Crypto Weekly Digest | January 23, 2023

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon

In this week's issue:

NEWS 📣

- Genesis Files for Bankruptcy

- Robinhood launches Crypto Wallet

- 1inch launches Hardware Wallet

- Australian National Bank launches CBDC $AUDN

- Three Arrows Founders building new exchange GTX

- AI Cryptos narrative picking up

- Fantom launch ecosystem initiative to share transaction fees

- Firesale on Coindesk?

- Circle building cross-chain bridge for USDC

MARKET WATCH 📈

- Top Performing Cryptos of the Week

- Important Upcoming Events

NEW VIDEOS ▶️

- My Top 10 Crypto Predictions for 2023

News

Genesis Files for Bankruptcy

Genesis Global Holdco LLC, the umbrella company of Genesis Global Capital, filed for Chapter 11 Bankruptcy Protection in the United States U.S. Bankruptcy Court for the Southern District of New York. This is a legal process that allows businesses to restructure their debt while continuing to operate.

The company estimated its liabilities in excess of $1 billion to $10 billion, with its top 50 creditors being owed over $3.5 billion. The filing affects the crypto lending business, which was severely impacted by the collapses of hedge fund Three Arrows Capital and crypto exchange FTX. The filing does not affect the derivatives, spot trading, and custody businesses.

Digital Currency Group, the parent company of Genesis, was not involved in the decision to file and stated that it intends to address its own obligations to Genesis during the restructuring process. As a result of the filing, customers of the Gemini crypto exchange, which had been locked out of their funds, may be able to recover their assets.

Robinhood launches Crypto Wallet

Robinhood, a retail trading giant, has released its digital wallet to more than one million people who had previously been waitlisted. The Robinhood Wallet app, a standalone smartphone app, allows users to trade, transfer, and view non-fungible tokens (NFTs). It is supported by over 50 tokens, including Compound, Polygon, Shiba Inu, Solana, USD Coin, and Uniswap. The wallet will be compatible with Ethereum and Polygon, two leading smart contract platforms, but will likely add more EVM compatible networks with time.

Using Polygon as a layer-2 scaling solution, users can convert tokens without incurring network fees. Additionally, those with access to the app will receive $5 worth of crypto in their wallet. To gain access, customers will receive an email with the code for the Robinhood Wallet iOS app. With the release of the digital wallet, Robinhood has made it easier for college students to access and use cryptocurrency. By providing access to tokens, trading, and other features, Robinhood has made it more accessible and convenient for college students to engage with crypto assets.

1inch Launches Proprietary Hardware Wallet

DEX aggregator 1inch Network officially launched its proprietary hardware wallet called “the 1inch Hardware Wallet.” The proprietary hardware wallet developed by an independent team working within the 1inch Network is “fully air-gapped” and comes in the size of a bank card, featuring a 2.7-inch E-Ink grayscale touch display.

It also features a damage-resistant Gorilla Glass 6 surface and stainless-steel frame and comes with wireless charging support. The wallet will also feature two limited edition versions in pink and gold with some design changes and corresponding NFTs.

Three Arrows Founders building new exchange GTX

Su Zhu and Kyle Davies, the managers of hedge fund Three Arrows Capital, plan to launch a new crypto exchange named GTX. They have partnered with the founders of CoinFLEX, a failed exchange, and aim to raise $25m.

The exchange will focus on trading cryptocurrency claims made by creditors of failed crypto-related ventures, a market worth $20 billion. However, the partnership between CoinFLEX and GTX has faced criticism from the crypto community due to the similarity in name with the now-defunct exchange FTX.

A leaked pitch deck for GTX attempted to justify the name by stating "because G comes after F" and claiming the platform was designed to fill the "power vacuum" left by FTX and appeal to claim holders. CoinFLEX has issued a statement in response to these concerns, emphasizing their commitment to transparency and stating that the funds raised will be used for operational growth and to increase value for creditors.

Australian National Bank launches CBDC $AUDN

NAB plans to launch AUDN, a stablecoin backed by the Australian dollar, on the Ethereum blockchain and Algorand smart contract platform in the summer of 2023.

AUDN’s applicability could extend to carbon credit trading, overseas money transfers and repurchase agreements. It would also be used for more efficient and cheaper settlements than the opposing interbank cross-border payment solution offered by SWIFT.

NAB’s stablecoin is backed entirely by the bank’s own capital, reassuring consumers against the current volatility of the wider cryptocurrency market. In addition, AUDN will enable users to settle transactions on the blockchain in real-time through a process called ‘atomic settlement,’ which allows multiple parties to settle linked transactions simultaneously. NAB also plans to offer stablecoins in “multiple currencies” in accordance with its regional licensing agreements.

