Aptos vs Sui

What is Aptos

Aptos is a highly scalable layer-1 blockchain. It was founded by developers who formerly worked on Diem, Meta's abandoned blockchain initiative, providing a solid foundation for the project.

Aptos is co-founded by Mo Shaikh (CEO) and Avery Ching (CTO), both former Meta employees with extensive experience in the blockchain industry. The team at Aptos Labs consists of a diverse group of PhDs, researchers, engineers, designers, and strategists. They have also expanded by acquiring several former Solana staff, including Austin Virts, former Head of Marketing at Solana.

Aptos incorporates elements from Diem's blockchain and Move, a Rust-based programming language developed by Meta. The network is designed to process over 130,000 transactions per second using its parallel execution engine (Block-STM), resulting in low transaction costs for users.

Unlike most blockchains, which execute smart contracts sequentially or require massive parallel workloads, Aptos processes all transactions simultaneously and validates them afterward. Failed transactions are aborted and re-executed, thanks to software transactional memory (STM) libraries that detect and manage conflicts. This approach streamlines the network's throughput capacity, addressing a major bottleneck for other layer-1 blockchains.

Key features of Aptos include:

- Flexible smart contract architecture, enabling seamless upgrades and improvements.

- Robust security measures, ensuring the protection of user data and assets.

- Enhanced scalability, allowing the platform to accommodate increasing transaction volumes.

With the knowledge gained from working on Diem's codebase, Aptos Labs aims to create a general-purpose blockchain network that can compete with existing blockchains like Bitcoin and Ethereum. The primary goals are to revive Diem's technology, utilize Move programming language, and ensure high throughput, low latency, and verifiable state synchronization in a decentralized network by leveraging Diem's architecture and novel techniques.

What is Sui

Sui is an innovative layer-1 blockchain project by Mysten Labs that aims to revolutionize the world of decentralized technology. Sui is designed to be the first internet-scale programmable blockchain platform, capable of instant settlement, high throughput, low latency, and cost efficiency to power applications for billions of users.

Similar to Aptos, Sui was founded by a team of researchers who previously worked at Novi Research (Meta’s advanced crypto R&D team). Among the founders is CEO Evan Cheng, who formerly headed research and development for Meta’s crypto wallet effort.

Unlike traditional blockchains, Sui is designed to scale horizontally, organizing data into independent objects and allowing transactions to be executed in parallel. This groundbreaking approach reduces computational power and transaction costs, making it an ideal solution for large-scale applications in the education sector.

Sui's primary features include:

- Unbounded horizontal scalability, allowing the platform to meet application demand while maintaining low operating costs per transaction.

- Parallel execution of independent transactions, eliminating the bottleneck present in traditional blockchains.

- Byzantine consistent broadcast, providing safety and liveness guarantees without the overhead of global consensus.

As a result, Sui offers unmatched scalability and instant settlement of transactions. Its authorities can add workers to increase processing power as network capacity grows, ensuring lower gas fees and improved user experiences for web3 applications in education.

Sui represents a crucial step forward in blockchain technology, promising a future where decentralized platforms can accommodate the increasing demands of applications and users in the education sector. Stay tuned for more updates on this groundbreaking project.

Shared Origins of Aptos and Sui

Diem is the failed cryptocurrency payments project originally created by Meta (formerly Facebook)

After years of seeking regulatory compliance, Diem ended abruptly in 2022. This led to the emergence of two innovative blockchain networks, Aptos and Sui, which stemmed from the collaboration of former Diem employees.

Cumulatively, both chains represent the culmination of years of distributed ledger scalability research, and have gained significant traction within the space over the past six months.

Consensus Mechanism Comparison

Aptos and Sui. While both networks employ proof-of-stake as their consensus mechanism, their distinct consensus algorithms and architectural designs result in unique capabilities and implications for the future of blockchain technology.

Aptos blockchain uses the fourth iteration of its consensus protocol, Aptos BFT, which is an advanced and low-latency consensus mechanism. Aptos BFT is derived from HotStuff, the original consensus protocol used in Diem (previously known as Libra). The key features of Aptos BFT are:

- Innovative reputation system: Aptos BFT includes a unique reputation system tailored for decentralized environments. It analyzes on-chain data and automatically adjusts leader rotations to compensate for unresponsive validators without human intervention, ensuring high availability and robustness.

