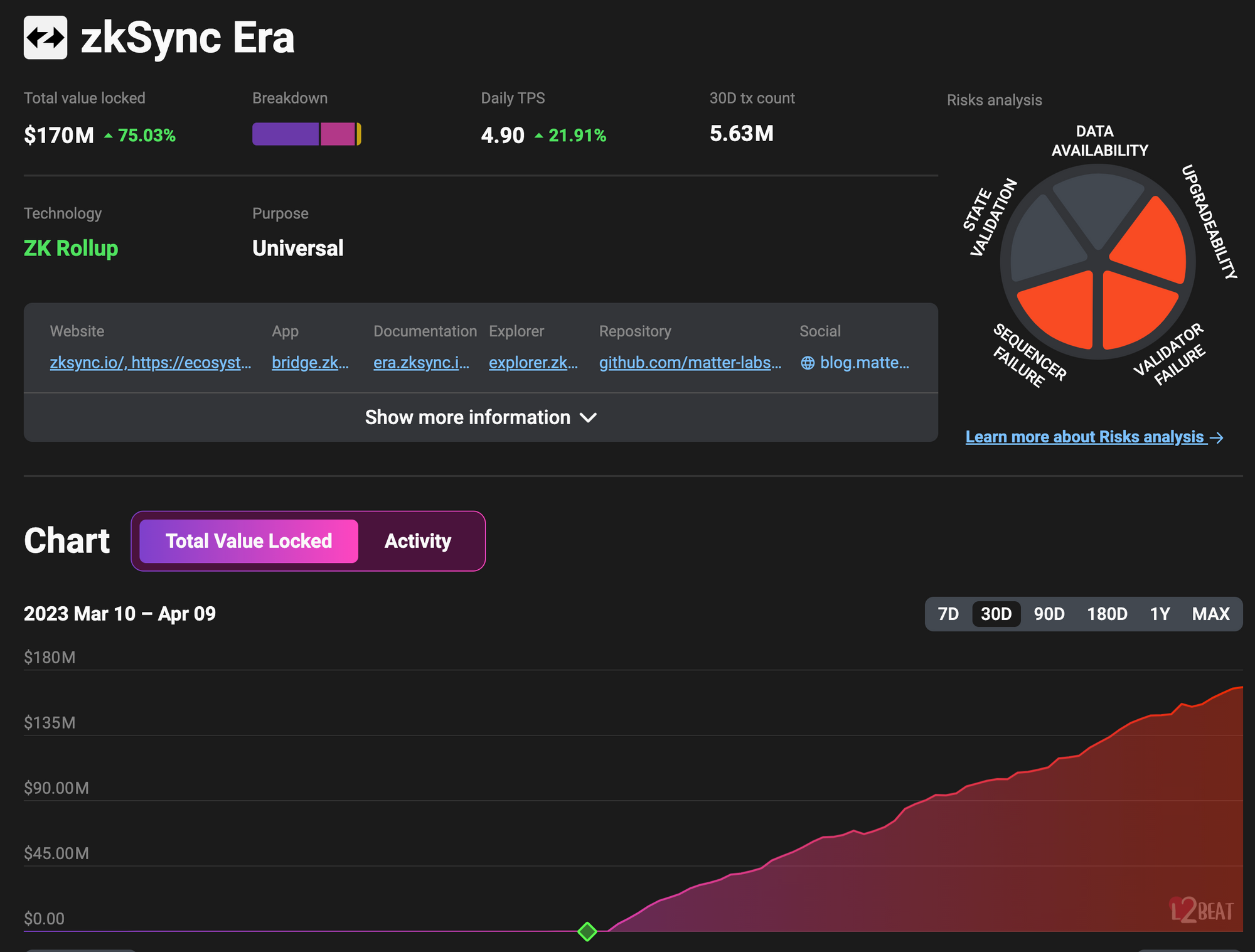

zkSync TVL continues to grow day after day, there is clearly interest from DeFi degen crowd to hunt new gems on the network right now.

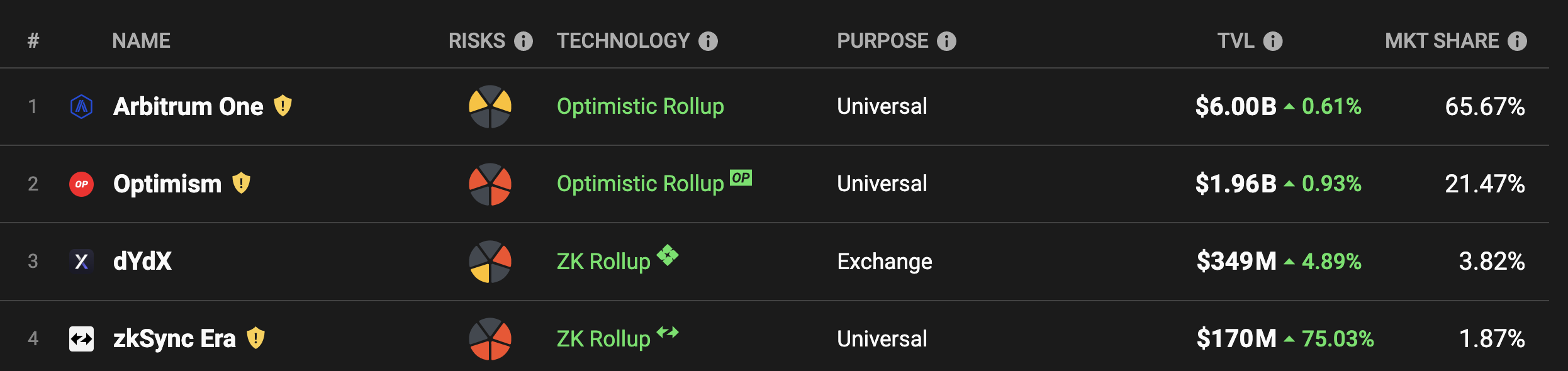

$170M in TVL already puts zkSync at the #4 spot in terms of TVL among all L2s.

