16 Million ETH to be unlocked after Ethereum Shanghai Upgrade, what happens next?

Happy New Year everyone! Welcome to issue #14 of the VirtualBacon Newsletter.

Before we start, I want to tell you guys about my upcoming course,

Primal Crypto Academy

If you're interested, click the button below to sign up for the early bird waitlist!

or go to primalcrypto.io

In this week's issue:

INSIGHTS 🧠

- Ethereum Shanghai Upgrade in March, everything you need to know

NEWS 📣

- Huobi sees $60M funds withdrawn due to Insolvency Rumors

- SEC objects Binance.US's plans to acquire Voyager

- Logan Paul vs Coffeezilla

- Judge rules Celsius Assets belongs to the Company

- Crypto Bank Silvergate Collapse 46% after $8.1B withdrawals in Q4

MARKET WATCH 📈

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS ▶️

- My Top 7 Altcoin Picks for 2023 (With Price Predictions)

- 6 Crypto Investing Mistakes to AVOID (If You Want to Get Rich)

INSIGHTS 🧠

Ethereum Shanghai Upgrade in March, everything you need to know

In March 2023, the Ethereum blockchain will undergo a major upgrade called Ethereum Shanghai. This upgrade will finally allow staked ETH to be withdrawn, which means millions of staked ETH will be unlocked after this upgrade.

But what does this mean for crypto investors? Let’s take a closer look.

What is Ethereum Shanghai Upgrade?

Ethereum Shanghai is the next major upgrade coming to the protocol in March 2023. Many potential improvements are being considered but one in particular, EIP-4895, is the most important to watch. EIP-4895 is the upgrade which would allow individuals and entities that hold staked ETH to withdraw it.

If you didn't know, Ethereum 2.0 staking has been running since December 2020, meaning people have been staking ETH for the past 3 years. However there was always one hitch: you can’t get any of that ETH back yet.

Today, some 15.83 million Ether — valued at nearly $20 billion are being held in special so-called staking wallets, with their owners unable to withdraw the coins, according to data tracker Beaconcha.in.

The Ethereum Shanghai Upgrade will enable users to stake their ETH without having to wait several months or even years for their rewards.

Will Ethereum dump in price due to staked ETH being unlocked?

NO, it is highly unlikely that there will be any kind of crash in the price of Ethereum due to the unlocking of staked ETH. Here's why:

First,

most ETH staked today are through exchanges or liquid staking platforms. When you stake ETH on Coinbase, Binance, or the leading decentralized platform Lido, you already get a "staked ETH" token back that is freely tradeable. These tokens track the price of Ethereum closely, and can eventually be redeemed for the original ETH.

Today, the amount of ETH staked through liquid staking protocols accounted for over 40% of the total ether deposits of more than 15.7 million, according to data sourced from Dune Analytics.

Secondly,

If people truly wanted to dump, the staked versions like stETH would trade at lower price than ETH already. But they never did. If there were higher amounts of ETH planned to be dumped, the $stETH token and other liquid versions of staked ETH tokens would trade at a lower price than real ETH.

One key implication is that the overwhelming majority of deposits occurred ahead of the FTX collapse: over 14.7M of the total 15.8M staked $ETH was deposited before November 2022. So most deposits occurred when $ETH was trading between $1500 - $3500 (and even above $4,000)

We could speculate that perhaps large institutional funds might need to recoup their locked capital through markets in real ETH. These are also likely to be players that could not participate in DeFi applications like Liquid Staking.

Perhaps just as importantly, there is competition between professional staking services: not all services offer the same APY rewards and each provider has a different commission rate (typically between 10-15%). Expect users to move between platforms for the best rates.

Third,

Once ETH staking can be freely unlocked, people will have more trust in the system and big money will be more confident to stake

The confirmation will bring significant relief for stakers and vested parties, as there has been recent FUD over a potential indefinite token lock-in for ETH staking. Now we can see the light at the end of the tunnel. If the Shanghai upgrade goes smoothly, this FUD also gets completely eliminated.