- Fast validation and finality: The consensus protocol allows Aptos to validate transactions in under a second, with blocks committed in shorter trips (down to 2). This results in sub-second finality as the average occurrence, making the blockchain highly efficient and responsive.

- Parallelization with BlockSTM: Aptos employs parallelization techniques by dynamically detecting dependencies and scheduling execution tasks using BlockSTM, a derivative of the HotStuff consensus protocol. This approach enhances the throughput and overall performance of the blockchain.

The Sui blockchain uses a unique consensus mechanism that differentiates it from traditional blockchains like Aptos. Its distributed ledger is based on a directed acyclic graph (DAG) rather than a linear blockchain, which affects its consensus mechanism and scalability.

Sui employs an asynchronous consensus protocol called Narwhal and Tusk, which divides responsibilities for data availability and ordering. This design enables Sui to parallelize the execution of many transactions.

The key differentiator of Sui from other Layer 1 (L1) solutions is that it does not rely on the consensus protocol for all transactions. Instead, it runs consensus only when needed to checkpoint its state and for transactions that require total ordering. Sui leverages "causal ordering" for most transactions, allowing it to bypass consensus when unnecessary.

Causal ordering means that Sui only orders transactions when it is essential, in contrast to other blockchains that completely order all transactions. This unique consensus architecture enables Sui to parallelize the execution of many transactions, potentially improving performance and scalability.

Due to its asynchronous protocol, Sui possesses a slight edge in security, as it can withstand denial-of-service (DoS) attacks.

Scalability Comparison

Aptos and Sui are both focused on optimizing scalability in the blockchain space, aiming to maximize network capacity similar to Solana. However, they approach the state growth bottleneck, a common challenge in scalability.

The scalability differences between Aptos and Sui blockchains can be summarized as follows:

Approach to state growth bottleneck:

- Aptos: Focuses on heterogeneous validators with constrained CPU and storage to address the state growth bottleneck.

- Sui: Plans to shard data storage efficiently and scale its resources horizontally.

Network capacity and throughput:

- Sui: Adapts to the demands of decentralized applications by scaling horizontally. Testnet transactions show an unoptimized single-worker Sui validator can execute and commit over 120k TPS. The number of workers scales proportionally to the processing power of nodes, resulting in reduced gas prices during network congestion.

- Aptos: Claims a max TPS capability of 100k+. The current TPS on Aptos Mainnet is around 4,000, with a roadmap to maximize engine utilization and eventually achieve 100k+ TPS.

Move Programming Language

Both Aptos and Sui blockchains use Move, a Rust-based programming language designed for building smart contracts and custom transactions. Move focuses on scarcity and access control to manage digital assets. However, there are differences in how Move is implemented on Aptos and Sui blockchains.

- Object model: Sui's Move uses an object-centric model, while Aptos employs an address-centric one. In Sui, tokens, smart contracts, and NFTs are represented as "objects," whereas in Aptos, most activities involve updating data related to addresses.

- Ledger updates: Aptos requires two ledger updates for simple transfers (one for the sender and one for the recipient), whereas Sui's object-centric model usually necessitates only a single update to the ledger for most transfers.

- Ownership and mutability: Sui's implementation of Move explicitly indicates whether an object is owned, shared, mutable, or immutable, while Aptos does not provide such clarity.

It's also worth noting that while Aptos utilizes the original version of the Move language carried over from Diem, Sui developed a slightly modified version and even named it "Sui Move".

Sui Move's object-centric model enables more efficient ledger updates and provides clearer information on object ownership and mutability compared to Aptos' address-centric model.

Fundraise History

Aptos Labs has raised $350 million in total from FTX Ventures, Jump Crypto, a16z, Tiger Global, Multicoin Capital, among many other capital ventures. Currently, Aptos Labs has 28 investors.

Sui is fast catching up after its latest Series B funding round in September 2022. Mysten Labs, the company behind Sui closed a US$300 million fundraise in this round. This brings Sui to a combined raise of US$336 million so far, after adding up the $36 million from Series A. Sui also states that they are currently valued at over US$2 billion.

