10 Crypto Predictions for 2023

Happy New Year everyone! Welcome to issue #13 of the VirtualBacon Newsletter.

Before we start, I want to tell you guys about my upcoming course,

Primal Crypto Academy

If you're interested, click the button below to sign up for the early bird waitlist!

or go to primalcrypto.io

In this week's issue:

NEW VIDEOS ▶️

- My Top 7 Altcoin Picks for 2023 (With Price Predictions)

- 6 Crypto Investing Mistakes to AVOID (If You Want to Get Rich)

INSIGHTS 🧠

- 10 Crypto Predictions for 2023

NEWS 📣

- Wolf of Wallstreet Jordan Belfort shares Crypto portfolio strategy

- Binance.US set to acquire Voyager Digital assets for $1B

- BitDAO $100M buyback of $BIT token

- SBF bailed out for $250M bond

- Vitalik shows support Solana Developer Community

- Turkey Central Bank completes CBDC test

MARKET WATCH 📈

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS

My Top 7 Altcoin Picks for 2023 (With Price Predictions)

6 Crypto Investing Mistakes to AVOID (If You Want to Get Rich)

INSIGHTS 🧠

10 Crypto Predictions for 2023

1. Bitcoin bottom already in (or at least not worth waiting for lower)

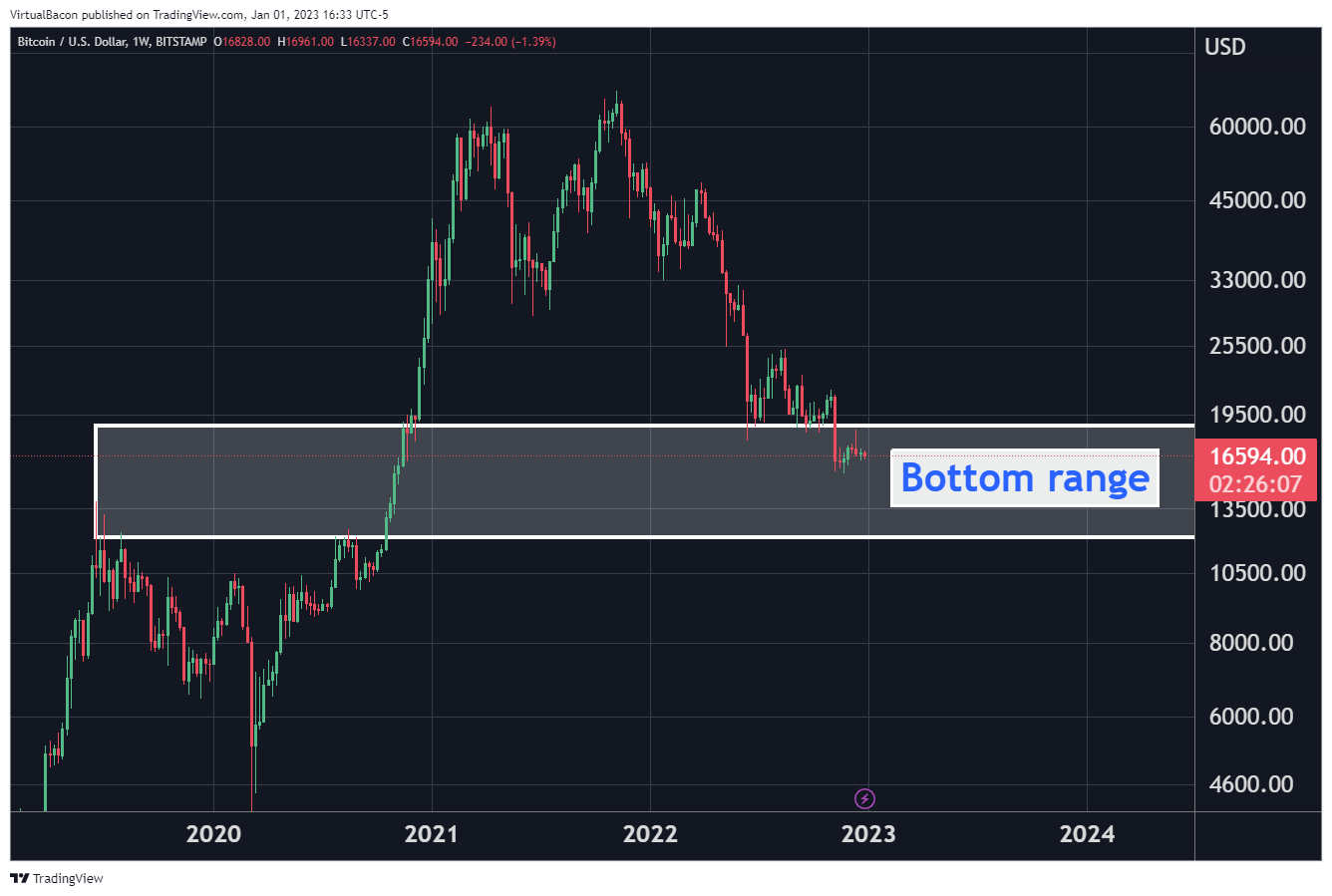

We have been following the same price range between $18k and $12k as the bottom range for Bitcoin. $18k was the last significant low from the LUNA crash in May 2021, while $12k is the previous highs from the accumulation in 2019 and 2020.

With the final straw of the FTX collapse, we have seen a convincing capitulation in Bitcoin as it has dropped to ast low as $15k. This has triggered the buying target that we have been waiting for, as Bitcoin price has hit the bottom target range.