Lastly,

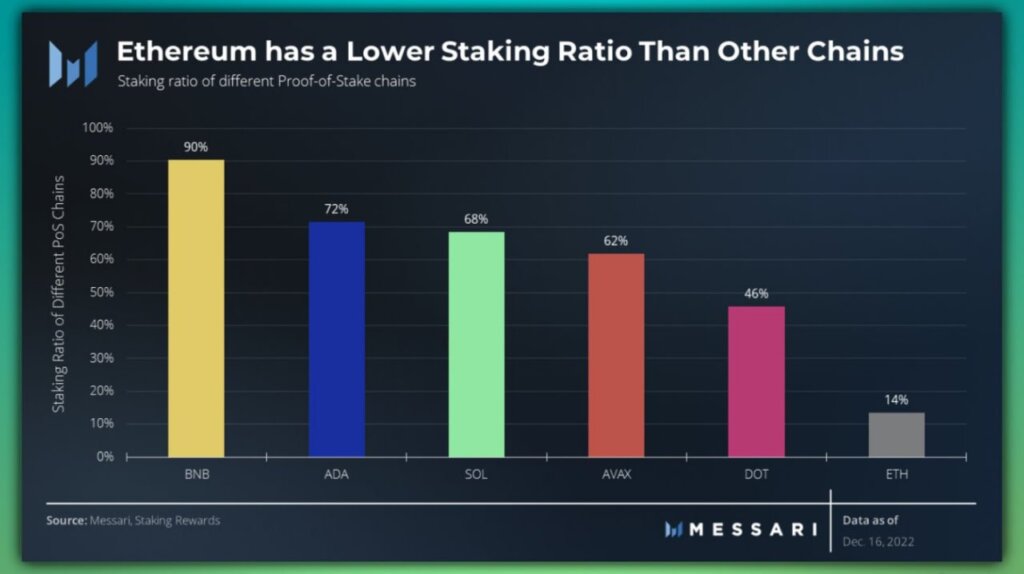

Ethereum currently has the lowest staking ratio when compared with other major chains. At just about 14%, the king of altcoins trailed behind other assets, such as Cardano [ADA] and Solana [SOL], which were above 70%.

Data from Messari showed Ethereum has the lowest staking ratio of any major Proof-of-Stake (PoS) chain. The staking ratio of other significant PoS chains ranged between 46%, going as high as 90% for BNB.

This has lead many to believe that Ethereum Shanghai upgrade will bring “a radical increase” in staked Ethereum, pushing the staking ratio higher and more in line with other chains. I personally believe this is the most likely scenario over the long term as well.

Why is this important for liquid staking derivatives like Lido Finance?

Liquid staking derivatives, or LSDs, is a popular way for people to stake Ethereum. Market leaders like Lido Finance address the locking issue by issuing a derivative token that represents the claim on the locked coins and the associated rewards. This allow users to trade their cryptocurrency assets without having to lock them up for long periods, and the derivative tokens can also be used elsewhere and potentially generating additional yield.

Governance tokens of top liquid staking products rally as Ethereum's Shanghai upgrade is set to "de-risk" ether staking by opening ETH withdrawals. The ability to freely withdraw rewards could increase demand for these platforms as people no longer have to trust the platform to hold your staked ETH.

Popular liquid staking derivative projects have all seen significant rises this week, the most notable market leaders are Lido DAO $LIDO, StakeWise $SWISE, and Rocket Pool $RPL.

TL;DR:

Ethereum Shanghai Upgrade and the unlocking of staked ETH may have Short term bearish volatility. This comes from people withdrawing to either recoup capital or shift staking provider.

But long term bullish as ETH staking will be much more trusted and bring in bigger stakers. Expect total percentage of ETH staked to increase quickly to match other POS networks.

Liquid Staking Derivative (LSD) Projects are seeing a major boost this week as the upgrade to unlock staked ETH seems to be confirmed to happen in March. This will likely drive more users and total value locked to LSD protocols as people will feel more confident staking ETH when it can be freely withdrawn.

Although this is a bullish development, the current price action of $LDO and other similar projects seem to be completely narrative and hype driven, so be careful speculating on this news after the coins have already pumped 70%.

News

Huobi sees $60M funds withdrawn in a day as insolvency rumor comes to light

- Huobi has confirmed that it will lay off 20% of its employees as part of a restructuring process following the acquisition of the company by Justin Sun.

- The company stated that the layoff ratio is currently not being implemented and that media allegations of the company's insolvency are untrue. Huobi has adjusted its business departments and implemented a new organizational structure after the acquisition by Justin Sun.

🟡 SUMMARY OF #HUOBI FUD

— Rock 🪨 (@DataaRocks) January 6, 2023

- Justin Sun to shutdown 1,100 staff Huobi China HQ

- Re-contracting all China employees to Huobi Global, Singapore

- Full-time employees become new staff with 3-Mth probation

- Revoked N+1 layoff compensation

- Revoked year-end bonus

1/🧵 cont'd pic.twitter.com/WDMbk2IQBk

- Huobi employees confirmed that Jusin Sun has implemented these measures forcefully, and shut down their internal comms channel. This has lead to many Huobi employees angry and without a job. People now fear for Huobi employees to run away with user assets, as the employees are Chinese, but the exchange technically is not regulated in China.

