Crypto Weekly Digest | January 30, 2023

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon

In this week's issue:

NEWS 📣

- Amazon launching NFT and Web3 Gaming Initiative

- DeFi Lender Aave Deploys Version 3 on Ethereum Network

- Doodles 2 launching on January 31st, will support multichain starting with FLOW

- US Government to release roadmap to crypto initiatives

- Polygon zkEVM in testnet, mainnet date to be released soon

- Canto Blockchain launches Contract Secured Revenue (CSR)

- Filecoin Virtual Machine (FVM) expected to go live in H1 2023

- SudoSwap's $SUDO token is live with lockdrop until March 1st

MARKET WATCH 📈

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS ▶️

- This MAJOR Ethereum Upgrade Changes Everything (2023 Ethereum Roadmap)

News

Amazon launching NFT and Web3 Gaming Initiative

Amazon is reportedly exploring ways to integrate blockchain and digital collectible technology into its platform. This could include the use of blockchain-based gaming and non-fungible tokens, with the potential of allowing customers to play crypto games and claim free non-fungible tokens.

This news is fresh off the heels of their Amazon x Avalanche news.

While there's no concrete announcements about this NFT program, Amazon has been open to a number of different initiatives such as company NFTs.

There's also been growing speculation on whether Amazon is trying to build a NFT marketplace to compete with Opensea.

DeFi Lender Aave Deploys Version 3 on Ethereum Network

Aave deployed v3 on Ethereum mainnet last week.

Aave v3 will introduce High Efficiency Mode (eMode) to help users reduce risk and increase capital efficiency when staking or borrowing correlated assets such as stablecoins and Liquid Staking Derivatives (LSDs).

eMode allows users to maximize their borrowing power with collateralized assets like wstETH (wrapped staked ether), enabling them to stake larger amounts of Ether on the Ethereum blockchain while still retaining liquidity and receiving rewards.

The new "Efficient Mode" will also have an easy looping feature for Ethereum staking to boost APY upto 45% with one click.

Sers, let me tell you something:https://t.co/hcgVpGFnj3 pic.twitter.com/1QwFND9vvQ

— definikola.eth (@definikola) January 27, 2023

Doodles 2 launching on January 31st, will support multichain starting with FLOW

Plans for Doodles 2 we're initially unveiled in the summer, with the goal of buildinf crosschain into the flow ecosystem.

With the original collection being capped at 10,000 NFTs, the Doodles 2 expands the collection, gives the project more funding, and also drives more adoption.

Doodles 2 will be a choose-your-own Doodle, with each NFT being fully customizable, but with only generic features.

In the future, new wearables collections and brand collaborations with partners, musicians, and creators will be released, as well as the ability to swap between a full-body or PFP perspective and unlock an animated version of an owned NFT.

The Doodle team believes in order to achieve their roadmap objectives, they must remain flexible and multi-chain. They recognize that the right choice of blockchain will depend on the problem needing to be solved, and that Doodles 2 is a product designed to reach the masses. This commitment to multi-chain flexibility will help ensure that Doodles can continue to grow and innovate in the Web3 space

US Government to release roadmap to crypto initiatives

The Biden administration has put a focus on continuing to ensure that cryptocurrencies do not undermine financial stability, protect investors, and hold bad actors accountable. To this end, the administration has identified the risks of cryptocurrencies and created a framework for developing digital assets in a safe, responsible way. They have also ramped up enforcement with the banking agencies and launched public awareness programs to help consumers understand the risks of buying cryptocurrencies.

Additionally, the administration is encouraging Congress to take action to prevent misuses of customers' assets, strengthen transparency and disclosure requirements for cryptocurrency companies, strengthen penalties for violating illicit-finance rules, fund law-enforcement capacity building, and limit cryptocurrencies' risks to the financial system. It is important to be mindful of Congress' potential to make jobs harder and worsen risks to investors and to the financial system.

The Biden administration says they are open to digital currency, and it could expand upon the current financial system. However, they believe there must be a responsible digital asset framework, further regulations, and education on Cryptocurrencies..

Polygon zkEVM in testnet, mainnet date to be released soon

Polygon's zkEVM's wrapped up 0n January 20th and the mainnet launch has been teased.

Zero-knowledge (ZK) rollups is a technology that bundles and verifies transactions using "proofs," which are small pieces of data that confirm the validity and immutability of the transactions. By deploying the Ethereum Virtual Machine (EVM) for Polygon's ZK rollup, developers are able to seamlessly transfer smart contracts from Ethereum to the Polygon environment.

This would allow allow the Polygon to further scale for mass adoption, while adding privacy for its users.

The mainnet launch is scheduled to be in Q1 2023, according to the official announcement of Polygon Labs.

Canto Blockchain launches Contract Secured Revenue (CSR)

Short, medium, and long-term predictions for Canto's newest feature: Contract Secured Revenue (CSR) pic.twitter.com/47fWqUJFUz

— Spencer Noon (@spencernoon) January 27, 2023

Canto is a new L1 network, and they recently implemented a novel revenue sharing model called CSR.