Could it revisit $12k in the next months? Sure it's possible. But I don't think it is worth it to wait for such cases to play out anymore. Hunting for the last margin of 20% is simply not worth it.

We also need to keep in mind that everyone has been waiting for the $12k target to hit, therefore it'll likely be a sharp bounce if it does come, and will be difficult to catch.

2. Ethereum continues to eat away at Bitcoin's market share

Ethereum has continued to show incredible strength against all the major market events, and we can clearly observe this on its price. While Bitcoin and most Altcoins have broken their lows from the Luna Crash, Ethereum has still held above its $1000 key support level.

We can more clearly see the strength of Ethereum on the ETH/BTC chart. Since the start of the bull run in 2020, Ethereum has consistently outperformed Bitcoin and followed a steady uptrend on the ETH/BTC ratio.

With the support trendline now squeezing against the upper resistance of the ETH/BTC ratio at 0.08, the first half of 2023 will be a crucial time to watch for Ethereum.

If ETH/BTC can break above the 0.08 resistance, this will lead to Ethereum reaching even higher levels of market dominance.

3. Market starts to recover catalyzed by Fed Pivot and Bitcoin halving

2 major fundamental events are lined up in 2023 for a Crypto market recovery.

First and most importantly, the potential US Fed policy pivot in first half of 2023. If rate hikes are indeed slowed down or even paused, investor interest across all markets will instantly be revived, and Crypto will see a strong recovery.