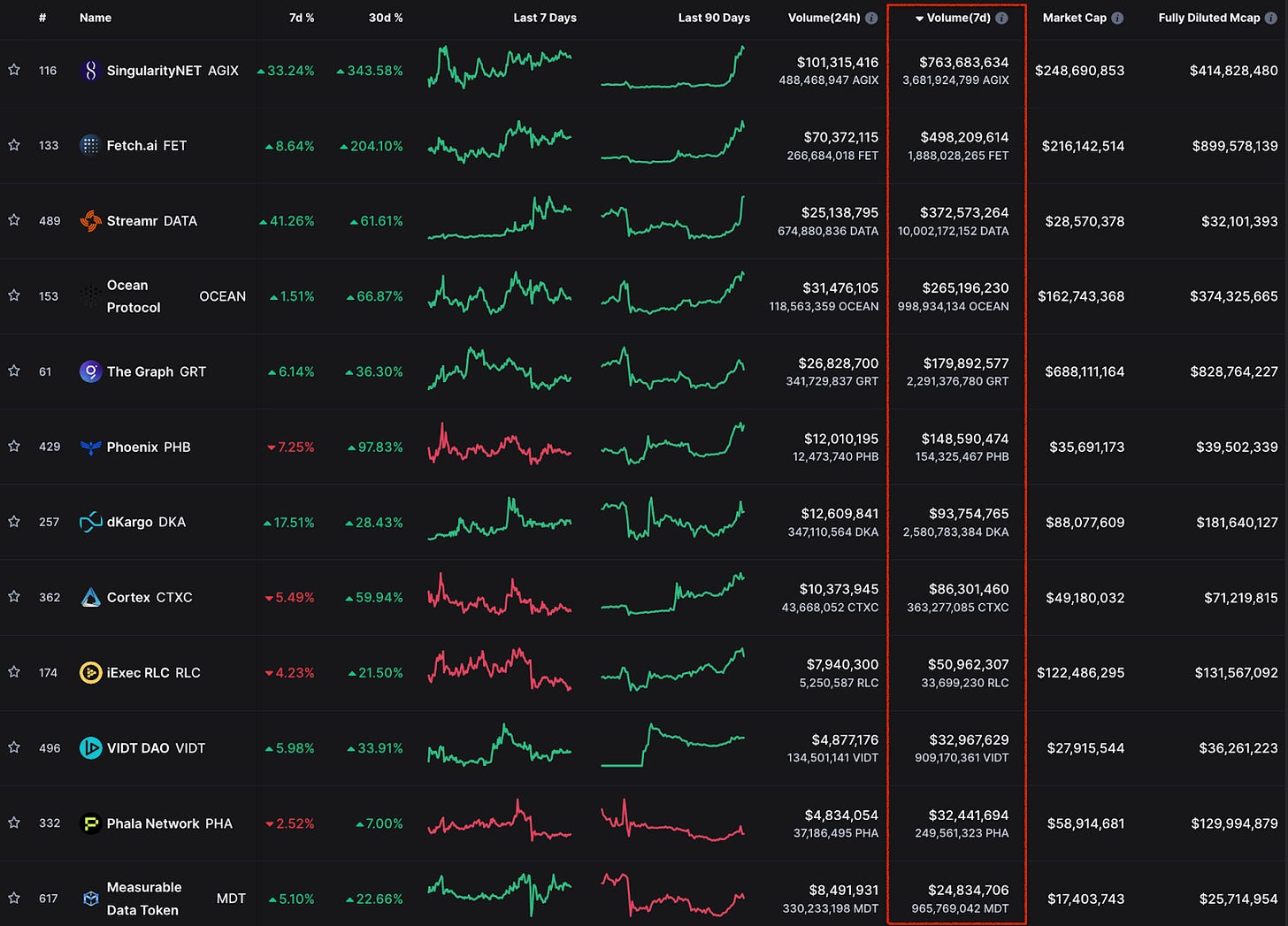

AI Cryptos narrative picking up

Lots of green and solid performance in the AI coins sector over the past few weeks. The thing about AI coins is that they give off similar vibes to metaverse tokens during the last bull run. The fundamentals are probably still too underdeveloped at this point in time, but the narrative is powerful in capturing the imagination of users. Of what the future may look like and how the technology will be utilized. All we have to look at is how everyone has recently been gushing about ChatGPT.

The concept of promising the future is a hallmark of crypto. People thinking that the metaverse is the future heavily contributed to gaming tokens going vertical in 2021. Do you think AI is the future?

Fantom launch ecosystem initiative to share transaction fees

Fantom has created an innovative way to support projects and applications that are building on its blockchain. They have launched a decentralized vaults product, called Ecosystem Vault, which is an on-chain fund financed by 10% of the transaction fees on Fantom. This fund is controlled by the community and serves as an opportunity for projects to receive funding for their efforts to build innovative dApps on Fantom.