Aptos Airdrop vs Sui Token Sale

Aptos Airdrop FUD

The token distribution mechanism of Aptos and Sui are highly different.

Similar to many new blockchain infrastructure projects, Aptos chose to do a large airdrop to early users of its testnet and community members.

Two groups of people received airdrops:

- Users who completed an application for an Aptos Incentivized Testnet

- Users who minted an APTOS:ZERO testnet NFT

In total, 23,454,750 APT tokens were be airdropped to 124,828 participants.

This was highly lucrative as the average participant received 200 APT tokens worth over $2000 dollars today.

However despite giving out so much free money, the Aptos Launch was still heavily fudded, and the Airdrop did not go very smoothly.

The Aptos Foundation claimed to have used certain measures to try to eliminate bots or otherwise suspicious accounts. Particularly filtering any user with more than 20 wallets connected, or had an IP address that was shared with more than 20 other accounts.

However the APT airdrop was still heavily botted at launch.

At listing time, people noticed that 189k APT were directly sold on the orderbook, even though no party was supposed to have such large amounts.

Exclusive: Aptos suddenly released an airdrop without strict anti-sybil attack, which led to some people getting a lot of airdrop tokens. Someone selling 189,567 APT directly on binance, resulting in the APT price from $15 to less than $13. pic.twitter.com/sE71UzRnSC

— Wu Blockchain (@WuBlockchain) October 19, 2022

X-explore research shows that Binance has accumulated 28,000 users who have deposited 16.3m APTs total on listing day, with an average of 600 APT per user. This is much higher than the intended amount of 200 APT per user, which shows a large portion of the users received multiple Airdrops through Sybil attacks. In fact, the Sybil address percentage is close to 40%, exceeding 6.3m.

There are also 7 large Sybil addresses with more than 50,000 APT each

Adding on the sell pressure of Airdrop farmers, people also speculated that the sudden airdrop announcement was used to hide the insiders selling tokens at launch.

"Suddenly" is a good plan to mask insider/team selling. zero Anti-sybil is a tell.

— Ericzoo.eth (@ericzoo) October 19, 2022

Adding salt to the injury, crypto media jumped on the Aptos Fud, calling the project out for raising huge amounts of money but not releasing tokenomics early before launch.

I understand the frustration of Airdrop farmers making quick cash in a new token launch, and we may never know if the team sold any insider tokens early in the frenzy. But the Fud wave has already calmed down now, and the $APT tokenomics is crystal clear today, where all investors are locked up in long term vesting schedules. So for the most part, I think this massive FUD wave around the Aptos launch isn't a cause for concern.

Sui Token Sale FUD

When it comes to the Sui Token, there was only a small airdrop for its Testnet Wave 1 and 2 validators. Validators were rewarded with 2,000 SUI for every testnet “wave” they participated in. The airdropped tokens were subject to a 1-year vesting period.

For the general public investors, they are learning from the mistake of Large Aptos airdrop, and is instead opting for a community token sale. This is called the SUI Token Community Access Program which will allow access to an earlier Recognition Sale to purchase SUI tokens to those who are eligible.

There are 2 rounds of SUI token sale, the Recognition Sale and the General Sale.

The Recognition Sale is only available to those whitelisted by the Sui Foundation. Those who are eligible can purchase up to 1,500 SUI from a pool for US$0.03. The tokens will be fully unlocked during the mainnet launch.

The following exchanges will participate in the SUI Recognition Sale: ByBit, KuCoin and OKX.

ByBit users have the largest allocation of Sui tokens with 94M SUI, whereas KuCoin and OKX have 25M SUI for sale each.

The General Sale participants will be able to purchase up to 10,000 SUI at US$0.10.

Only KuCoin and OKX will be hosting the General Sale, and each exchange has been allocated 225m SUI for sale in this round.

Looking at the Tokenomics, SUI has a total supply of 10 Billion tokens. Which means the Recognition Sale has a Fully Diluted Valuation of $300M, while the General Sale has a FDV of $1B.

In my opinion, these numbers are super fair and lucrative for the public investors. This is because Sui and Mysten Labs have already reached a valuation of $2B in its latest private funding round. This means institutional investors like A16z, Jump Binance Labs, and Coinbase Ventures all bought into the token at a $2B FDV.