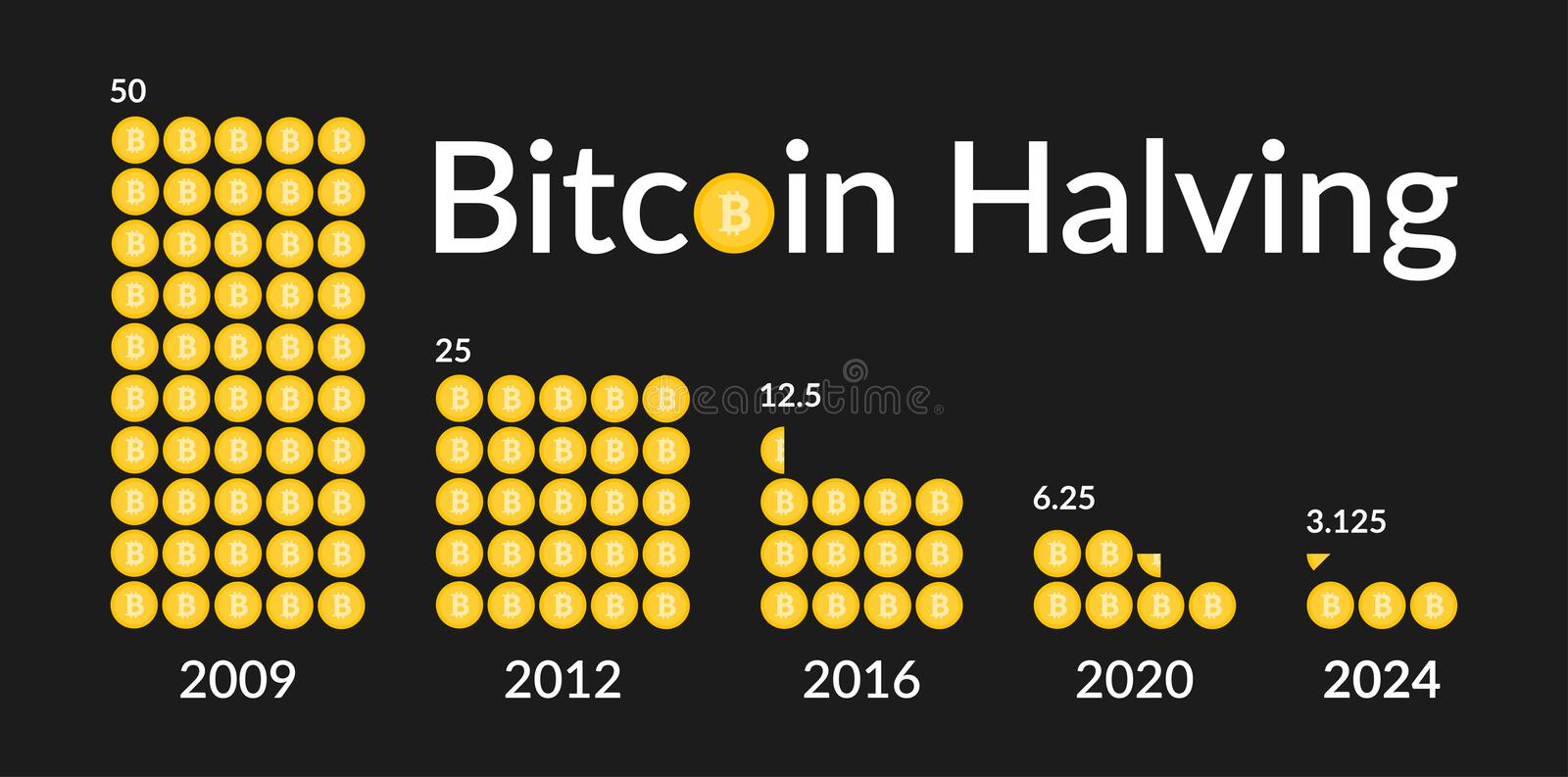

The second bullish event is the next Bitcoin halving that's scheduled for April 2024. Since Bitcoin's inception, it has followed a consistent 4-year price cycle indicated by the Bitcoin halving.

The market bottoms usually happen around 1 year before each Bitcoin halving, and the bull run typically lasts until 1 year after each Bitcoin halving.

This timeline also lines up with Bitcoin's bottom in the first half of 2023.

4. Ethereum 2.0 brings mainstream adoption

The third event is the continued upgrades and adoption of Ethereum 2.0

The Ethereum merge in 2021 was the first big step to improving the Ethereum user experience and revamping its economics for institutional adoption.

