The war on Binance and all US Exchanges | Weekly Digest

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon

In this week's issue:

Major events

- The War on Binance from the US

- Global De-dollarization

Quick Takes

- Twitter logo changed to Doge, zkSync traction, US selling silk road BTC, Bittrex & Paxful Shutdown, Operation Chokepoint 2.0, Hong Kong becoming new hub

New Videos

- Is ETH about to crash!? | Ethereum Shanghai Upgrade Explained

The War on Binance from the US

Many pieces of negative news came out in the past few weeks, targeting Binance from multiple fronts.

March 27 - CFTC Sues Binance over US Regulatory Violations

The U.S. Commodity Futures Trading Commission (CFTC) has sued Binance and founder CZ over allegations of offering unregistered crypto derivatives products in the U.S.

Key Details:

- Binance is under investigation by the CFTC, IRS, and federal prosecutors for potential violations of Anti-Money Laundering rules and allowing U.S. traders access to unregistered securities.

- Binance is accused of engaging in unregistered trading activity since 2017, despite publicly stating its intent to block or restrict U.S. customers.

- The lawsuit alleges that Binance used a complex network of corporate entities to obscure the platform's ownership, control, and location.

- Employees were directed to use VPNs to spoof their locations, and key customers were instructed to set up shell companies to avoid restrictions.

- Internal chats between Binance employees, including CCO Samuel Lim, are cited in the lawsuit.

- Binance has pledged to cooperate with regulators.

The U.S. government's actions against Binance and other major players in the crypto space signal a broader crackdown on the industry. Binance had already acknowledged the likelihood of regulatory action and begun working with regulators.

March 29 - Leaks Suggest Binance Concealed Links to China

Internal documents suggest that Binance executives instructed employees to conceal the company's presence in China.

Despite claiming to have left China in 2017, Binance continued to use a Chinese bank for some employee salaries and maintained an office in the country until 2019.

Binance denies these allegations and insists that it does not operate in China nor has any servers based there.

April 1 - Binance, CZ, and other influencers sued for promoting unregistered securites

Just a few days after the CFTC suit, another group of investors has filed a class-action lawsuit against Binance, its CEO, and several online promoters, accusing them of selling unregistered securities.

The lawsuit, submitted to a Miami federal court, claims that Binance's proprietary cryptocurrency, BNB, should have been registered with regulators before being offered to U.S. investors. By law, investors who purchase unregistered securities can seek reimbursement in court.

Binance has declined to comment on the pending litigation, stating that it plans to "vigorously contest the untrue allegations in this lawsuit."

April 3 - Binance CZ rumored to be wanted by Interpol

The rumor was initially circulated by UpOnly podcast host Jordan Fish, who posted an encrypted tweet that, when decrypted, read: "Interpol Red Notice for CZ." Twitter account hyuktrades also contributed to spreading the rumor but has not commented further.

As of April 3, Interpol's website does not list a public Red Notice for Binance CEO Changpeng Zhao, despite rumors suggesting otherwise. Twitter detectives have read through nearly 7,000 public Red Notices on Interpol's site found no mention of CZ or his colleague Samuel Lim. Interpol has not responded to any public inquiries to confirm or deny these allegations.

It is possible that a private Red Notice is in circulation or pending approval. However, no evidence of a notice or leak has been found. If a Red Notice were issued, it would act as a request for authorities to locate and provisionally arrest Zhao, rather than as an international arrest warrant or a mandate for action against him.

Expect more Binance FUD to come over the next few weeks

This seems to be part of a larger effort to control the crypto industry and tarnish anything associated with China. By emphasizing Binance's Chinese roots, the U.S. government might aim to keep the exchange at arm's length, much like the TikTok ban.

Rumors of issues with bank withdrawals at Binance.US have also surfaced. As allegations and legal battles continue, the future of Binance's American subsidiary remains uncertain.

Potential Impact: If found guilty, Binance may face fines, injunctions, and civil lawsuits from affected users or investors, essentially amounting to a slap on the wrist. Such outcomes have been seen historically, with companies making substantial profits and settling for relatively small fines.

However, if Binance's reputation is damaged as the largest crypto exchange in the world, it could lead to a loss of confidence in the entire crypto industry. This comes on the heels of several institutions struggling over the past year, including the more mainstream-friendly FTX, which could have negative implications for the crypto space as a whole.