Not only is the valuation super favorable for the public sale buyers, but the vesting is also attractive. The Recognition Sale has 100% fully unlocked tokens for participants, while. the General Sale has a 1 year linear vesting schedule. For the regular public investor, this vesting schedule might seem long, as you don't get all your tokens in one go. However this 1 year timeline is actually super short compared to typical vesting schedule of private investors. For instance the Aptos private sale investors have a 4 year vesting schedule with a 1 year cliff, meaning they do not receive any tokens in the first year, and only gradually receive them from year 2 to year 4.

Truth be told, if I had the opportunity to invest in $SUI at either the recognition sale or general sale terms, I'd jump on the opportunity.

Aptos is currently trading at a $12B dollar FDV. If Sui achieves the same valuation, this would be a 40X return for recognition sale, and 12X return for general sale.

Despite this lucrative public sale offering, Sui is still receiving huge backlash for not giving out a free airdrop for the hundreds of thousands of Airdrop farmers.

How many communities support you?

— Mozza | Suiswap (@Ghallank10) April 16, 2023

How many validator fees have you let down?

No Airdrop = No Community,

Let see, how long your damn project will last.

We don't want other projects to follow in your damn footsteps.#suiScam pic.twitter.com/DShNb2qtEN

#SuiScam got trending on Twitter, and people flooded to the timeline saying

"No Airdrop = No Community"

I think this is the most ridiculous argument.

According to official numbers from Sui, they have received a total number of 180,000 accounts eligible for the Recognition sale, and 96,000 accounts were randomly selected.

Compared to the Aptos Airdrop recipients of 125k, Sui actually attracted more ecosystem users.

Not only this, but the recognition sale is also done through partner exchanges, which has huge benefits over an airdrop:

- Each account must be KYCed with the exchange, which means it will be very difficult to create multiple accounts to get more allocations.

- Each user still needs to pay a tiny bit of money ($300) to purchase 1000 Sui tokens. These tokens will for sure trade at much higher value after listing, so the users really are not taking on any risk. Instead this money requirement will also filter out potential farmers who are only after free money.

- Each user is able to receive a much larger token allocation, 10000 SUI tokens vs 200 APT per user. Even after accounting for the 10x difference in total supply, each qualified user is still receiving 5X the shares as many SUI tokens than in the APT airdrop.

With these points considered, I think the SUI Token Sale campaign is much smarter and fair than the Aptos Airdrop. This will likely lead to much healthier token price growth after launch, and the current FUD around "No Airdrop" is really because of Airdrop Farmers crying for not receiving free money.

Also consider the contrasting campaigns of Aptos and Sui. No matter how you release the tokens through Airdrop or Public Sale, you cannot please everyone and people will FUD your project either way. Focus on the real terms of the tokenomics which will give you a real edge in a new token launch.

Comparing $APT and $SUI Tokenomics

APT Token Overview:

- Used for transaction and network fees

- Employed in governance voting and securing the blockchain via proof-of-stake

- Validators and stakers share rewards

- Maximum staking reward rate starts at 7% p.a. and decreases over time

- Further use cases currently unspecified

- Initial supply: 1 billion tokens, distributed across community, core contributors, Aptos Foundation, and investors

- Staking rewards increase total supply, while transaction fees (currently burned) reduce supply

APT is the native token of the Aptos platform and is used to pay for transaction and network fees. Validators have the opportunity to prioritize high-value transactions and discard lower-value ones, ensuring efficient operation when the system is at capacity. Network fees will be deployed to make the cost of using Aptos proportional to the costs of hardware, maintenance, and node operation.

APT tokens can also be used for governance voting on protocol upgrades and on/off-chain processes, as well as to secure the blockchain through a proof-of-stake model. Validators holding a minimum number of staked APT tokens can participate in transaction validation and decide on reward distribution between themselves and their stakers. Stakers can select validators to stake their tokens with and receive a pre-agreed split of rewards. The maximum reward rate for stakers starts at 7% per annum, decreasing by 1.5% per year until it reaches 3.25% per year. However, reward amounts and mechanisms can be changed by governance voting.