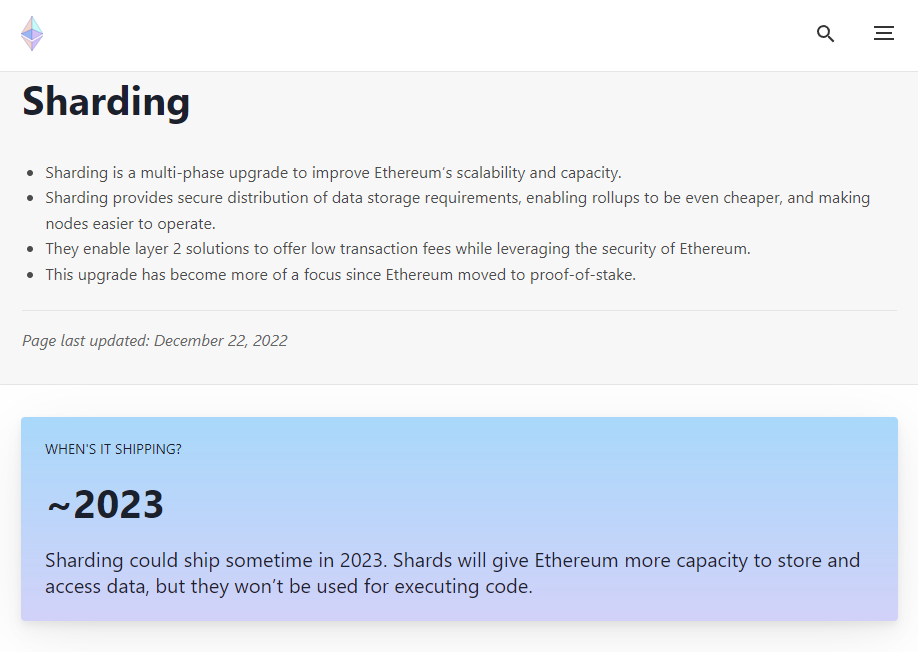

Going into the next cycle in 2023, Ethereum will continue to see speed and cost improvements thanks to ETH 2.0. Sharding will be coming sometime in 2024 which separates the main Ethereum network into different shards based on the intended usecase. This will further improve the usability of the network.

There is simply no second best for Ethereum’s network effects, and it’s now clear that Ethereum will become massively scalable in the future, the only question is when.

Another benefit of Ethereum 2.0 is that ETH issuance was cut down by over 90%. Combined with the token burning mechanism of EIP 1559, more ETH are burned everyday than there are new ETH created.This has truly made Ethereum a deflationary token.

So this means that as network activity increases, more ETH will be burned, further decreasing the ETH supply.

As Ethereum 2.0 is the biggest upgrade ever to the protocol, I’d expect many large players to still be skeptical about its new economic design. Therefore, I don’t think the deflationary nature and the 10%+ staking yield is priced in yet at current time. As more and more time goes on into the first half of 2023, people will start to see the stability of Ethereum 2.0.

The longer the time goes on, the less risky it is for Ethereum 2.0 to fail, and the more capital will be slowly deployed into Ethereum to take advantage of its deflationary nature and staking rewards.

I expect the full effects of ETH2 to kick in a year after the merge in mid 2023, which makes the current time an incredible opportunity to accumulate.

5. XRP Case Settlement

The lawsuit between Ripple XRP and the SEC has been dragged on forever, but it really does look like we could get a settlement in late spring/early summer.

The whole premise of the case is to determine whether or not XRP is a security.

Could it be argued that Ripple should own less of the XRP supply and make the network more open? Sure. While there are many thing I don't like about XRP such as its centralization and poor tokenomics, I still think XRP should not be classified as a security.

Aside from being used as a settlement asset on Ripple Network for global payments, it's also being used as the native gas token on the XRP Ledger, along with many other DeFi usecases.

If this case does conclude in XRP's favor, it will be a massive win for the Crypto industry as a whole, as XRP becomes one of the few coins that is regulated and set as a precedent for the Crypto space.

Do not underestimate the significance of this event, as it will not only impact XRP's price, but also all coins related to payment networks in the future.

If XRP wins, fully expect payments coins to rise and become a popular narrative in the next cycle.

If XRP loses, the opposite will happen.

6. Lots of Crypto regulations

Most of the upcoming regulations on cryptocurrency are expected to be positive, but some may be negative. These regulations will likely vary by region and will not necessarily be the same worldwide.