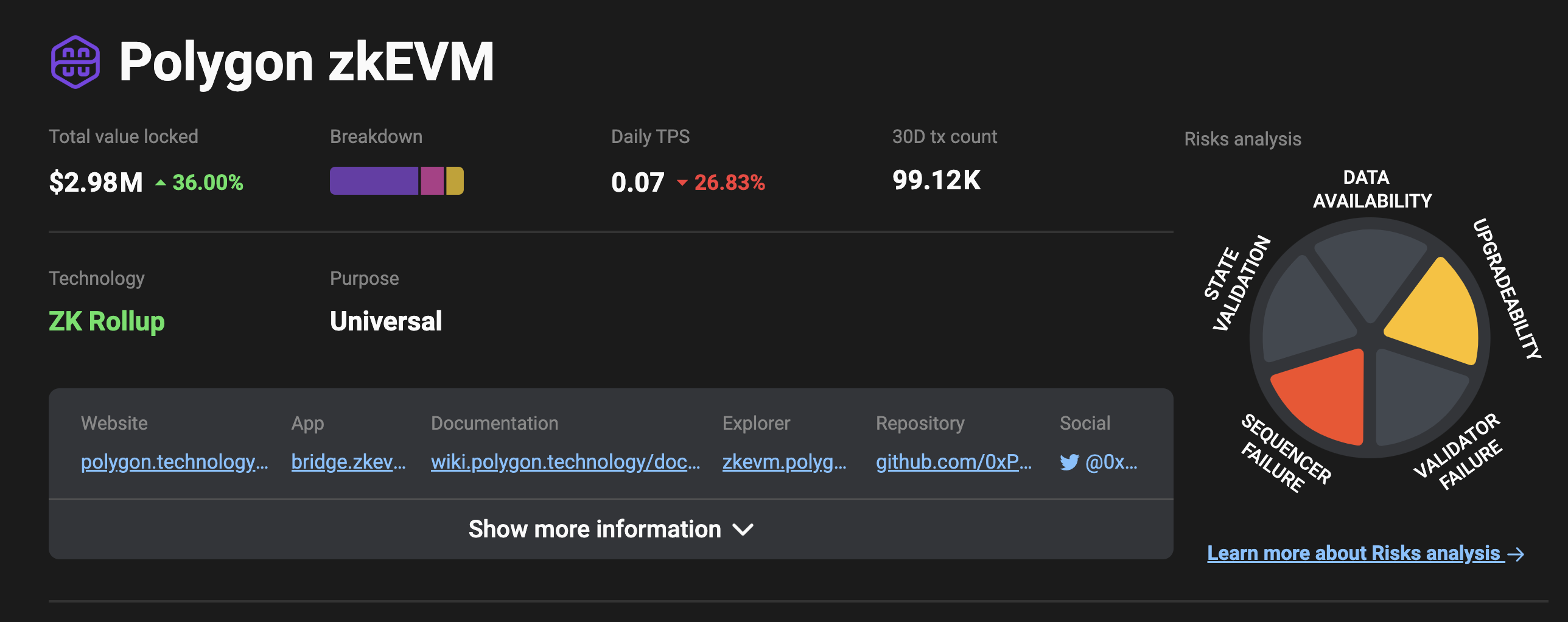

In comparison, Polygon's zkEVM is seeing very little adoption, with only $3M of TVL.

This is likely attributed to the fact that Polygon already has a mature ecosystem in its POS chain along with the MATIC token. So people are not expecting brand new opportunities and tokens to launch on the Polygon zkEVM.

zkSync is looking like the winner in the zkEVM race at the moment.

Take advantage of this opportunity to discover the next GMX or Radiant Capital on zkSync, much like those who capitalized on early projects on Arbitrum.

What's more, the likelihood of receiving a zkSync airdrop has increased, as the platform has not yet released its token. Mainnet actions, which require real money for gas fees and deter bots and airdrop farmers, are expected to play a significant role in qualifying for the zkSync airdrop.

Don't miss out on this incredible chance to get in on the ground floor of a major project. Start interacting with zkSync today and position yourself at the forefront of this emerging ecosystem.

More Trouble at Binance, even outside the US

Binance.US having trouble finding banking partner in US

Binance loses License in Australia

The war on Binance continues, it does feel like something is about to break soon..

Quick Takes

Why you need to watch the Reddit Gen 3 NFTs drop on April 10th

Last Call to study the Ethereum Shanghai Upgrade on April 12th

US Treasury release 2023 defi illicit risk assessment

Why TraderJoe's liquidity book AMM model could be a game changer

Facebook and instagram to stop supporting NFTs on April 11th

US government sold 9800 Silkroad BTC on March 14th and will sell 41500 in 4 more transactions this year

Opensea launched no-fee ‘Pro’ market place with NFT rewards

Dogecoin drops after Twitter ditches the Dog Logo

SushiSwap DEX Suffers $3.3M Loss in Smart Contract Exploit

New Videos

Top 6 AI Crypto Coins | All Hype or Future of Blockchain?

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Consider Signing up to MEXC Exchange, it is a globally accessible exchange with no KYC, and has 1,500+ Altcoins for you to choose from.

MEXC Exchange: $9,100 Signup Bonus (Use code MEXC-BACON)