APT's initial supply is 1 billion tokens, with 82% currently staked for Proof of Staking (PoS) participation. The distribution of APT tokens is as follows:

- 51.02% to the community with a 10-year vesting period

- 19.00% to core contributors with a 4-year vesting period

- 16.50% to the Aptos Foundation with a 10-year vesting period

- 13.48% to the project's investors with a 4-year vesting period

SUI Token Overview:

- Used for proof-of-stake mechanism and on-chain voting

- Asset denomination for gas fees, storing transactions, and other operations on the Sui platform

- Rewards distributed to consensus participants (stakers)

- Total supply capped at 10 billion tokens, with some liquid at mainnet launch

- No built-in deflationary mechanisms; however, increased network activity will raise demand for SUI

- Storage fund reduces the amount of SUI in circulation as on-chain data requirements increase

Mysten Labs' native token, SUI, has a detailed whitepaper explaining its tokenomics. SUI tokens are used in a similar way to other PoS blockchains, staked within an epoch for proof-of-stake participation and on-chain voting. SUI tokens are also used to pay for gas fees, store transactions, and other operations on the Sui platform, with rewards distributed to consensus participants.

The total supply of SUI is capped at 10 billion tokens. A share of SUI's total supply will be liquid at mainnet launch, with remaining tokens vesting over the coming years and distributed as future stake reward subsidies. SUI does not currently have built-in deflationary mechanisms, but increased network activity will increase demand for SUI. The presence of a storage fund will also create monetary dynamics, as higher on-chain data requirements will lead to a larger storage fund, reducing the amount of SUI in circulation.

Aptos' APT token is primarily used for transaction and network fees, governance voting, and securing the blockchain through a proof-of-stake model. Validators and stakers share rewards, with a maximum staking reward rate that starts at 7% per annum and decreases over time. The initial supply of APT is 1 billion tokens, distributed across various categories. Further use cases for APT are currently unspecified.

In contrast, Mysten Labs' SUI token is employed for the proof-of-stake mechanism, on-chain voting, and as an asset denomination for gas fees, storing transactions, and other operations on the Sui platform. Rewards are distributed to consensus participants (stakers), and the total supply of SUI is capped at 10 billion tokens, with some liquid at the mainnet launch. While there are no built-in deflationary mechanisms, increased network activity will raise demand for SUI. Additionally, the storage fund reduces the amount of SUI in circulation as on-chain data requirements increase.

Note on Shared Ecosystem

Since Aptos and Sui are both based on the Diem blockchain and use the Move programing language, much of the developer tools and ecosystem projects are shared between the two networks. As we compare their respective ecosystems in the next section, note that some projects are shared and function across all "Move-Based" blockchains, while others are specifically built for Aptos or Sui alone.