The European Union is set to release its final regulations on cryptocurrency markets early next year, but they will not go into effect for another one to two years. These regulations will provide institutional investors with clarity on how to approach investing in cryptocurrency, particularly altcoins.

We've seen new investors being burnt by shady lending platforms and exchanges which have all been shown to steal customer funds. The ever increasing accessibility of Crypto is also harmful to retail investors, as shady ICOs and rugpulls are much more commonplace today than in the last cycle.

The lack of regulatory clarity has been a major barrier for institutional investment in the past. The establishment of clear regulations could lead to a surge in investment and potentially contribute to a recovery for the cryptocurrency market in the first quarter of the year.

However, it's worth noting that some of these regulations may be harmful, particularly those related to peer-to-peer payments, decentralized finance, privacy, and self-custody. These areas pose a threat to the traditional financial system, and so may be subject to stricter regulation.

7. Decentralized Exchanges to go mainstream

While DeFi platforms remains volatile for majority of retail users, Decentralized Exchanges are at the tipping point of mainstream adoption. When Shiba Inu was taking over the internet by storm, we've seen brand new investors onboard into MetaMask and TrustWallet particularly to trade on DEXs. The user experience of DEXs have become accessible enough for the everyday investor.

But I expect much more users to start trading on Decentralized Exchanges for 2 reasons.

First, the fall of FTX and doubt across all Crypto exchanges have made all investors lose trust in centralized exchanges. People are treating them much more like a platform to buy coins, rather than a bank to store their money.

Second, regulations have made it impossible for users to protect their privacy or even access any platform at all. KYCs are being enforced by all centralized exchange today, and it isn't just for large deposits/withdrawals, but all functionalities are restricted if you do not complete KYC.

If you are a resident of the US or Canada, you are almost out of options for all exchanges today. Coinbase, Binance, ByBit, Huobi, Kucoin, basically no exchange supports US or Canadian residents now. Not only this, but advanced features like Futures trading, staking, new token sales, are all banned by regulation. Just last month, Canada has completely banned Leverage Trading in the country.

Even if you live in a less restrictive country, gone are the days of trading Crypto freely, as every exchange will require you to KYC and tag all your deposits and withdrawals to track all your on-chain activities.

While these measures do protect us from hacks and scams, it does take away the self-sovereign nature of Crypto investing, and I believe Decentralized Exchanges will truly become mainstream in the next cycle.