In order for a proposal to be funded, it must receive at least 55% approval from the community, with at least 55% of FTM stakers in attendance. This is made possible by decreasing the burn rate of FTM on fees earned and redirecting the resulting 10% to the vault.

Through this initiative, the Fantom community will have the chance to grow through incentivizing builders and users. These funds will likely go back to Fantom users, likely through LP incentives.

Firesale on Coindesk?

CoinDesk, one of the most popular crypto news publications, is exploring the potential of being sold.

The media company recently hired Lazard, a financial advisory firm, to help with the process. This news comes on the heels of a story broken by CoinDesk about FTX's balance sheet – later being found insolvent. This story has caused multiple regulatory investigations and even the collapse of the exchange, as well as issues for a related crypto lender.

CoinDesk was founded in 2013, and has been a leader in publishing news surrounding cryptocurrency and blockchain since then. CEO Kevin Worth has stated that the company has received numerous inquiries about the potential sale. As the future of cryptocurrency continues to grow, CoinDesk is looking to capitalize on their success and continue providing quality reporting on the industry.

Circle building cross-chain bridge for USDC

Cross-Chain Transfer Protocol (CCTP) is an on-chain protocol that simplifies the process of transferring USDC across different blockchains.

CCTP allows users to burn native USDC on one chain and immediately mint the same amount of USDC on another chain. This eliminates the need to use a conventional “lock-and-mint” bridge, which has potential security risks and results in fragmentation of liquidity.

Developers can easily incorporate CCTP into their applications and provide users with a more capital efficient and user-friendly experience. CCTP unifies liquidity across the entire ecosystem and makes transfers of USDC more convenient.

Market Watch

Top Performing Coins of the Week

Most of the top performers this week are either some of the most fundamentally strong projects or the most shorted coins – only fueling buy pressure on short squeezes.

APT

Aptos is a token that has strong fundamentals, but there is immense short interest on the token. This short interest is likely due to unlocks, VC allocations, hedging, ect. Due to the low circulating tokens, APT is very illiquid in spot markets, marking it easily susceptible to pumping when the market turns green. While it can go a lot higher, APT will likely come back down into a more reasonable range in the weeks and months to come

APT Fully diluted market cap has now surpassed Avax, Sol, and Matic's FDV.

CRV + CVX

Curve and Convex are some of the strongest tokens in DeFi. CRV emissions are key to incentivize yield on different stablecoin pools. This has led to dozens of projects buying crv to drive their products yield, most notably FXS and LDO are some of the biggest buyers.

Convex is the largest holder of CRV, and holds ~40% 0f circulating supply. This means that Convex essentially controls the yield on Curve, and their governance token, CVX, is the governance token for this. Each CVX has 5.44 CRV locked. CVX also is a large holder of FXS.

AXS

Axie Infinity's governance token, AXS, was likely spurred on by the metaverse narrative, and has since broke out of its previous range. This move was likely speculators squeezing out shorts. AXS can pump, but its not as fundamentally strong as other metaverse projects.

OP

Optimism is one of the fundamentally sound projects on this list. This last move was likely shorts covering positions, but there are more long term buyers in the lows. Now, as OP enters price discovery, there will be little resistance to hold OP back, if we continue to go higher.

FXS

Frax has been a powerhouse recently, in regards to the liquid staking service. They have garnered an immense amount of staked Eth, and already have a war chest of CRV + CVX, so Frax can easily out incentivize their competition. This could be a key narrative, given Eth stakers are chasing the highest safe yields.

SHIB

Again, shorts covering + squeezing. However, this shows that early retail is here and willing to play. This is a sign that we can go higher, as retail chases.

Important Upcoming Events

- January: Curve Finance Stablecoin launch

- January: AAVE $GHO stablecoin public testnet

- January: Optimism Bedrock upgrade testnet

- Feb 2: DYDX massive token unlock with 105% of circulating supply distributed to investors

- Feb 4: $FLUX halving

- Feb 28: Filecoin FEVM release

- Feb: Shiba Inu's Shibarium Layer-2 launch

- March: EOS Trust EVM mainnet launch

- March: Ethereum Shanghai Hard Fork

- Q1: Redacted Cartel $BTRFLY launching $DINERO stablecoin, collateralized by LSDs

- Q1: DCG to liquidate main investment holdings including $API3, $HBAR, $ZEC, $FLOW, $MANA

NEW VIDEOS

My Top 10 Crypto Predictions for 2023

END

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out my recommended exchanges:

Binance - #1 Exchange in the World (Use code VirtualBacon for $600 Bonus)

APEX: ByBit's DEX - TRADE WITHOUT KYC (Use code APEX-BACON for Bonus)