Aptos Ecosystem

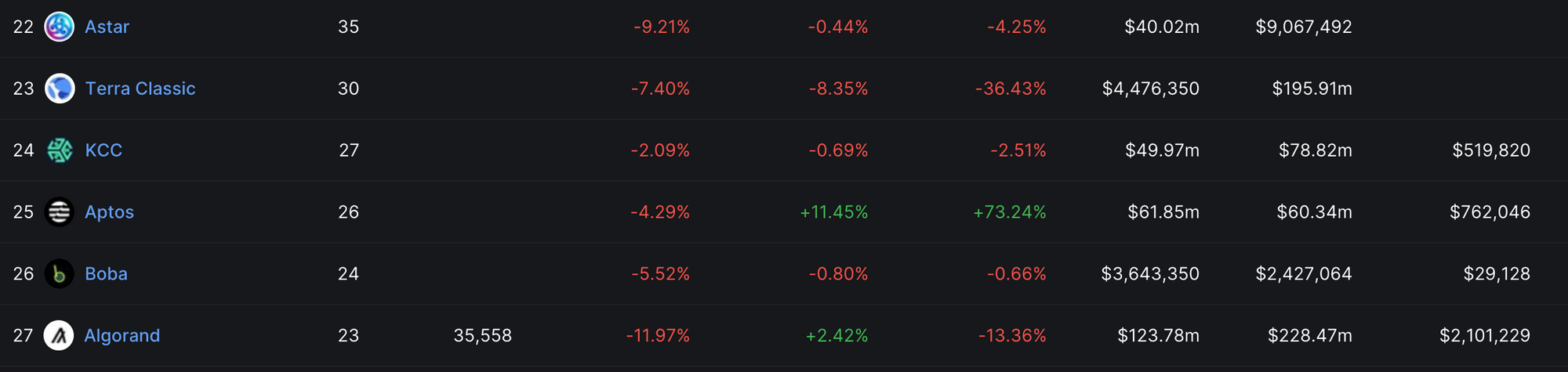

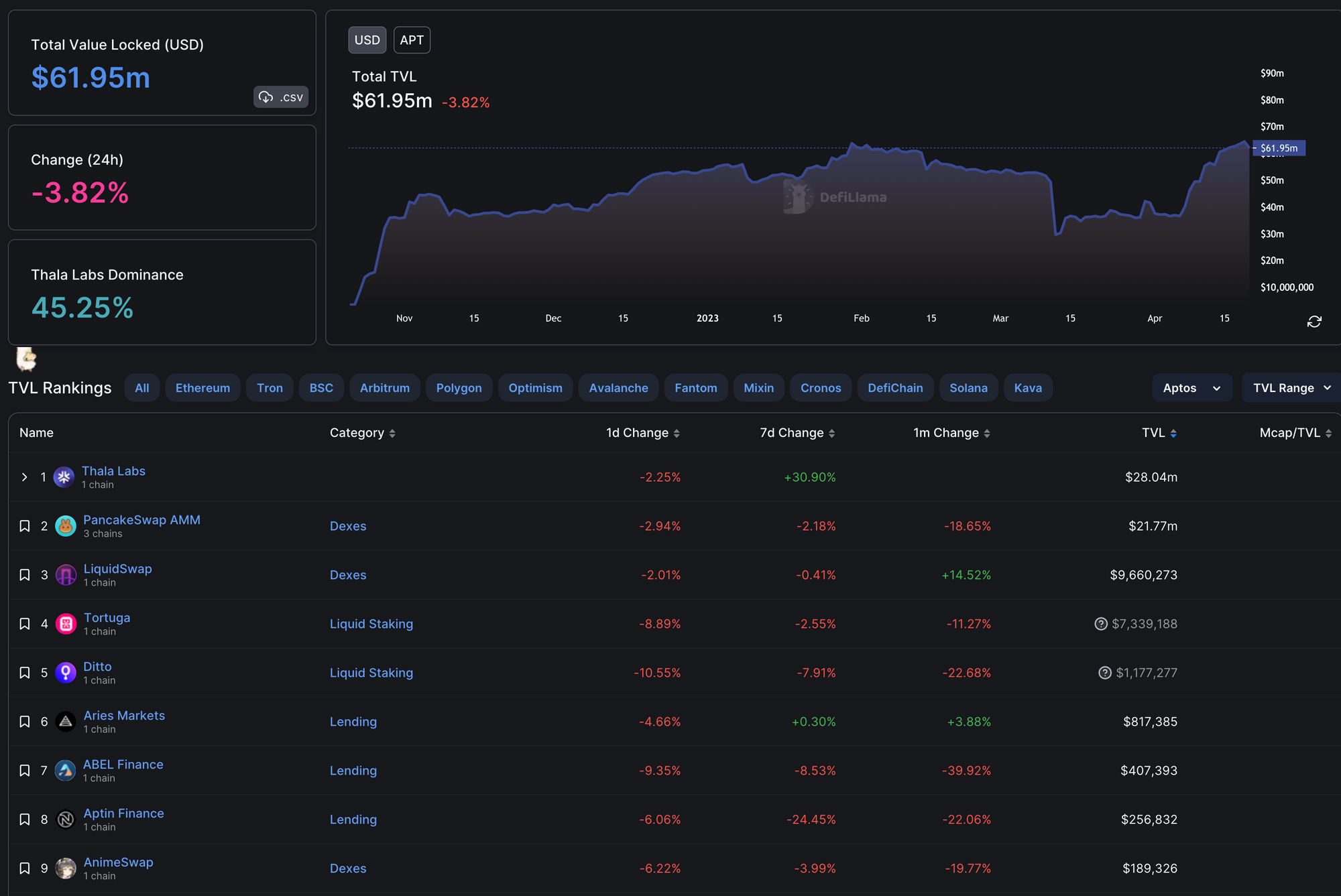

Aptos is already live on Mainnet for a few months, it currently has $62M dollars of TVL, with 26 active ecosystem projects with real money deposited on the network.