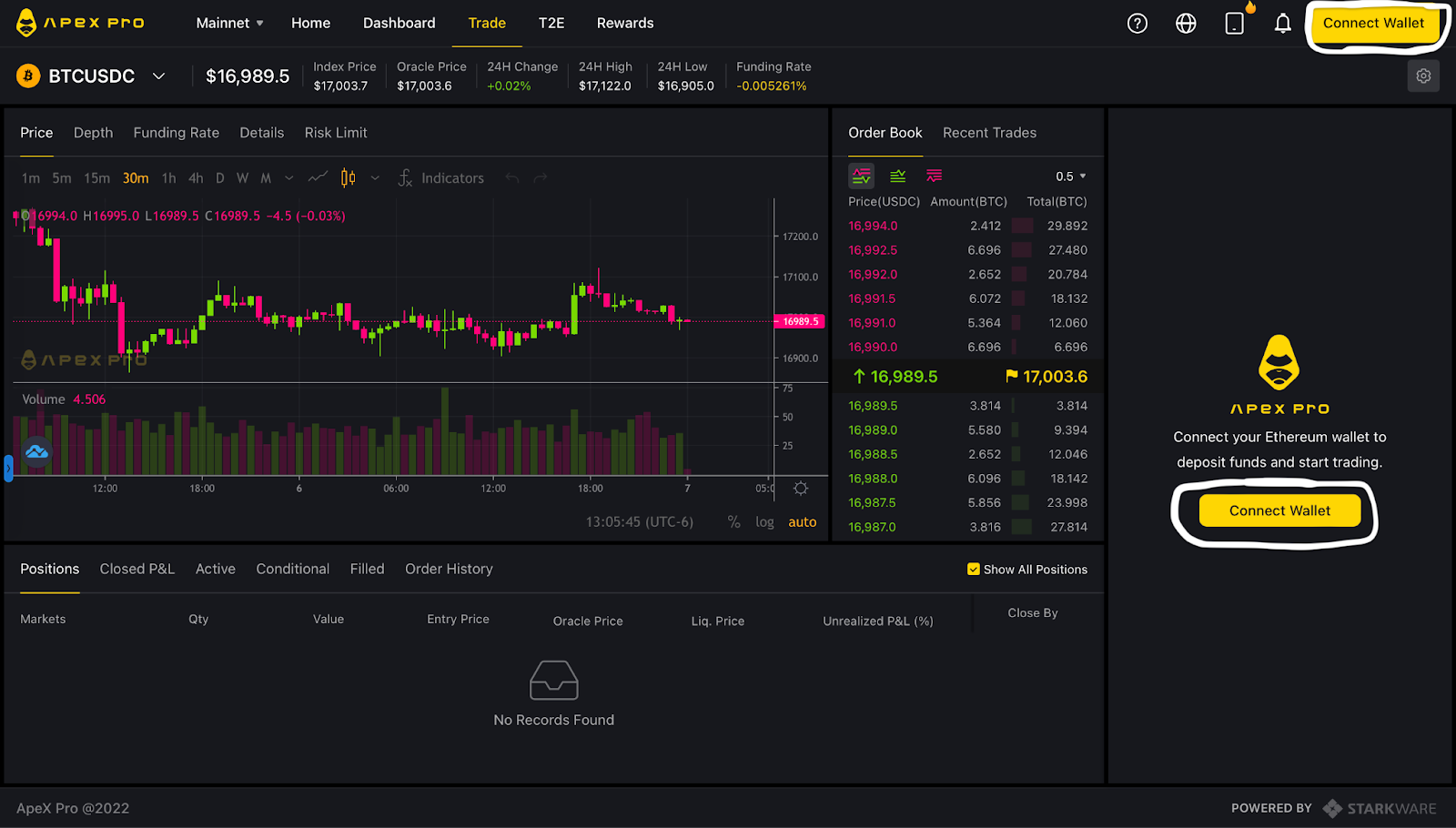

Luckily, the technology has advanced so much that you aren't giving up much. Take Apex Exchange for example, they're by far my favorite exchange today, as you can easily onboard to it directly from MetaMask, and start trading with any type of order, even with upto 30X leverage. I can also rest assured as they are made by the team from ByBit, and carries the same security and world class liquidity.

They also have a trade-to-earn campaign right now where you can earn a few hundred dollars per month as reward just by trading on the platform.

This is not sponsored by Apex, however I do have an affiliate link with the platform if you want to check it out. 👇

Fully expect many top centralized exchanges to release their decentralized counterparts in 2023, and pay attention to this new narrative forming.

8. More countries to adopt Bitcoin as legal tender, payments, and global trade

After El Salvador and Central African Republic adopted Bitcoin as legal tender, countries now have a clear path to adopt Bitcoin in order to fight hyperinflation, sanctions, or other forms of economic crisis.

On top of the list of next countries to adopt Bitcoin as legal tender, we have paraguay, Venezuela, Ukraine, Russia, and Zimbabwe. You start to notice a pattern quickly.

Another option for countries to utilize Bitcoin is through adopting it as a payment method and global trade asset. Brazil made the plunge last month, and we could see more countries opting for this route to get around sanctions.

9. Ecommerce giants to continue integrating Crypto Payments

Big tech companies are expected to continue announcing cryptocurrency integrations in 2023, as Crypto has shown incredible interest and maturity in the last cycle.

The first area of adotion is Crypto as payment solutions. We've seen Visa, Stripe, and PayPal all integrate Ethereum wallets for their merchants and customers. This is clearly a move to generate revenue due to increasing interest to transact in Crypto. Apple and Amazon have both hired for crypto-related positions in recent years, and if they do announce Crypto integrations they should be in the area of payments as well.