- Huobi sees $60M funds withdrawn in a day as insolvency rumor comes to light

Remember that $FTT buy wall at $22?$HThttps://t.co/BVfd49cYHw

— Uncle (APE certified) 🧢 (@UVtho) January 6, 2023

- Unfortunately, Huobi also has its own exchange token $HT and people quickly draw comparison to $FTT token of FTX.

- Justin Sun puts buy wall on HT to prevent price plunge, but seeing how 31% of Huobi's assets are in $HT token, it's looking awfully similar to the case of FTX.

- Regardless of whether Huobi pulls through or not, I still urge everyone to withdraw funds from Huobi ASAP.

SEC objects Binance.US's plans to acquire Voyager

The SEC has raised concerns about the $1.022 billion deal between Binance's U.S. arm and Voyager Digital, filing a "limited objection" to the acquisition.

The SEC has requested more information about the deal, including details on Binance.US's ability to fund the acquisition, the company's plans for operations following the deal, and how customer assets will be secured during and after the transaction.

The SEC has also suggested that Binance.US may not be able to afford the acquisition without potentially receiving funds from Binance's global entity. Voyager announced on December 19 that it had agreed to Binance.US's bid to acquire its assets.

If you were hit by the Voyager collapse, make sure to keep watching this deal play out as it could be the final hope for a quick resolution to recoup your funds.

Logan Paul vs Coffeezilla

YouTuber Logan Paul has threatened to sue fellow YouTuber and internet detective Coffeezilla for defamation after he accused Paul’s CryptoZoo nonfungible token (NFT) project of being a scam

It's arguable that traditional game markets and the Crypto NFT markets are vastly different and many legit NFT projects have suffered the same fate. However I still find it unacceptable for Logan Paul to have been involved in such a shady project and pushing to his followers, without taking any responsibility.

See this video of BitBoy's which covers both sides of the story and paints the full picture.

Judge rules Celsius Assets to belong to the Company

The U.S. federal judge has determined that customers of Celsius's "Earn" product, which provides interest on cryptocurrency investments, have given up control of their assets to the company, thereby making them part of Celsius's bankruptcy estate.

As a result, Celsius is able to maintain control over the assets in its Earn accounts. This ruling may affect investors in similar products from other platforms, a number of which have filed for bankruptcy in recent months.

Some customers had argued that Celsius had violated its contract or failed to meet its fiduciary responsibilities, but the judge determined that the company's terms of service were clear.

Crypto Bank Silvergate Collapse 46% after $8.1B withdrawals in Q4

Silvergate Capital's stock fell 46% after the company reported an outflow of $8.1 billion in digital asset deposits during the fourth quarter and laid off 40% of its staff, around 200 employees, in an effort to reduce costs.

The bank has also abandoned its plans to introduce a digital currency and has written off the $196 million spent on acquiring the technology and assets of Diem Association from Meta Platforms.

Despite these developments, the CEO of Silvergate stated that the bank has a cash reserve larger than its digital asset-related deposits and took measures to maintain cash liquidity in anticipation of potential deposit outflows. To address the outflows, Silvergate sold $5.2 billion in debt securities, resulting in a loss of $718 million.

The collapse of FTX first sparked the crisis for Silvergate, which held deposits for FTX units and Alameda Research, the trading firm at the heart of the crypto exchange’s downfall.