This puts Aptos at the 30th spot on all chains rankings based on TVL, and 25th based on number of active projects. These numbers are ok compared to more legacy chains like MultiverseX and Algorand, but it is definitely not yet a productive ecosystem by market leading metrics. Most EVM based Layer-1s and Layer-2s have hundreds of projects deployed with hundreds of millions in TVL.

The core infrastructure projects, like DEX, lending protocol, Stablecoin issuer, and yield aggregator are integral parts of the ecosystem.The core infrastructure’s tokens will receive a similar hype as Aptos, but have lower valuations, so there’s opportunities to strike true gems.

The best projects have been building on Aptos for a few months, and have an official partnership/backing from Aptos Labs.

Top Aptos Wallet: Pontem Wallet, Martian Wallet

Top Aptos DEX: Pontem’s LiquidSwap.

Pontem is building a suite of defi and infrastructure in the Aptos ecosystem.

Currently, Potem’s DEX, Liquidswap, is the top DEX on Aptos in both TVL and volume.

The Team behind Pontem has been working with Aptos’ ecosystem since the beginning of testnet 6 months ago. Pontem also received investment from Aptos Labs directly, cementing their position.

The Team also secured a partnership with Aptos to build key infrastructure to the ecosystem, like wallet, DEX, etc. Even building an EVM that is yet to launch, with 10,000 TPS.

The token details are yet to be announced, so this gives a chance to potentially enter at a good price and farm the token early.Check their Twitter for further details.

Twitter: https://twitter.com/PontemNetwork?s=20&t=s0WBOnzO6lGIalLbaU_ehg

Website: https://pontem.network/

Top stablecoin: ArgoUSD

ArgoUSD is a collateralized debt position (CDP) that creates a stable coin, USDA. The CDP style stablecoin is highly battletested, with the leader being MakerDAO and DAI.

This Argo’s stable coin has little chance to depeg, as the debt can be liquidated before entering a risky debt threshold.

Each $1 in $USDA will be over collateralized by a basket of coins like APT, wBTC, wETH, and other stables.

Argo currently doesn't have a governance token, so it might be worth using the app to get a possible airdrop

Twitter: https://twitter.com/ArgoUSD?s=20&t=uDEg1G9b--OVnNCdBoXVSQ

Website: https://argo.fi/

Docs: https://medium.com/@argo_fi/argo-mainnet-launch-50fb859d8719

Overcollateralized Stablecoin: Thala Labs (Works on Both Aptos and Sui)

Thala is another algo stable coin backed by a collateralized debt position (CDP).

Thala will let you borrow against APT, tAPT (Tortuga Staked APT), and other coins to mint $MOD, the Thala stablecoin.

The team behind Thala has focused on build partnerships and integrations with various protocols on Aptos.

The main competitor to Thala will be the already launched ArgoUSD

Thala will soon announce plans for their dapp and token launch on their social media.

Twitter: https://twitter.com/ThalaLabs?s=20&t=s0WBOnzO6lGIalLbaU_ehg

Website: https://www.thala.fi/

Liquid staking: Ditto (Aptos Only)

Ditto is a liquid staking platform with just less than 500k TVL, currently.

Ditto let’s users convert APT into stAPT, and earn up to 7% APY on their APT, while still having the liquidity.

Ditto’s governance token, $DTO, isn’t live yet, but there is a rewards campaign to farm some $DTO tokens early

By staking APT with Ditto platform, Liquidity providers are currently earning DTO rewards.

Website: https://www.dittofinance.io/Twitter: https://twitter.com/Ditto_Finance?s=20&t=PRRaW_4mqgyeaUjK6HZ7eQ

Top Money Market: Superposition (Aptos Only)

Lending protocols are key for the growth of the ecosystem, as this allows whales to take leveraged bets within the ecosystem, and tap into otherwise locked liquidity.