10. Tech giants to embrace Decentralized Social Media

The other major narrative that's taking over tech giants' boardrooms, is the call for open and decentralized social media platforms.

Some have already made moves. Twitter, in particular, is expected to integrate crypto features on its platform, both in forms of payment and social activities. Elon Musk has laid out the plans to turn Twitter into a super app with wallet, social, and payments built into one. Binance and CZ seems to be in on the mix, having invested $500M in the Twitter acquisition.

Meta and Instagram have also announced their integration of multiple blockchains including Ehtereum, Polygon, Solana, and Arweave to host their NFTs and decentralized storage.

It's also worth noting that the adoption of crypto by big tech companies could be connected to the metaverse, as users are dissatisfied with centralized versions created by firms like Meta. Meta's role in the crypto world may involve providing hardware and access points that enhance the user experience, but hopefully they can eventually turn to decentralized alternatives in order to generate revenue from the technology.

NEWS

Wolf of Wallstreet Jordan Belfort shares Crypto portfolio strategy

Bitcoin + Ethereum

Jordan explains that he wouldn't own any coins outside of Bitcoin and Ethereum.

Opening with the FTX fraud debacle, Jordan alludes to most coins getting repriced, in 2023, or possible struggling against the less risky BTC and ETH.

Jordan Belfort hasn't sold any crypto, and is currently accumulating both of the majors, even though he believes the market could dip lower.

Eth and BTC are more in tune with his risk appetite, and believes these two will be substantially higher in the coming years.

Reevaluating Altcoins

Jordan adamantly believes selling during bouts of fear is the worst thing to do possible, but not if the asset continues to fall.

He says to examine each one, refer back to the fundamentals, and more importantly, the reason why you bought the coin.

Was it an asset you really believed in, or one you thought you could sell to a greater fool?

Jordan would personally sell all other altcoins he bought during the hype, and hold all coins he believed in.

Portfolio Strategy

Jordan says diversifying is key.

Jordan only has around 10% of his portfolio in crypto and he suggests others to do the same, something we've seen echoed by Mark Cuban.

Jordan then explains the boomer ideology of putting upwards of 80% of your money into the S&P 500, with some money reserved in bonds and other assets.

My Take Away

Jordan is a well respected individual among many investors, and his words should not only serve as advice, but also a litmus test for traditional investor sentiment towards crypto.

I would restructure his advice around only holding Bitcoin and Ethereum. I keep the majority of my crypto holdings in Bitcoin and Ethereum, while holding a select baskets of alts I believe will survive any possible long bear market. (AR, UNI, Matic, my top 2023 Altcoin list)

Diversifying should be something you practice with exchanges and wallets. However, with assets, this must aline with your financial goals and appetite. If you have a large risk appetite, then you could make a larger ROI by holding more altcoins, but this comes with more risk. Conversely, if you don't have a large risk appetite, then crypto should only account for a faction of your overall portfolio, especially altcoins.

Concentrated positions can create wealth, but they can also create risk - Warren Buffett

Binance.US set to acquire Voyager Digital assets for $1B

- Binance.US will acquire assets of bankrupt crypto lender Voyager Digital for $1.022 billion. After a review of strategic options, the firm said that Binance.US represented the “highest and best bid for its assets.

- The $1.022-billion bid consists of the fair market value of Voyager’s cryptocurrency portfolio at a to-be-determined date in the future, along with an additional consideration equal to $20 million of incremental value

- The deal is set to close by April 18, 2023

- Binance has agreed to make a $10-million deposit in good faith and will reimburse Voyager for certain expenses up to a maximum of $15 million. A hearing will be held by the presiding bankruptcy court to approve the purchase agreement on Jan. 5, 2023. In addition, the sale is subject to a creditor’s vote and other customary closing conditions.

- Voyager's committee of unsecured creditors said that it believes that the Binance.US bid "appears to be the best transaction at this time," though said it was "still evaluating" given a limited timeframe to evaluate the decision

BitDAO buyback

- The price of BitDAO’s bit token jumped more than 20% in less than 24 hours ahead of the expected approval of a $100 million buyback plan

- The buybacks are slated to begin on Jan 1., and the DAO will purchase bit at $2 million in USDT a day for 50 days.