CSR is a new experimental mechanism implemented on Canto that rewards developers when users interact with their smart contracts. This incentivizes web3 developers to build and grow their protocols to further user engagement.

While critiques of such mechanisms are not unheard of, the Plex Labs CSR dashboard tracks the highest-earning smart contracts.

This mechanism has caused a surge in growth on the Canto network, and will likelt benefit the whole ecosystem to grow.

Spencer Noon highlights these targets for the CSR program:

Short Term:

- CSR incentivizes a turbo

-bootstrapping of new apps on Canto, as opportunistic app devs move into this greenfield to make $$

- This starts a flywheel that attracts more Canto users, which in turn attracts more devs, which then attracts more users, etc. etc.

Medium Term:

- As the system calibrates, at first there will be negative externalities experienced by the broader Canto ecosystem: higher gas costs, more gas-inefficient apps, and lower-grade applications such as forks.

- Users will complain loudly about this on Crypto Twitter

Long Term:

- This is where things get interesting 🍿

- Once the dust settles, app devs will ultimately find themselves in an extremely competitive environment. They will then be forced to build gas-efficient applications if they want to collect any CSR.

- Devs who play the long game and build gas-efficient apps from Day 1 will have earned the trust of users and therefore be much more likely to win their categories long-term.

- Gas prices will find equilibrium and fall in line with market rates of other L1s.

Filecoin Virtual Machine (FVM) expected to go live in H1 2023

1/x The Filecoin Virtual Machine (FVM) & Why It Matters: A thread

— HQHan.eth (@duckie_han) August 26, 2022

The FVM looks to be a game-changer for @Filecoin.

It is expected to go live in 1H 2023.

This introduces programmability and EVM-compatible smart contracts to Filecoin.

Let's dive into what this means ⤵️

Filecoin is set to launch their own L1 in 1H 2023.

Filecoin is a decentralized storage network that provides a cost-efficient, scalable storage solution to the Web3 space. It uses cryptographic proofs of physical work to verify the storage of data, making it a verifiable and secure option.

Messari have called this new system as "Decentralized Physical Infrastructure Networks" (DePIN), while others have called it "Proof of Physical Work" (PoPW).

The idea behind DePIN / PoPW is that crypto protocols can effectively incentivize and coordinate human activity, making them powerful for developing real-world decentralized infrastructure & hardware networks.

Different hedge funds and Venture capitals see DePIN as a massive leap forward for the entire crypto space.

"If we think of L1 ecosystems as nations, then Filecoin has a competitive advantage in storage services & 'exports' this to other L1s."

SudoSwap's $SUDO token is live with lockdrop until March 1st

It's time >s<$SUDO governance will be launched later today, along with the lockdrop and airdrop.

— sudoswap (@sudoswap) January 30, 2023

SUDO is initially non-transferable. Transferability can be enabled by a standard governance vote.

Read below for more details 🔽

$SUDO governance will be launched later today, along with the lockdrop and airdrop. SUDO is initially non-transferable. Transferability can be enabled by a standard governance vote.

The $SUDO lockdrop and airdrop can now be accessed at http://sudoswap.xyz/#/lockdrop