BNB grew in usage with Venus protocol, Polygon saw explosive growth with Aave, Avax expanded quickly with Qi. This will likely be similar.

The leading lending protocol will not only draw immense TVL, but also be key infrastructure for the ecosystem as a whole.

Superposition has also received investment from Aptos Labs directly, so definitely a ecosystem leader to watch.

The dapp and token are yet to launch, so Follow their social media for more information.

Website: https://www.superposition.finance/

Twitter: https://twitter.com/SuperpositionFi?s=20&t=PRRaW_4mqgyeaUjK6HZ7eQ

Top perpetual DEX: Tsunami Finance (Aptos Only)

Derivative markets overlap spot markets in traditional finance, as it allows for investors to protect and leverage financial assets.

Futures are the largest derivative in the crypto space, as it allows speculators to tap into crazy leverage

Futures on robust L1 chains, like Arbitrum’s GMX and Solana’s Mango Markets, are growing in popularity and volume.If Aptos continues to have a longevity like Solana, then it’s Futures markets will continue to grow in volume.

Tsunami is a yet to launch perp exchange with no price impact, low fees, and high leverage (30x).

Tsunami’s governance token hasn’t launched yet, but I’m sure it will be a highly anticipated launch within the ecosystem.

Website: https://tsunami.finance/

Twitter: https://twitter.com/TsunamiFinance_

Docs: https://docs.tsunami.finance/guides/nami-governance-token

Sui Ecosystem

Top Wallets: Sui Wallet, Suiet Wallet (Both Sui Only)

Sui Wallet is the official web3 wallet of the Sui blockchain. The non-custodial web3 wallet is available as a browser extension and can be used to store and manage SUI and other tokens and NFTs in the network.

It can also connect to Sui-based dApps and access transaction history in Sui Explorer. The Sui Wallet will also let users stake SUI tokens and earn rewards.

Suiet is another alternative that is built by a third party team.

Best DEXs: Sui Swap (Sui Only)

Pontem, MovEX, Cetus Protocol, PancakeSwap, AnimeSwap (Aptos and Sui)

Best Launchpad: SuiPad

Best NFT Marketplaces: Soufl3, Blue Move

(Both work on both Aptos and Sui)

Dex Aggregator: Umi Protocol

Sui’s first DEX aggregator, Umi, combines multiple AMMs, order books, and other liquidity protocols to provide DeFi users with deep liquidity, the best swap routes, and exchange rates to trade tokens. Umi Protocol leverages a graph search algorithm to find the best swap routes for DeFi traders, and its user-friendly API offers a smooth and fast interface.

Developed originally on the Aptos blockchain, Umi Protocol has garnered considerable attention among DeFi users since its launch in 2021. Umi’s SDK and API offer developers and professional traders higher trading efficiency and versatility.

Liquid staking: Tortuga (aptos and Sui)

Tortuga is a liquid staking platform which allows users to earn yield on their APT and unlock further defi potential in dapps like Thala.

Tortuga is backed by top funds, FTX ventures and Jump Capital.

Currently yielding 7% APY and with over $300k in TVL, tAPT and Tortuga have room to grow.

There isn’t a Governance token for Tortuga yet, but this should be announced in the coming days, as the ecosystem's active users continue to grow.

You can easily swap your APT for tAPT and possibly earn an airdrop or reward for using the platform.

Be sure to follow Tortuga’s twitter for further announcements about a token

Website: https://tortuga.finance/

Twitter: https://twitter.com/TortugaFinance?s=20&t=uDEg1G9b--OVnNCdBoXVSQ

Top Leverage Trading DEX: Aries Markets (Aptos and Sui)

Aries Markets is a Margin trading protocol that lets users borrow against their assets for undercollateralized trades.

Aries Markets isn’t live yet, but the protocol is currently live on the Dev testnet.

Aries markets secured an Audit from OtterSec, and is now working to open margin trading with whitelisted DEX pools.

This project is still early, so expect more information about launch in the coming days or weeks.

Pay attention to their social media and discord for updates about the dapp and token launch

Website: https://ariesmarkets.xyz/

Twitter: https://twitter.com/AriesMarkets