Market Watch

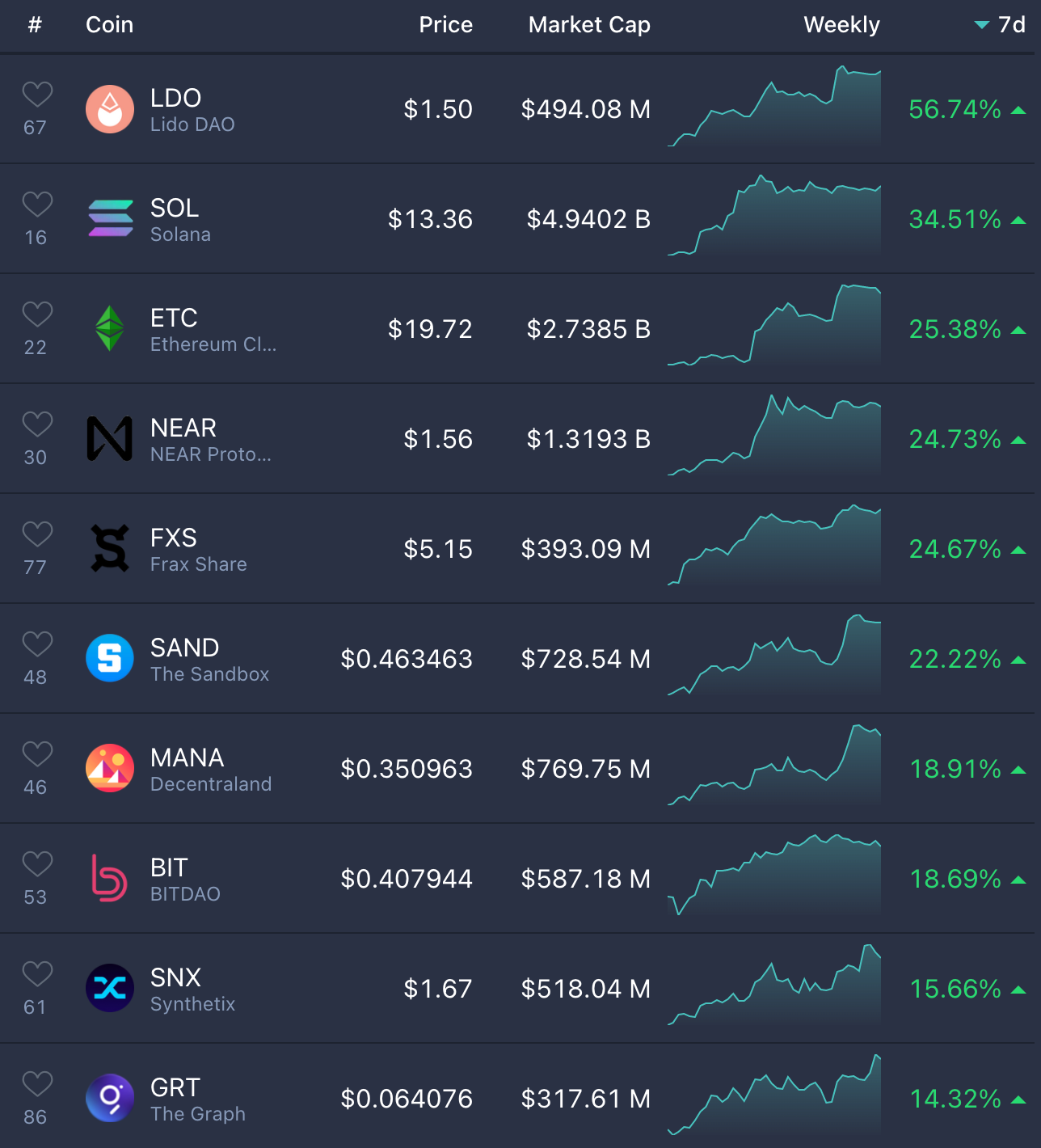

Top Performing Coins of the Week

LDO

The liquid staking derivative (LSD) has picked up steam, with the Shanghai Ethereum update set to unlock staked Eth. This bullish narrative caused a short squeeze on shorters trying to front run LDO's token unlocks

ETC and Near

Ethereum classic and Near are coins that were cumulated by Genesis, and with their rumored insolvency, there has been a growing short pressure. The shorts were blow out on the news that Genesis's loans cannot be recalled until maturity, which seems to be April 2023.

FXS

FXS has a fast growing Ethereum staking service, and with the recent LSD narrative booming, FXS is beginning to steal marketshare from other staking derivatives like Rocketpool.

BIT

BitDAO has a $100m buyback initiative currently. Starting on January 1st, BitDAO is buying $2m a day for 50 days. on Jan 14th, there is a ~$75m team unlock, however, the team haven't sold any of their tokens. Could the buy back be drawing exit liquidity for the team, or is the unlock purely coincidental?

SNX

Optimism has boomed in users over the bear market, gaining a significant amount of DAUs (daily active users). Investors have taken note of SNX's on the "real yield" narrative, as holders get more in fees from trades than GMX. Traders pay less fees on SNX, by 3x. SNX is also held by Genesis and this pump could also be fueled by shorters, but SNX is fundamentally sound regardless.

Important Upcoming Events

- January: DeGods and Y00ts migrate to Polygon

- January: LOOKS token unlock Jan 9th

- January: Mina Ethereum Bridge

- January: LDO vesting unlocks

- January: Alameda dumping coins (LDO, SOL, REN) due to chapter 11 proceedings

- January: Optimism Bedrock update

- January: Aave v3 update, followed by GHO stable coin

- January 16th: STFX public toekn sale

- February: DYDX vesting unlock

- February: Lyra Finance, a Optimism options protocol, is set to launch on Arbitrum

- March 2023: Ethereum Shanghai Hardfork

- 2023 Shibarium Launch (Shib + Bone) (unknown launch date)

- 2023: GMX potentially expanding to Polygon and BSC

- 2023: XRP lawsuit settlement

NEW VIDEOS

My Top 7 Altcoin Picks for 2023 (With Price Predictions)

6 Crypto Investing Mistakes to AVOID (If You Want to Get Rich)

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code APEX-BACON for Bonus)