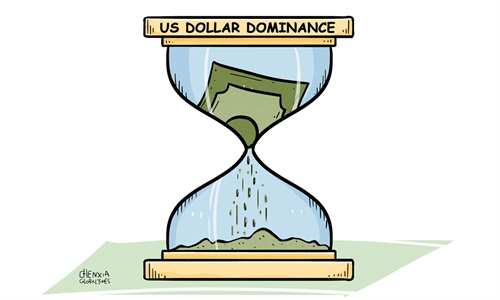

Global De-dollarization

As we witness unfolding global events, questions arise about the potential collapse of the USD as the world's reserve currency. This would signify a major shift in the financial landscape, given that the U.S. has maintained this dominant position for several decades since WW2.

China-Brazil Currency Deal

China and Brazil have agreed to trade in their respective currencies, allowing them to conduct trade and financial transactions directly in yuan or reais instead of relying on the US dollar. This move is expected to reduce costs, promote bilateral trade, and facilitate investment. Given that China is Brazil's largest trading partner, with bilateral trade reaching a record $150.5 billion in 2022, this deal reflects the strong momentum between the two nations.

More significantly, this agreement may signal a growing trend towards de-dollarization as countries increasingly trade in non-dollar currencies and diversify their foreign exchange reserves. The US dollar's dominance has evolved into a tool of political coercion, with the US able to impose unilateral sanctions and export its risks globally through irresponsible monetary policies.

Russia and India also making moves away from USD

Following the Russo-Ukrainian war and subsequent sanctions against Russia, several countries, including China, India, and Brazil, are reducing their dependence on the U.S. dollar and moving towards alternative global banking systems. The U.S. government's weaponization of the dollar is the main factor driving this shift.

Ruble-yuan trade has increased eightfold since the beginning of 2022, while Russia and Iran are reportedly working on a gold-backed cryptocurrency to replace the dollar in international trade payments. China and Brazil recently agreed to trade in their own currencies, further internationalizing the yuan. Beijing also has currency deals with Russia, Turkey, Pakistan, and others, and is working to expand this list.

In a historic move, China recently completed its first-ever yuan-settled energy deal, involving 65,000 tons of liquified natural gas (LNG) from the UAE. Saudi Arabia, a key U.S. ally, has expressed openness to using other currencies besides the dollar for oil trade settlements.

India is also working to internationalize its currency, the rupee, and announced that trade between India and Malaysia can be conducted in rupees. India is already trading in rupees with Russia, Mauritius, Iran, and Sri Lanka.

Saudi Arabia Quickly Distancing from USD

Saudi Arabia the past 7 days

— Watcher.Guru (@WatcherGuru) April 3, 2023

1) 🇸🇦 Saudi Arabia to adopt economic strategy without US dependence, following decline in relations under Biden Administration, FT reports.

2) 🇸🇦 Saudi Arabia, Russia, UAE, Iraq, Kuwait, Oman, and Algeria to cut oil production output until the end…

As countries continue to seek financial independence and alternatives to the dollar, the trend towards de-dollarization is expected to grow, challenging the U.S. dollar's global hegemony.

Arbitrum Foundation Secretly sold ARB tokens

The Arbitrum Foundation has come under fire for selling ARB tokens worth nearly $1B without the approval of token holders. The foundation converted 10M tokens to fiat for operational costs and allocated 40M tokens as a loan to market maker Wintermute. These tokens were intended to fund a "special grants" program to foster growth on Arbitrum.

The controversy arose when the foundation sold tokens before the conclusion of the AIP-1 vote, rendering the governance process essentially useless. The foundation argues that certain parameters must be decided before true decentralized governance can be achieved, and that the special grants are crucial to the project's viability against competition.

While it's true that a business needs fresh capital to operate in a competitive market, the foundation's actions have raised concerns about the effectiveness of governance in the crypto space and prompted questions about the transparency and accountability of such processes.

Quick Takes

Twitter Blue Bird Logo changed to DogeCoin logo, Elon Musk makes jokes again

zkSync clearly the best new ecosystem to participate in, TVL doubles in 4 days to $100M

The US government sold $215M worth of seized Bitcoin from the Silk Road marketplace.

Bittrex shutting down operations in US completely by April 30th due to regulatory environment

Paxful shutting down its P2P Crypto Exchange - likely due to heavy US userbase

More crypto companies moving to Hong Kong in face of US regulatory crackdown

Operation Chokepoint 2.0 confirmed by Mike Novogratz, citing more US Crypto crackdown to come

New Videos

Is ETH about to crash!? | Ethereum Shanghai Upgrade Explained

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Consider Signing up to MEXC Exchange, it is a globally accessible exchange with no KYC, and has 1,500+ Altcoins for you to choose from.

MEXC Exchange: $9,100 Signup Bonus (Use code MEXC-BACON)