Market Watch

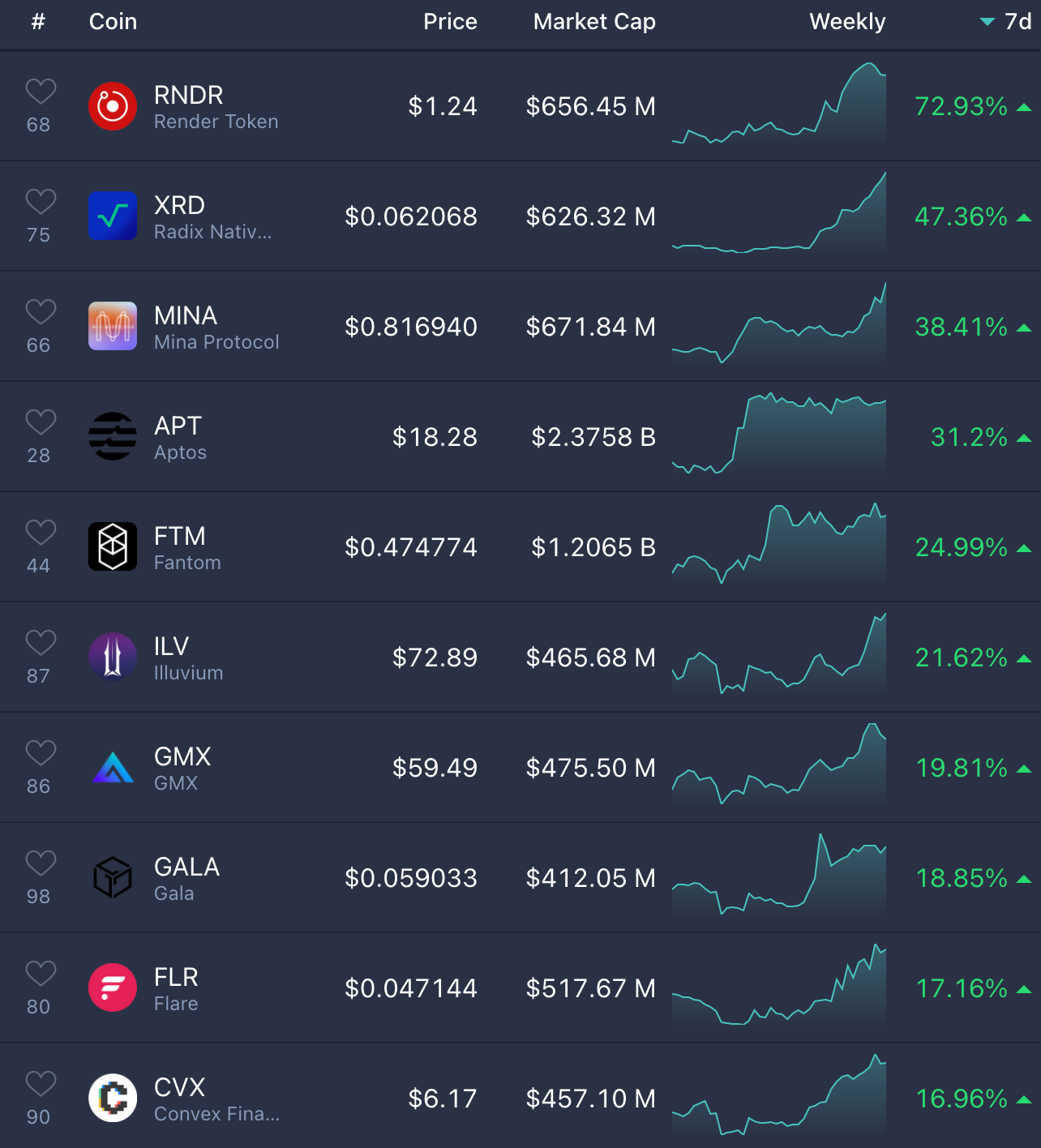

Top Performing Coins of the Week

RNDR

Render has been one of the tokens at trhe forefront of the AI narrative. That aside, there has also been growing speculation that Apple will integrate the Render app to be standard on all Iphone and Ipads.

MINA

Mina is a L2 network that leverages the ZK-Snarks technology. This makes Mina fast, cheap, and private. Mina has recently announced the ZKIgnite and Cohort 1 programs. This will allow developers to seek funding for the zkDapps they wish to create. There will be $500k and 500k Mina to be allocated to devs.

APT

Echoing the same concerns from last week, Aptos is a fundamentlly strong Layer 1 that has a strong future, however, the recent price action is due to the low float (low circulating supply) and perpetual futures shorting. Since a very finite supply is vested, whales can manipulate Spot price to impact futures traders, allowing for easier short squeezes and liquidation cascades. Currently, Aptos has a higher FDV than Solana, Polygon, and Avax.

FTM

Fantom network recently release news about their initiative to allocate 10% of network fees burned to a fund. This fund will be used to incentive Devs to build on the network.

FLR

Flare is the Ripple backed blockchain that was airdropped to users. The token surged this week when a governance proposal was passed to lengthen the FLR distribution, resulting in a reduction of inflation.

CVX

The curve wars are likely back. Projects that need deep liquidity on Curve finance need to "bribe" (Vote) their way into incentivizing that liquidity. To do this, they need to accumulate CRV and vote. Convex saw this trend early and became the nearly the majority holder of CRV (40%). This means that each CVX holds 5.28 CRV, and a project is likely arbbing the intrinsic value of the CVX token.

Important Upcoming Events

- Feb 4: $FLUX halving

- Feb 6: Syntropy $NOIA network public launch

- Feb 7: Shade Protocol

- Feb 14: $BLUR NFT marketplace airdrop and token launch

- Feb 28: Filecoin FEVM release

- Feb: Shiba Inu's Shibarium Layer-2 launch

- March: EOS Trust EVM mainnet launch

- March: Ethereum Shanghai Hard Fork

- Q1: Curve Finance Stablecoin launch

- Q1: AAVE $GHO stablecoin public testnet

- Q1: Optimism Bedrock upgrade testnet

- Q1: Redacted Cartel $BTRFLY launching $DINERO stablecoin, collateralized by LSDs

- Q1: DCG to liquidate main investment holdings including $API3, $HBAR, $ZEC, $FLOW, $MANA

- Q1: Syscoin optimistic rollup launch

- Q1: Polygon zkEVM launch

NEW VIDEOS

This MAJOR Ethereum Upgrade Changes Everything (2023 Ethereum Roadmap)

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code BACON for 10% off fees forever)