- The proposal cited "limited deployment opportunities" as one of the reasons for returning excess capital back to token holders.

- Even after the repurchase program, the BitDAO treasury is expected to maintain $300 million in USDT and USDC, with an additional 270,000 in ether worth around $345 million.

SBF bailed out for $250M bond

- News outlets all around the globe reported that Bankman-Fried got out of jail by posting a gargantuan, unprecedented “$250 million bond.” In court, Assistant U.S. Attorney Nicholas Roos described it as the “largest ever” pretrial bond.

- bail bondsman would charge between 10%-15% of the amount in cash to issue a surety bond or “bail bond.” In the case of Bankman-Fried’s astronomical bond, 15% of $250 million would be $37.5 million. But Bankman-Fried did not pay $37.5 million for his bond

- There is a second way to acquire a bail bond. A defendant, or someone on their behalf, may pledge collateral in the full amount of the bond.So, in Bankman-Fried’s case, that would mean he would need a benefactor to step up and pledge property worth $250 million to get the bond. But that did not happen either.

- Instead, Bankman-Fried’s parents promised to pledge as collateral their Palo Alto, California, home, where he'll also be staying under house arrest. The Palo Alto home is rumored to be worth $4 million. And that is the full extent of the collateral pledged to guarantee the $250 million bond. No other collateral was posted or promised.

Vitalik shows support Solana Developer Community

- SOL rebounded from Thursday’s low of $8.19 and retook the $9.50 range where it had been trading for much of the day

- “Some smart people tell me there is an earnest smart developer community in Solana, and now that the awful opportunistic money people have been washed out, the chain has a bright future,” Buterin tweeted shortly before SOL’s Thursday recovery began.

- For SOL to recover it will likely have to shake off its association with Bankman-Fried, who invested heavily in SOL and supported Solana projects with FTX venture deals and market-making from Alameda Research.

Turkey Central Bank completes CBDC test

- The Turkish central bank first announced it was looking into the benefits of introducing a digital Turkish Lira in September 2021 in a research project called “Central Bank Digital Turkish Lira Research and Development.”

- noting it had “made no final decision regarding the issuance of the digital Turkish lira.”

- Several countries, including the United Kingdom and Kazakhstan, have recently begun piloting central bank digital currencies.

MARKET WATCH 📈

BIT

BitDAO passed a proposal for a $100m buy back program. The DAO will purchase $2m a day starting Jan 1st, lasting for 50 days total.

LDO and RPL

Lots of chatter on Twitter around the Ethereum Liquid Staking narrative this week. This is likely due to the upcoming Ethereum ShangHai Upgrade that will finally unlocked staked ETH to be withdrawn from Ethereum 2.0.

Lido and Rocket Pool are the two leading platforms in this area

APE

With the introduction of staking last month, Ape has faced a regeim of negative funding and open interest. This means that the shorts are paying longs >100% apy to keep their positions open. So when price turns bullish, shorts either must pay for their positions to stay open in the red, or cover their position (rebuy) and seek a better entry. This leads to explosive, yet weak price action.

Important Upcoming Events

- January: 1Inch Fusion Update

- January: DeGods and Y00ts migrate to Polygon

- January: GNS To enter Arbitrum ecosystem

- January: LOOKS token unlock Jan 9th

- January: Mina Ethereum Birdge

- January: LDO vesting unlocks

- January: Alameda dumping coins (LDO, SOL, REN) due to chapter 11 proceedings

- January: Venus VXS v4 update

- January: Optimism Bedrock update

- February: DYDX vesting unlock

- March 2023: Ethereum Shanghai Hardfork

- 2023 Shibarium Launch (Shib + Bone) (unknown launch date)

- 2023: GMX potentially expanding to Polygon and BSC

- 2023: XRP lawsuit settlement

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code APEX-BACON for Bonus)